Upstart (UPST) Initial Coverage

Core business, team & culture, opportunity, financials, valuation & target, and risks

Upstart Network is on a mission to “enable effortless credit based on true risk.” The company seeks to make credit better through the use of machine learning and artificial intelligence. Founded in 2012, Upstart is headquartered in San Mateo, CA. The company made an initial public offering on December 16th, 2020, trading on the Nasdaq.

I first engaged with Upstart in May 2017. I created an investor account on what I believed was a peer-to-peer lending platform. The platform promised better outcomes due to not only considering a borrower’s credit score, but also their employment and education history.

In November 2019, Upstart announced they would no longer accept investments from individual investors. It became evident that Upstart leveraged this crowdsourced model to generate the initial transactions, collecting seed data to build a predictive model.

I initiated a position in Upstart on December 22nd, 2020.

Core Business

Upstart is a cloud-native company, applying their core competency in machine learning to the consumer credit vertical. The company incorporates many signals beyond those considered for traditional credit scores to build a comprehensive and predictive credit model.

Primarily a lending technology platform, Upstart partners with banks, fueling their digital transformation initiatives and improving their lending operations. The value proposition is clear: their predictive model enables superior loan products, enabling more affordable credit.

Efficacy of loan programs can be measured by three inter-related metrics:

Approvals: do you offer the borrower a loan?

Conversion: does the borrower accept the loan, given the proposed interest rate?

Loss rates: how many borrowers default on their loan?

Beyond providing automation and efficiency through an all-digital experience, Upstart greatly improves lending efficacy by offering more approvals, higher conversion, and lower loss rates. Banks can leverage Upstart for cost optimizations and/or growth.

