Q2 2022 Earnings Roundup 8.13.2022

A brief review of the market, portfolio earnings scorecard, and a look into earnings from Paycom, Datadog, Cloudflare, and The Trade Desk

The markets have been in rally mode the last few weeks.

The WSJ closed out the week with the following headline:

The Nasdaq has gained over 20% since the low on June 16th. Year-to-date performance is shown in the graph below.

High growth stocks, in particular, have been fueling the rally, handily outperforming the market recently.

The shift in risk appetite is in part driven by the recent CPI report for July, which was released on Wednesday, August 10th. CPI came in lower than expected, with inflation increasing 8.5%, while expectations were set for 8.7%.

The July reading reflects the general downward pressure in commodities pricing starting in June, with the exception of natural gas. The downward pressure appears to be subsiding.

Retail gas prices, however, continue their steady decline.

The bond market, often considered conservative, smart money, provides a different perspective.

Shortly after peaking in mid-June, the yields on the 10-year and 2-year inverted and continue to diverge. A yield inversion occurs when shorter-term government bonds have higher yields than longer-term yields and is generally seen as a harbinger of recession.

Relatedly, the market appears to be pricing in rate cuts in 2023. The Fed typically cuts rates to stimulate the economy in times of need; a recession would seemingly qualify.

It is impossible to know for certain if this is the beginning of a new bull market or if it is another bear market rally. For now, the signals dominating the market’s attention are easing inflation and better than feared earnings.

Q2 2022 Portfolio Earnings

Over the last two weeks, just over a third of our portfolio companies reported earnings.

Our portfolio companies continue to demonstrate strong revenue growth and superior margins, even throughout this challenging period. A few are highlighted below.

PAYC

Paycom is a leading cloud-based HR software provider for small-and-medium businesses. They continue to benefit from the strong job market.

For Q2 2022, Paycom reported revenue of $317 million, up 31% year-over-year. (The quarter-to-quarter comparison is less meaningful, as Paycom experiences seasonality related to tax season and other employer functions.)

The company reported GAAP net income of $57 million, for a margin of 18%.

Paycom has a stellar track record. While the pandemic had a significant impact on employment and therefore Paycom’s business, they maintained steady growth throughout. A year after the pandemic, they returned to their targeted growth of > 30%.

Additionally, Paycom is a very profitable business that does not require capital to grow. EBITDA margins have consistently been ~40% and their EBITDA return on capital has been increasing from under 44% in March 2021 to nearly 50% in June 2022.

Looking forward, Paycom expects revenue in the range of $327-$329 million for Q3, representing 28% growth year-over-year. Note that many companies have been conservative in their guidance, given the macro uncertainty.

For the full year, Paycom raised guidance, now expecting revenue in the range of $1.354-1.356 billion (up from 1.3-1.34 billion), representing ~28% year-over-year growth.

Notable comments from the earnings call with CEO and Founder, Chad Richison:

“We continue to see strong demand for self-service payroll and automation of human capital management as more companies and their employees embrace innovative solutions like Beti.”

“Beti is the future of payroll, and already over 13,000 clients or nearly 40% of our client base have embraced Beti. That's great progress, but as I've said, I expect all clients will eventually deploy Beti in order to finally experience the correct way to do payroll.”

“Our revenue growth continues to be driven by strong demand for easy to use employee focused solutions and our success in attracting new business wins.”

“During the second quarter of 2022, we took advantage of a dislocation in the stock market, and repurchased approximately 360,000 shares for a total of roughly $100 million. Through June 30, 2022, Paycom has repurchased nearly 4.65 million shares since 2016, for total of nearly 588 million, and we currently have 550 million remaining in our buyback program.”

“We are raising our full year 2022 guidance as a result of very strong second quarter financial performance and the continued strength of demand trends. We now expect revenue in the range of $1.354 billion to $1.356 billion or 28% year-over-year growth at the midpoint of the range. We expect adjusted EBITDA in the range of $546 million to $548 million, representing an adjusted EBITDA margin of 40% at the midpoint of the range.”

