Market, Earnings, and Adobe (ADBE) - June 22, 2024

Market commentary, portfolio company earnings results, and a deeper look into Adobe

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The S&P 500 (SPY) reached another all-time high this week, trading above 550 for the first time ever. A 7-day winning streak came to an end on Thursday. The index closed marginally lower on Friday at 544.5, just a few points away from the all time high.

The most recent pullback in May reversed course before reaching the 50-day simple moving average (SMA). Today, the index sits comfortably above both 50-day and 200-day trend lines.

Strength begets strength. For now the momentum continues, with higher lows and higher highs.

Year-to-date performance across indices:

Nasdaq +17%

S&P 500 +15%

Dow Jones +4%

With the S&P 500 expected to earn roughly $241 per share this year, the market is trading at a forward price/earnings ratio of roughly 22x. Valuation looks somewhat stretched based on historical standards.

The earnings yield – simply the inverse of the ratio – comes out to roughly 4.5%. For comparison, the 10-year Treasury currently yields 4.3%.

Short interest is at a record low for both the S&P 500 and Nasdaq. When investors short the market, they are betting the market will go down. Those bets are dissipating.

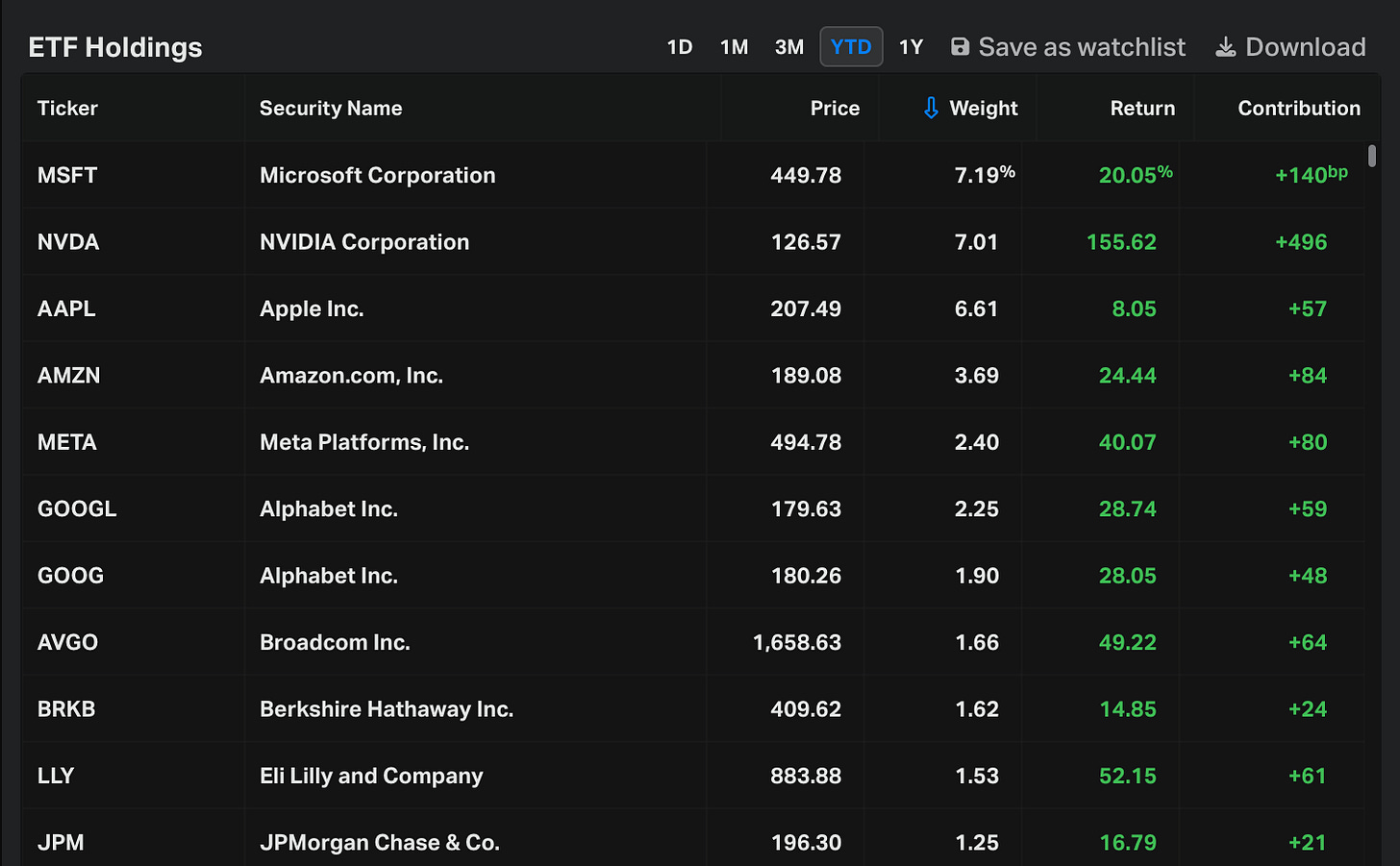

The S&P 500 is market-cap weighted, giving increasing importance to the larger companies. Those largest companies are increasingly significant drivers of the market. Looking at the top 5 companies:

Microsoft +20% YTD

Nvidia +156% YTD

Apple +8% YTD

Amazon +25% YTD

Meta +40% YTD

The S&P is at its highest concentration by weight of top 3 holdings, when looking at data going back to 1980.

Comparing the S&P 500 (SPY) to an equal-weighted index with the same companies (RSP) shows the significant divergence. The equal weighted index is up 5% YTD compared to 15% for the market-cap weighted index.

The dynamic is notable across investment styles.

Growth investing (+20%) is significantly outperforming value investing (+7%).

Small caps are down 2% for the year, compared to +15% for the S&P 500.

Nvidia, up +156% YTD, is single-handedly the most significant influence. Nvidia briefly passed both Microsoft and Apple to become the world’s most valuable public company.

One year ago, Nvidia was worth $1 trillion.

Ten years ago, Nvidia was worth $10 billion.

