2022 Market Review - December 31, 2022

Market review including performance, volatility, sectors, styles, commodities, inflation, rates, and real estate

Market

The markets closed out a challenging 2022 on December 30th, 2022. All three major indices posted losses:

Dow Jones (DIA): -7.02%

S&P 500 (SPY): -18.18%

Nasdaq (QQQ): -32.58%

Ever since crossing below its 200-day moving average, the S&P 500 has been struggling. The index’s attempts in April, August, and December were each faced with resistance. On the positive side, December brought about a convincing attempt and the the gap between the 50-day and 200-day moving averages has narrowed.

For comparison, the S&P climbed steadily throughout 2021, never even approaching its 200-day moving average.

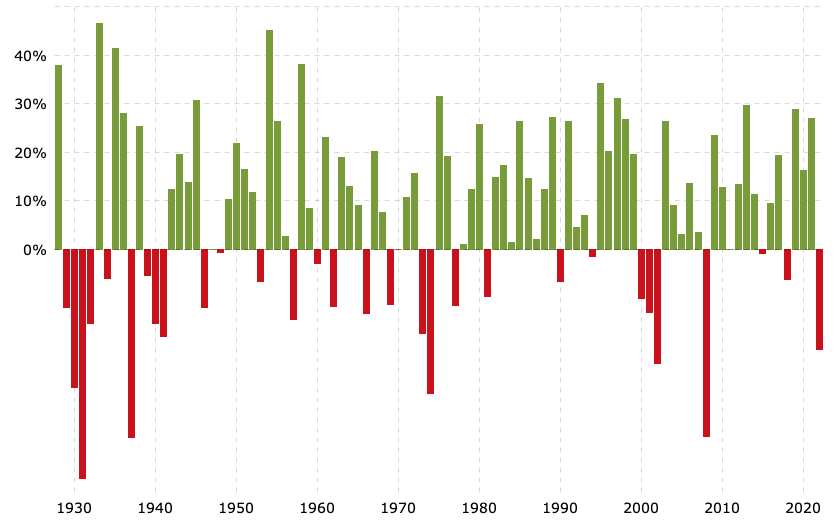

In the last 20 years, only two years fared worse than 2022 (-18%): 2008 (-38%) and 2002 (-38%). Prior to that, you have to go all the way back to 1974, and then to the 1930s.

