Market, Earnings, and EW - September 16, 2023

Market commentary, portfolio company earnings results, and an initial look into Edwards Lifesciences

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market is presenting a challenging technical picture.

The local peak set at the end of July appears to be an intermediate top. The ensuing humps – the two attempts to push higher at the end of August and mid September – formed lower highs.

The market ended the week at 443, the same level the market bottomed at in early September.

If the market doesn’t bounce back from here, it wouldn’t be surprising to see the market retrace to the ~430 level for another 3% drop in the short term.

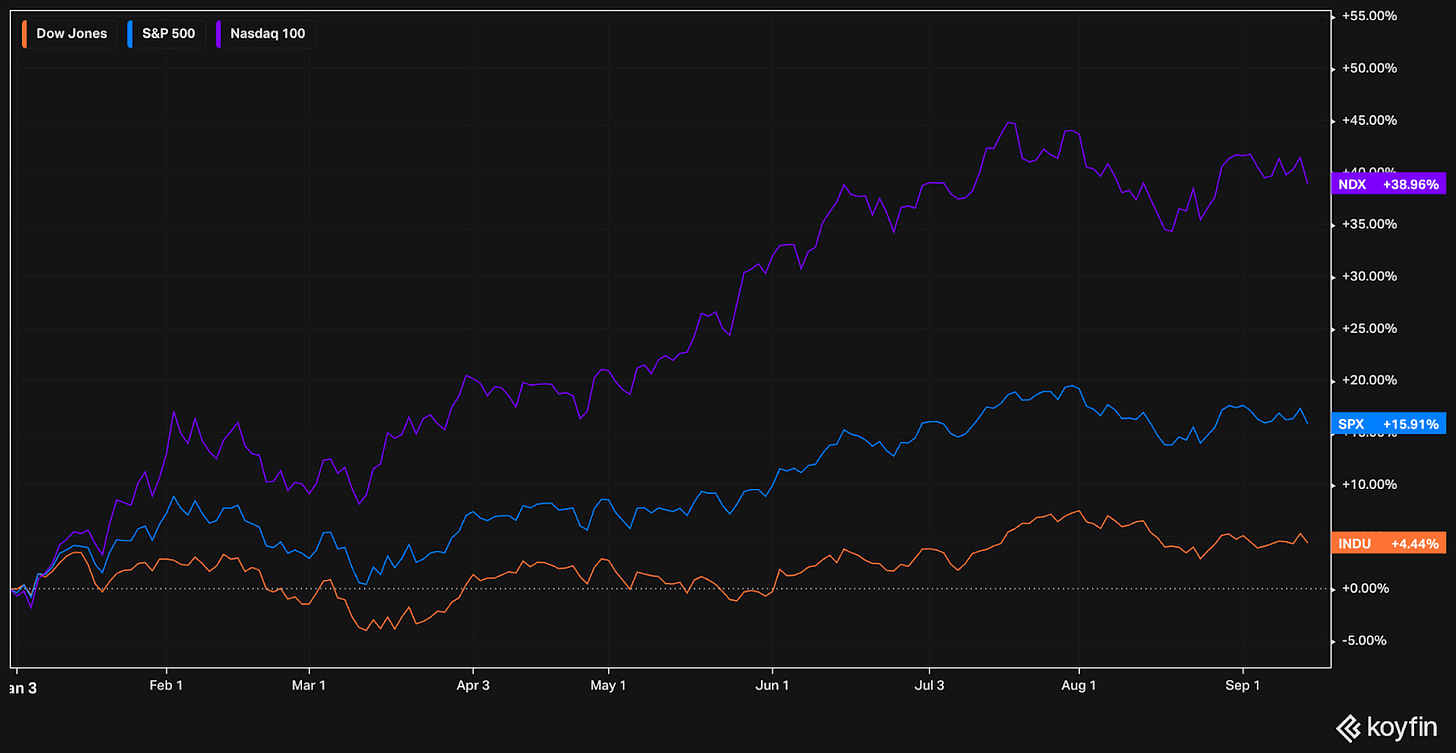

Year-to-date performance across indices:

Nasdaq +39.0%

S&P 500 +15.9%

Dow Jones +4.4%

Gains have been strong this year. As for what’s next, the current technical picture, coupled with the macro indicators below, don’t paint a particularly positive picture for the the equities markets.