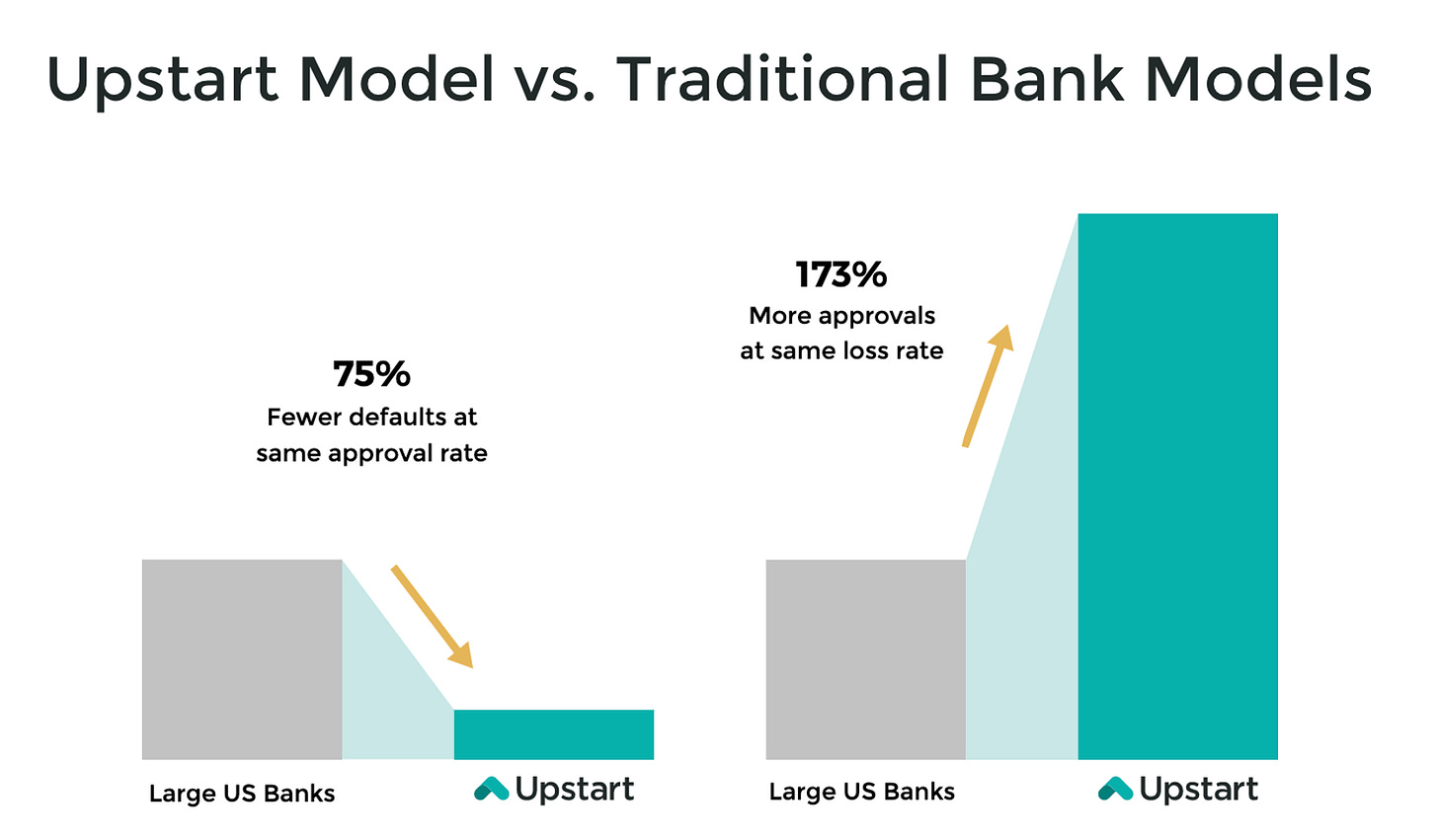

With Upstart’s model, banks deciding to maintain their existing loss rates are able to grow their lending program significantly, making more loan approvals at lower interest rates. Upstart conducted an internal study comparing their model against those of several large U.S. banks and found those large banks could approve 2.7x as many borrowers, maintaining their existing loss rates. In a separate report, the Consumer Financial Protection Bureau (CFPB) found Upstart’s model approves 27% more borrowers with a 16% lower average APR, when compared to traditional models.

Banks focused on controlling costs can implement Upstart’s services to maintain their existing loan volume while significantly reducing loss rates. The aforementioned internal study found that Upstart could enable those banks to lower loss rates by almost 75% while keeping approval rates constant.

When tested with unprecedented uncertainty during the COVID- 19 pandemic, Upstart’s model was approximately five times more predictive than FICO credit score alone, resulting in immaterial impact on loan performance of bank partners and institutional investors.

