Gauging the Quality of a Business with ROIC

Many popular metrics, including price per earnings, price per cashflow, and price per sales, focus on the valuation of a business…

Many popular metrics, including price per earnings, price per cashflow, and price per sales, focus on the valuation of a business. Valuation metrics give insight into what an investor is paying for a business. They do not, however, give much indication as to the quality of the underlying business. Valuation metrics, for example, do not explain why high-quality companies consistently demand higher premiums. While valuation metrics are worthy to consider in security analysis, they do not tell the whole story.

ROIC

Return on invested capital (ROIC) is a useful ratio to understand the efficiency and quality of a business. Connecting the company’s income statement (profit) with the balance sheet (resources), ROIC measures the return a business achieves on the capital in use. As shown below, ROIC is calculated as the net operating profit after tax (NOPAT) divided by the average invested capital.

See this explanation for a comparison between NOPAT and net income.

Adding revenue to both the numerator and denominator, the formula can yield additional insights.

The two components are equivalent to capital turnover and profit margin, respectively, leading to the following formula:

A business with a particular amount of resources available, selling at a particular margin, will achieve a higher return the more cycles it completes.

For a concrete example, consider a business that has $100,000 in resources and is able to produce and sell with a 10% profit margin. If the business is able to cycle through that process 4 times in a year, the business would achieve ROIC of 40%.

Companies typically take on debt, or leverage, in an effort to expand. Analyzing the company’s ROIC gives insight into whether the expansion is destroying or creating value. A company with ROIC lower than their weighted cost of capital would be destroying shareholder value. In this situation, the debt would come at a higher cost than what is produced. Conversely, a company with ROIC greater than their weighted average cost of capital would have an opportunity to create value through expanding operations.

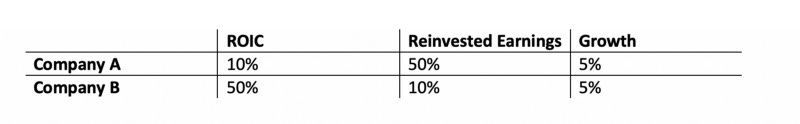

A company is valued by the discounted future cashflow it can produce. ROIC gives an indication into how much free cashflow a company will return to its owners. Consider two companies: Company A with ROIC of 10% and Company B with ROIC of 50%.

All else being equal, the company with ROIC of 50% will be able to grow at the same rate with significantly less investment. For every dollar of earnings, Company A requires a reinvestment of $0.50, while Company B requires $0.10. Company B produces $0.90 of free cash flow, or 80% more than Company A’s $0.50.

This explains why companies with higher ROIC are more valuable — not all earnings are created equally.

High-ROIC Case Study: Mastercard

Mastercard Incorporated, the transaction processing company providing various payment solutions, has maintained a consistently high ROIC. Dating back to 2008, the company has produce returns in excessive of 36%.

The company’s capital structure includes $5.4 billion of equity capital and $12.6 billion of debt capital.

With under $18 billion in total capital, Mastercard is able to produce revenue of $17 billion and net income of nearly $8 billion.

Indicative of a clear competitive advantage (perhaps the duopoly with Visa), Mastercard’s efficiency demonstrates the high quality of the business.

Investors have taken notice. Since July 2009, Mastercard stock has returned over an average of 30% per year. Mastercard’s total capital of nearly $18 billion pales in comparison to its market capitalization of $308 billion.

Mastercard has had high ROIC since 2008. Valuation tracked below the company’s normal P/E of 27.14 from 2008–2012, making for attractive entry points. The company traded near the company’s normal P/E, suggesting fair valuation, up until 2017 when the price began to diverge. Mastercard appears to trade at a significant premium today.

Conclusion

A composite of the profit margin and capital turnover, ROIC is an important metric to consider when evaluating the quality of a business. Thinking as a business owner, this metric allows an investor to consider how to allocate capital for best use.

While ROIC can give indication as to the quality of a company, no single data point should be used exclusively to make an investment decision. Quality companies typically trade at a premium. This begs the question as to what is an appropriate premium for a given company.

Amongst valuation metrics, balance sheet analysis, and qualitative assessments, including ROIC in the analysis of securities can give an insight into the competitive advantage and future compounding potential of a company.