Market, Earnings, and PayPal (PYPL) - May 11, 2024

Market commentary, portfolio company earnings results, and a deeper look into PayPal

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

Momentum came back strong as the SPY closed in the green for 7 days in a row. The index crossed the 50-day simple moving average and took off with vigor.

The index is now just 0.5% away from a new all-time high. The bull market continues for now.

Year-to-date performance across indices:

S&P 500 +9.5%

Nasdaq +7.9%

Dow Jones +4.8%

The most recent employment report gave a hint of the labor market cooling off.

Unemployment ticked up to 3.9%. This is seemingly bad news – unemployment up means fewer people have jobs, which in turn means productivity is down.

However, the markets rallied. The weakening job market gives the Fed more leeway to lower rates, which would be a boon for asset prices.

The Fed Funds rate expectations moved in a favorable direction. The market now expects two cuts by the end of the year, and another two cuts in the first half of next year. If that is the case, rates would be down nearly a full point.

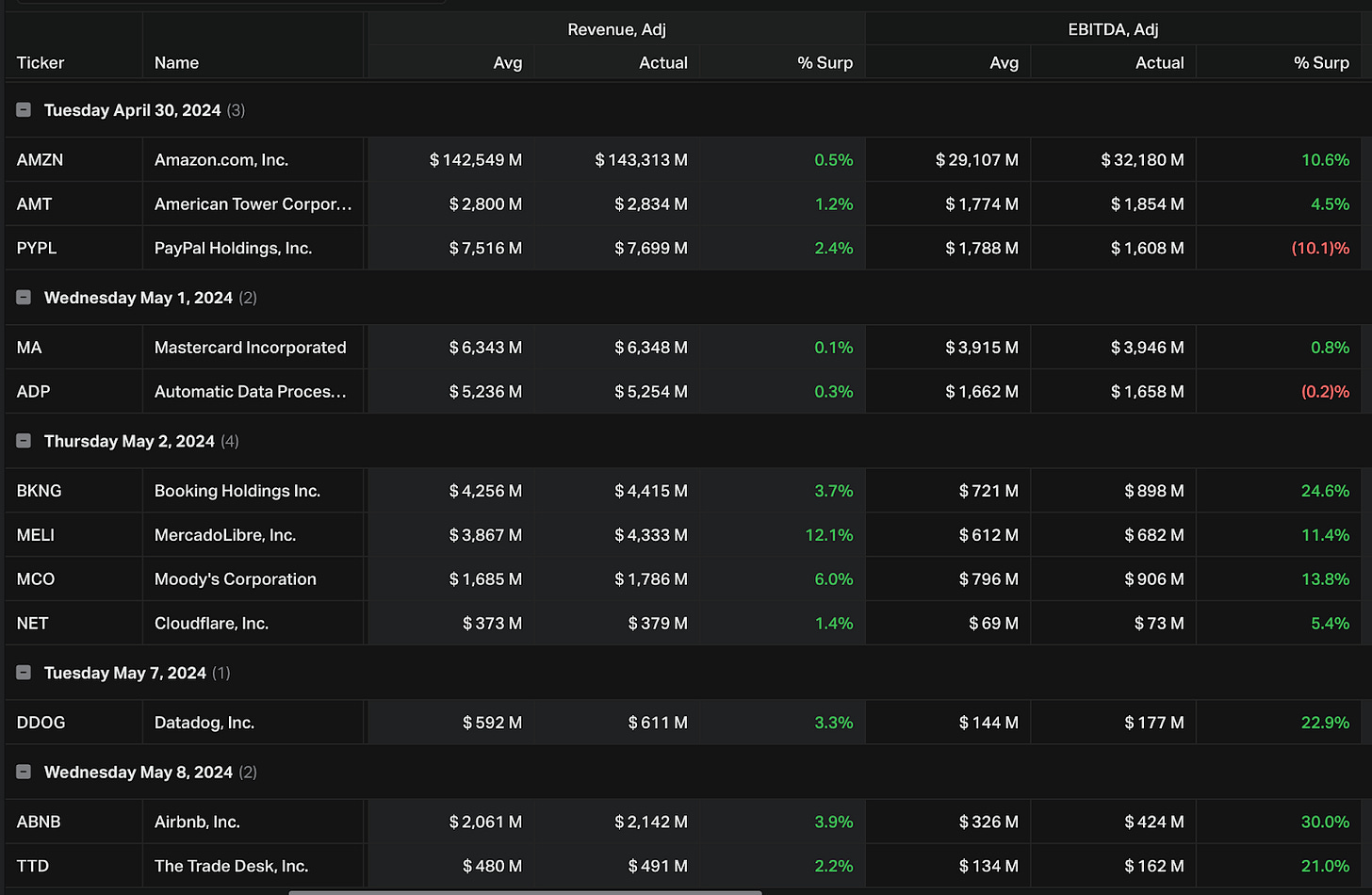

Earnings

Twelve portfolio companies reported earnings over the last 2 weeks.

