Investing in Equities for the Long-Term

Evidence-based reasoning as to why equities should be the primary vehicle of investment for long-term investors

Everyone has unique financial goals. The key to successful investing is identifying clear goals and executing a plan to achieve those goals. There are many factors to consider, including, but not limited to, the investor’s timeframe, risk tolerance, need for capital, and source of income. Generally speaking, a diversified allocation is a prudent strategy.

For the long-term investor — one with an investment horizon of 10, 15, or 20+ years — I present the case for a strong allocation towards equities.

Equities and the attractive long-term results

To understand the long-term results of investing in the stock market, compare a hypothetical investment of $100 in the S&P500 compared to a similar $100 investment in 10-year treasury bonds.

Dating back to 1928, the average annual return for stocks, as measured through the S&P500, comes in at roughly 10.50%. For treasury bonds, the average annual returns are 5.76%. Historically, the annual return for stocks has been nearly 5% higher than that of bonds.

This difference is magnified over time. The following graph shows the growth in nominal amounts over the 88 year period.

Dating back to 1928, a $100 investment in the S&P500 would be worth $328,645 in 2016.

In contrast, the same $100 investment in 1928 in 10-year treasury bonds would be worth $7,110 in 2016.

The difference is life changing. An investment in stocks returned nearly 47 times more than an investment in bonds over the same time period.

The reward is not without risk

The well-known trade-off between risk and reward proves true when looking into the variance of the returns for any individual year.

Annual returns from the S&P500 range from roughly -43% to 52%, while Treasury bonds have a tighter range of roughly -11% to 33%. Bonds are notably more stable, providing downside protection in any difficult year.

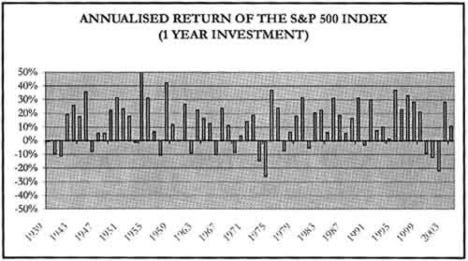

The following graph shows annual returns of the S&P500 from 1928 to 2016. The volatility, rather pronounced, tends to cluster together.

Stocks may vary significantly in value for any given year.

An investor will undoubtedly be troubled by any significant decrease in portfolio value. Behavioral economic studies indicate that humans tend to place outsized significance to losses relative to gains, leading to emotional reactions. Fortunately, there is a way to mitigate this volatility.

Mitigating risk with time

As evident in the previous graph, stocks have experienced more years of positive returns than negative returns. Leveraging this positive skew, an investor can lower the risk of investing in stocks by holding for longer periods.

The following graphs show annualized returns for various holding periods. Each bar represents the average annual return of an investment held for the specified amount of time preceding the year of the x-axis.

The first graph, with a holding period of one year, confirms the volatile returns previously analyzed. As the holding period increases up to the 30-year holding period, the average annualized returns become more stable and, therefore, more predictable. The volatility of the expected return appears to be inversely related to the holding period.

Another study, presented in Burton Malkiel’s “The Random Walk Guide to Investing”, found similar results.

The graph above shows annual returns for various time periods between 1950 and 2002. Investing in common stocks for any 1-year period appears to be a gamble, resulting in annual returns between -26.47% and 52.62% . In comparison, an investment held for 25 years throughout this period would have returned between 7.94% and 17.24%.

The range of expected annualized returns narrows significantly as stocks are held for a longer period of time.

Conclusion

“History doesn’t repeat itself, but it often rhymes.”

-Mark Twain

History does not guarantee future results. It can, however, provide valuable learnings. Over the long-term, stocks have historically averaged annual returns of over 10%. In comparison, treasury bonds, which tend to be less volatile, averaged 5.76%. While bonds may be particularly helpful in moderating portfolio volatility, the stability comes at a cost. The difference in annual returns, compounded over time, can lead to significantly different outcomes.

Bonds are not the only way to mitigate volatility. Holding stocks for a longer period of time reduces risk by averaging out volatility from any single year. The volatility of equity investments over time should be considered by any investor in setting his financial goals. By understanding and internalizing the advantage of an extended holding period, investors can strengthen their rational self to mitigate any emotional reaction.

Equities are a compelling investment vehicle for any investor with a long-term investment horizon.