2024 Q3 Letter

Review of quarterly results, contributors and detractors, portfolio overview, and personal reflection

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along. →

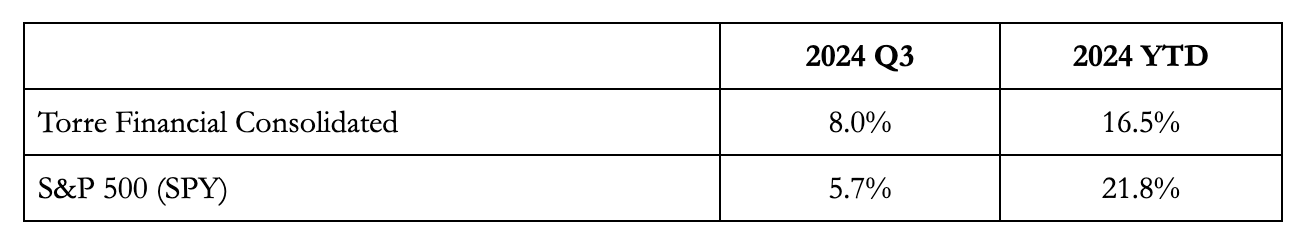

Consolidated Torre Financial accounts increased 8.0% for the quarter. The S&P 500 (SPY) increased 5.7% over the same period.

Returns for individual accounts may vary as each account is managed separately.

Our portfolio performed well this quarter, closing the gap in performance against the S&P 500. We were fully invested for the majority of the quarter. The work we have done to diversify our portfolio across technology, healthcare, real estate, risk management, and more has helped decrease volatility. When the market dipped, our portfolio declined less than the overall market.

The S&P 500, a market-weighted index, has benefited from the rush to semiconductors. Nvidia, which is not a portfolio company, has skewed the index to the upside. Nvidia is up 173% YTD. With a market cap of $3.3 trillion, Nvidia makes up over 6% of the index.

The economy and the market have faced a barrage of issues, from inflation, unemployment, hurricanes, wars, to Chinese stimulus, and many more. Given our focus on high-quality companies, we are able to stay invested throughout many of these concerns as stocks continue to climb the wall of worry.

Top Performers and Detractors

The following companies were the top performers in Q3, followed by their Q3 performance:

PayPal (PYPL) +35%

MercadoLibre (MELI) +28%

Agree Realty (ADC) +23%

American Tower (AMT) +20%

UnitedHealth Group (UNH) +19%

Both PayPal and Agree Realty had been struggling for a while, often showing up as detractors. This quarter, they boomed. The tide seems to be shifting as their value is being realized.

PayPal’s new CEO Alex Chriss is reinventing the company, focusing on their core competencies as a mobile wallet and payment processor.

REITs, including Agree and American Tower, benefitted from the Fed’s pivot as they cut rates by 50 bps in September.

The following companies were detractors to our performance, followed by their Q3 performance:

Edwards Lifesciences (EW) -27%

Airbnb (ABNB) -16%

Alphabet (GOOGL) -9%

Adobe (ADBE) -7%

Amazon (AMZN) -5%

Edwards reeled back after an earnings release where they lowered their growth outlook for their main product, TAVR. There are additional factors in the mix, including the spin off of their critical care business segment which can make the financial numbers look worse off as well as the new CEO Zovighian who has been in the role for just over a year. October brings a potentially significant catalyst as they will announce results for their Early TAVR trials which could accelerate growth if positive.

Other detractors include big tech companies. Given their recent outsized performance, this pullback is more likely a healthy breather than anything else. Of the big tech names, Google, Amazon, and Adobe offer some of the most compelling value.

Portfolio Overview

Overall, our portfolio is very well positioned and we are very confident going forward.

Over the last two years, we’ve done a lot of work to diversify our portfolio beyond technology.

We’ve added healthcare names including Abbott, Danaher, Edwards Lifesciences, and ThermoFisher Scientific. Healthcare companies provide resilience in that their demand is typically not dependent on the economy. Health is not something that people defer due to costs. Healthcare research is a multi-year venture and not likely to be swayed by short-term, month-to-month factors.

We’ve added real estate companies, expanding our position in Agree Realty and initiating American Tower. Real estate provides a mix of stability, growth, and cash flow. Hard assets such as land tend to appreciate over time while tenants pay rent monthly, which REITs often distribute as dividends.

We’ve added risk management companies such as Intercontinental Exchange and FactSet Research, while adding to Moody’s and S&P Global. We label these companies as risk management because they help their customers make better informed decisions. In today’s world, this visibility is a must. As market volatility increases, the value of these products increases, making them great antifragile components of our portfolio.

All of these companies exhibit high returns on capital, competitive advantages, and durable growth.

In order to accommodate these new positions, we have exited positions in many of our high growth, early stage software companies including The Trade Desk, CrowdStrike, Zscaler, Cloudflare, and Datadog. While we believe these can be all exceptional companies, the risk to our portfolio is too significant on both valuation and volatility.

Many are cash flow profitable, but not profitable on a GAAP basis. The difference there is mostly due to stock-based compensation (SBC). The issue with high SBC is two parts: 1) it dilutes ownership and 2) it makes the company less resilient. Because SBC is determined by the stock price, if the price declines significantly it puts the company in a very difficult position. Either morale suffers because people are getting “paid less” in total compensation, or the company issues more stock at a lower price which can be extra highly dilutive. In looking to make our portfolio more resilient, we made the difficult decision to exit these companies that we think very highly of.

When compared to the S&P 500, our portfolio companies:

have slightly lower revenue growth and slightly less ROIC

are more efficient in their use of capital on a FCF basis

have superior margins across the board

use less leverage

and are much cheaper on a FCF yield basis

As mentioned above, the index is benefiting significantly from Nvidia’s contribution. Excluding NVDA, the S&P500 would have revenue growth of 8% (vs. 13.5%), ROIC of 20.3% (vs. 23.6%), and similar decreases across the rest of the metrics.

Our portfolio has more diversification across sectors, higher margins across the board, and is more attractively valued than the index.

Our portfolio’s free cash flow (FCF) yield of 3.7% is significantly above the index’s 2.9% and rivals the US 10 year treasury yield of 4%. Our equity portfolio’s free cash flow will increase over time, while bond cash flows are fixed.

Portfolio Management

Diving into the details on the portfolio and target allocation weights:

Keep reading with a 7-day free trial

Subscribe to Torre Financial Newsletter to keep reading this post and get 7 days of free access to the full post archives.