Market, Earnings, & Veeva (VEEV) - March 15, 2025

Market commentary, portfolio company earnings results, and a deeper look into Veeva (VEEV)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The decline continued these last two weeks. The S&P 500 fell into correction territory on Thursday as it notched a 10% drawdown from its recent highs.

The index is trading below its 200-day moving average, indicating deteriorating momentum. The last time the index traded below the long-term trend-line was in October 2023.

While momentum has taken a hit, the index traded higher on Friday, as shares caught a bid right at the correction level. It is possible for continued buying to bring back some momentum. However, uncertainty and volatility tends to fuel itself in the market. All three major indices are in the red for 2025.

Year-to-date performance across indices:

S&P 500 -4.13%

Nasdaq -5.22%

Dow Jones -2.48%

Trump and his administration continue to sow seeds of worry and concern.

In a Fox News interview on “Sunday Morning Futures," Trump mentioned he was willing to work through a bit of disruption for longer-term gains.

"There is a period of transition, because what we’re doing is very big. We’re bringing wealth back to America. That’s a big thing... it takes a little time, but I think it should be great for us.”

When asked whether he thinks a recession is imminent, Trump responded:

“I hate to predict things like that. Look, we’re going to have disruption, but we’re OK with that.”

The administration continues to shake things up across the board: from massive federal government layoffs, to escalating trade wars with Canada, Mexico, and Europe all simultaneously, to limiting global support and aggravating allies, and more.

Some believe that Trump’s actions are undermining some of the most important pillars on which our country is built: free trade and NATO, the alliance strengthening Europe and North America. The WSJ’s Saturday Essay, Trump Is Overturning the World Order That America Built, dives into the details.

The prosperity of the USA is certainly coupled with the rest of the world. Not only does America rely on international imports for competitive pricing, but many of the largest American companies also rely on international sales for growth.

Over the last year…

60%+ of Apple’s revenue was international

60%+ of Nvidia’s revenue was international

51% of Alphabet’s revenue was international

40%+ of Meta’s revenue was international

49% of Microsoft’s revenue was international

The market has picked up on this. The Magnificent 7, which have led the markets higher over the last few years and grown to become a major concentration of the broader indices, have sold off in the last month. Most of these companies have seen steeper declines than the index.