Diving into macro:

The US Dollar looks to be recovering and gaining strength. A strong US dollar presents a negative influence on companies that have international sales.

Oil is similarly building momentum, with WTI crude crossing above the $90 mark. High oil prices affect production and transportation, with those costs eventually making their way to the end user in the form of higher prices. Higher prices results in higher inflation, which gives the Fed more grounds to raise rates.

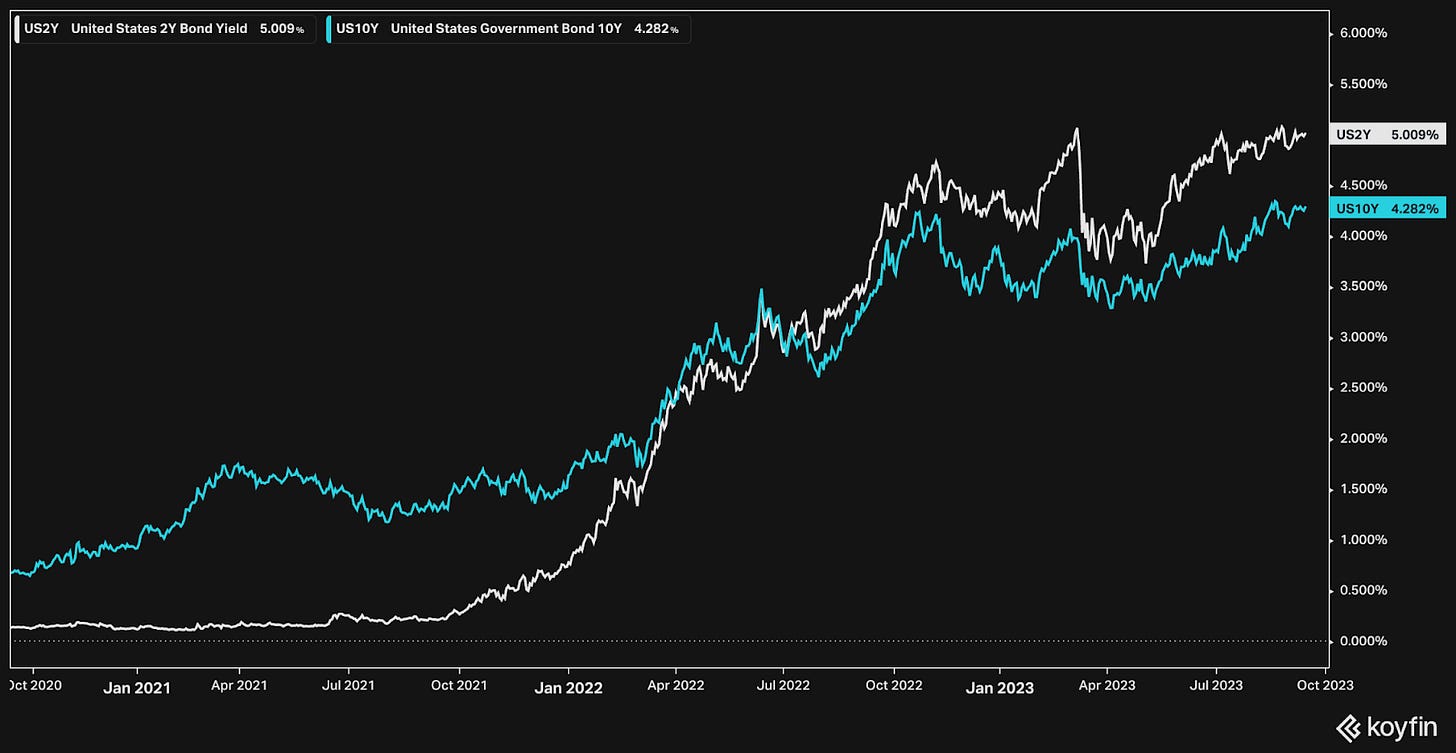

The bond market seems to be picking up on it. The 2 year and 10 year yields continue to climb. The 2 year recently breached the 5 handle.

