Q2 2022 Earnings Roundup 8.27.2022

A brief review of the market, portfolio earnings scorecard, and a look into earnings from INTU and SNOW.

The rally that began in mid-June faced resistance this week, just as the S&P 500 touched its 200-day moving average.

Coincidentally, the yield on 10-year treasuries started creeping back up after bottoming around August 1st. The 10y-2y yield curve remains inverted.

Commodities similarly seem to be ticking up slightly.

While inflation seems to have peaked and generally seems to be coming down, concerns are that it might end up “sticky” in the 3-4% range.

On Friday, Jerome Powell made it clear that the Fed must continue raising interest rates and keep them high until inflation is under control.

"Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely against loosening policy"

"Whilst the lower inflation readings for July are welcome, a single months improvement falls far short of what the committee will need to see before we are confident that inflation is moving down"

"So, we are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%.

His hawkish commentary resulted in a significant market decline, with all 3 major indices falling between 3% and 4% for the day.

The market adjusted expectations accordingly. As of last week, the odds between a 50 bps and 75 bps rate hike in the September 21st Fed Meeting were roughly even. Now the odds are 61.5% towards a 75 bps and 38.5% towards a 50 bps hike.

The macro economy continues to paint a complicated picture. While there is pressure, it is difficult to know what is already priced in.

While I try to keep an eye on and monitor the macro picture, I work to focus my attention on how individual companies are performing, maintaining a business-owner perspective.

Q2 2022 Portfolio Earnings

Over the last two weeks, four portfolio companies reported earnings.

INTU

Intuit’s mission is to power prosperity around the world. Intuit is the parent company behind many well-known financial products including TurboTax, Quickbooks, Mint, Credit Karma, and Mailchimp.

Intuit’s fiscal calendar ended on July 31, 2022. Intuit’s full year results for fiscal 2022 are summarized below:

Total revenue grew to $12.7 billion, up 32% year over year

GAAP operating income was $2.6 billion, or 20.5% of revenue

Non-GAAP operating income was $4.5 billion, or 35.4% of revenue

For the fourth quarter:

Total revenue was $2.4 billion, a decrease of 6% year over year

GAAP operating income was -$75 million, or -3% of revenue

Non-GAAP operating income was $433 million, or 18% of revenue

Other highlights include:

The company increased the dividend by 15%

They repurchased $1.9 billion of stock throughout the year

They received authorization for a new $2 billion buyback program, for a total of $3.5 billion authorized, or nearly 3% of the market capitalization

The decline in revenue might seem worrisome at first glance, making Intuit’s sales seem cyclical. Over 45% of Intuit’s revenue comes from TurboTax. Being tightly coupled with the tax season, any changes there can have significant effects. In this case, the decrease is primarily due to the tax deadline being extended into this quarter last year.

As shown in the financials summary below, Intuit has been able to grow annual revenue consistently at a high rate.

Intuit is highly profitable, as evidenced by the high 30’s TTM EBITDA margin and similar FCF margin.

Additionally, the return on total capital has been very attractive from both an EBITDA and FCF perspective.

Revenue growth, profitability, and capital efficiency are the key tenets behind my investment philosophy.