PayPal (PYPL)

Prior coverage: Market & Earnings Review - May 13, 2023

PayPal has undergone drastic changes since we last covered the company a year ago.

Alex Chriss was appointed CEO in August and started in September. Previously he led various roles at Intuit, most recently serving as the head of the Small Business & Self-Employed Group.

Nine months into the role, Alex Chriss has already shown some positive changes.

He built out a completely new CEO team including Chief Marketing Officer, Chief People Officer, GM of Small Business and Financial Services, EVP and GM of Consumer and Global Marketing, Chief Investor Relations Officer, EVP Chief Enterprise Services Officer, Chief Corporate Affairs and Communications Officer, amongst others.

PayPal has historically been active on acquisitions. Alex Chriss stated one of his goals was to audit the company’s offerings and brands, ensuring they are all strong and able to contribute. HappyReturns was sold off immediately as Alex joined (it was likely already in the works). They doubled down on Xoom, their international payment transfer application. Users can now send international transfers for free, leveraging PayPal’s stable coin PayPal USD.

Alex hosted an innovation session, PayPal First Look, in which they revealed several big bets focused on their core offerings.

A transformed checkout experience, optimized for mobile

Fastlane by PayPal, allowing guests to quickly bypass checkout details

Smart Receipts, allowing merchants to advertise

Advanced offers platform, offering multiple stacked cash back offers to consumers

A reinvented PayPal app

Enhanced Venmo business profiles

Needless to say, there’s been a lot of activity. They are looking to reinvigorate their application and services. The combination of Braintree, PayPal, and Venmo makes for a very compelling strategy.

Diving into the financials:

TTM revenue growth has maintained steady at 8%. While it is a significant slowdown from 2021’s growth rates in the 20s, if it maintains at 8% or even accelerates, that would be bullish.

TTM gross margin ticked down to 39%, down significantly from 48% in 2021. This is the crux of the concern with PayPal. Braintree, a much lower margin offering, has seen rapid expansion. Braintree strategically sets PayPal up well to sell merchants more offerings. But that has yet to come across in the fundamentals.

SG&A and R&D as a percentage of revenue have come down to 11% and 10% respectively, showing the cost discipline they’ve applied over the last few years.

TTM EBITDA margins held steady q/q at 24% and have been in a slight uptrend the last few years. This is good to see. Even though gross margins compressed, their cost discipline has helped EBITDA grow.

TTM FCF margin was up to 16%, another important metric moving in the right direction

The balance sheet is strong with over $3 billion in net cash.

Shares outstanding were unchanged at 0%. In the last few years, they were declining as PayPal had a sizable buyback authorization of $5 billion. This is likely offset by stock packages for new executive hires.

EBITDA ROC and FCF ROC are looking very strong at 24% and 16% respectively. The company has been improving their efficiency.