“With only 5% share of a growing TAM, we have a long runway for continued high margin revenue growth for years to come. Our differentiated solutions and go-to-market strategy, particularly with Beti are working well and driving new client growth and higher revenue per client.”

“Combining our raised 2022 guidance for revenue growth, with adjusted EBITDA margin guidance, implies we are well on our way to deliver a material improvement over the Rule of 65 we achieved in 2021.”

“For every 25 basis points that interest -- the Fed funds rate goes up, we get about $5 million of annualized interest income”

DDOG

Datadog is a leader in the cloud infrastructure and monitoring space. They provide cloud-agnostic tools and solutions for software. devops, and security engineers to better understand the state of their applications in the cloud.

Q2 2022 results and highlights are summarized below

Revenue of $406 million, year-over-year growth of 74%

GAAP net loss of $4.8 million, for a margin of -1%

Free cash flow of $60.2 million, for a margin of 15%

Revenue growth accelerated quarter-over-quarter from 11% to 12%

Acquisition of Seekret API Observability Platform, extending their offerings

Datadog is another very efficient business. While GAAP net income is negative, the business itself is generating a lot of cash flow. The cash flow return on invested capital is north of 50%. A common characteristic amongst software companies, they are able to continue to scale their business without the need for a lot of capital. Combining this efficiency with this level of revenue growth makes for a unique opportunity.

For Q3, Datadog expects revenue between $410-$414 million. This appears to be a cautious outlook representing only 1-2% sequential quarterly growth (down from 12%) and ~53% year-over-year (down from 74%).

For the full year, Datadog expects revenue between $1.61-1.63 billion, representing ~58% growth year-over-year.

Notable comments from the earnings call with CEO and Founder, Olivier Pomel:

“We ended the quarter with about 2,420 customers with ARR of 100,000 or more, up from 1,570 in the year ago quarter. These customers generated about 85% of our ARR.”

“We generated free cash flow of $60 million and a free cash flow margin of 15%. And our dollar based net retention rate continues to be over 130%, as customers increased their usage and adopted more products.”

“In Q2, while we overall saw strong customer growth dynamics, we have seen some variability in growth among our customers. We saw our larger spending customers continue to grow but at a rate that was lower than historical levels. This effect was more pronounced in certain industries, particularly in consumer discretionary, which includes e-commerce and food and delivery customers and affected more specifically our products with a strong volume based component such as log management and APM suite.”

“While these near growth data points and the current micro climate are leading us to be prudent with our short term outlook, we remain very bullish about our opportunities and confident in our execution as we continue to see positive trends underpinning our business.”

“First, the number of hosts and containers being monitored by our customers is growing steadily, which points to continued momentum of cloud migration and digital transformation projects.

Second, we had strong execution on the new logo side as new logo ARR was robust as we added a record 1,400 new customers in the quarter, including the impact of turning off about 200 customers in Russia and Belarus in Q2. And we closed a number of sizable six to seven figure year-over-year deal during the quarter with diverse customers, including a media conglomerate, a metal ore mining company, a US government agency, the SaaS business and a hyperscaler.

Third, our pipeline of large new logos and new product cross-sells going into the second half of the year is strong. And fourth, churn remains low with gross revenue retention steady in the mid to high 90s.”

“We believe that software is a deflationary force and we are confident in our ability to help our customers do more with less, should economic conditions worsen…We recognize the macro environment is uncertain as we look into the back half of 2022. But we also see no change to the long-term trends toward cloud-based services and modern DevOps environments, and observability remains critical to that journey.””

“We believe cloud migration and digital transformation are drivers of our long-term growth and our multiyear trends that are still early in their life cycle. And we believe it is increasingly critical for companies to embark on these journeys in order to move faster, serve their customers better and in times like these become more efficient with their infrastructure and engineering investments. So we plan to continue to invest in our solid priorities to execute on these long-term opportunities.”

