2024 Q2 Letter

Review of quarterly results, contributors and detractors, portfolio overview, and personal reflection

Results

Returns for individual accounts may vary as each account is managed separately.

Contributors & Detractors

Top Performers

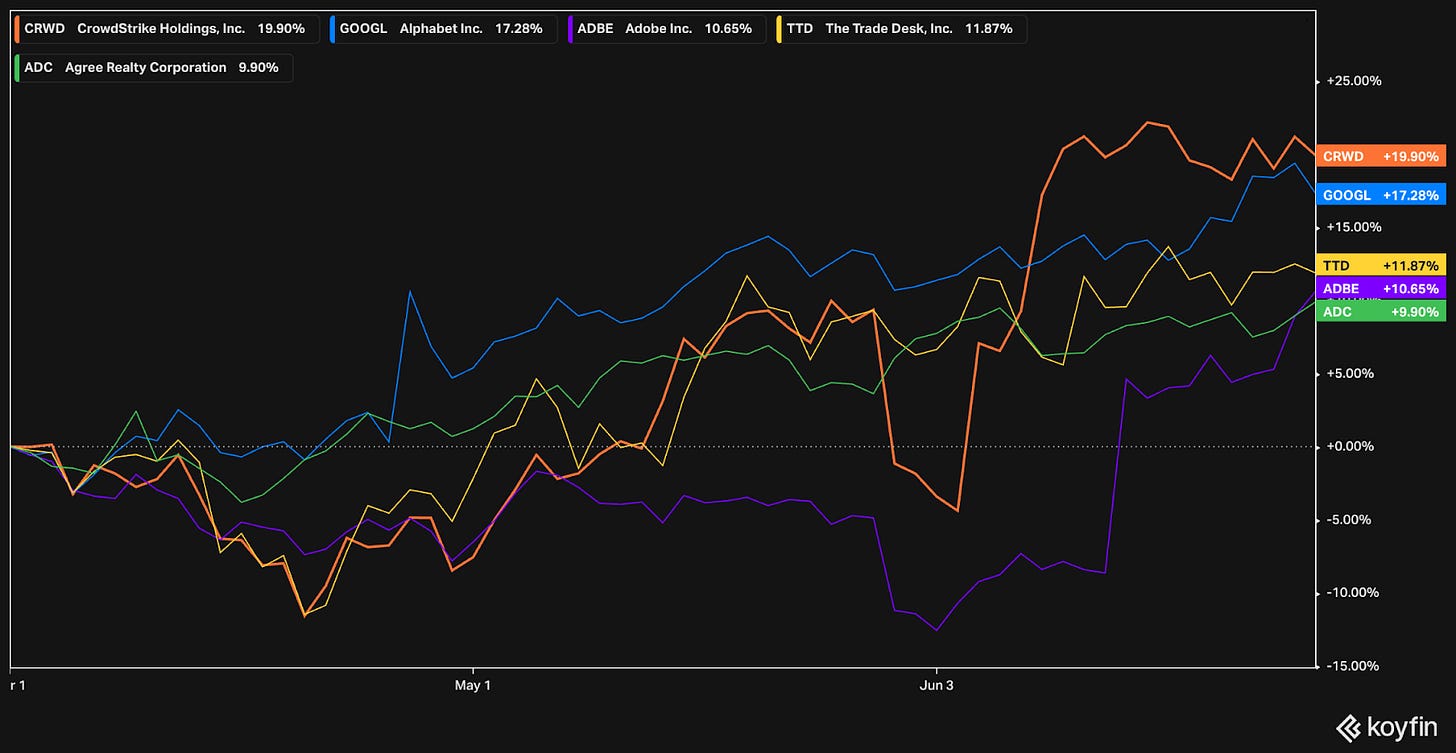

Crowdstrike (CRWD) has appeared in the top performer list the last 3 quarters. The momentum continues this quarter, increasing 20% in Q2 alone. Cybersecurity is seen as mission-critical for enterprises of all sizes. Crowdstrike is emerging as the next-generation leader. Their cloud-native solutions are top tier and they’ve continued to expand their platform with more and more offerings. While shares are expensive at this level, shares are supported by strong fundamentals including consistently strong revenue growth and high profitability.