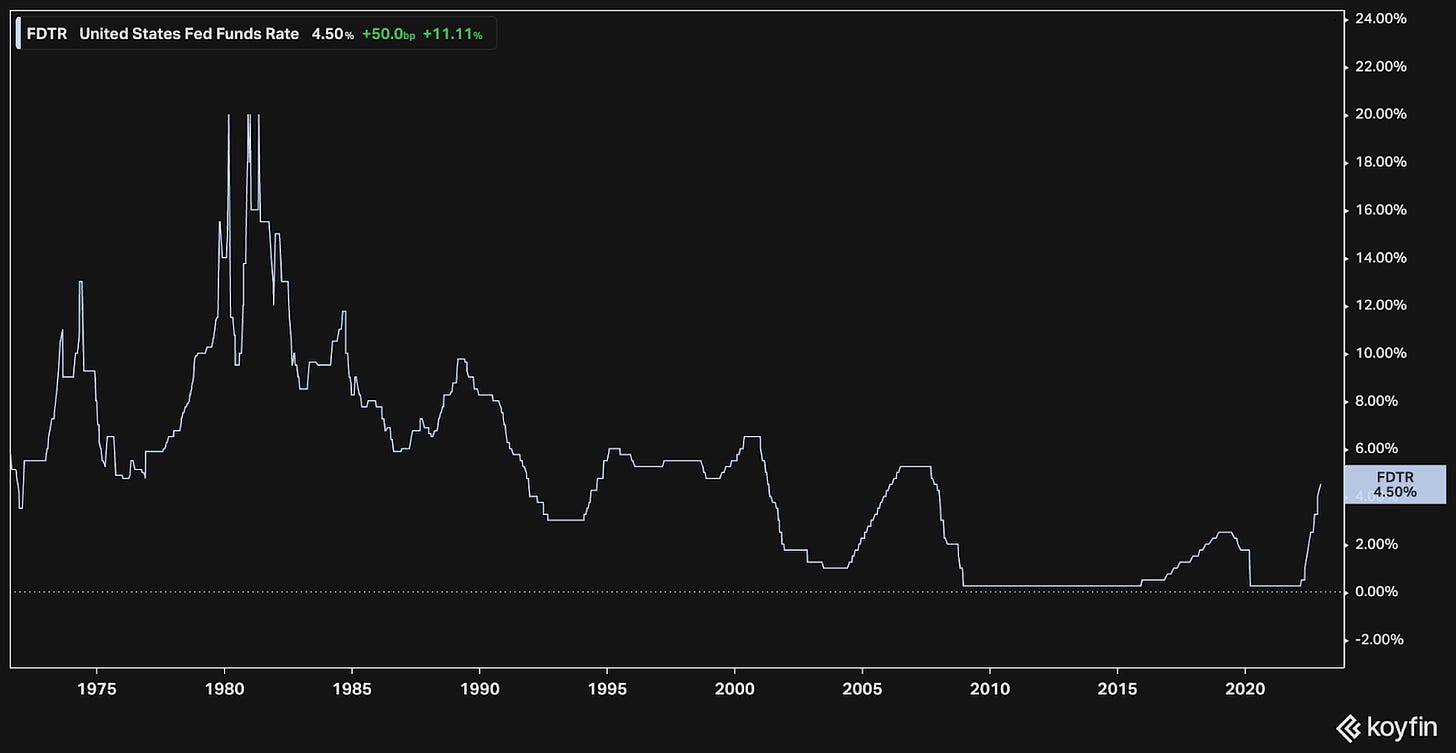

The last few years have experienced rapid and dramatic cycles. When the pandemic kicked off, the economy hit a full stop. Loose monetary policy and generous fiscal policies were applied, turbocharging the economy – particularly in consumption of goods and asset prices. Coupled with supply challenges, prices increased. Inflation started edging higher. Consumption shifted from goods to services, maintaining price pressures as supply concerns eased. The unexpected war in Ukraine further complicated supply chains and energy markets. Rates soon followed. Monetary policy went into reverse, tightening at the fastest pace in over 40 years.

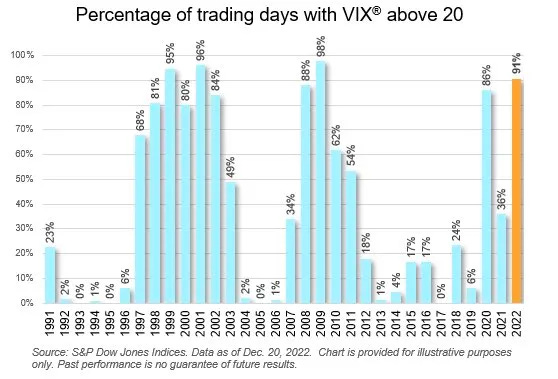

The VIX is a well known index that tracks expected volatility. Derived from S&P 500 index options with near-term expiration dates, it provides a forward-looking projection of what to expect. The last few years have been particularly elevated. In 2022, the VIX was above 20 for 91% of trading days, rivaling 2009, 2001, and 1999.