The latest CPI report, released on September 13th, came in at 3.7%, an increase from the prior 3.2%. Consumer prices rose by 0.6% month-over-month in August. Gasoline prices, which jumped over 10% in August, made up more than half of the increase in the CPI.

All that being said, the market is holding strong on the belief that the Fed is done with rate hikes. The market expected the Fed to hold steady in September, with odds of 97%. The market is still expecting at least 1 more hike – there is a roughly ⅓ chance of an increase in each of November, December, and January.

Only time will tell.

Q2 2023 Earnings

Over the last two weeks, 2 portfolio companies reported earnings.

Zscaler (ZS) and Adobe (ADBE) beat consensus expectations across the board.

Zscaler, a leader in cybersecurity and zero trust network access (think of it as a next-gen VPN solution), continues to show strong growth and execution.

Adobe has launched a flurry of new AI products, establishing themselves as a clear leader in the space of bringing AI solutions to creative tools. Although the financial results have yet to show a significant lift, it is only a matter of time for these new offerings to either lift revenue and/or ensure more durable revenue growth over time by strengthening Adobe’s moat.

Edwards Lifesciences (EW) – Initial Coverage

This issue dives into more depth than usual, being the introduction to Edwards Lifesciences.

Edwards Lifescience was founded in 1958, by Miles Lowell Edwards as he set out to build the first artificial heart. Since then, Edwards has grown into a $45+ billion company, doing over $5 billion in revenue a year. They have stayed true to their original goal – helping solve for heart disease.

“Cardiovascular disease is the number-one cause of death in the world and is the top disease in terms of health care spending in nearly every country. Cardiovascular disease is progressive in that it tends to worsen over time and often affects the structure of an individual’s heart.”

“Since our founder, Lowell Edwards, first dreamed of using engineering to address diseases of the human heart, we have steadily built a company on the premise of imagining, building, and realizing a better future for patients.”

Edwards has always been, and continues to be, focused on the same problem. Innovation in such a critical, and high regulated, space doesn’t happen overnight. Edwards has built a culture around a long-term focus – they invest in products, experiments, trials, etc over multiple years.

Bernard Zovighian stepped into the CEO role in January 2022. Previously, he had helped establish a new and upcoming division of the company (TMTT) where he became a VP. He succeeds Micahel Mussalemm who is retiring at the age of 70 and was CEO for over 20 years, since 2000.

The company reports results in 4 segments: TAVR, TMMT, Surgical Heart., and Critical Care.

Transcatheter Aortic Valve Replacement (TAVR) focuses on solving for aortic stenosis. Let’s break that down.

“Catheter” is essentially a, small flexible tube.

“Transcatheter” would be a small flexible tube that goes through or across something.

“Aortic valve” is the valve that helps regulate the outflow of blood from the heart.

“Stenosis” means narrowing.

Over time, the aortic valve can narrow. As the walls close in, it reduces the blood throughput. The heart can beat and push hard, but if the aortic valve is too closed, there won’t be sufficient blood flowing out.

TAVR is an industry-wide term for solutions that help solve this problem. Edwards’ main offering is the SAPIEN family of valves.

These small instruments are injected into the aortic valve, and placed such that they reinforce the valve to help keep it open.

These are delivered through a catheter, i.e. a small tube or wire, instead of via surgery. This minimally invasive approach is significantly better for patients as it is less damaging and lends to an easier recovery.

Transcatheter Mitral and Tricuspid Therapies (TMMT) focuses on solving for mitral and tricuspid regurgitation.

The mitral valve is one of 4 that helps keep blood flowing in the right direction. This valve regulates blood flow from the left upper chamber (left atrium) to the lower left chamber (left ventricle).

The tricupsid valve sits between the two chambers of the heart. These valve flaps open to let blood flow from the upper right chamber (right atrium) to the lower right chamber (right ventricle).

