2023 Year-End Review

Results, top & bottom performers, reflection, plan for 2024, and themes to watch next year

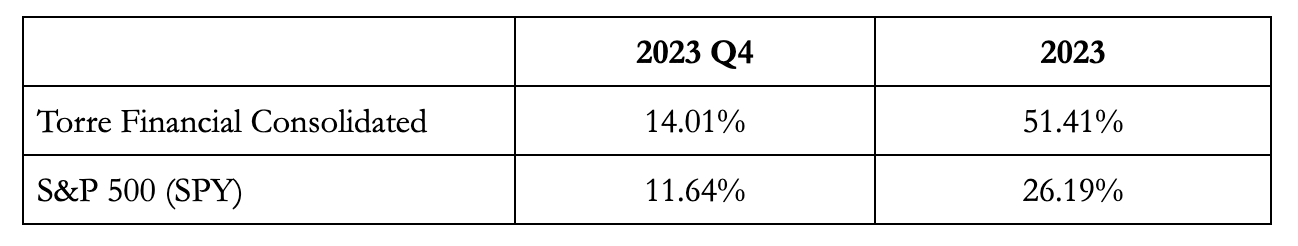

Results

The fourth quarter of 2023 ended on December 31st, 2023.

The consolidated return for Torre Financial accounts was 14.01% for the fourth quarter and 51.41% for the full year.

The S&P 500 (SPY) returned 11.64% for the quarter and 26.19% for the year.

Returns for individual accounts will vary as each account is managed separately and tailored towards each client’s investment objectives and risk profiles.

Full year performance across indices:

Nasdaq (NDX) +53.8%

S&P 500 (SPX) +24.2%

Dow Jones (INDU) +13.7%

Contributors and Detractors

Top Performers

Software companies came back with a vengeance in 2023 after a difficult 2022.

Meta (META) had a complete turnaround as Mark Zuckerberg pressed for a year of efficiency, reducing capital expenditures and driving profitability. This was in stark contrast to his 2022 commitments for heavy (10b+/year) investments to make the metaverse a reality. Meta’s Reels feature has also seen strong adoption, demonstrating their ability to withstand and outcompete potential threats such as TikTok.

Crowdstrike (CRWD) and Zscaler (ZS) are both next-generation leaders in different areas of cybersecurity. Their offerings have been resilient throughout the market turbulence. Global instability has only made their services more critical.

Salesforce (CRM) has benefited from a similar narrative to Meta. Marc Benioff has pushed the company aggressively towards profitability and efficiency. Investors are seeing progress and there is plenty of potential yet to be realized.

Cloudflare (NET) is one of the highest potential companies in our portfolio. They have a broad array of offerings covering simple things like cloud delivery network (CDN), to cybersecurity solutions including zero-trust network access (ZTNA), to competing with the titan cloud providers with new distributed computing platforms (workers and edge computing). Cloudflare is seeing a significant boost from AI/ML providers.

Bottom Performers

Detractors typically attract more scrutiny to determine whether the price action is justified or an opportunity.

Paycom (PAYC), a payroll and human resource technology company, faced headwinds with the Fed’s tempering of employment markets. Additionally, in November, the company announced significant deceleration in growth, guiding for ~14% growth versus the historical 20-30% range. Chad Rishison, founder and CEO, attributed the change to their new offering, BETI. The narrative is that by allowing employees to do their own payroll, there are fewer mistakes, less paperwork, and therefore lower service fees. Effectively, their new offering is cannibalizing their existing services. If that is the entire reason, that could end up being a big positive. It is hard to say to what extent BETI plays in the revenue slowdown given so many confounding factors including increased competition and employment market headwinds. Paycom is a highly efficient company, continues to show innovation, and has everything necessary for durable growth. We are holding to see how this plays out.

PayPal (PYPL) has gone through a lot of changes. Their unbranded payment processing service (Braintree) has seen strong adoption and is growing rapidly. Although it is high volume, it is much lower margin than the PayPal branded checkout that has faced increased competition (Google Pay, Shop Pay, Stripe’s Link, Amazon checkout, etc). New users' accounts are also flat. Nearly the entire executive team has been rotated this year, with Alex Chriss coming in as the new CEO. They have plans to leverage the PayPal network to radically revamp the checkout experience, launching as soon as March 2024. The financials are solid, revenue is growing, revenue drivers are supportive of durable growth, and the company is trading at an attractive valuation. If they are able to revamp checkout successfully, 2024 could be a great year for the stock.

Agree Realty (ADC) is a triple net lease REIT. More than anything, the price action is driven by the increase in rates. REITs are typically seen as safer, fixed-income-like investments that provide stable cash flows. The company is executing very well and likely to come out stronger.

Danaher (DHR) is a new addition to the portfolio this year. We took advantage of the weakness in share price to initiate and build positions. Danaher is a critical service provider for biotech companies, where spend and investment has been under pressure. Biotech, however, is a secular trend that will see continued growth for many years. Danaher has a superb management team with a proven track record.

ADP (ADP), the largest payroll provider, has seen headwinds from the employment market, similar to Paycom. ADP is a very stable company and well positioned for continued growth.

Portfolio Overview

We seek to invest in the highest quality companies, those that are efficient and exhibit durable growth.

Efficient businesses make the most of their available capital (high return on capital ratios), are profitable (high margins across the board – gross, free cash flow, net income), and are effective at converting earnings into free cash flow (solid working capital practices and low capital intensity).

Durable growth can come from secular tailwinds (growing industries) as well as business model dynamics (increasing usage or consumption with existing customers; pricing models that grow with inflation).

The combination of efficiency and growth, sustained over time, maximizes the magic of compounding. At Torre Financial, we look for these companies and seek to invest at reasonable prices.

When compared to the S&P 500, our portfolio companies are superior in revenue growth, are more efficient in their use of capital, have superior margins across the board, and have stronger balance sheets (higher interest payment coverage, through lower leverage).

The portfolio’s FCF yield is slightly below the index, yet quite comparable and very reasonable for a higher quality selection. This combination of superior fundamentals and reasonable valuation allows for a high probability bet of outperformance.

High quality companies are rare, there are only so many out there. In line with our investment philosophy, we aim to keep portfolio turnover at a minimum. Each company is rigorously evaluated and vetted as a long-term opportunity before being introduced.

We hold our portfolio to a maximum of 30 companies, ensuring we pick the best of the best and make the hard decisions when necessary. We strive to invest for 5+ years, which implies we turn over fewer than 6 companies a year. Our turnover activity is low, yet incorporates significant investment in research. We spend a lot of time learning, so that we can have the best possible companies and target allocation.

We started this year with 28 portfolio companies. We exited three and added five, bringing the portfolio up to the maximum of 30 holdings.

We listened to over 100 investor meetings, analyzed over 10 companies with deep dives, and read over 30 books.

Diving into the details on the portfolio and target allocation weights…

Upgrade to a paid subscription to access portfolio details, weighting decisions, year end reflection, and look forward plan for 2024.

Keep reading with a 7-day free trial

Subscribe to Torre Financial Newsletter to keep reading this post and get 7 days of free access to the full post archives.