Alphabet (GOOGL), the parent company of Google, had a rough start into the AI-era. Over time, their expertise and dominance has become ever more prevalent. Alphabet has been investing heavily in their cloud computing platform, Google Cloud Platform (GCP). GCP offers specific differentiated solutions for large data sets and developing machine learning models. Google may have the largest and most robust infrastructure for AI. Throughout the quarter, Google has demonstrated their ability to execute quickly. Google’s Gemini AI is now offered to Google Workspace users as an add-on. Google Search results include gen-AI answers that are highly functional. Google develops their own AI-capable semiconductor chips. Additionally their big bets such as Waymo self-driving cars continue to move in the right direction. On top of strong fundamentals, Google has significant optionality. The market started paying more attention this quarter. Google shares are still attractively priced.

The Trade Desk (TTD) is another repeat top-performer. Helping businesses make more money is an attractive business to be in. The Trade Desk helps their customers distribute and optimize advertisements across many different distribution platforms. With 2024 being an election year, advertisement spend is expected to be strong. The Trade Desk shares are quite expensive.

Adobe (ADBE) flipped into a top performer this quarter, after appearing as a bottom performer Q1. Concerns have been plenty. Investors have been worried about competitors Figma and Canva encroaching their market. The whole creative market apparently was facing existential risk, with concerns about generative AI solutions eliminating the need for specialized tools. The recent earnings release changed sentiment – shares bounced back after an unexpectedly strong report. Adobe’s Firefly is being deeply integrated across their suite of products. It is clear enterprises need more tailored solutions and cannot fully leverage consumer-facing generative AI solutions. Large companies need tooling to ensure consistency across their assets, from brand tone, messaging, colors, design, and more. Rather than limit usage, AI applied to the creative space has unlimited potential. With AI, companies can test 100s or 1000s of asset variations for marketing campaigns and optimize automatically. Adobe is well positioned. Shares are fairly valued.

Agree Realty (ADC) appeared as a bottom performer for a series of quarters, and appears as a top performer for the first time. As a triple-net REIT, Agree Realty’s valuation is closely tied to interest rates. Rates have been steady for a year now. Markets expect the next move to be a rate cut. ADC pays an almost 5% dividend, with steady monthly distributions. Management is savvy, making great decisions with foresight and building a high quality portfolio of tenants including Walmart, Home Depot, Dollar General, Kroger, and many more. Shares are attractively priced.

Bottom Performers

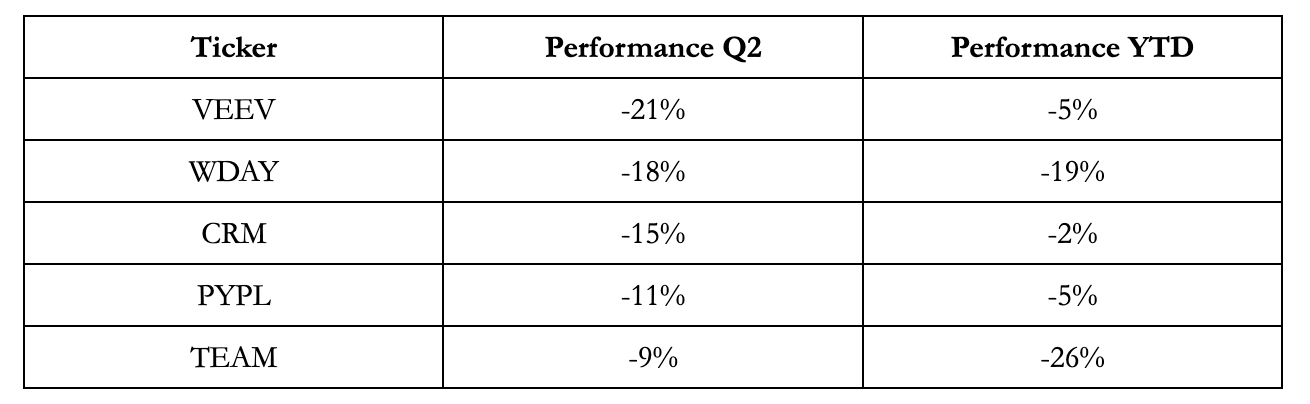

As evident in this list of bottom performers, enterprise software-as-a-service companies faced pressure throughout Q2. Investors were concerned about AI efficiencies reducing the amount of employees that need software solutions. Many SaaS companies charge per user. A reduction in users would lead to a reduction in price.