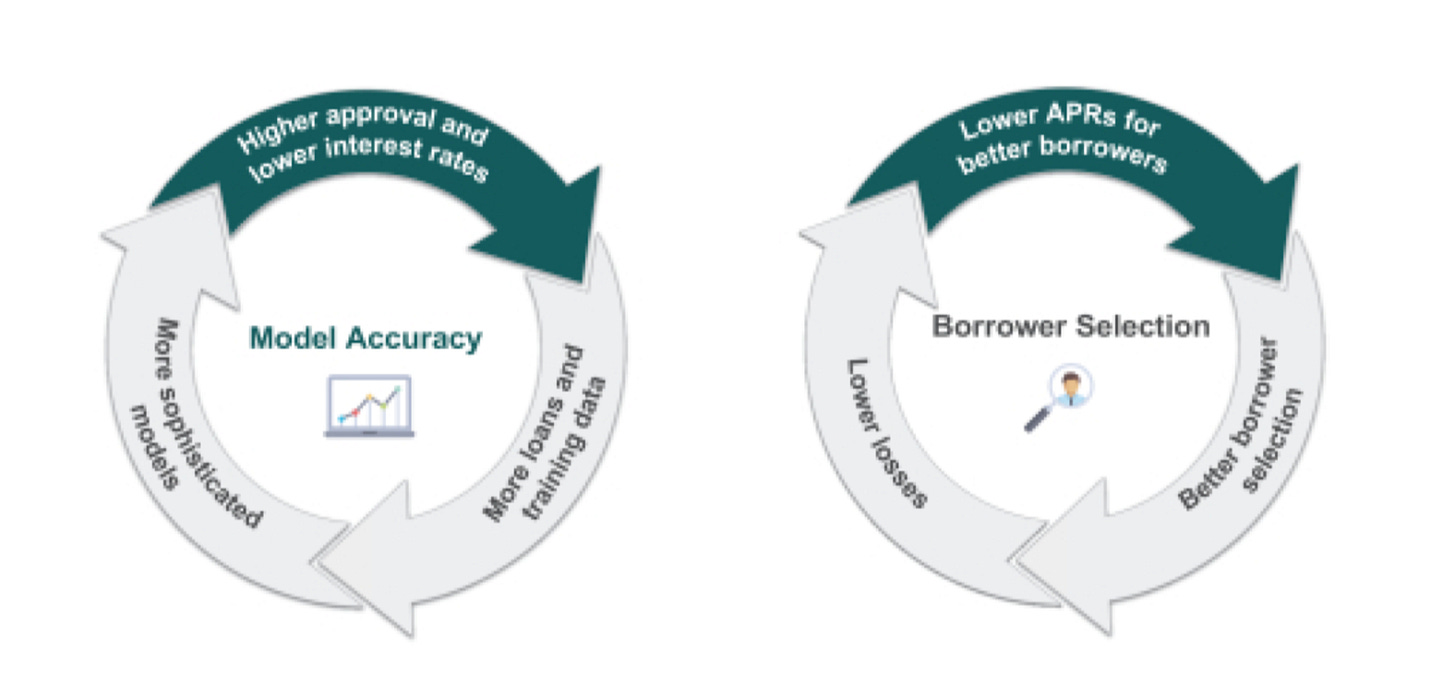

The above results are the outcome of a robust, predictive AI model. Upstart has built a comprehensive library, tracking over 1,600 variables across 9 million repayment events. This ever-growing training data set, collecting signals across all of their bank partners, is a unique competitive advantage. The quantity and quality of the data determines the output of machine learning models. More data leads to higher approval rates, lower interest rates, and lower loss rates.

Beyond the credit model, Upstart also provides technology and solutions for servicing loans, giving consumers a means to track and pay their loan

In contrast to the popular subscription-based business models, Upstart is a usage-based platform. Upstart charges banks 3-4% of the loan value for each referral and, separately, a platform fee of 2% of loan value for each originated loan. Upstart also charges the holder of the loan an ongoing servicing fee of 0.5-1%.

Upstart began offering unsecured personal loans, first, with a peer-to-peer lending platform and, consequently, partnering with banks.

In May 2020, Upstart announced their AI-powered Credit Decision API, an important step in that it allows others to build on top of Upstart, solidifying Upstart’s positioning as a foundational platform.

In June 2020, Upstart began offering auto loans.

As of September 30, 2020, Upstart has transacted a total of $7.8 billion in cumulative loan value. There is significant opportunity to expand into other verticals of consumer credit.

Management, Team, & Culture

Dave Girouard left Google after eight years in 2012 to start Upstart with Anna and Paul on the fundamental belief that credit unlocks opportunity. Affordable credit opens new opportunities and enables upward mobility. The average American has approximately $29,800 in personal debt; reducing the price of borrowing for consumers has the potential to dramatically improve the quality of life for millions of people.

Dave Girouard, founder & CEO, 54, is first and foremost a manager. He focuses on building and leading the team, setting the strategy, and reinforcing the culture. He was most recently at Google, joining at ~1,500 employees. While Google grew to ~50,000 employees, he eventually became the President of Google Enterprise, where he supported a large team of over 1,000 people building Google’s cloud applications including Gmail and Google Docs. His previous employers include Apple, Booz Allen, and Accenture. He has a degree from Dartmouth College in Engineering Sciences and Computer Engineering, as well as an MBA from the University of Michigan.

Anna Counselman, co-founder & SVP of People, 39, also comes from Google where she was most recently Head of Premium Services & Customer Programs. Anna graduated Summa Cum Laude from Boston University with a B.A. in Finance and Entrepreneurship.