When either of those two valves are too loose, or not operating properly, they can cause issues with blood circulation. Blood can regurgitate, or reverse, back into the atriums instead of proceeding into the ventricles.

In other words, the heart is doing the hard work of beating, but the blood isn’t moving where it is supposed to. Pressure from the heartbeat is lost as some blood accidently flows back to where it came from.

Edward’s TMTT solutions are effectively a clip that sits on the valve and keeps it more closed. This prevents blood from flowing backwards, and alleviates the issues of regurgitation.

TMTT and the Pascal solutions are also minimally invasive, delivered via a catheter (i.e. wire or cable). In fact, Edwards invented the hardware, the Pascal Precision System, to enable this delivery.

Surgical Structural Heart provides components for enabling successful heart surgery. Products include tissue, valves, and other conduits that can be implanted via surgery.

Critical Care is focused on sensors and monitoring systems, to help track patient’s recovery. Whether patients have surgery or a non-invasive solution, it is important to monitor and ensure patients are stable after the treatment. Their solutions include finger cuffs, oximetry sensors, algorithms to draw insights from the incoming data, and the machines that display the data.

Edwards is expecting $6 billion of revenue this year. Breaking it down by segment:

TAVR is about 67% of sales, growing over 10% year over year

TMTT is about 3% of sales, growing nearly 100% year over year (sales of 200m this year, up from just over $100m last year)

Surgical Structural Heart represents 15% of sales, growing mid-single digits year over

Critical care represents 15% of sales, growing roughly 10% year over year

The TAVR market is effectively a duopoly between Edwards (EW) and Medtronic (MDT).

Edwards has some $4 billion of sales in TAVR.

Medtronic has $3.3 billion in revenue in Structural Heart and Aortic (SHA), which competes with Edwards’ TAVR but also includes other solutions from EW’s TMTT and/or Structural Heart segments.

In 2014, MDT settled a lawsuit with EW on patent infringement. Medtronic paid Edwards over $1 billion in remuneration and the two agreed not to sue each other for the next 10 years. They recently renewed the same deal not to sue, but this time EW paid MDT a sum of $300 million. Few details were provided.

Others have tried to enter the TAVR market, but have been unsuccessful thus far.

Boston Scientific had a TAVR product, Lotus Edge. They pulled it out in 2020. They did say they would be back in 2024 with a 2nd version. The Accurate neo2 valve is not currently approved by the FDA.

Abbott had TAVR products and was able to get up to 5% market share. In July 2023, Abbott withdrew the Trifecta valves from the market.

Benzinga estimates the market size for TAVR at $4.6 billion in 2022, an expects 12.2% CAGR through 2028 for a TAM of $9.1 billion. Although the TAVR market estimation and sales numbers don’t quite line up, it does go to show Edwards’ dominance in the market. As for the projection, Edwards generally agrees with the expected growth, estimating the market at $10 billion in 2028.

There are significant secular tailwinds in the market. In 2021, only 12 of 100 patients with Severe Aortic Stenosis (SAS) received treatment (that is up from 6 of 100 in 2011). There is clearly a large gap to close, which is considered in the expected growth.

Beyond the under-treatment, Edwards continues to push the frontier with two critical trials underway to expand coverage.

The “EARLY TAVR trial” looks to bring treatment up earlier in the patient lifecycle. Currently, patients need to be diagnosed with Severe Aortic Stenosis and show symptoms. This trial seeks to understand if early intervention, before symptoms occur, results in better outcomes for patients.

The “PROGRESS trial” looks to expand treatment from only a severe diagnosis to also a moderate diagnosis. If treatment can happen earlier and result in a better outcome, patients would benefit from earlier intervention.

Both of these trials are potentially very meaningful, as they could easily triple the addressable market for TAVR. These could expand the 2028 market from $10 billion to $20-30+ billion.

All of this research, hard work, and innovation has paid off for Edwards. Looking at long term performance, over the last 10 years:

Revenue grew from $2 billion to $5.6 billion, nearly 3x.

Net income grew faster, from $400m to $1.4 billion, more than 3x.

