The stock market has bounced back rapidly in the post-pandemic world, partly due to significant government action including abundant stimulus and rock-bottom interest rates.

As the world adapted to a remote workforce and companies of all sizes invested in digital transformation, technology companies came to the forefront. Software-as-a-service (SaaS) technology companies, in particular, saw significant tailwinds in their business which were quickly reflected in their valuation.

For context, examples of some well-known SaaS companies include Salesforce, Zoom, Snowflake, Cloudflare, Crowdstrike, Datadog, Okta, Veeva, DocuSign, Paycom, Slack, amongst many more.

Valuation

SaaS companies are valued on the basis of their revenue over the next-twelve-month (NTM). Given the nature of their subscription-heavy business models, revenue is relatively predictable. The following graph shows the expansion in the revenue multiple (EV/NTM revenue) over time.

Multiples hovered between 5-8x for the majority of 2015-2017. Multiples began expanding in 2018, reaching a high of 11-12x in 2020. After the temporary shock from the pandemic, multiples have skyrocketed, reaching nearly 22x.

Segmenting the data by growth cohorts provides additional insight.

The high growth and mid growth cohorts have experienced the majority of the expansion, while the low growth group has stayed relatively flat. The divergence of the groups is significant, with high growth companies reaching multiples over 40x and trading at almost twice the multiple of mid growth companies.

Tailwinds

Technology companies are benefiting from a confluence of factors.

Given their strong growth trajectories, many of these companies reinvest any and all cashflow into their business. They are not looking to generate free cash flow today, but, rather, are focused on revenue growth today to enjoy larger cash flows in the future.

Consequently, declining interest rates have resulted in a tailwind for these companies. A common intrinsic valuation method is to discount all future cashflows of the company to present day. The lower interest rates are advantageous to SaaS companies since all future cashflows are adjusted and discounted at the new, lower rate. If interest rates rise, however, all future cashflows would have to be discounted to today at a higher rate.

Another significant boon to SaaS companies has been the step-change focus on and investment in digital transformation. Companies have not only adopted solutions for immediate operational needs, but also have accelerated their timelines for larger investments in moving to the cloud.

“We’ve seen two years’ worth of digital transformation in two months.”

– Satya Nadella, CEO, Microsoft (source)

The acceleration in digital transformation has a long-term compounding effect. Pulling in a few years of growth can result in a very different end result.

Consider a 10-year period with 10% growth. An initial value of $100 would become $259 at the end of the period. If growth is accelerated the first two years to 50% growth, the end result would increase to $482, or almost 86% greater than the base case.