Today: $3.2 trillion.

Although it may feel like a smooth ride recently , Nvidia has had its fair share of challenges in the past. Within the last 5 years, the share price dropped by more than 50% – twice!

Volatility is the price of admission – no risk, no reward. Nvidia isn’t alone. Many high profile companies have had similar volatility.

Microsoft has had declines of 30%+ and 20%+.

Apple has had almost five 30%+ drawdowns in the last 10 years.

Netflix saw its shares decline nearly 80% just a few years ago.

Patience is easy to talk about, yet harder to practice.

Nvidia, and the broader semiconductor industry, have had a stellar year. The industry is up 58% YTD, a clear winner.

Hardware is the first phase of the cycle. Those semiconductors need to be put to use…

Semiconductors are building blocks for data centers and cloud infrastructure which are used to run software applications.

Those investments are starting to come through. Hyperscale clouds are benefitting. After some softness over the last two years, cloud revenue is starting to accelerate.

Software has struggled recently. Many enterprise SaaS companies are trading at depressed prices, down 20% or more, as buyers have expressed caution in buying cycles, as they evaluate their AI strategy and which providers will help them accelerate their ambitions.

If the AI hype and the capital investments in chips are to have a durable future, it will likely be through value ultimately delivered via software applications.

Earnings

One portfolio company reported earnings over the last 2 weeks.

Adobe (ADBE)

Prior coverage:

Adobe continues to execute well. They have been under scrutiny by the market, questioning their ability to fend off competitors while adapting to and benefiting from the AI movement.

Adobe has three major platforms:

Creative Cloud, which includes Photoshop, Express, Lightroom, Illustrator, Premier Pro, and more

Experience Cloud, which includes marketing and commerce solutions for analytics, managing assets, optimizing campaigns, and more

Documents Cloud, which includes everything PDF such as Acrobat, e-signatures, and more

All of these offerings are underpinned by Adobe Firefly, their foundational AI.

Adobe is using AI to make it easier for users to use their products and services – to generate and edit images, to summarize PDF documents, to enhance the productivity of marketers, and much more.