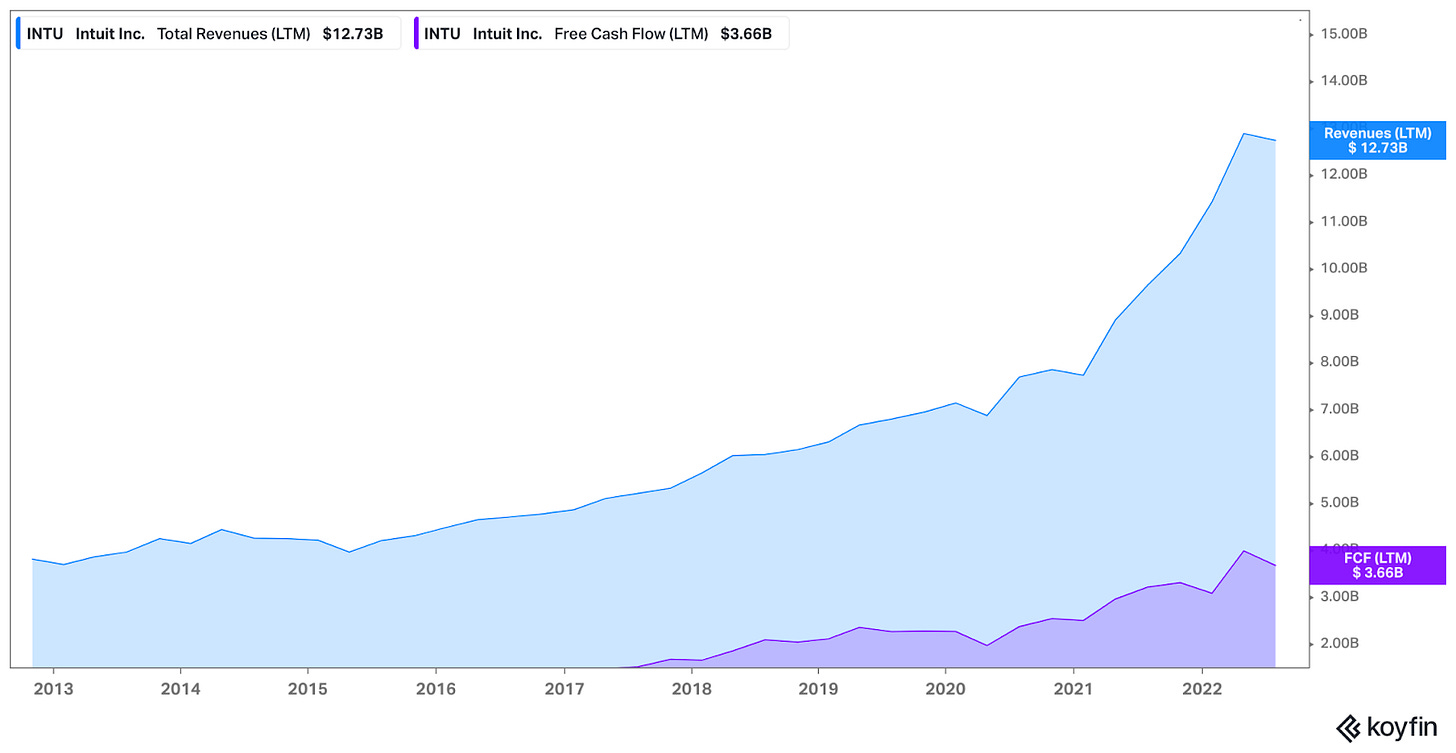

Visualizing revenue and FCF on a graph shows the trajectory over time. While Intuit had no FCF before mid-2017, they have been able to grow into it over time.

Looking forward, Intuit expects revenue of $14.5-$14.7 billion for the full year, representing growth of 15-16%.

Highlights from the earnings call with CEO Sasan Goodarzi:

“We had a very strong fourth quarter, ending the year with momentum as we executed on our strategy to be the global AI-driven expert platform powering prosperity for consumers and small businesses. We continue to be focused on solving our customers’ biggest problems by putting more money in their pocket, eliminating work and saving people time and ensuring that they have complete confidence in every financial decision they make.”

“Our 5 Big Bets are: revolutionize keep the benefit, connect people to experts, unlock smart money decisions, be the center of small business growth, and disrupt the small business mid-market.”

“The scale of our platform along with our rich data gives us the unique ability to see leading indicators, such as growth in charge volume, number of hours employees are working and number of workers paid, bank account balances of our small business customers, credit card utilization and delinquency rates for members. This allows us to be forward-looking and adjust quickly.