NET

Cloudflare, the infrastructure company focused on helping build a better internet, provides solutions around security, performance, and reliability. While Datadog helps engineers see what is going on in their applications, Cloudflare helps make applications faster and more secure.

Cloudflare CEO Matthew Prince has commented on Cloudflare’s 3 main acts.

Act 1 is focused on networking including cloud delivery network, web app firewalls, distributed denial of service prevention, dns, and more.

Act 2 is focused on security, particularly zero-trust network access and related offerings.

Act 3 is an ambition to become the fourth major cloud, offering their own platform for running applications and code. They are competing with the cloud titans Amazon Web Services, Microsoft Azure, and Google Cloud Platform, albeit from a different angle. Cloudflare, for example, is focused on edge computing and distributed data storage.

Cloudflare’s Q2 results are summarized below:

Revenue of $234.5 million, increase of 54% year-over-year

Operating cash flow of $38.3 million, or 16% of revenue

Free cash flow of -$4.4 million, or -2% of revenue

Revenue accelerated slightly quarter-over-quarter, to 11% from 10% prior quarter

Cloudflare has been remarkably consistent, posting revenue growth of roughly 50% since early 2019..

For Q3, Cloudflare expects revenue of $250-251 million, roughly 46% year-over-year growth.

For the full year, Cloudflare expects $968-972 million in revenue, representing roughly 48% year-over-year growth.

Additionally, Cloudflare expects to be free cash flow positive in the back half of the year.

This guidance is encouraging, showing there is no shortage of demand for Cloudflare’s offerings.

Notable comments from the earnings call with CEO and Founder Matthew Prince:

“We added a record 212 new large customers, those paying us more than $100,000 per year, and now have 1,749 customers over this threshold. These large customers now represent 60% of our revenue, up from 50% six quarters ago. This trend illustrates how large, established enterprises increasingly form the foundation of Cloudflare's business. In fact, today, 29% of the Fortune 1,000 are already paying Cloudflare customers, a nearly threefold increase over when we went public less than three years ago.”

“Our dollar-based net retention remained strong at 126%, down 1% over last quarter. While there may be some noise in this number from quarter-to-quarter, we won't be satisfied until it's above 130% and best of breed among the companies we consider peers.”

“What I'm watching closely is our free cash flow margin. It showed significant improvement quarter-over-quarter, and we continue to forecast it will be positive in the second half of the year.”

“14 years ago, in 2008, at the onset of the last global recession, Google pulled their full-time offers for all their summer interns, which included my co-founder at Cloudflare, Michelle Zatlyn. If that hadn't happened, Cloudflare would have never been born. At the same time, I learned what a margin call was and, simply embarrassingly, literally had to borrow money from my mom to pay my rent. That's when I got an extremely personal lesson on the importance of free cash flow, and it's why I'm ensuring right now in this uncertain time that Cloudflare is prioritizing being free cash flow positive.”

“Remaining performance obligations, or RPO, came in at $760 million, representing an increase of 10% sequentially and 57% year-over-year. Current RPO was 76% of total RPO.”

“We are fortunate to be uniquely positioned as a provider of mission-critical services to our customers.”

“One of the really powerful things about Workers is its efficiency. And so a workload, an equivalent workload running on Workers versus running on any of the sort of traditional public clouds, AWSs, or Google Cloud or Microsoft Azure, is typically significantly less expensive to run. … The days of just wildly spending on your cloud bill, I think, are behind us… in these particular environments where people are trying to figure out how to stretch a dollar even further, Workers and Cloudflare's platform as a whole is very effective at helping people save money.”

TTD

The Trade Desk, an ad-tech company, provides a platform for buyers of advertising to shop across various advertisers, purchase programmatic ads, and evaluate performance.

The Trade Desk is similar to Google in that it provides up-to-date pricing and provides very clear tracking and return on investment for advertising dollars. Google’s products are focused on their own publishing platforms, namely Google.com, YouTube, their display network, etc. The Trade Desk has inventory across many different providers. For example, advertisers could go to TTD to buy placement on Disney Plus. Bringing the data-driven approach, which has proven to be successful, to a broad array of advertising platforms is an attractive proposition.