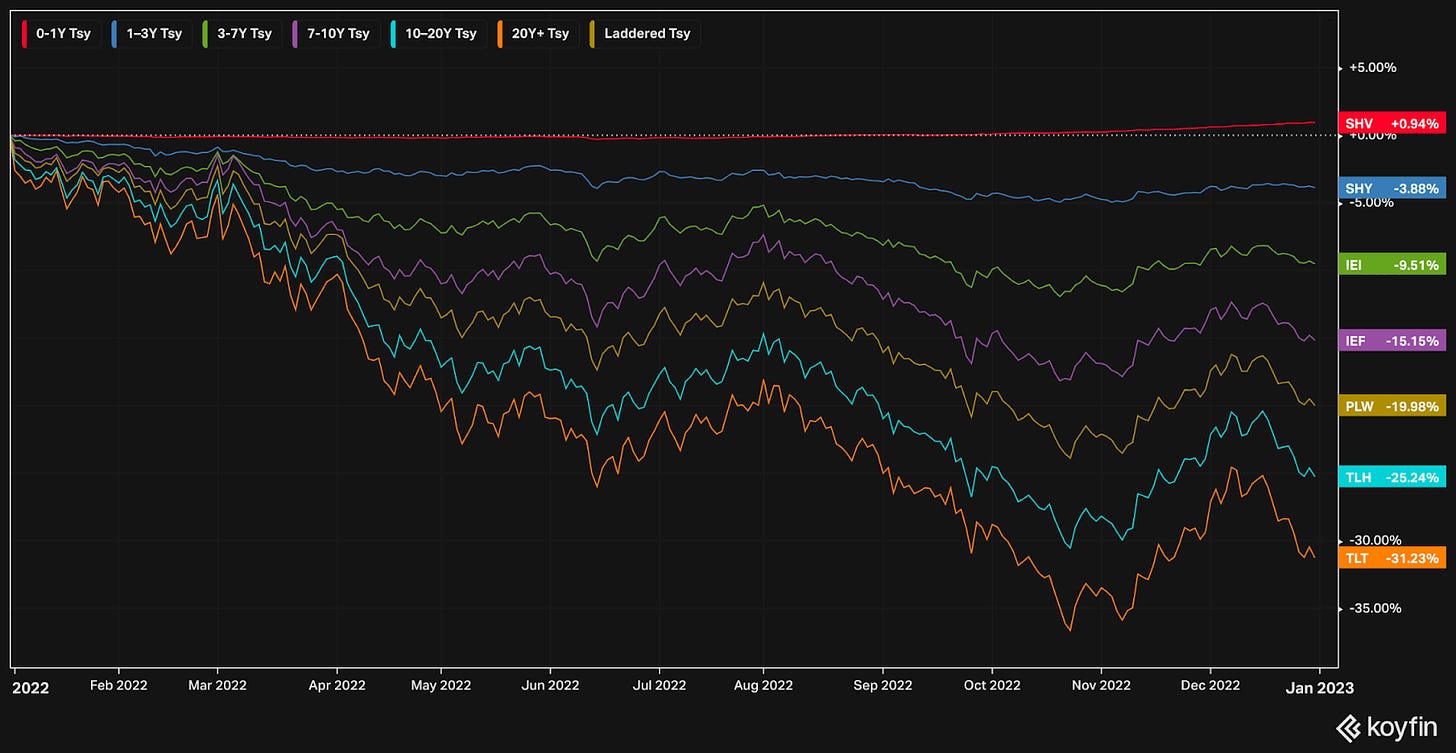

There was nowhere to hide. Bonds, which are typically used to counteract stock price volatility, fared just as poorly.