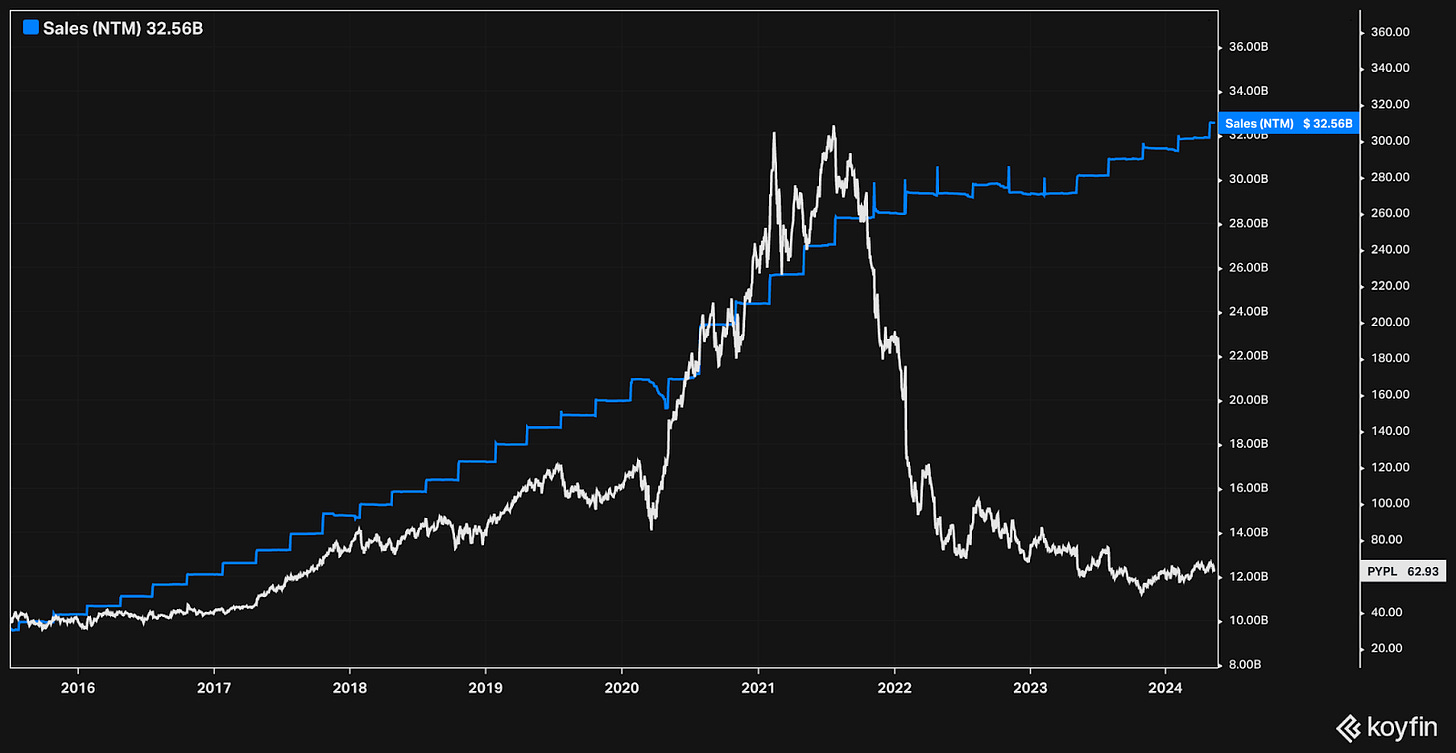

As noted, sales have grown rather steadily.

EBITDA has been under significant pressure due to evolving product mix affecting gross margins and cost efforts. This volatility is less than desirable, and is certainly reflected in the stock price.

Looking at the chart more closely:

PayPal has mostly traded sideways over the last year, down -2.4% over the period. There are however some positive notes showing up.

The November low seems to have marked a turning point. Since then, the stock appears to be in an uptrend. In April, the 50-day SMA crossed above the 200-day SMA, a strong technical indicator known as “the golden cross”.

More recently, the share price dipped below the 50-day SMA. It will need to reclaim that to continue the march upwards.

As for valuation:

The EV/NTM revenue and EV/NTM EBITDA of 1.9x and 10x are not demanding at all, and again reflects the uncertainty regarding gross margins. These multiples are more typical of a company not expected to grow much/at all.

The FCF yield of 8% is very strong. Investors can get 8% FCF returns from PYPL along with future growth – quite attractive compared to the risk-free rate of 5%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share dilution of 0%.

In 5 years, if PayPal trades at the same multiple of 10x and EBITDA grows roughly inline with revenue at 10%, an investment today could return 8.8% per year.

If PayPal turns the corner with accelerating growth and expanding gross margin, the results could be significantly better.

Fast Graphs provides another perspective.

Shares are currently trading for 14.93x P/FCF. If they were to trade at the same multiple in a few years, PYPL could return 16% per year.

If shares trade to the normal, historical average P/FCF of 29x, that would yield a return of 49% per year.

Closing

The market has been on an unrelenting climb for the last few months, and so far experienced only a momentary blip. Will the bull market continue throughout the rest of the year?

It is impossible to know what will happen in the future. That is what makes investing such a challenging endeavor.

At Torre Financial, we focus on finding the best investment opportunities at any time. We focus on companies that have high returns on capital, competitive advantages, and durable growth. We assess primarily on fundamentals, and continually reevaluate and rebalance according to what the market is offering.

Regardless of what the market does, we look for opportunities at the company level. PayPal has gone through significant challenges the last few years. We believe things are starting to change.

--

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.