Paul Gu, co-founder & SVP of Product, 29, has a background in quantitative finance. He built his first algorithmic trading strategies on the Interactive Brokers API at the age of 20 and previously worked in risk analysis at the D.E. Shaw Group, a hedge fund, in 2011. Paul studied economics and computer science at Yale University and then joined the Thiel Fellowship.

Sanjay Datta, CFO, 46, joined Upstart in December 2016. He was most recently at Google, having been there since June 2005 and serving various roles including Vice President of Finance for Global Advertising and Finance Director of Corporate Revenue. Sanjay has a joint honors degree in Economics and Finance from McGill University in Montreal and an MBA from Stanford University.

Upstart pays a special attention to their culture, which is evident in their values. The values, that were put together in the first year of the company and have been maintained for nearly a decade, are as follows:

Every second counts. “We definitely are a culture where we realize that moving quickly, making decisions quickly, is enormously important.”

Do the right thing, even when it’s hard. “Companies take shortcuts to growth, shortcuts to big numbers in ways that are not long-term successful. We’ve never chosen to take those paths. We do things that are right for the business long-term, but they’re not as much fun in the short term.”

Make clever use of numbers. “We’re a quant-like company who really likes to think hard about the math and the science behind something and how it can be done better.”

Be smart and know you might be wrong. “We really want to hire incredibly bright people who have confidence in their ideas. At the same time, people that realize they’re not always right and there’s always another valid opinion out there that you should listen to.”

Don’t assume it can’t be done. “Don’t just look at something and say ‘oh that’s never been done before … it’s impossible.’ Think hard about the underlying premise.”

Sources: Upstart, The Ladders

Upstart was to Inc Magazine’s Best Workplace for 2020. “Building a great place to work for the best talent was a priority for us from day one. It is not an accident that we have received best place to work awards in both our San Mateo and Columbus locations. Our employee engagement results are seven points higher than our technology peers and have even increased over the past year during the COVID- 19 pandemic.”

Source: Upstart S-1

As of September 30, 2020, Upstart had 429 full-time employees. The company continues to invest and grow aggressively, with plans to triple the engineering team in 2021.

Opportunity

"We're at the beginning of a golden age of AI. Recent advancements have already led to invention that previously lived in the realm of science fiction." -Jeff Bezos

Upstart is uniquely positioned to take advantage of the AI-era, which is expected to be a significant extension of previous movements including PC, mobile, and cloud.

One of the largest obstacles in creating an effective machine learning model is amassing large quality data sets. Similar to CrowdStrike, Upstart benefits immensely from its first-mover advantage. With an eight-year head start, Upstart’s models are already effective. As they continue to operate and gain more data points, the model improves, pulling them further away from competitors. This data moat becomes an almost insurmountable competitive advantage.

By partnering with banks, Upstart is able to tap into existing infrastructure to more quickly gain a large volume of transactions and data points. In machine learning, specialization and scale is advantage. In contrast, a few fintech companies such as Chime and Varo Bank seek to compete directly with banks through AI-powered online banks. Upstart’s strategic decision to partner with banks is laudable.

Upstart’s actions to become an API-first company are evident with the recent announcement of their Credit Decision API product. Strategically important, this approach allows Upstart to wedge itself in the foundation of their partner’s digital transformation efforts.

As of September 30, 2020, Upstart had 10 bank partners. There are over 4,500 FDIC-insured commercial banks in the USA.

Upstart has been initially focused on unsecured personal loans. From April 2019 to March 2020, there were $118 billion in U.S. unsecured personal loan originations, representing 8% growth over the prior year. Upstart facilitated the origination of $3.5 billion in unsecured personal loans, or less than 5% of the total market.

Albeit the fastest-growing segment, personal unsecured loans are a small slice of the overall consumer lending opportunity. From April 2019 to March 2020, there were $625 billion in U.S. auto loan originations, $363 billion in U.S. credit card originations and $2.5 trillion in U.S. mortgage originations. These opportunities represent a market of nearly $3.5 trillion – 1,000 times more than Upstart’s transacted volume of $3.5 billion. The market for consumer lending includes other categories such as student loans, point of sale loans, and HELOCs. Once mature, it would not be unthinkable for Upstart to expand beyond consumer credit into commercial lending.