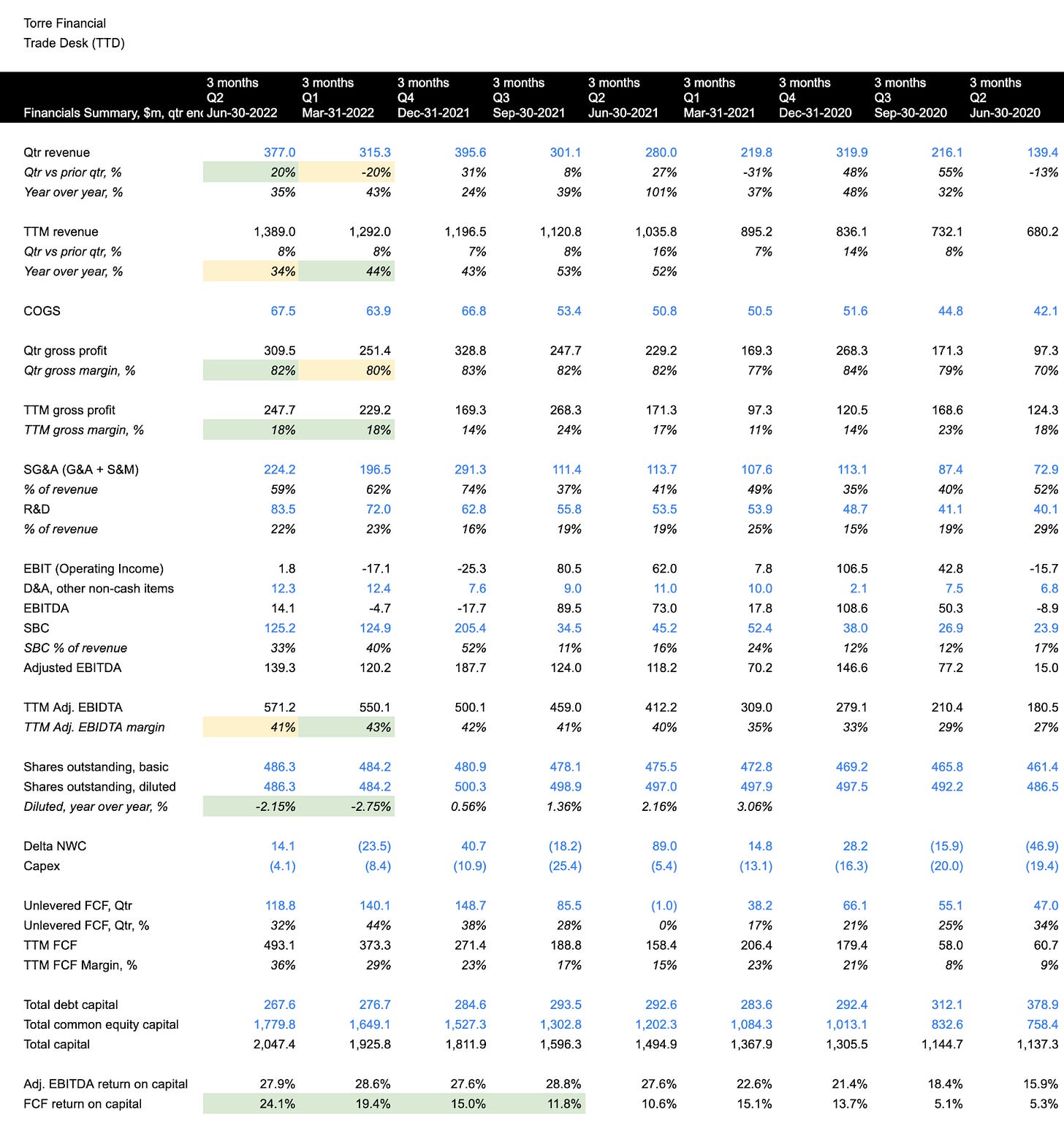

The Trade Desk’s Q2 results are summarized below:

Revenue of $377 million, an increase of 35% year-over-year

GAAP net loss of $19 million, or 5% of revenue

Adjusted EBITDA of $139 million, or 37% of revenue

The Trade Desk is another very efficient business. The total capitalization of the company (common equity + debt capital) is $2.05 billion. Over the last 12 months, they had free cash flow of $493 million. They have generated a 24% free cash flow return on capital, while at the same time growing revenue 35%.