“Our tax businesses are very resilient, and we do not expect a mild recession to have any significant impact.”

“Small Business and Self-Employed Group, QuickBooks and Mailchimp are mission-critical for our customers whose livelihood depends on our platform. In fiscal year 2022, approximately 80% of the Small Business and Self-Employed Group revenue was subscription-based.”

SNOW

Snowflake markets themselves as the Data Cloud company. They provide solutions for large companies to harness the power of the vast amounts of data they have. Their solutions sit on top of cloud providers (Amazon Web Services, Google Cloud Platform, and/or Microsoft Azure). They not only provide tools to connect and facilitate the understanding of data, but also provide solutions to share data sets. This shared ecosystem of data creates a powerful network effect.

Snowflake’s second quarter results are summarized below:

Total revenue came in at $497.2 million, representing 83% growth year-over-year

Revenue growth accelerated quarter-over-quarter, up 18% vs 10% for the prior quarter

Gross margin came in at 65%

Operating loss was $207.7 million

Free cash flow margin came in at roughly 12%

Remaining performance obligations (RPO) came in at $2.7 billion, growing 78% year-over-year and representing 170% of TTM revenue

Net revenue retention came in at 171%

Snowflake boasts an impressive profile.

Sustained, elevated revenue growth in the 100s, 90s, 80s

Highly predictable growth, driven by their enterprise segment and RPO

High customer engagement and increasing consumption, demonstrated by their net revenue retention (the 171% can be interpreted as a customer spending $100 in year 1 is increasing spending to $171 in year 2!)

Continued evidence of operating leverage. As shown below, gross margin, EBITDA margins, and FCF margins have all continued to improve quarter-by-quarter

Software businesses do lend themselves to invest upfront in creating a differentiated product offering. As a company scales, it begins to reap the benefits.

While Snowflake has yet to show consistent profitability and efficiency, the trajectory is in place.

The following chart helps visualize the operating leverage through Snowflake’s revenue and FCF.

Looking forward, Snowflake expects year-over-year revenue growth of 60-62% for the next quarter. They are also guiding for positive operating income, with a margin of 2%.

Highlights from earnings call with CEO Frank Slootman:

“Our success is fueled by broad-based workload enablement. The core idea behind the Snowflake Data Cloud is to enable work to come to the data and prevent data from having to be moved to the work. Previously, data was copied, transferred and replicated to be used wherever it was processed. That led to massive operational complexity, cost and governance risks. The Snowflake Data Cloud promises to bring that regrettable legacy to an end.”

“Initially, organizations use Snowflake to drastically improve overnight analytical processes so that fresh up-to-date data about the business was reliably available first thing. Checking that box, customers move on to using data for predictive insights and prescriptive solutions.“

“Snowflake’s data sharing solves the challenge of data access and enrichment. In Q2, the number of Snowflake data sharing relationships measured with what we call stable edges grew 112% year-on-year. 21% of our growing customer base has at least one stable edge, up from 15% a year ago.”

“Our next frontier of innovation is aimed at reinventing cloud application development. Our ambition is far reaching. Our aim is to transform how cloud applications are built, deployed, sold and transacted.”

“Turning to profitability for the full year of fiscal 2023, we expect on a non-GAAP basis, approximately 75% product gross margin, 2% operating margin and 17% adjusted free cash flow margin”

Closing

The macroeconomic picture remains uncertain. Whether the Fed can maneuver a “soft landing” to bring down inflation is unclear. Only time will tell what will happen.

In a high inflation environment, investment options are limited. Holding cash is a losing proposition. Bonds and other safe investments may not keep up with inflation either. Ultimately, the drivers of inflation are reflected in the companies providing those goods and services.

Focusing on high quality companies, such as those with revenue growth, profitability, efficiency, and strong balance sheets (or a company demonstrating a trajectory towards these!) seems to be a fundamentally sound approach, regardless of the macroeconomic environment.

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.