Upstart recently launched their expansion into auto lending, a market more than five times larger than personal unsecured loans. Upstart completed the first auto loan transaction in September 2020.

Financials

Upstart has demonstrated the ability to effectively monetize their service.

Revenue growth has been impressive, growing nearly four-fold over four years from $57 million to an estimated $196 million in 2020.

As of September 2019, Upstart had 250 employees. In 2019, Upstart had just under $165 million in revenue. This equates to $660,000 in revenue per employee.

For 2020, Upstart was on track for annual revenue of $196 million, considering straight-line extrapolation of revenue of 147m for the first 9 months of the year. Upstart was able to grow at nearly 20% is in the midst of an unprecedented pandemic, quite a remarkable feat.

As of September 2020, Upstart had 429 employees. Considering $196 million in revenue, this equates to $456,000 in revenue per employee, a healthy amount considering Upstart is presumably investing in the company’s future initiatives.

Upstart reported a GAAP profit of $9.6 million for the third quarter of 2020.

While a typical enterprise SaaS company may have more inherent predictability, Upstart’s usage-based model enables significant leaps in scale. Each bank partner brings significant additional volume, resulting in step-function increases.

Valuation & Target

On December 16th, 2020, shares of Upstart began trading on the Nasdaq, initially priced at $20 for a market capitalization of $1.45 billion.

As of January 8th, Upstart shares trade at $52.73, representing a market capitalization of $3.8 billion.

Considering the estimated $196 million in annual revenue for 2020, Upstart is currently trading at a price-to-sales (P/S) multiple of 19.4 on the last twelve months (LTM).

In valuing growth companies, it is important to take a long-term approach and necessary to extrapolate what the company could become. The following sensitivity graph considers possible valuations for annual revenue growth between 10-50% and a range of revenue multiples between 5-25.

The table below provides data points for comparison across technology companies, considering market capitalization, revenue growth rate, and the current LTM P/S multiple.

Given the above comparables, coupled with Upstart’s long runway and endurable competitive advantages, I believe that an average revenue growth rate of 30% over the next five years a LTM P/S multiple of 15 in 2025 are prudent expectations.

Within five years, Upstart could reach a market capitalization of $10.9 billion, nearly triple today’s valuation of $3.8 billion. This represents an opportunity to earn a compound annual growth rate of 23.46% over the next five years.

The expected revenue growth and revenue multiples could turn out to be conservative.

Holding the position beyond the quoted five years could lead to significantly more upside. Upstart has a long runway ahead and is just getting started.

Risks

As with any investment, there are a myriad of risks.

Upstart is a new company offering an innovative service. While they have demonstrated value to their current customers, the sample size is quite small, with only 10 bank partners. Upstart’s product-market fit is still in the early phase and will need time to mature.

The sale process can be long and enduring, considering the importance of the function to a bank’s operations.

There is the risk that other institutions or startups begin to compete in the space. If competitor were to overtake Upstart’s model’s efficacy, that could be significantly detrimental. Large institutions may decide to build out their own machine learning models.

Attracting and retaining talented people will be an ongoing challenge for Upstart. As they continue to scale, the company will need to preserve their quality bar and retain key employees.

Being a small, growth company, the share price will likely be volatile. The market will likely reprice the company after significant announcements.

Notwithstanding the risks, I believe that Upstart’s services provide significant value-add and, in five years-time, Upstart will be a significant player in our country’s financial system, providing next-generation lending infrastructure.

–

If you enjoyed this article, I invite you to subscribe if you haven’t already.

Please feel free to share this article with any friends or family.

Torre Financial is an independent investment advisory firm focused on opportunities in equities across the value, growth-at-a-reasonable-price, and high-growth segments. If you are interested in investment management services, please feel free to reach out to me directly.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

https://torrefinancial.substack.com

-

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.