Market, Earnings, and Zscaler (ZS) - June 8, 2024

Market commentary, portfolio company earnings results, and a deeper look into Zscaler

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The recent volatility led to a small 1.6% pullback in May. The selling was quickly exhausted as the index nearly touched the 50-day simple moving average before bouncing higher.

A new all time high was established last week. The market continues to build momentum with higher lows and higher highs.

The index is becoming increasingly concentrated in the largest companies including Microsoft, Nvidia, Apple, and other large tech companies. Rotation into other companies would help broaden the support and keep the momentum going.

Year-to-date performance across indices:

Nasdaq +13%

S&P 500 +12%

Dow Jones +3%

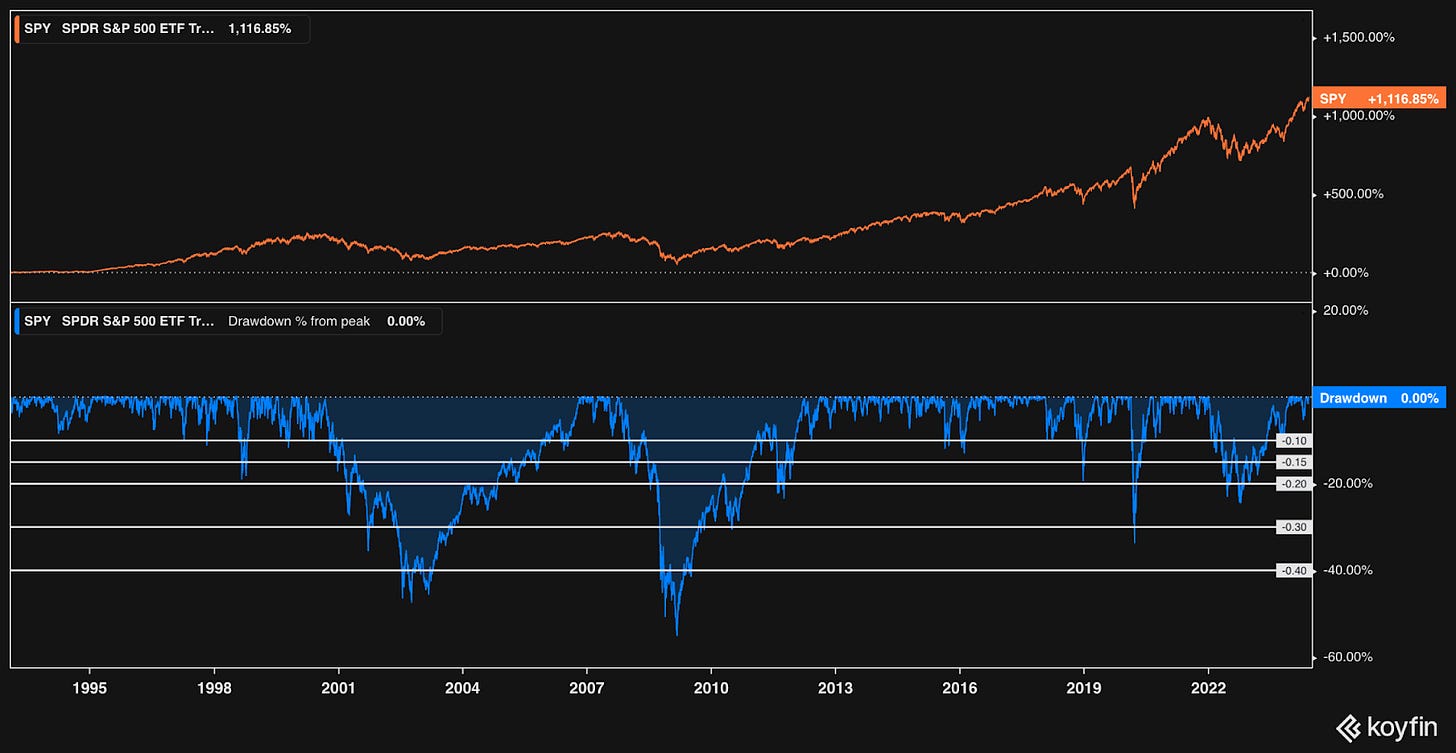

Over the long term, the stock market’s general direction is up. In any given year, however, drawdowns are common.