For Q3, The Trade Desk expects revenue of at least $385 million, ~28% year-over-year increase.

Notable comments from the earnings call with CEO and Founder Jeff Green:

“In the first half of the year, marketers shifted to decision data driven advertising on the open Internet more rapidly than ever. And as a result, the Trade Desk has become increasingly indispensable as the default DSP for the open Internet and Connected TV. Perhaps the most encouraging aspect of our business through the first half of this year has been the rate at which we sign new and expanded joint business plans or JBPs [joint business plans] with our clients.”

“There are a few vectors and macro factors that are creating an amazing opportunity for us to grow into a much bigger company and wind share regardless of the economic environment. I’d like to take a minute to identify those macro factors that are providing wind at our back. First, there is a secular tailwind that continues to propel us forward, and that’s the worldwide shift to advertising fueled connected television.”

“The second macro factor that is helping us grab share is that walled gardens like Google’s ad network are being downgraded in priority. For most of the last two decades, when dollars move over from offline spending to online spending, they have gone first to Google and other walled gardens.

One way to define a walled garden is to think about an internet publisher or a content destination that is so large and dominant in their content segment, that they can be draconian to advertisers and still win business. Google’s advertising products are a textbook example. Many have pointed out that Google does its own performance measurement. They have run marketplaces with questionable integrity and fairness, but they win advertising budgets because of their dominant position and their size and footprint around the world.

CTV has started to change this dynamic in our industry though, because no one in CTV is big enough to be as dominant in TV as Google has been with search or with Chrome or double click, their ad server that is almost irreversibly integrated into the Google ad network machine. As a result, the marketplace for premium CTV is fair, especially in relative terms and extremely competitive, because of the efficacy of moving picture and sound coupled with these competitive market dynamics for the first time ever, some of the biggest brands in the world have a new place to spend their first dollar on the Internet, which is premium CTV.

CTV is fast becoming a must buy. And in some cases, the highest stack rank part of the digital media plan for many brands. This trend is changing the makeup of the whole Internet, and it is likely to change the role of walled gardens in our industry, especially the smaller walled gardens. So the bottom line on this second major macro trend, the draconian tactics of walled gardens are now being challenged because of the competitive nature of CTV as advertisers increasingly prioritize premium CTV content.”

“The third macro trend that is creating market opportunity for us is the worldwide pressure on Google. There has been a great deal of regulatory scrutiny of Google over the past couple years. We’ve seen the reports of investigations and complaints from the Department of Justice, the states attorneys general concerning various forms of alleged antitrust violations in Google’s ads business, but it’s not just here in the United States, it’s also in various other countries around the world.”

Closing

Earnings throughout Q2 have been better than feared. Coupled with the signals of easing inflation, the market has been on the upswing. On the flip side, the inverted yield curve and expected rate cuts in 2023 seem to signal an upcoming recession.

While the macroeconomic climate is important to monitor, our focus in investing has always been bottoms-up first. We want to identify successful businesses with long-term, durable advantages.

Compounders are companies that are able to invest capital in unique opportunities offering a high return on invested capital. For some of the more growth-focused companies, GAAP income might be negative, in part due to non-cash expenses. The true quality of the business performance can be seen through the free cash flow. If a business can generate free cash flow, and doesn’t require tying up that capital into the business to continue growing, the non-cash expenses could be worth the investment. In software, where the marginal cost to serve is minimal, there is a winner-take-most (if not winner-take-all) dynamic.

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.