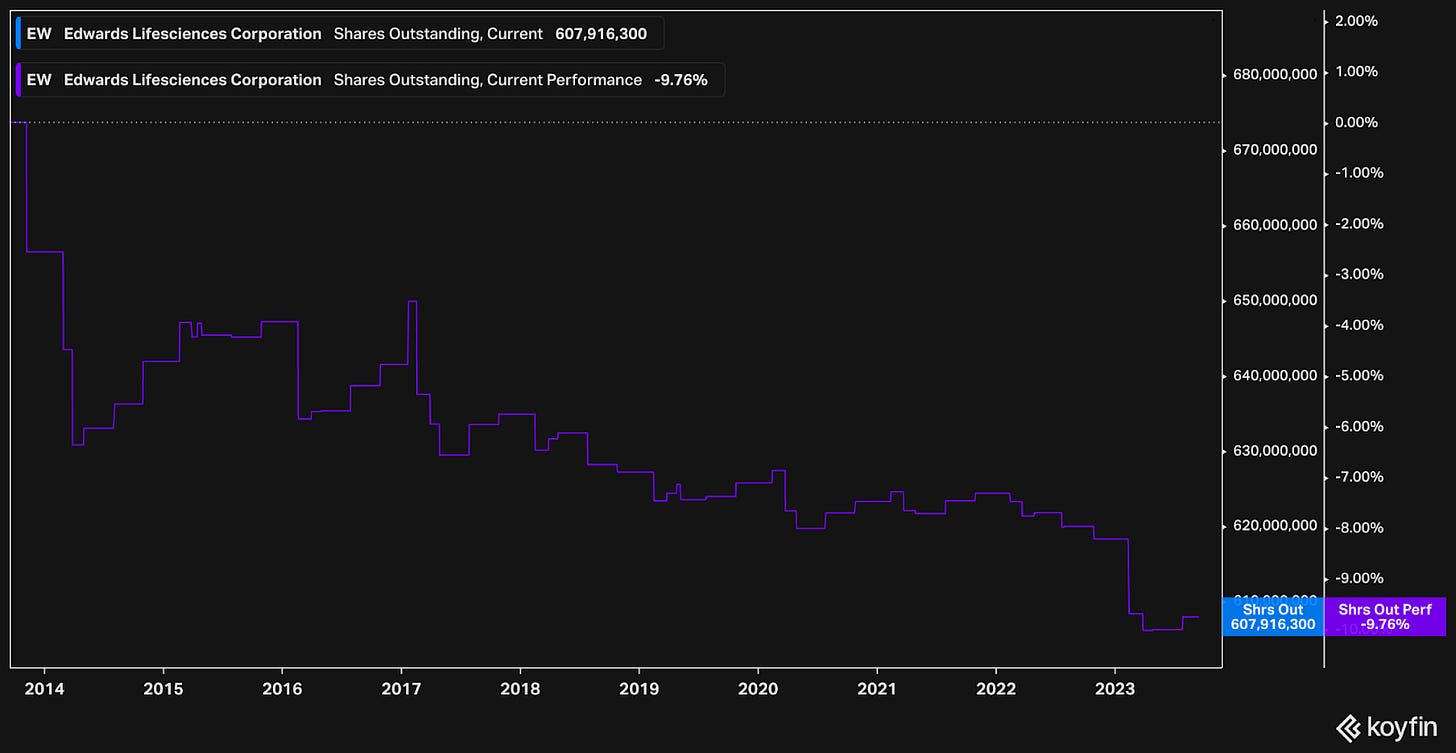

Management has been buying back shares, eating away nearly 10% of the shares over the last 10 years. Share buybacks reduce the overall count, which increases the ownership of the remaining shareholders and boosts per share figures, such as EPS or FCF/share.

The results have been extraordinary for shareholders. EW shares (20% CAGR) have significantly outpaced both the Nasdaq (17% CAGR) and the S&P 500 (10% CAGR).

Some key elements to this outperformance are the durable & consistent growth, profitability characteristics, and the capital efficiency of the business (i.e. ROIC, FCF ROC, etc).