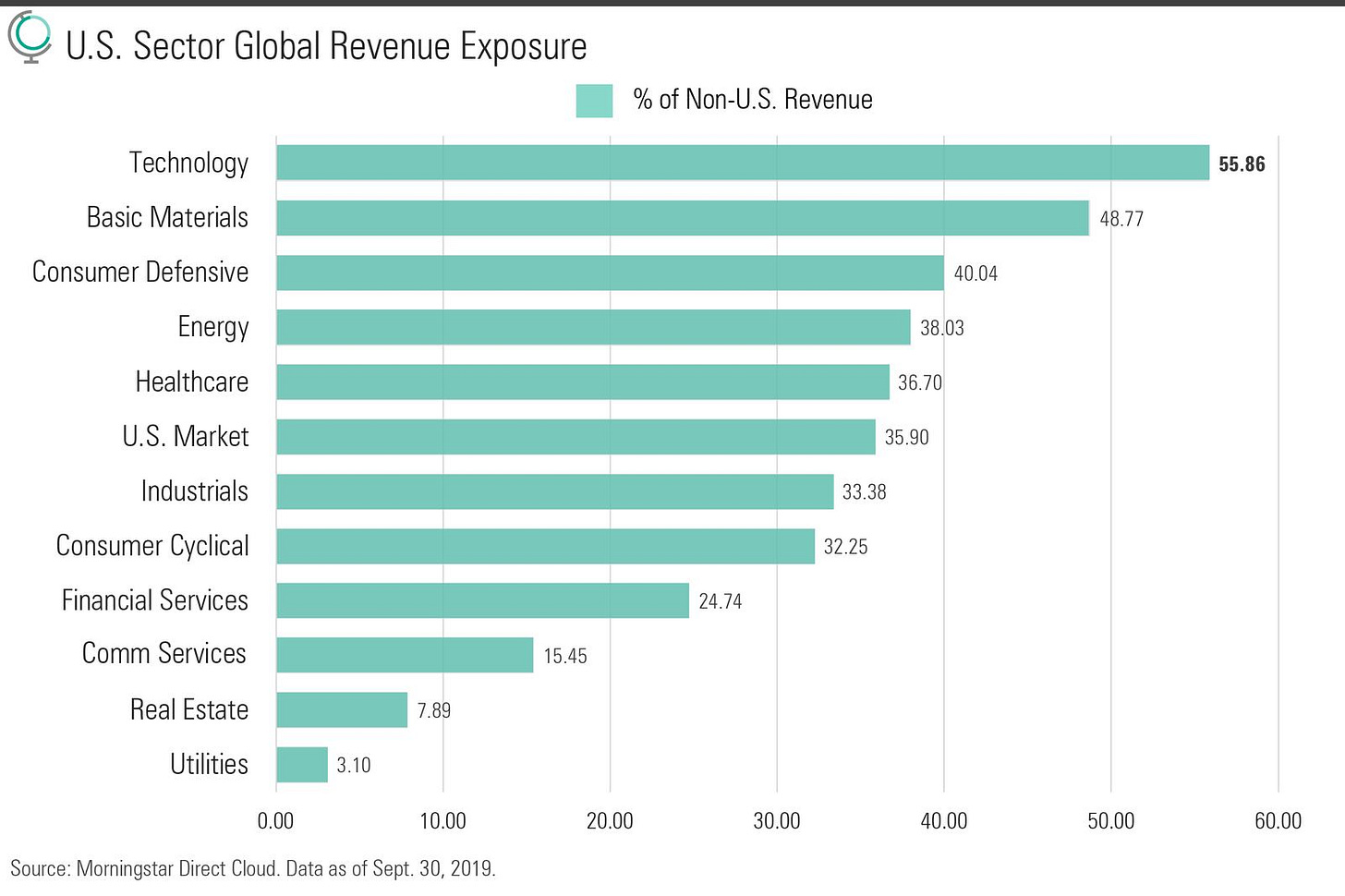

It isn’t only the Mag 7 either. Many sectors beyond Technology have significant international exposure, including Materials, Consumer Staples, Energy, Health Care, amongst others.

The US market is lagging other countries in YTD performance for 2025.

All that being said, the S&P 500 has so far experienced a very normal decline.

A double digit drawdown is normal – the market experiences a 10% decline on average once per year.

In 2024, the largest drawdown was 8.5% and the market closed up 25%.

In 2023, the largest drawdown was 10.3% and the market closed up 26.3%

Looking back further, the pattern is clear: drawdowns are a normal part of investing.

All the recent volatility has led to a spike in the volatility index, or VIX, which reached a local high of 30.

Historically, buying peak fear has paid off. Forward returns have been very strong.

Buying when the VIX spikes above 35, leads to median returns of:

14.9% after 1 year

25.9% after 2 years (12.2% annualized)

34.2% after 3 years (10.3% annualized)

When the VIX spikes above 45, it’s been even better, with median returns of:

18.7% after 1 year

30.9% after 2 years (14.4% annualized)

46.8% after 3 years (13.6% annualized)

The CPI report came in lower than expected, with inflation easing to 2.8% in February. Truflation, a real-time gauge on inflation, shows inflation at 1.5%. Lower rates are welcomed, as they make it easier for the Fed to lower rates.

Given the market’s sell off, lower growth expectations, lower inflation, and the general uncertainty, markets are starting to adjust expectations on rates.

As of January 2025, the market expected just 1 rate cut for all 2025.

As of March 2025, the market is expecting 3 rate cuts for the year. That would bring the Fed Funds Rate down to 3.50-3.75% from the current 4.25-4.50%. While lower rates do benefit asset prices, the intention of lower rates is typically to stimulate slowing economies.

Earnings

Over the last two weeks, 2 portfolio companies reported earnings.

Veeva Systems (VEEV)

Prior coverage:

Veeva Systems is a leader in cloud solutions for the life sciences and healthcare industry.