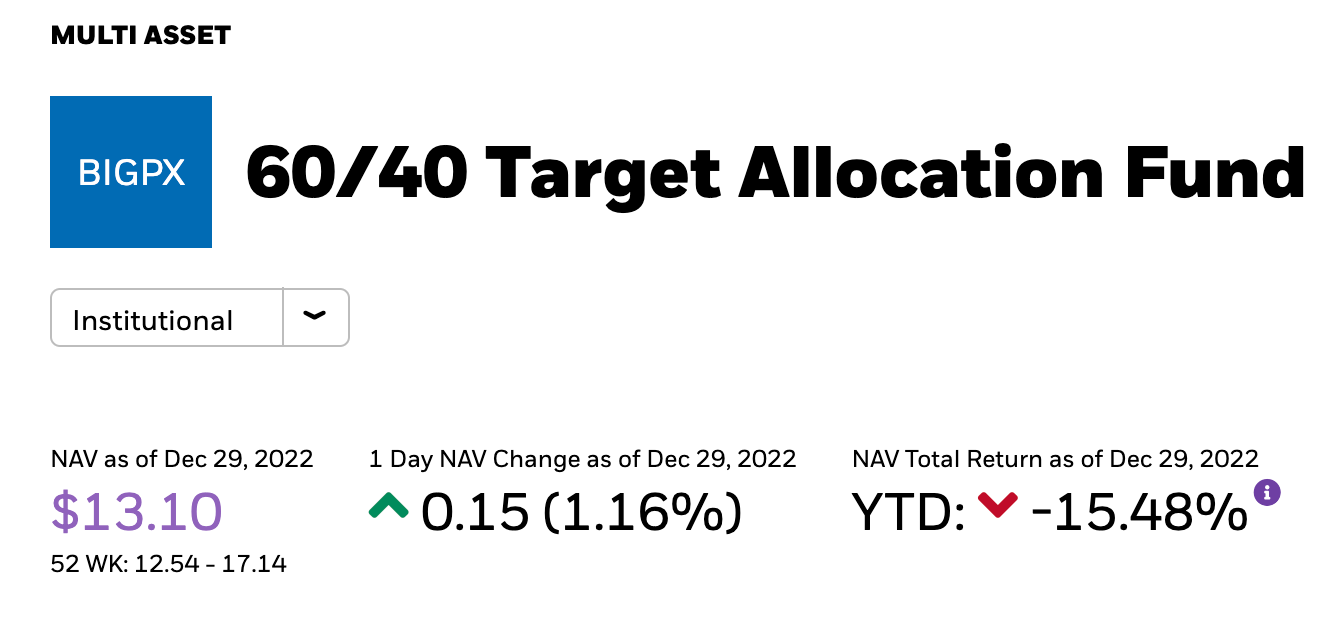

The typical 60/40 portfolio (60% equities, 40% bonds) had one of its worst years ever, posting losses north of 15%.

Cross-sections

Looking at performance across sectors, energy stands out as the clear winner. Utilities, consumer staples, and healthcare nearly broke even. Real estate and technology suffered similarly. Consumer discretionary and communications rounded out the bottom.