With all the movement in AI, sales cycles have been elongated. AI has introduced a lot of uncertainty and changes in strategies. Companies want to ensure they are choosing partners that will propel them forward.

Additionally, smaller SaaS companies faced concerns that their products or offerings would be replicated by mega cap technology companies and embedded with AI, making their offerings obsolete.

Our take is that these concerns are transient. AI usage in the workplace has been limited. Use cases today include internal and customer-facing chatbots, searching for information within the enterprise, timely assistance via copilots, and summarizing data or content. There certainly is value. That being said, we are yet to see transformational employment shifts from AI.

If AI fulfills the promise of making employees more productive, it will likely lead to an explosion of new offerings and solutions. It is more likely to increase output globally vs. reducing employment.

Veeva Systems (VEEV) sells software solutions to large pharmaceutical companies, helping them develop drugs more quickly with clinical-focused software and sell more with dedicated CRM software. Veeva has a proven model, being profitable throughout most of its history. Recent concerns stem from slightly lower guidance than expected and lower deferred revenue. Customers are going with shorter contracts. We find these concerns to be temporary. We are excited about the long-term prospects and find shares trading at a very attractive valuation.

Workday (WDAY) offers human resource management and financial planning software to large enterprises. They help companies with two of their most critical assets: their people and their money. Workday has grown steadily over time and has a long runway. Shares fell after they reduced full year guidance, citing longer sales cycles. Guidance and backlog fell short of expectations. Workday is a critical need for any modern enterprise. Shares are attractively valued.

Salesforce (CRM), similar to other enterprise SaaS companies, dipped after citing elongated sales cycles. They have changed their go-to-market strategy, focusing on customer needs with a platform approach instead of selling products individually. This seems well timed, as many companies are looking to consolidate vendors benefitting those with larger platforms. Salesforce has a very unique data set – they have every interaction their customers have with their customers. This data is likely to be a great source of value when coupled with AI. Salesforce is also attractively priced.

PayPal (PYPL) is a repeat bottom performer. Alex Chriss and the new executive team have been busy making many changes. PayPal seems well positioned with their Braintree processing, enhanced checkout flows, and new opportunity to build out an advertisement business. Shares started building momentum throughout the quarter. Apple announced a series of enhancements and capabilities for Apple Pay. The heightened competition concerned investors and put a halt to the momentum. There’s a lot of value in shares at current prices. The concern is PayPal’s ability to reinvigorate their branded checkout. Management will need to start demonstrating real change there to win investors back.

Atlassian (TEAM) is another enterprise SaaS company; they sell workflow solutions for teams to collaborate better. This is a new addition to our portfolio last quarter. Atlassian offers significant value at current prices. Similar to Salesforce, they have very unique data for their customers, which they already are leveraging with AI. Shares have caught some bids and started moving up recently; the company is attractively priced.

Portfolio Overview & Activity

At Torre Financial, we invest in companies that have high returns on capital, competitive advantages, and durable growth. We focus primarily on fundamentals, and continually reevaluate and rebalance according to where we see the best value.

High returns on capital is an indicator on the efficiency of a business, ensuring they make the most of their available capital. Target companies often exhibit low capital intensity and effectively convert earnings into free cash flow, allowing them to reinvest excess cash flow at high incremental rates of return and/or return it to shareholders.

Competitive advantages are more qualitative in nature and give insights into the durability of a company’s profitability. Considerations include scale & size, market structure, barriers to entry, differentiation & pricing power, company culture, amongst others.

Durable growth can come from secular tailwinds (i.e. growing industries), business model dynamics (i.e. indexed on transactions), innovation (i.e. building new offerings), amongst others.

The combination of efficiency and growth, sustained through advantages, increases the intrinsic value of the business over time.

At Torre Financial, we look for these companies and seek to invest at reasonable prices. Portfolio growth follows the company fundamentals.