In 2005, Founder and CEO Peter Gassner left Salesforce to build a healthcare vertical solution. While they raised $7 million from angels and VCs, they grew super efficiently and only needed $3 million to get all the way to their $4+ billion IPO in 2013.

“Peter: We were simple angel investors when we just started, and then about 15 months in, some angel investors, I think that was $3 million and Emergence was $4 million. We never actually used the Emergence $4 million, but I thought we might at the time. We got within about $100,000 of using it and then we went public.” - Acquired

After starting with a CRM for healthcare, Veeva has expanded to offer a multitude of vertical specific solutions.

The business is organized around those three pillars:

Veeva Development Cloud - applications to help run clinical trials, coordinate with contract research organizations, keep electronic records, manage quality content, and much more

Veeva Commercial Cloud - software and analytics to help commercialize products, including customer relationship management (CRM), database of validated medical content, digital asset management solution for managing promotional material, solutions to maximize marketing effectiveness

Veeva Data Cloud - data platform of reference data, deep data, and transaction data; such as customer data including demographics, speciality, affiliations; database of key people, publications, conferences; database of de-identified longitudinal patient and projected prescriber data that can be used for planning, patient finding, journey analytics, incentive compensation, and more

In 2024, Veeva set a 2030 goal of reaching an annual run rate of $6 billion, which is more than double their $2.75 billion in annual revenue.

Veeva seems on track and likely to achieve their goals. They continue to execute very well, driving innovation and growth organically. While they are not the fastest growing SaaS company, their growth is measured and consistent. Their runway is long and ever expanding. Their fiscally responsible culture is evident and the impact is clear as they continue to grow profitably.