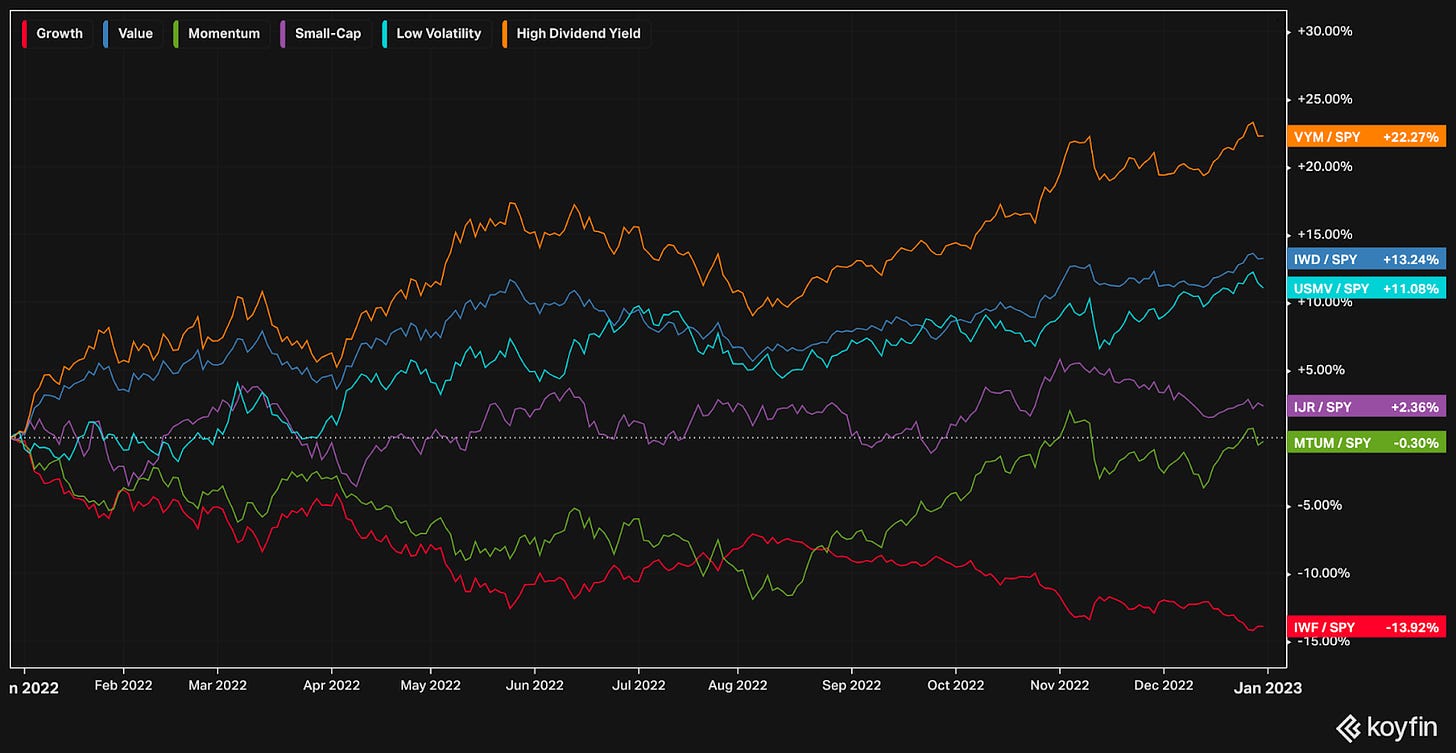

Looking at performance across investment styles against the S&P 500, high dividend yield, value, and low volatility outperformed. Small cap and momentum held up, nearly at par. Growth rounded out the bottom.

Looking at performance across qualitative factors against the S&P 500, buybacks and spin offs outperformed. Quality held up, nearly at par. Hedge funds, private equity, and IPOs rounded out the bottom.

Digging Deeper

Volatile commodities, high inflation, rising rates, and have been the story of the year.