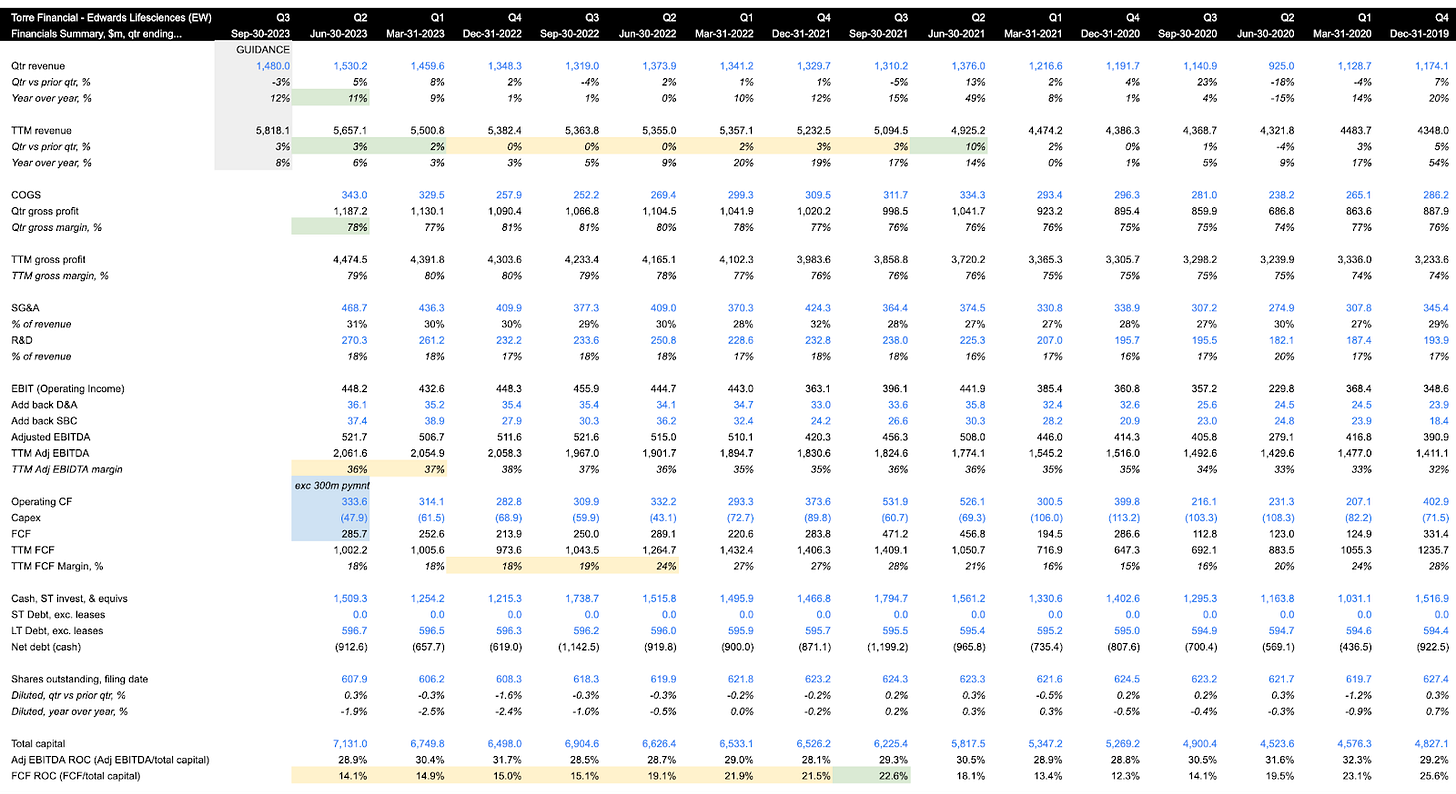

Diving into the quarterly financials:

Revenue dipped with COVID, struggled to rebase, and has since shown recovery. The latest quarters show an inflection point, and coupled with guidance, point to ongoing acceleration in revenue growth to 8% year-over-year. Management is guiding for 10-12% growth for the year.

Gross margins have swayed between 77-81%, but generally stayed consistent within the range. Recently, gross margins ticked up to 78%.