Even in those years with large gains, the market typically experiences a drawdown of between 5% to 20%.

Going back to 1980, the average intra-year drawdown is 13%.

The S&P 500 saw a double-digit decline within the year more than half of the time (22 of 42 years). Of those years, 64% (14 of the 22 years) ended the year with a positive return.

Drawdowns happen. They should be expected.

Typically, investors should expect a…

5% decline any given year

10% decline every 1.6 years

20% decline every 4 years

30% decline every 9 years

40% decline every 16 years

As for the current market, drawdowns over the last 5 years are plentiful:

March 2020: -34% – COVID (expected once every ~10 years)

September 2020: -10% (expected once every ~1.5 years)

October 2021: -5% (expected once a year)

October 2022: -25% (expected once every 5 years)

October 2023: -12% (expected once every ~1.5 years)

April 2024: -5% (expected once a year)

Volatility is the price of admission in investing. The market has had a fair share over the last 5 years.

It is important to stay invested. By extending the investment horizon, the overall volatility can be significantly reduced.

In any given year, returns for equities can range between -39% and 47%.

Over a 20 year holding period, that narrows to between 6% and 17% annualized.

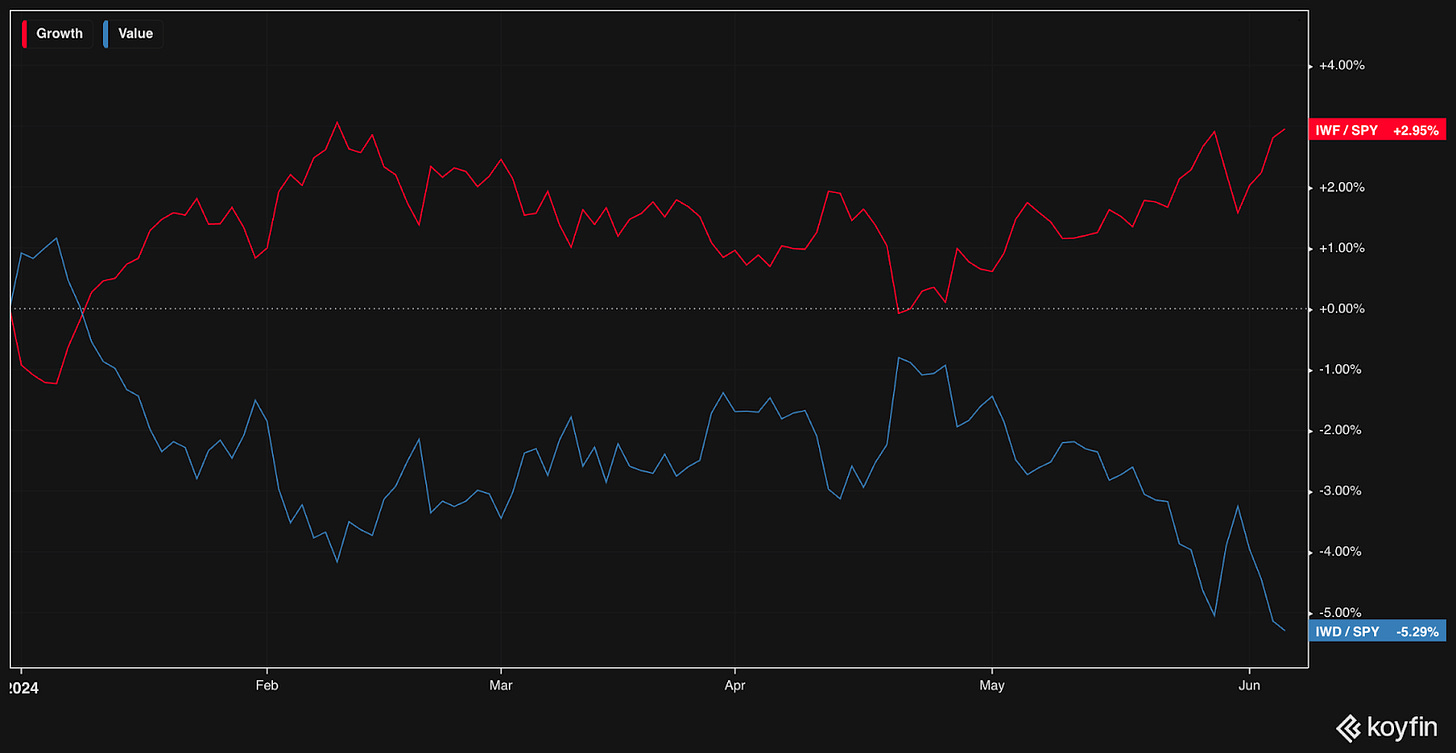

Year-to-date, growth investing is driving the market higher while value investing is underperforming. The two styles seem to be moving nearly perfectly inversely, when normalized with the S&P 500.

Recent market optimism seems to be driven by global central banks.

The global rate cut cycle started with the Bank of Canada and the European Central Bank both cutting rates. The Fed is yet to act.

The Fed has a dual mandate & is responsible for ensuring maximum employment while keeping inflation in check. Needless to say, it can be tricky to balance as full employment leaves more money to spend, which increases demand and drives up prices.

The nonfarm payroll report was released on Friday. Unemployment ticked up slightly to 4% in May compared to 3.9% in April. Markets expected 185,000 jobs to be added. The report came in much higher at 272,000. A strong employment market reduces the need for stimulus, thereby lowering the need for a rate cut.

Truflation, a real-time inflation index, has oscillated between 2-3% this year.

