Upstart (UPST) - December 2021

Quarterly results recap, market reaction commentary, opportunity, and valuation

For prior coverage, see:

Upstart has been on quite the roller coaster ride throughout the year.

Beginning the year at roughly $40, Upstart’s price peaked at just over $400 in mid-October before retreating to the current level of roughly $170.

Even at today’s price, following a decline of 57%, Upstart’s YTD performance is impressive at +320%.

This kind of performance and price action draws attention, which in turn amplifies volatility.

What is happening with the company?

Quarterly Results Recap

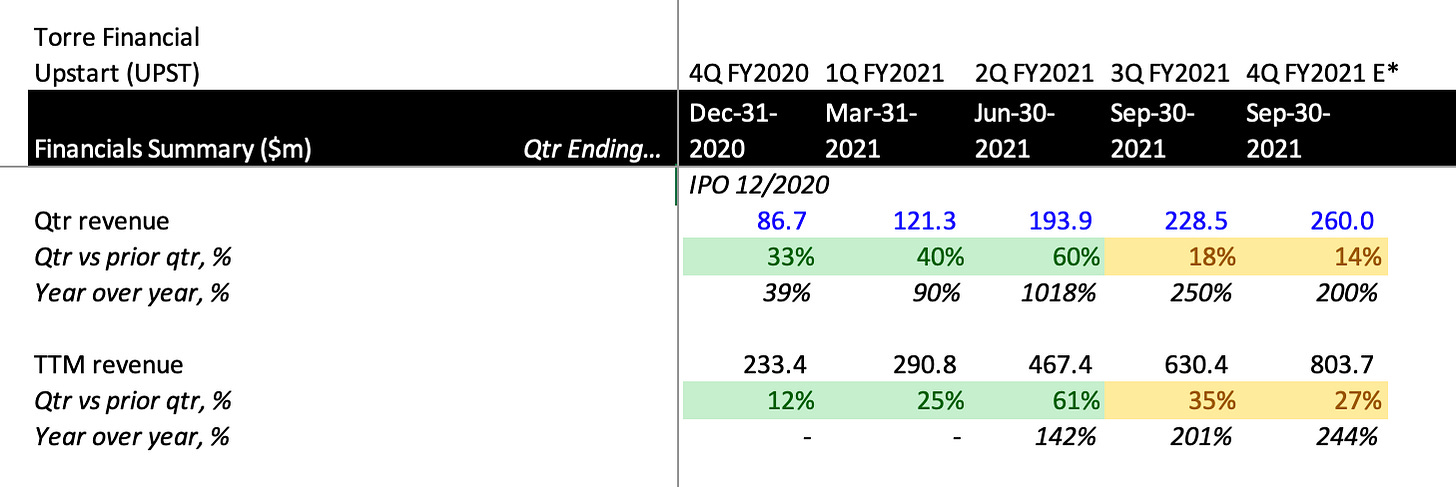

Since their IPO in December 2020, Upstart has had an exceptional run with significant growth backed by positive cash flow.

March 2021

Upstart announced Q4 2020 results, posting quarterly revenue of $86.7 million and 2020 fiscal year revenue of $233.4 million.

For fiscal year 2021, they guided for revenue of approximately $500 million and EBITDA margins of 10%. For context, the consensus estimate for full year revenue was $354.3 million at this time.

May 2021

Upstart announced Q1 2021 results with quarterly revenue of $121 million.

They increased the guidance for fiscal year 2021 from $500 million to $600 million.

August 2021

Upstart announced Q2 2021 results with quarterly revenue of $194 million.

They again increased revenue guidance for fiscal year 2021 from $600 million to $750 million. They also increased EBITDA margin guidance from 10% to 17%.

November 2021

Upstart announced Q3 2021 results with quarterly revenue of $228 million.

They guided for Q4 revenue of roughly $260 million. When combined with the actual quarters, this guidance implies full year revenue of over $800 million, another increase over the prior $750 million.

The change in revenue guidance for FY 21 is consolidated in the table below.

All said, Upstart has had a fantastic year, increasing their full year guidance each single quarter.

The company is on track for over $800 million in revenue for 2021, an increase of over 240% versus the prior year’s $233 million.

Market Reaction

Since the mid-October high of $400, the stock has declined 57% to $172.

Market reactions are often driven by a confluence of many factors, making it difficult to pinpoint an exact reason for any reaction in particular. Below are a few factors that may have contributed.

Upstart’s growth trajectory has tempered. Since the IPO up until Q3, quarter-to-quarter growth had been accelerating. In Q3 there was a deceleration, and the guidance for Q4 confirms that trend. The quarter-to-quarter growth rates for Q4 (2020), Q, Q2, Q3, Q4 (expected) are 33%, 40%, 60%, 18%, 14%.

Relatedly, the shares were bid up to elevated multiples. The EV/sales (NTM) ratio reached a peak of 33x before coming back down to 12.5x.

Macroeconomic changes have also likely contributed. As inflation concerns are seen to be lingering, there is increasing talk of rising interest rates. Higher interest rates negatively affect growth companies that are leaning into future cash flows.

And lastly, the recent scare with the Omnicron COVID variant has brought some uncertainty to the markets as of late. Some market participants tend to sell first and assess later.

Opportunity

Upstart continues to be very well positioned for continued growth. The positive cash flow gives them optionality. They have executed well and continue to expand their addressable market.