Note – EBITDA, Operating Cashflow, and FCF are adjusted for the $300 million payment made to MDT. The two made an agreement, a covenant not to sue. (Sounds like a nice way to maintain a duopoly!)

Adjusted EBITDA margins are healthy, at 36%.

FCF margins are similarly healthy at 18%. The cash flow conversion isn’t as strong as other companies we cover, due to the nature of the business.

The balance sheet is strong, with over $1.5 billion in cash, and under $600 million in debt.

Shares outstanding are decreasing year over year, currently at a pace of 2%. This is great to see. The management team is taking advantage of the relatively low price and strong balance sheet to buy back aggressively.

The company has been very capital efficient, generating EBITDA ROC near 30% and FCF between 15-25% historically. This is a significant spread on the cost of capital, allowing for significant value creation.

As for the outlook, management is very positive. From the latest earnings announcement:

“Overall, given the improving environment and strong first half performance, the company now expects full year 2023 sales to be in the $5.9 to $6.1 billion range, versus the prior guidance of the high end of $5.6 to $6.0 billion. The company now expects full-year total company and TAVR sales growth to be in the 10 to 13 percent range on a constant currency basis, versus previous guidance of 10 to 12 percent.”

"The exciting developments during the first half of the year reinforce our confidence in our patient-focused innovation strategy and our longer-term outlook, and we anticipate a year of value creation as we pursue important therapies that will benefit many more patients. We look forward to launching a number of differentiated technologies, as well as achieving important milestones across all of our product lines," said Zovighian.

Shares have been under pressure the last few years, as rates rose and crushed long duration assets. Edwards is a solid business, and there’s little doubt that it will bounce back. That being said, from a risk-reward perspective, it may not be a bad idea to wait for some strength to build in the chart. The 50-day SMA is about to cross below the 200-day SMA. Patience until the drawdown stabilizes and starts to build can prove wise. Investors eager to enter could initiate a small position, and add over time.

Turning to the valuation:

EW trades at 21.4x EV/NTM EBITDA. This is a very reasonable valuation for an efficient company with significant competitive advantages and durable growth.

The FCF yield of 2.3% is nothing to get excited about. Even after the recent share price, it shows the premium valuation the company commands. For context, the SPY has a TTM FCF yield of 3.4%.

The following table shows potential annualized returns over the next 5 years given a spectrum of EBITDA multiples and EBITDA growth rates.

This model includes annual share reduction of 1%, via buybacks.

Assuming EW is able to maintain a multiple of 20x EV/NTM EBITDA and EBITDA growth is able to come in at 15-20% (outpacing revenue growth of 10-12%), investors could reasonably expect between 14-19% annualized returns over the next five years.

Fastgraphs provides yet another perspective on valuation. Edwards has had steady EPS growth over the last 15 years, with not 1 down year! If multiples were to expand back above historical norm over this period (which has happened often in the past), annualized gains could be over 20%.

Closing thoughts

The macro environment presents a challenging picture for equities. Whether a strong dollar, higher costs due to oil, or ultimately higher rates for longer – there appears to be more headwinds than tailwinds. That, coupled with some high flying valuations (i.e. NVDA, ARM) there are certainly risks in the market today.

On the flip side, consensus is growing around the idea of a soft landing, where the Fed can successfully tame inflation without too much destruction to the economy & jobs market.

At Torre Financial, we remain focused on finding the best investment opportunities at any time. We focus on companies that have high returns on capital, competitive advantages, and durable growth. We focus primarily on fundamentals, and continually reevaluate and rebalance according to what the market is offering.

The last few months we’ve been trimming some of the more expensive companies that have done well this year. We’ve been rotating into more attractively priced portfolio companies, with shorter durations.

Edwards Lifesciences is a great example. They are a dominant player in a highly regulated environment with limited competitors. They are focused on their problem set, proving to be good stewards of capital, and continue innovate and expand their market. Edwards is a prime example of a long-term compounder. Additionally, the market seems to be presenting an attractive entry point.

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders – companies with high return on capital, competitive advantages, and durable growth.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.