Market & Earnings Review - July 22, 2023

Market commentary, portfolio company earnings results, and closer look into UnitedHealth Group (UNH)

Market

The S&P 500 continues to climb higher with momentum building as the index has closed higher 8 of the last 10 weeks. The market cleared the 430 peak set in August 2022 without much issue. The next level to watch for resistance would be 462, the local peak from March 2022.

The Dow Jones Industrial Average is starting to show signs of life, registering 10 green days in a row. The Nasdaq, which has been the clear leader this year, gave up gains this week.

Year-to-date performance:

Nasdaq +41%

S&P 500 +18%

DJIA +6%

Rotation

The recent relative performance shift from Nasdaq to Dow is consistent with our observations.

Earlier in the year, the market gains were particularly concentrated in mega caps. Performance now seems to be more evenly distributed, with the equal-weight SP 500 index having outperformed the market-cap weighted SP 500 index over the past month by 1% to -0.4%. Early leaders seem to be easing up as investors rotate positions.

Even indices are rotating. The Nasdaq 100 announced a rebalancing to lessen the weight of the mega caps. Taking place July 24th, the change reduces position sizes in Apple, Microsoft, Google, Amazon, Nvidia, Meta, and Tesla by roughly 1-3%. That capital will be reallocated to all other stocks in the Nasdaq 100, which will get a boost.

Market rotation is seen as healthy as it helps build momentum while combating the excess. Markets may have more room to run. As the common Wall Street adage says: Strength begets strength.

Within Torre Financial, we have been doing some rotation in our own portfolio over the last few months. Many of the companies we’ve been accumulating this year such as Adobe, ADP, PayPal, Booking, Danaher, and Airbnb are showing relative strength against the market.

Earnings Season

Banks kicked off the Q2 earnings season on July 14th. Results were generally well received, especially considering banking turmoil earlier in the year. Loan loss provisions, however, spiked. Provision for credit losses are the amount banks expect to lose to bad loans. The largest six lenders, including JP Morgan, Wells Fargo, US Bank amongst others, set aside roughly $8 billion. This was much higher than last year, and higher than expected. These provisions for losses give insight into the banks’ expectations of the upcoming economic landscape.

More broadly, earnings have similarly been mixed. For example, Tesla’s report showed sales are holding up well, but showing weakness in profitability and pricing power. Tesla’s inventory has been steadily growing (not good). As another example, Netflix showed weaker than expected sales but stronger profitability. The broader theme – companies have been making trade-offs between growth and profit.

Energy is a standout weak spot — not surprising given crude oil trades in the $70s, down about 30% year over year. The sector is expected to post an earnings drop of over 48% year over year.

Artificial Intelligence (AI)

Artificial intelligence, a trending topic this year, is showing no signs of slowing. The hype is starting to turn into cash.

Earlier this year, Microsoft invested $13 billion in OpenAI, the company behind ChatGPT. Recently, Microsoft shares hit all-time highs after announcing their new generative AI subscriptions bundled within Microsoft 365. The AI add-on will cost $30/user/month, a significant upsell compared to the current monthly plans ranging from $12-$57/user/month.

Salesforce also announced pricing for their AI offerings. Sales GPT and Service GPT will start at $50/user/month each, with additional credits to be purchased for usage of Einstein GPT.

Apple, known for being more cautious with releases as they work to perfect experiences, also entered the AI arena. Apple has started testing a Chat GPT competitor, Apple GPT, internally. The foundation behind the AI chat bot is known as “AJAX” and has been in development since 2022.

Macro

Inflation continues to come down, driving markets up. The most recent CPI release showed a better than expected rate of 3%.

Truflation shows a continued decline, estimating current inflation at 2.13% using more timely, daily information.

Given the strength in the economy and resilience in the job market, the Fed is expected to hike the federal target rate one more time up to 5.25-5.5% before pausing. The economy is likely still absorbing the impact of the rate hikes – the peak impact is felt 1 year after, according to TD.

Markets are expecting a cut in March, which is quite a push back from earlier expectations looking for cuts in September. Given the low inflation readings, the possibility of a cut seems reasonable.