The market continues to expect a rate cut in 2024. The expectation is for the first to come in September, with rates coming down nearly a full point by April 2025.

Before Friday’s nonfarm payroll report:

After the report:

Earnings

Four portfolio companies reported earnings over the last 2 weeks.

Zscaler (ZS)

Prior coverage: Market & Earnings Review - June 10, 2023

Zscaler is an emerging leader in the cloud-native networking security space. They offer the next generation of the corporate network – one built for the cloud instead of physical offices, one that works for the new remote world.

A key differentiator for Zscaler is the zero trust approach.

In the traditional networking approach, all of the systems within the network have free access to each other. Once you are in, you are in the entire system. Typical breaches occur by finding a vulnerability at the edge (say maybe at a specific branch location, via a wifi connection). Once a bad actor gets access there, they can get access to the central systems as well as any other branch or factory!

The next generation solution, which Zscaler pioneered, is zero-trust architecture. Any attempt to access any node in the network is checked. Even if a bad actor were to somehow get access to a system, they wouldn’t even be able to discover other systems in the network. Traffic from the branch to any other system goes through Zscaler’s solution first. It verifies the traffic is secure before allowing it to proceed.

Those checks might include company policies, origination data (ip address, device, location, etc), user identity (along with their two-factor authentication), historical traffic patterns, frequency of requests, amongst many other data points. Zscaler’s solution parses all of it in realtime and decides whether to allow or block the request.

Their solutions have resonated with the market. Revenue has grown at 52% CAGR over the last 4 years. Today, it is still growing at 33%. Many other software companies have seen a much steeper deceleration.

Cybersecurity, as an industry, has some powerful secular tailwinds. Security concerns are serious matters. They can be fatal for many companies. Breaches or other more serious infiltrations can erode trust. Now with AI, bad actors are leveling up their attacks – more attacks, higher sophistication. On top of that, the SEC now requires timely disclosures of any incident. Needless to say, security is a top priority at any enterprise. It is an immediate concern and companies are willing to pay for mitigating the risk.