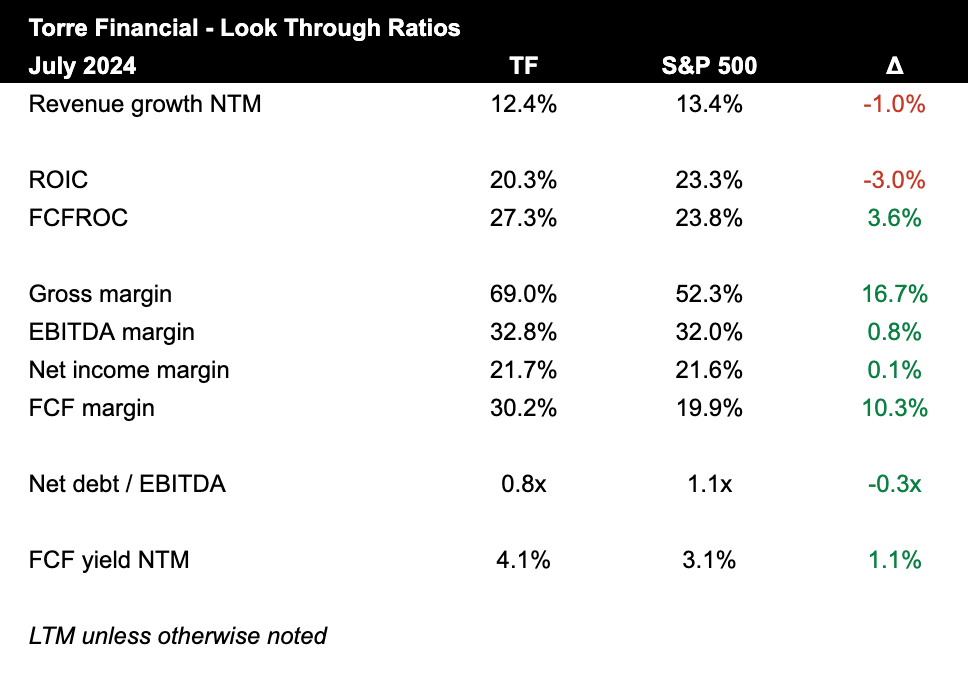

When compared to the S&P 500, our portfolio companies:

have slightly lower revenue growth

are more efficient in their use of capital on a FCF basis

have superior margins across the board

use less leverage

and are much cheaper on a FCF yield basis

Revenue growth is slightly lower for our portfolio, primarily due to the extreme high growth of the mega caps such as Nvidia. Because the S&P 500 is market-cap weighted, larger companies have a more significant impact.

Aside from revenue growth, the TF portfolio is higher quality with stronger margins and FCF efficiency.

At the same time, the TF portfolio is also much more attractively valued, with a FCF yield of 4.1% against 3.1%. Looking at valuation in terms of multiples, TF goes for 24.4x FCF while the S&P 500 trades at 32.3x FCF.

TF offers more efficient businesses with better margins and comparable growth for ¾ the price of the index.

The combination of superior fundamentals and valuation allows for a high probability of outperformance over the long term.

High quality companies are rare. In line with our investment philosophy, we aim to keep portfolio turnover at a minimum. Each company is rigorously evaluated and vetted as a long-term opportunity before being introduced.

We hold our portfolio to a maximum of 30 companies, ensuring we pick the best of the best and make the hard decisions when necessary. We strive to invest for 5+ years, which implies we turn over fewer than 6 companies a year. Our turnover activity is low, yet incorporates significant investment in research so that we can have the best possible companies and target allocation.

We are continually evolving our processes to improve. Some of the key performance indicators of our work input are shown below.

This quarter, we had heightened activity, as we added 4 new companies and exited 3. We have now added 6 new companies this year, hitting our stated limit.

Diving into the details on the portfolio and target allocation weights…

Behind paywall: full list of positions and target weights each month, a breakdown of buy/sell activity with rationale, superinvestor spotlight, thoughts on portfolio diversification, and looking beyond efficiency metrics for a deeper understanding

Keep reading with a 7-day free trial

Subscribe to Torre Financial Newsletter to keep reading this post and get 7 days of free access to the full post archives.