Foreign exchange markets seem to agree. The US Dollar hit a 15+ month low, dropping nearly 13% from the peak from a year ago. As rates increased, investors were attracted to buy dollars and benefit from the high yields. The expectation of declining rates has the opposite effect – the yield is not expected to stick around, so investors may sell dollars for something else. A weak dollar benefits companies with significant international sales.

Q2 2023 Earnings

Over the last two weeks, two portfolio companies reported earnings.

UnitedHealth Group (UNH)

Previously covered in Market & Earnings - January 21, 2023

UnitedHealth Group is a leader in healthcare, and the largest constituent of the Dow Jones Industrial Index.

United HealthCare Corporation was founded in 1977, IPO’d in 1984, and changed names to UnitedHealth Group in 1988.

UnitedHealth reports in two divisions:

UnitedHealthcare – 54% of overall earnings from operations

Optum – 46% of overall earnings from operations

“UnitedHealthcare provides health care benefits globally, serving individuals and employers, and Medicare and Medicaid beneficiaries. UnitedHealthcare is dedicated to improving the value customers and consumers receive by improving health and wellness, enhancing the quality of care received, simplifying the health care experience and reducing the total cost of care.”

UnitedHealthcare is the insurance that many employers provide for their employees.

“Optum’s health services businesses serve the global healthcare marketplace, including payers, care providers, employers, governments, life sciences companies and consumers. Using market-leading information, analytics and technology to yield clinical insights, Optum helps improve overall health system performance: optimizing care quality, reducing care costs and improving the consumer experience.”

Optum provides additional value-added services that are complementary to healthcare insurance, such whole-person health offerings with telemedicine/care coordination/home healthcare, HSA accounts, insights and analytics for population health management and health data analytics, pharmacy solutions, mental health and substance abuse services, and more.

Turning to the financials:

Revenue growth has turned a corner, and is showing continued acceleration. Quarterly revenue is up 16% y/y from 15% and 12% previously. TTM revenue is up 14% up from 13% and 12% from prior quarters.

Gross margins are showing slight improvement, to 25% from a historical 24%. Although operations (and therefore costs) are increasing, UNH is able to maintain their gross margin steady.

EBITDA margins are also increasing, up to 11% from 8-9% previously.

Efficiency gains are making their way to FCF, with margins climbing up to 11%, a high watermark over the last few years.

Cash is building on the balance sheet and net debt is decreasing, after having jumped with the acquisitions of Change Healthcare ($13.4b) and Optum360 ($12.8b) in 2022.

Shares outstanding increased slightly last quarter, which is atypical for UNH.

Capital efficiency, alongside margins, shows improvement up to 23-24% for both EBITDA and FCF ROC, up from 15-20% previously.

United Healthcare shares have been under pressure in 2023. Investors have been worried about increased operations could weigh on margins, increased risk appetite has lured investors to more growth companies, and potentially nervousness around the $3.3 billion Amedisys deal. Shares got into the low $450s, before a strong earnings result drove confidence and the stock jumped up back above $500.

As for the valuation:

UnitedHealth Group is going for very reasonable multiples of 1.3x NTM revenue and 13x NTM EBITDA. This is quite an attractive valuation for such a quality enterprise with consistent revenue growth and profitability.

The FCF yield of 7.7% compares very favorably to alternatives (i.e. bonds for 3-4%). The double digit growth makes the yield all the more attractive.

The following table shows potential annualized returns over the next 5 years given a spectrum of EBITDA multiples and EBITDA growth rates. This model incorporates a 1% annual share count reduction.

Assuming slight multiple compression to 12x EV/NTM EBITDA and achievable growth of 10%, investors could reasonably expect annualized returns of 10% over the next five years. Any additional improvement or enhancement could yield a higher return.

Closing thoughts

Markets are continually challenging investors. Many investors, including institutional investors, fall into the emotional lure.