For Zscaler more specifically, there is significant opportunity for growth. They started allowing users to have secure & fast access to the internet and software applications. They expanded to better serve remote work. Then they solved the need for applications to communicate with each other, app-to-app. Now, there’s a new wave of interconnected devices and edge computing. Given the seemingly never-ending supply of applications, devices, and access requirements, Zscaler seems well positioned for continued, durable growth.

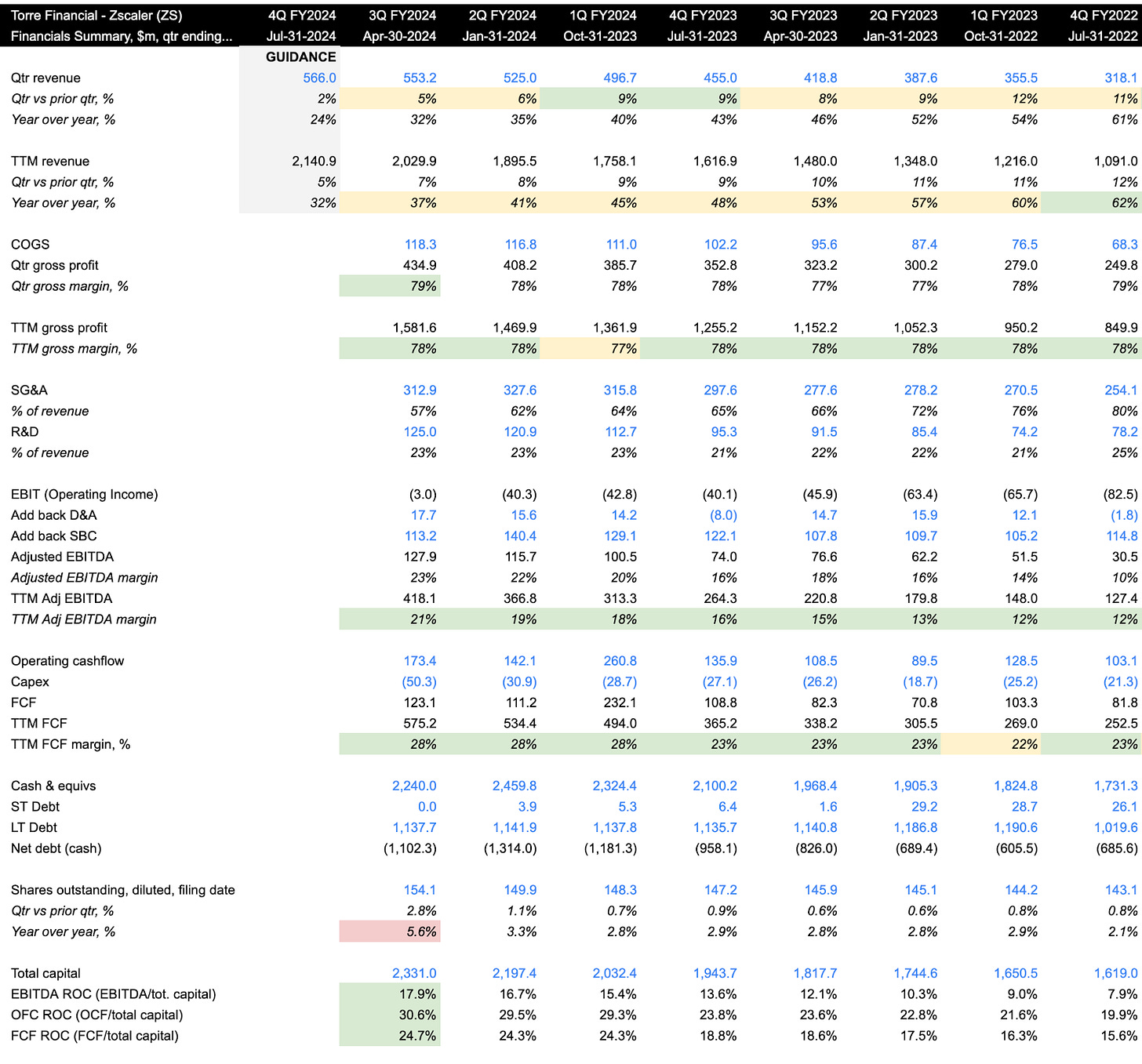

Diving into the financials:

TTM revenue came in at 37% y/y. Although decelerating, it is doing so gracefully. 30%+ growth in the current environment is rare, and the guidance seems to show confidence in that continuing.