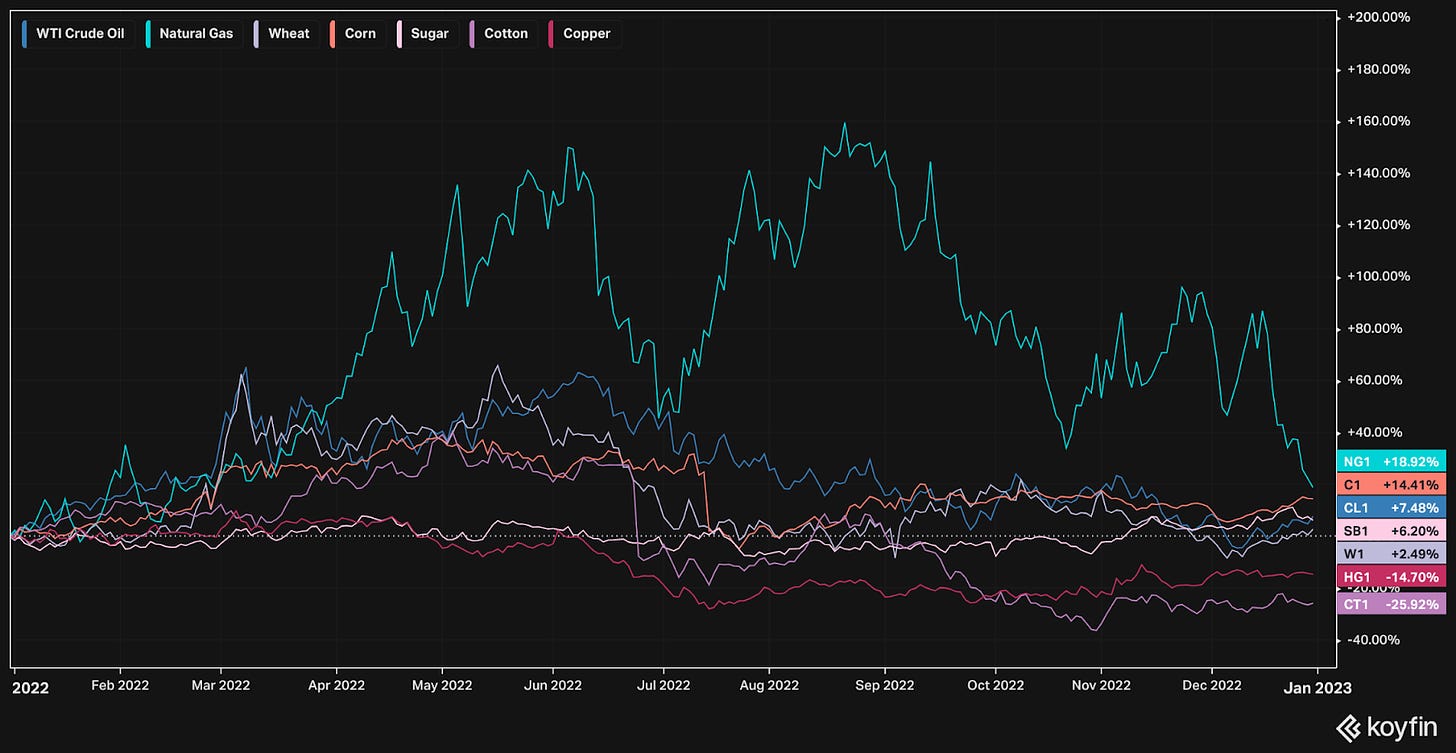

At one point in the year, natural gas was up 160% (340%+ annualized!). Other commodities, such as oil and wheat were up 50% in the summer. That being said, they have all come down from their highs.

CPI peaked in the summer, posting a headline number of 9%.

Rates have come up significantly. More concerning than the rate itself is the rate of change – the pace at which rates have moved.

The market is forward-looking and prices in expectations.

The true effects of the rate increases on the economy take time.

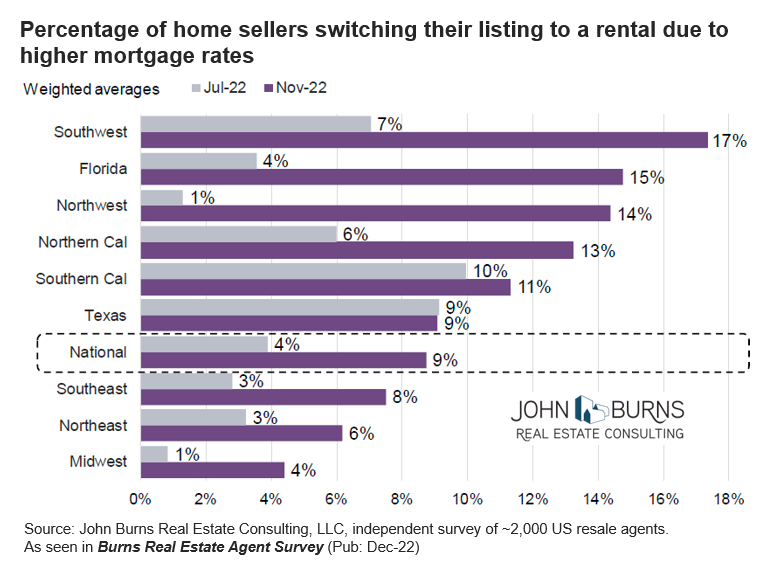

The real estate market is a prime example. As rates climbed, mortgage rates increased from ~2% to ~7%. Interestingly, housing prices have yet to come down. Sales, however, ground to a halt – fewer deals are being made, presumably as expectations between buyers and sellers have widened. “Stable” prices, based on low volume, may not be as stable as they seem. The inability to sell has sellers switching to renting. If demand in the rental market holds steady, and the supply increases, rental prices will come down. This in turn will lower the attractiveness of switching to renting, and incentivize deals at lower prices.

The stock market has already priced this in. Private investments have not. There is a growing disconnect, particularly evident in non-traded, semiliquid vehicles such as Blackstone’s BREIT.

General consensus is that there is trouble ahead for the economy, and therefore businesses fundamentals. Most economists are calling for a recession in 2023. The stock market has priced some of that in. The extent of the recession, and the degree at which it is priced in, is unknown.

There are also ongoing developments to take into account. The latest: China’s reopening. Will China’s reopening improve supply chains and increased spending help spur growth? Or will it drive energy prices higher, resulting in a new jolt of inflation and make the case for additional tightening?

