2025 Q2 Letter

Review of quarterly results, contributors and detractors, portfolio overview, and personal reflection

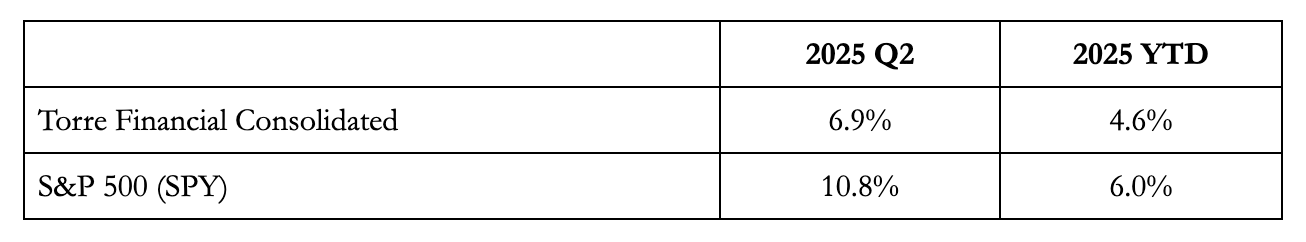

Torre Financial consolidated accounts increased 6.9% for the quarter. The S&P 500 (SPY) was up 10.8% over the same period.

SPY is an ETF tracking the S&P 500, an index of 500 companies. Torre Financial invests in 25-30 high quality companies. Returns for individual accounts may vary as each account is managed separately.

The market bounced back with vigor following the tariff-induced sell off in the first quarter. The v-shaped recovery in the second quarter was one of the fastest recoveries from a correction, driven by a settling macroeconomic landscape.

The strong performance has been particularly pronounced in the tech sector, with the Nasdaq gaining nearly 17% compared to the S&P 500’s 11%. Large cap and momentum names pushed higher, driving performance across Technology, Communication, Industrials, and Consumer Discretionary sectors. Energy, Health Care, and Consumer Staples lagged.

Many ongoing concerns seem to be subsiding – inflation has come down, tariff rhetoric is settling down, the job market is holding up, daily volatility has declined significantly, and interest rates are expected to come down soon this year.

Additionally, the AI boom continues, the dollar is weaker (promoting international sales; reducing the real cost of debt), and earnings growth is strong.

Looking forward, there are still many issues at play. The tariff deadline is approaching. The geopolitical scene seems fragile. The market is frothy – valuations are high and momentum “meme” names are taking off.

The market seems to be set up for a rotation, when money flows from the high valued sectors that have performed well to the more attractive sectors that have lagged, such as from tech to industrials.

Our portfolio is well positioned for whatever the market may bring. We continuously review our portfolio composition and the individual companies we invest in. We’ve been diversifying underlying exposure in order to build a more resilient portfolio. We seek to invest in the best companies – those with high return on capital, durable growth opportunities, and competitive advantages such as brand, culture, and/or strong management teams amongst others.

Our companies are well-equipped to handle any turbulence. They are resilient: high margin, high cashflow, and strong balance sheets which provide optionality. A company with a strong business, strong management, and low valuation is able to defend itself and even take advantage of temporary dips in share prices.

The recent market movement shows how important it is to avoid timing the market. After a nearly 20% drawdown in April, the stock market closed at a new all-time high in early July. The stock market can be unpredictable in the short term.

Top Performers and Detractors

The following companies were the top performers in Q2 2025:

MercadoLibre (MELI) +31% in Q2

Intuit (INTU) +27%

Arista Networks (ANET) +26%

Veeva Systems (VEEV) +24%

Meta (META) +22%

Tech companies swept the top performance. MercadoLibre is back again after posting a strong Q1. These companies have strong outlooks, driving favorable forward-looking return potential.

The following companies were detractors to our performance in Q2 2025:

UnitedHealth Group (UNH) -38% in Q2

ThermoFisher Scientific (TMO) -13%

Pepsi (PEP) -10%

Agree Realty (ADC) -5%

FactSet (FDS) -1%

Defensive sectors underperformed. Health Care, Consumer Staples, and Real Estate all lagged in the second quarter.

UnitedHealth Group made the headlines as the company withdrew guidance for the year and the CEO unexpectedly stepped down. The issues started in December, when Brian Thompson, the CEO of UNH’s insurance arm, was shot and killed as retaliation to the company’s approval methods. The company seems to have loosened approval, as costs have increased since. Additionally, pricing pressure from government programs coupled with strategic decisions to expand into Medicare and Medicaid have also squeezed profits. Shares dropped nearly 55% throughout April and May. We decided to exit completely early on, at about 20-25% higher than current prices.

Visa and Mastercard, while not on the list, dipped in mid-June. The market reacted strongly to new regulation for stablecoins. Circle (CRCL), a newly public company focused on stablecoins for payments, is up 800% since IPO. There have been many narratives looking to threaten their networks, including crypto and buy-now-pay-later networks just a few years ago. Visa and Mastercard are very strong businesses with very entrenched moats. Their value extends far beyond just paying and includes their distribution network with all the banks & merchants, their rewards points programs for consumers, value added services such as dispute resolution, and much more. A new narrative is insufficient to challenge those moats.

Portfolio Overview

We invest in very strong, proven businesses across various industries with attractive business models. We build our portfolio to perform in any market environment.

Our portfolio is well diversified with varied exposure across a broad array of themes: AI, cloud, advertisement, healthcare, risk management, enterprise efficiency, payments, travel, data centers, industrials, real estate, and more.

All of our companies exhibit strong returns on capital, competitive advantages, and durable growth. We balance quality with appropriate valuation in order to protect our capital while staying invested.

When compared to the S&P 500, our portfolio:

Slightly lower revenue growth of 9.1% vs 11.1% for the index

Higher return on invested capital (ROIC) of 24.8% vs 23.2%

Higher free cash flow return on capital (FCFROC) of 28% vs 24.5%

Superior margins across the board – 69% gross, 40% EBITDA, 29% net income, 31% FC

Stronger balance sheets, with less debt than the market

Significantly cheaper, with a FCF yield of 3.6% versus 2.8% for the index

Whatever the market may bring, we’re determined to stay invested in equities for the long term since it is known that is the best way to build wealth over time. The strength of our portfolio companies, and the combination of them all together in one portfolio, provides the robustness and resiliency to withstand any turbulence.

As always, we thank you for trusting us with your capital. Your commitment, confidence, and patience is essential for long term success.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

See below for additional details and insights from the quarter.

Keep reading with a 7-day free trial

Subscribe to Torre Financial Newsletter to keep reading this post and get 7 days of free access to the full post archives.