TTM gross margin came in at 78%. It has been steady over the last few years. The latest q/q reading of 79% shows potential upside there.

TTM EBITDA margins came in at 21% and have been steadily increasing over time. They are up from 12% roughly 2 years ago, demonstrating their operating leverage and focus on profitability.

TTM FCF margin of 28% is similarly moving in the right direction. The fact that FCF is higher than EBITDA is great – it shows some pricing power as Zscaler is able to bill and collect from their customers in advance.

The balance sheet is strong, with over $2.2 billion in cash and about $1.1 billion in long term debt. The net cash balance has been generally growing over time, up to $1.1 billion from $685 million about a year ago.

Shares outstanding came in at 154.1 million, a +5.6% y/y. This is very high, even against Zscaler’s prior quarters where the dilution was closer to 3% y/y. We will be watching this and want to make sure it reverts to the mean.

Return on capital (ROC) metrics look very strong between 18-30% across EBITDA, OFC, and FCF ROC. The total capital invested has expanded over time, growing to 2.3 billion from 1.6 billion about a year ago. This is in part due to the shares that have been issued.

Zscaler has been very consistent over time, outperforming their own guidance and the market’s expectations, on revenue:

And EBITDA:

Taking a look at the price action:

Zscaler shares had been in a general uptrend since the golden cross back in July 2023, even withstanding the broader market volatility in October 2023.

Starting 2024, the momentum shifted. Selling started in February, likely driven by general concerns about cybersecurity as a large incumbent Palo Alto Networks reported weak billings.

In May 2024, shares hit the death cross, where the 50-day SMA crosses below the 200-day SMA. The decline accelerated, taking shares down to the 150’s.

A strong earnings report brought some life back. Shares jumped up, crossing above the 50-day moving average. ZS seems to be hovering right around the 50-day SMA. If shares can hold above that level, they can start to rebuild momentum.

As for valuation:

Shares are trading at 10.7x NTM revenue and 46.4x NTM EBITDA. These multiples are on the higher end, but not extreme for 30%+ growth.

The FCF yield of 2.2% is attractive based on historical valuation levels. It does trade at a premium against the broader market, again based on the fundamentals – growth and profitability – they exhibit.

Another way to think about the yield is to extrapolate it out. The current yield of 2.2% with a FCF CAGR of 25% over 5 years results in a 6.7% FCF yield on cost. The company will likely still be growing after 5 years. If this is extrapolated out to 10 years, that would be over 20% FCF yield on cost – and most likely still growing too. That is the value in growth investing – planting seeds today for outcomes tomorrow.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share dilution of 4.5%.

Over the next 5 years, if the multiple compresses to 30x and EBITDA is able to grow at 25% (just slightly above revenue growth), shares could return ~9% per year.

For a bullish case, consider multiples compressing to just 35x and 30% growth, that would return ~17% per year.

For context, analysts are projecting ~30% EBITDA growth in the next few years. Also, Zscaler just raised their guidance for the full year.

Fast Graphs provides another perspective.

If shares were to trade at 30x operating cash flow in the near future, shares could be trading at $217. An investment at today’s price of $174 could return 11% per year.

Closing

Volatility is the price of admission. It is important to remember this – during the good times and the bad alike. Market drawdowns will occur, and they often present opportunities. The caveat is they are impossible to predict accurately & consistently.

Our approach is to stay invested in equities, because we know that over time they will generate the best returns.

At Torre Financial, we focus on finding the best investment opportunities at any time. We focus on companies that have high returns on capital, competitive advantages, and durable growth. We assess primarily on fundamentals, and continually reevaluate and rebalance according to what the market is offering.

--

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.