Closing

It has been a challenging year for investors across the board. There have not been a lot of opportunities to capitalize on this year, with the exception of energy.

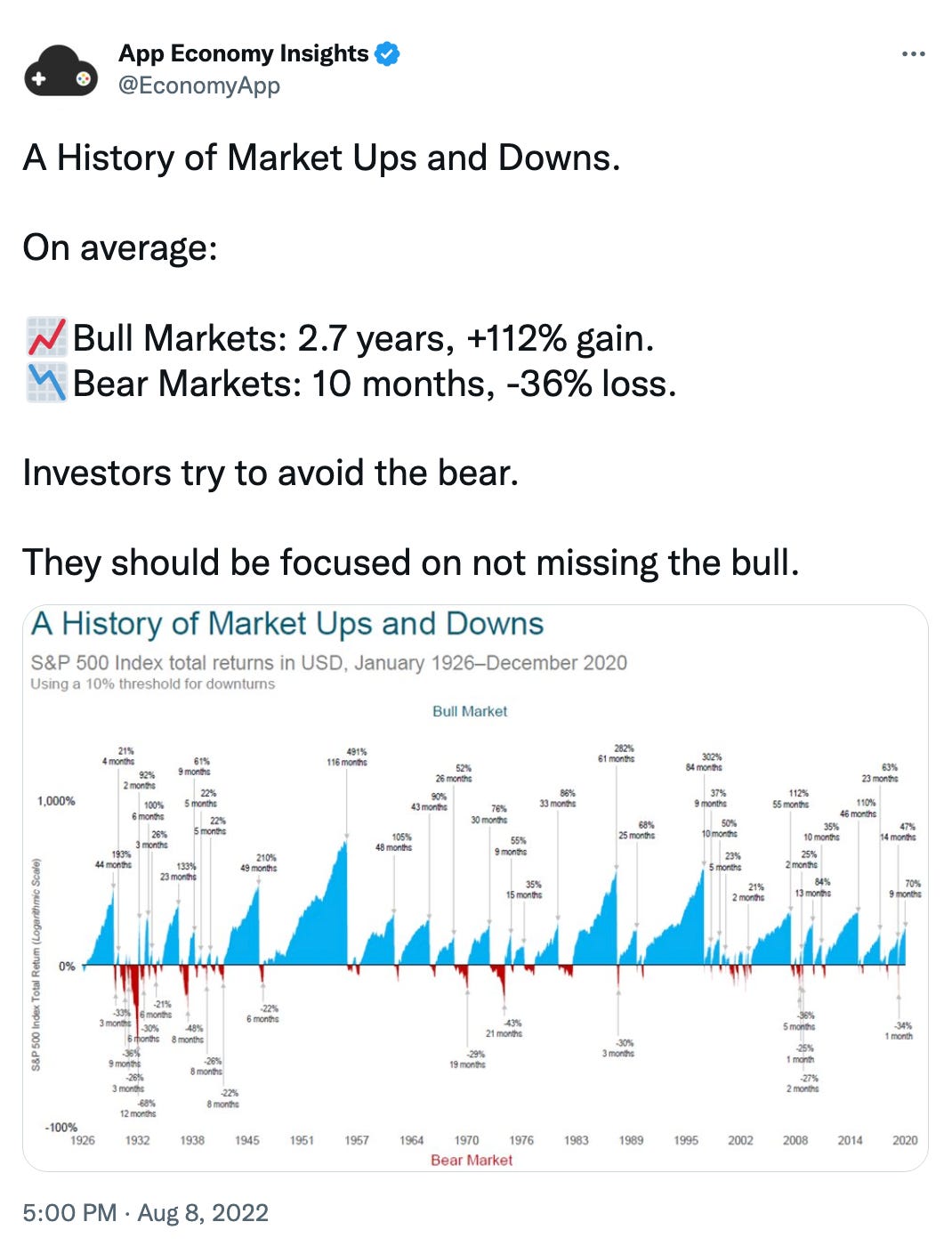

The stock market has been the greatest wealth creation invention, ever. Tough markets are the price of admission. Over the long term, the stock market delivers unrivaled returns.

This tweet from App Economy Insights sums it up well:

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.