The following excerpts from the Q3 2021 earnings call demonstrate the solid execution and growing opportunity.

“A year-ago, we had 10 bank and credit union partners on our platform. Today we have 31 partners and we're adding them faster than ever.”

For perspective, there are over 4,000 banks and over 5,000 credit unions in the USA.

“Personal loans continue to drive the growth in profitable economics of Upstart. Post-pandemic, the demand for these simple installment products has re-accelerated”

“Last quarter, I told you that for the first time an Upstart bank partner decided to eliminate any and all FICO requirements for their borrowers. … And even better, I'm also pleased to tell you that 4 Upstart bank partners have now dropped their FICO requirement”

Banks are beginning to rely exclusively on Upstart, a very strong signal as to the efficacy of their models.

“A year ago, a handful of auto loans had been refinanced in a single state. Today, more than 4,000 Upstart powered auto loans have been originated in 47 different states.

“As a reminder, The Auto Lending market is at least six times the size of Personal Loan market. … We're also making rapid progress on our auto purchase product. In the third quarter, we rebranded the Company and the product formerly known as Prodigy to Upstart Auto Retail.

“In fact, we've now tripled the number of dealers on our platform compared to a year ago, and in Q3, we added an average of more than 1 rooftop a day. … The first Upstart powered loan was originated through our auto retail software with one of our longstanding dealership partners right here in the Bay Area. … We believe Auto will be a meaningful contributor to our financials next year”

Upstart has invested significantly in Auto and seem to be executing according to plans. It was not meaningfully represented in this year’s revenue -- that looks to be changing next year.

Auto is not the only new market they are entering. They continue to reinvest into new areas.

“First, we're working toward a small dollar loan product designed to help consumers with unexpected and immediate cash needs: think a few $100 repaid in just a few months. … It can significantly accelerate the pace with which we can bring the underbanked into the financial system. … And it can likewise accelerate the pace of learning by Upstart's AI models. ”

“Second, we believe there is an unmet need to provide fast, easy access to affordable installment loans to business owners across the country.”

“The home mortgage market. It's by far the largest consumer lending category.”

They are clearly focused on the long term, investing in the future. Small loans will allow them to build a track record for people that may otherwise be unable to take on larger loans.

All of these loan offerings build on each other, helping the Upstart model pull further and further away from any possible competitors. More signal in small loans improves personal loan/mortgage/auto loans.

At the same time, they continue to focus on profitable growth:

“You don't likely see Upstart chasing low-margin, 0-margin, money-losing parts of the credit industry because they're not of interest to us…. we're obviously looking for strong contribution margins and things that can help us to grow.”

“… The other category of auto that we're getting into now is auto retail lending and purchase items at the point of sale dealership. And we expect those economics to look better because there's less acquisition costs involved, because you at the point-of-sale and frankly, some of the operations required to generate the loan are handled by the dealers. So we view that to be a higher-margin product.”

Current Valuation

The intrinsic value of any company depends on an almost unlimited set of variables. Consequently, determining and exact number is a challenge. Precise financial models may provide a confident assessment, yet with questionable accuracy.

In contrast, a back-of-the-envelope assessment that shows the impact of different key metrics can provide a spectrum of the possible outcomes.

The following analysis shows the expected return over a five-year period varied across revenue growth and EV/sales multiples.

Investors are best served by setting expectations on the conservative end of the spectrum.

In terms of multiples, Upstart’s EV/sales multiple has ranged between 9.3x and 33x throughout this year. It has only been below 13x two times, and for brief periods in each.

For reference, mature companies like Salesforce and Facebook have multiples in the 7-10x range while high growth SaaS companies like Cloudflare and Datadog may have multiples in the 20-50x+ range. Note that Upstart’s business model is primarily usage-based as opposed to subscription.

Given the above, it is reasonable to consider that Upstart will be trading at or above a 10x multiple in five years.

On the revenue front, Upstart has had strong historical growth. This year represents over 240% growth versus the prior year.

The expected quarter-to-quarter growth for Q4 2021 of 14% is equivalent to 68% annualized growth going forward.

Upstart has been primarily driving revenue from the Personal Loan segment. They will continue to add bank partners, to which they will be able to sell existing and new solutions. Auto Loans is a brand new segment, in a larger market, that will begin contributing next year. Future opportunities in small loans, business loans, and mortgages seem to provide opportunities for continued growth.

Given the above, annual revenue growth of 20% seems to be reasonable as long as the company is able to continue to execute consistently.

If Upstart is able to grow revenue at a compound annual growth rate (CAGR) of 20% over the next five years and the EV/sales multiple compresses to 10x, an investor could expect annual returns of 15.5%.

Multiples generally tend to move in conjunction with growth rates. Any positive skew would allow for significant upside. Consider a reasonable upside scenario:

If Upstart is able to grow revenue at a compound annual growth rate (CAGR) of 30% over the next five years and the EV/sales multiple expands slightly to 15x, an investor could expect annual returns of 35.7%.

Closing

Despite the drawdown in share price, Upstart’s fundamentals continue to look promising.

Many great companies, including Amazon and Netflix, experienced significant drawdowns. Looking back from today, those drawdowns seem irrelevant.

The volatility often tempts investors to time the market to optimize returns. Attempting to boost returns through trading opens the door to more mistakes.

Focusing on the fundamentals and the long-term picture helps investors see past short-term worries.

Upstart is a promising business with a solid team, large addressable market, and a mission to do good by through financial inclusion.

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.