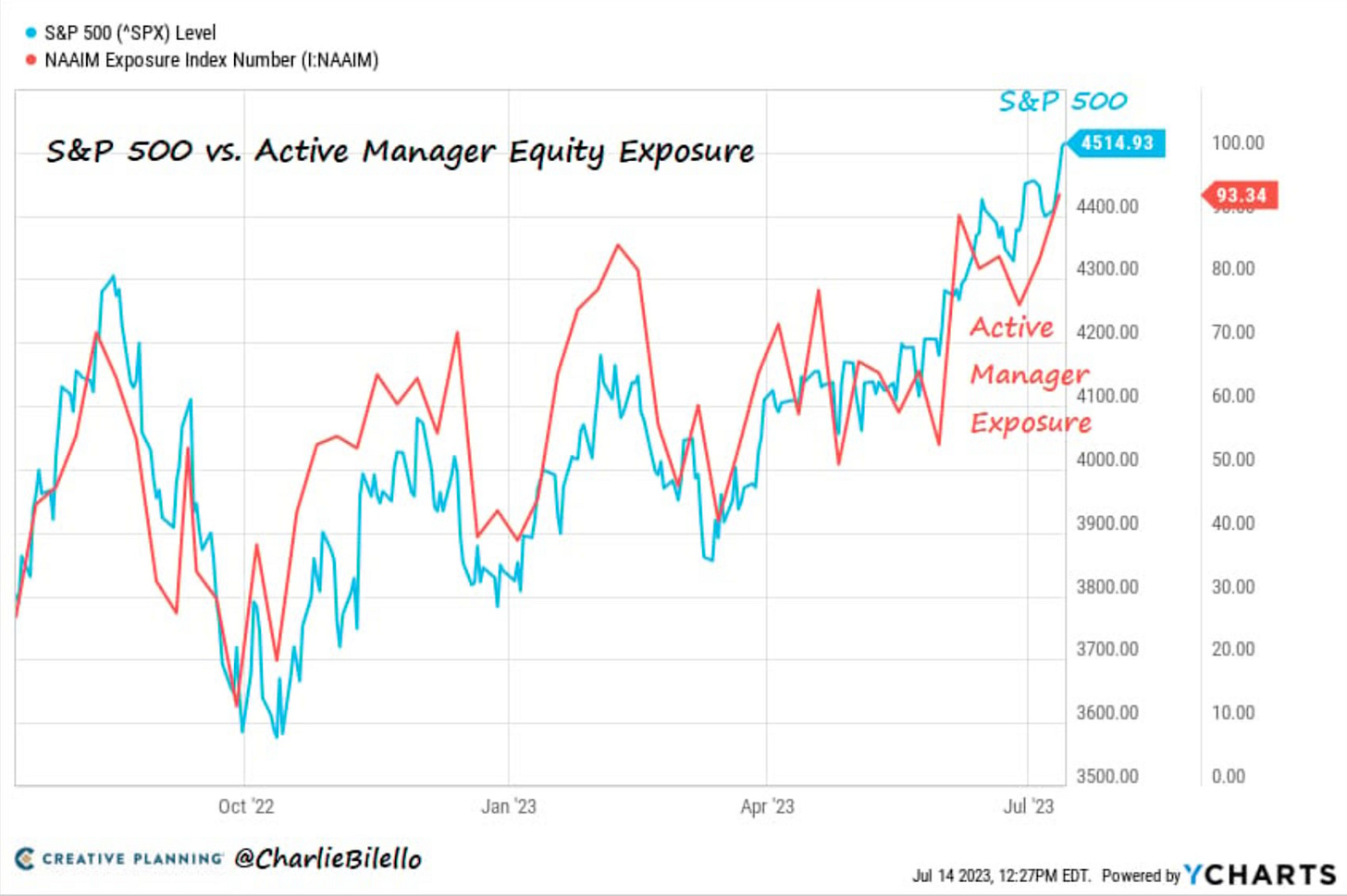

The following chart shows active manager exposure (looking at publicly available manager data, i.e. ETFs and mutual funds). It appears active managers as a group are selling low and buying high.

At Torre Financial, we focus on company fundamental performance first. We strive to stay invested through good times and bad, always looking for the best fundamental companies to drive the best returns. We continually evaluate our positions and rebalance according to what the market is offering.

UnitedHealth Group is a stalwart, continuing to perform throughout any climate.

Earning season is just getting started. Next week we will hear from many companies and we’ll get additional insights into their operations and future expectations. Here’s the upcoming line up for our our portfolio companies:

Tuesday - MSFT, GOOGL, V, DHR, MCO, MSCI

Wednesday - META, NOW, ADP

Thursday - MA

Stay tuned.

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.