On ROIC: Stalwarts and Compounders

Return on invested capital (ROIC) is a strong indicator of a quality company. This metric gives insight into the efficiency of a company —…

Return on invested capital (ROIC) is a strong indicator of a quality company. This metric gives insight into the efficiency of a company — net income produced in relation to the capital invested.

For a more thorough review, see Gauging the Quality of a Business with ROIC.

Given an intuitive understanding of ROIC, it may sound worthwhile to seek out companies with a high return on invested capital.

While including this metric in any equity analysis is encouraged, it is important to note that not all ROIC is created equally.

Stalwarts: High ROIC, Low Growth

Stable, high-quality, mature businesses are often times referred to as stalwarts, or blue-chip companies. These may be companies with strong moats, maintaining a clear competitive advantage and producing healthy profits over many years.

Stalwarts are often well-positioned in their industry, achieving high returns on invested capital. Opportunities to grow their business, however, may be limited due to their size and market.

Names that fall into this category could include Colgate-Palmolive, 3M, Cisco, Procter & Gamble, Johnson & Johnson, and McDonald’s, to name a few.

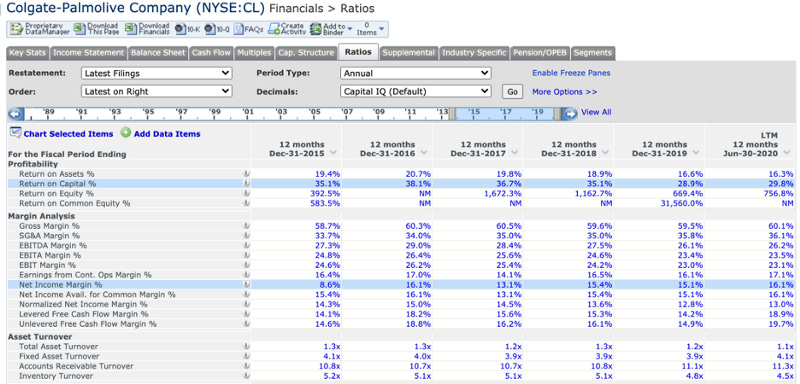

For illustration, consider Colgate-Palmolive. The company produces many well-known household products across oral care, personal care, home care, and pet nutrition.

Colgate is a high-quality company with consistent high returns on invested capital, currently near 30%.

Consumption of household products such as those sold by Colgate exhibits consistent, stable demand. For the same reason, growth is muted. This is reflected in Colgate’s revenue numbers, which have been essentially flat over the last few years.

Opportunities to invest in large projects that show promise of high returns and will move the needle are hard to come by, given their large scale. Conversely, taking on many small, high-return projects may not be efficient, or even feasible. For these reasons, reinvestment in the business is limited.

Colgate maintains capital expenditures in single-digit percentage of sales, most recently at 2.1%. The company pays out roughly 52% of free cashflow as a dividend, returning money to shareholders.

Although Colgate, like many stalwarts, is a stable and efficient businesses, opportunities to expand the business are limited. Rather than reinvest, they tend to return money to shareholders through dividends or buybacks.

Compounders: High ROIC, High Growth

Compounders are companies that have identified and captured a strong business opportunity. They can continue to grow by reinvesting in their business.

Compounders typically do not return large amounts of money to shareholders, whether by dividends or share buybacks. The opportunity cost is too significant. The money could be better used to grow the business until all growth is exhausted.

A compounder with a high ROIC is a unique opportunity to make an initial investment in a company that continually reinvests the money it earns in high rates.

Consider Starbucks. Starbucks was able to create a very profitable business concept out of coffee.

Each store costs roughly $680,000 to build and has annual operating earnings of $450,000. This results in a short payback period of 1.5 years for each new location.

Let that sink in. Starbucks is able to invest $680,000 one-time to open a new location that produces $450,000 every year.

By piling the earnings from the existing stores into the creation of new stores, Starbucks is able to invest their new capital in high-return opportunities.

Starbucks has been doing just that — today, they have over 30,000 retail locations. As the USA market has become saturated in recent years, Starbucks has focused on growing in China to continue expanding their total addressable market.

Starbucks has been able to maintain return on invested capital above 20% while at the same time continuing to grow revenue.

The result: shareholders have been rewarded.

Starbucks is one example of a compounder in the retail space; others names include Chipotle, Ulta Beauty, and Below Five. They have successfully demonstrated their ability to reproduce profitable locations.

The retail store model is a useful illustration of the concept of compounding. Compounders, however, be found in any sector. Amazon and Salesforce are great examples in the technology sector that leverage both internal research and development as well as acquisitions to continue compounding.

Closing

Not all companies with high returns on invested capital are alike. It is important to differentiate between ongoing benefits from initial investments and the opportunity to invest incremental capital at high rates of return.

Stalwarts and compounders are different company profiles and are suitable to different investors. Which is better depends on the investor’s objectives and risk tolerance.

Stalwarts benefit from stable and mature operations, typically returning cash to shareholders.

Compounders benefit from a unique opportunity to reinvest earnings into high return opportunities. Their return on incrementally invested capital is what allows them to compound at significantly faster rates.

Over time, the difference can be drastic. A $10,000 investment in Colgate 20 years ago would be worth roughly $26,400 today. A similar investment in Starbucks would be worth over $151,000 today.