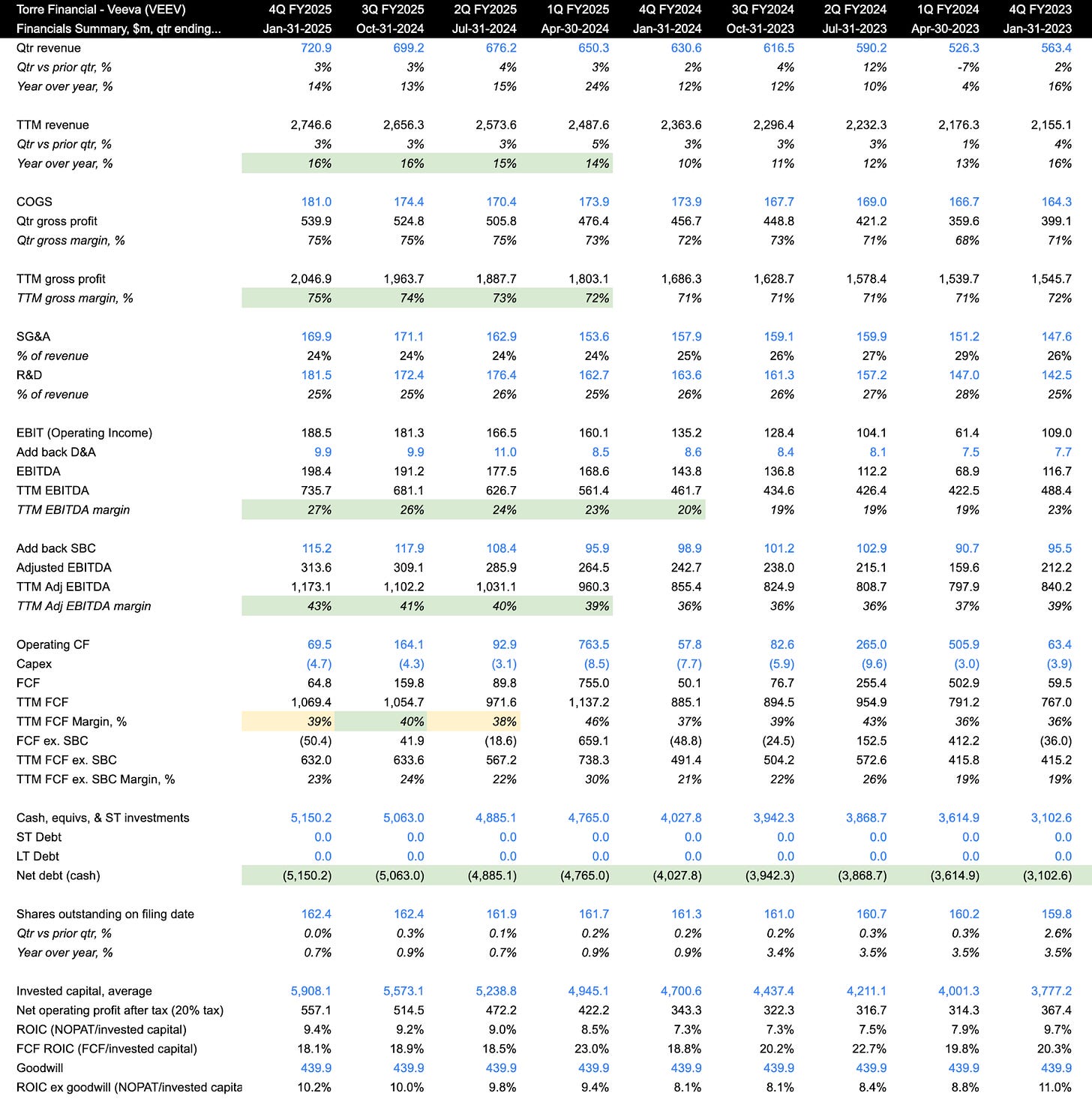

Diving into the quarterly financials:

TTM revenue grew at 12% y/y, continuing to accelerate over the past few quarters

TTM gross margin ticked up to 75%, a very high level and showing their meticulous focus on continuous improvement & pricing power

TTM EBITDA margin has also expanded nicely, up to 27% from 19% just two years ago

TTM FCF margin came in at 39% and has been generally steady around that level. FCF margin being higher than EBITDA is a great sign generally. It is important to call out that a primary factor here is stock based compensation, which is a true expense, just not cash.

Taking that into account, when excluding SBC from FCF, the adjusted FCF excluding SBC margin comes in at 23%. This is a more realistic indicator – still a good level and very healthy.

The balance sheet is pristine, with 0 debt and a growing pile of cash of now over $5 billion.

Shares outstanding ticked up 0.7% y/y. It is nice to see this come down from the 3%+ just two years ago.

On efficiency, ROIC and FCF ROIC come in at ~9% and ~18% respectively. When adjusting FCF for SBC, the FCF ROIC comes down more inline to ~10%. These are not the highest efficiency metrics. In fact, at face value they seem paltry. The counterbalance here is the company is continuing to invest heavily and delivering on those investments with new products, new offerings, etc, which are fueling continued growth. As with any early investment, it is yet to be seen how efficient the mature operation would look. While technology & SaaS is generally understood to have high margins and high efficiency at maturity, there’s a little bit of risk because it isn’t there today.

As for valuation:

Veeva trades for 25x EV/NTM EBITDA, which seems to be a very reasonable price for a well-managed company with a long runway ahead. The 25x multiple is one standard deviation below their 10-year mean of 27.8x, indicating the current valuation is relatively attractive.

From a FCF perspective, the current yield of 3.3% is inline with the historical mean of 3.2%. Compared to the 10 year yield at 4.2%, Veeva’s combination of growth and FCF yield seem reasonable. It would take just 2-3 years for Veeva’s FCF yield to overcome the 10y yield – that is without considering the downward pressure on long term yields (lower inflation, lower fed funds rate, etc).

Looking at the next few years, revenue is expected to grow ~10-13% and EBITDA is expected to grow ~13-15%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes share count declines by 0.5% per year. Returns include dividends.

Over the next 5 years…

If EBITDA grows at 12% CAGR and the multiple contracts to 24x, shares could return 9% per year

If EBITDA grows at 14% CAGR and the multiple slightly expands to 26x, shares could return 12% per year

Fastgraphs provides another look:

If shares were to trade at a P/E of 35x, significantly below their historical normal P/E of 62 an inline with recent years, shares could generate annualized returns of 11% going forward.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Good stuff on the Truflation data - gonna pull that for myself 🤣

Can you double click on how you made this calculation? --"It would take just 2-3 years for Veeva’s FCF yield to overcome the 10y yield"