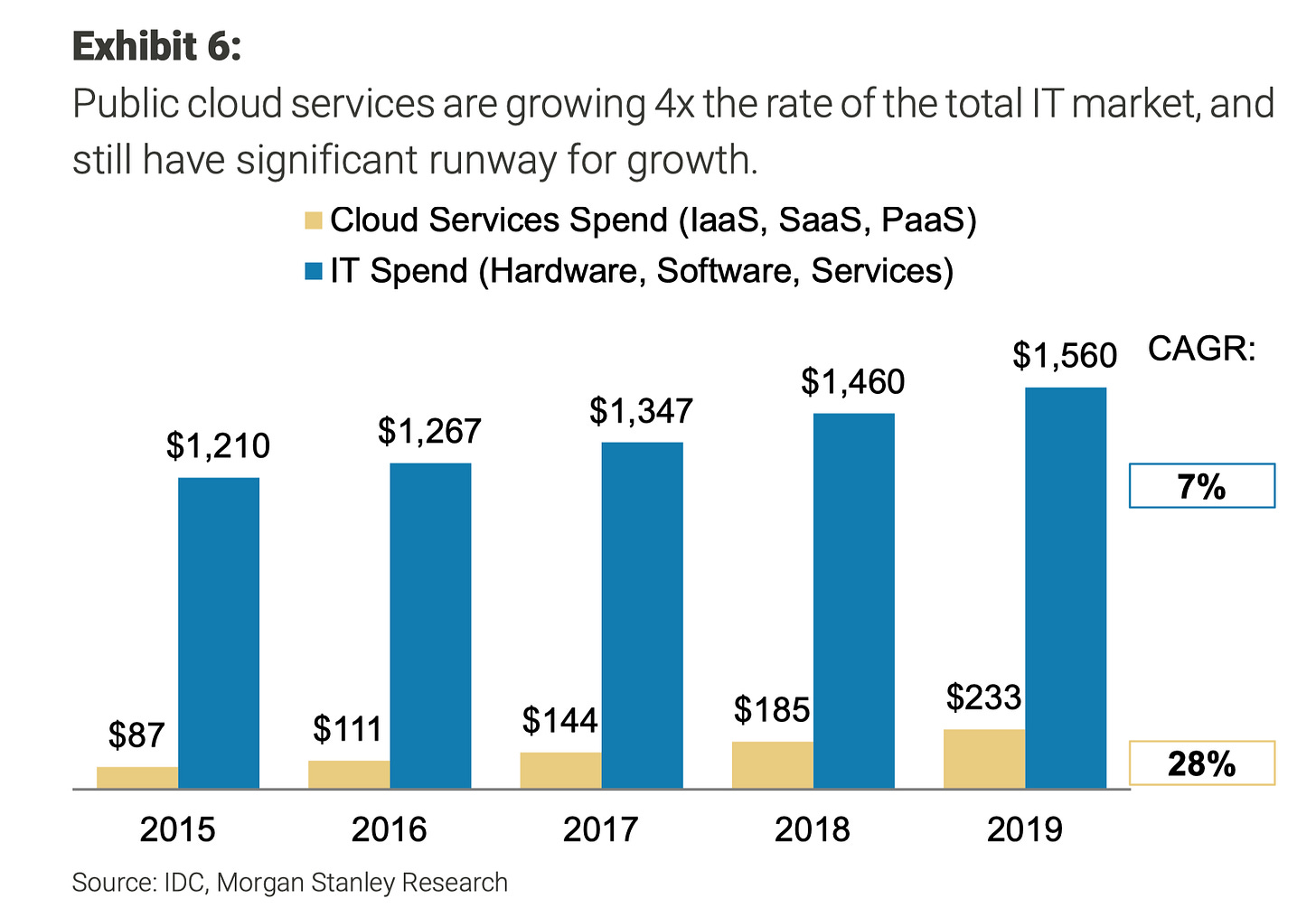

Enterprise spending on cloud services has grown at 4x the rate of IT spending over the last few years.

As large enterprise companies migrate on-premise solutions to the cloud, adoption of SaaS services will accelerate. Morgan Stanley expects cloud adoption of enterprise workloads to more than double by the end of 2022.

The share of cloud service spending is a small fraction, at roughly 15%, of total IT spending. Cloud services are still in the early innings and have a long runway ahead.

Looking Forward

All that being said, revenue multiples of 20x, 30x, or even 40x seem like a high price to pay. Are these multiples sustainable? Can SaaS companies be a worthwhile investment at such a steep valuation?

The high multiples are unlikely to be sustained. Compression seems inevitable as growth and interest rates normalize.

The crucial component here is the timing, which is difficult to prognosticate. Whether multiple compression happens in a few weeks or over the span of a few years would make a significant difference. Considering the high revenue growth rates of many of these companies coupled with a sufficiently ample time horizon, investors can plan around the inevitable compression.

For illustration, consider a company growing revenue at 50% year-over-year for five years. With significant multiple compression (40x to 15x) spread out over 5 years, an investment in this scenario would still yield a compound annual growth rate of 23%.

Note that maintaining revenue growth rates of 50% over five years would be quite the feat. It is also unlikely for compression to occur so smoothly, as the market could reprice growth stocks at any time.

Rather than considering hypotheticals, it may be worthwhile to analyze individual companies.

Crowdstrike (CRWD) is a cloud-native leader in cybersecurity. Revenue and growth rates are shown below.

As of closing on March 5th, 2021, CRWD trades at a share price of $183. CRWD has an enterprise value of $39.5 billion and is trading at roughly 32x NTM revenue.

Considering the investment outcome over the next five years, it is worthwhile to explore a spectrum of possibilities because the future is uncertain.

The following table shows possible outcomes for various revenue growth rates and multiples. The cells highlighted green indicate positive returns, or growth over today’s $39.5 billion valuation.

To get a clearer picture, the table can be tweaked to show the compound annual growth rate of the enterprise value which would be more indicative of annual share price appreciate.

An investment in Crowdstrike today, at 32x, would yield a 11.8% annualized return over five years if revenue grows at 30% and multiples compress to 15x, a suitable pre-COVID multiple for the high-growth cohort.

If compression is less severe, from 32x to 20x, the same revenue growth of 30% would yield 18.4% annualized returns.

In the case of higher revenue growth, there is clear upside, even under significant multiple compression.

Note that this analysis looks at growth in enterprise value. Other factors such as share dilution would have an effect on the share price.

This same exercise can be done with any company to understand the spectrum of possibilities.

Datadog (DDOG) is a cloud-native leader providing monitoring and analytics platforms for developers and operations teams.

With a share price of $82 as of March 5th, 2021, Datadog has an enterprise value of $24.3 billion and trades at roughly 29x EV/NTM revenue.

Revenue for the twelve months ending December 2021 is estimated at $833 million.

Annual revenue growth rates for 2018, 2019, and 2020 were 96.6%, 83.2%, and 66.3%, respectively.

Over the next five years, if revenue growth rates average 30% and multiples compress from 29x to 15x, an investment in Datadog would yield annualized returns of 13.8%.

Again, there is clear upside if either multiples or growth rates stay elevated.

Conclusion

The post-pandemic world has seen a step-function change in the importance and reliance of technology. Many technology companies have benefited from this paradigm shift and prices of publicly traded technology companies skyrocketed. Technology companies posted incredible returns in 2020, reaching over 500% returns in some cases and leading to high multiples. These steep valuations can be a showstopper for some investors.

This article demonstrates how strong growth can combat the inevitable multiple compression.

The few examples provided, however, do not yield conclusive results. To determine whether an investment is appropriate, or valuations are justified, investors should seek to understand the situation, assess the story behind a company, and assign their own probabilities to the possible range of outcomes.

-

If you haven’t already, I invite you to subscribe. I plan to post 2 articles per month.

Please feel free to share this article with any friends or family.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

https://torrefinancial.substack.com

–

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.