Their AI offerings are built for enterprise, with strict content and copyright controls, allowing personalization of tone and voice, and many more controls. This is a key differentiating factor when compared to other popular consumer-facing offerings.

Applying AI to Adobe’s clouds allows for unbound opportunity and expansion.

As a counter-example, consider applying AI to help address customer service issues. A customer service call or chat takes a fixed amount of time, say 10 minutes. There are a finite number of calls/chats and they take a finite number of time or effort. The maximum optimization could result in 10 minutes of savings per call/chat. This space is bounded. There is a limit to the value that can be achieved through automating the task.

In the creative and marketing space, there is no limit. The more efficiently you can produce and scale more things, the better.

Consider running an ad marketing campaign with 1 single asset, an image. With AI, you could up that to 10 variations, 100 variations, or many more. Combining asset creation with the marketing engine, you could have a personalized ad (or multiple!) for every user.

The opportunity for creation is unbounded. This shows the opportunity space with AI for companies like Adobe, unlocking more value for them to capture.

In their most recent earnings call, Adobe highlighted this opportunity:

“Turning to Creative Cloud, creative professionals are leading the global charge to meet the ever-increasing demand for engaging content across a variety of platforms and channels. Enterprises rely on creative professionals to produce differentiated content to drive increasingly personalized marketing campaigns. Solopreneurs and small businesses need to stand out in a crowded digital landscape with engaging videos and designs. Educators are passionate about providing students with the visual communication skills needed to thrive in the decades ahead. Consumers are increasingly looking for ways to share their stories digitally. Creative Cloud, Express and Firefly Services are uniquely positioned to catalyze this opportunity for everyone, by leveraging the promise of generative AI.”

The company was broadly optimistic about the opportunity and demand for their product – they beat earnings and raised guidance.

“Given this rich product roadmap, focus on execution and customer demand in the first half of the year, we are pleased to raise our annual Digital Media net new ARR, Digital Experience subscription revenue and EPS targets.”

Diving into the financials:

TTM revenue came in at 11% for the 2nd quarter. Q3 guidance calls for further acceleration up to 12%.

TTM gross margin held steady at 88%. Gross margin for the quarter came in at 89%, indicating a positive trendline.

TTM EBITDA margin was 47%, also quite steady over the last few years.

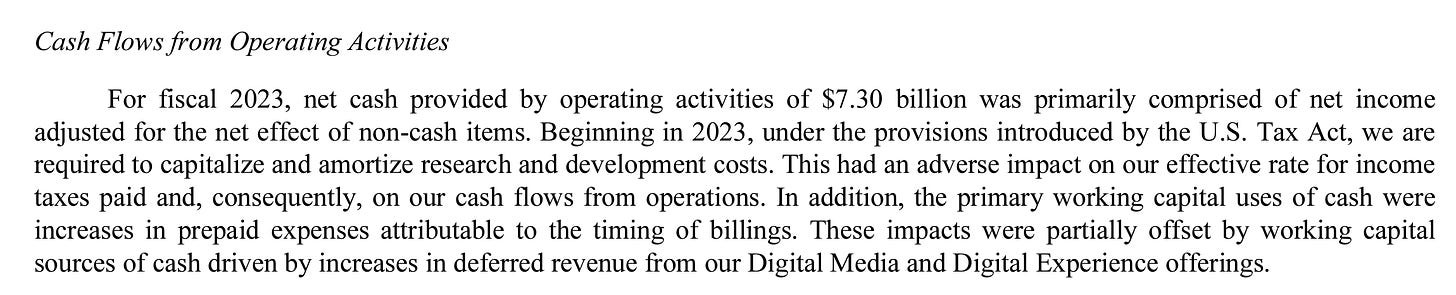

TTM FCF margin of 31% is down from the prior 33%. The divergence between EBITDA and FCF is always a yellow flag and warrants further investigation.

In the base case, it means a company is booking sales but not necessarily collecting on them. This might be due to deferred payment plans or other customer-favorable terms, often indicating competitive pressures.

For Adobe, this is in part due to the $1 billion termination fee paid to Figma in Q1. Overlooking that quarter, quarterly margins do still show a degradation in FCF conversion over time.

The difference can be explained by a difference in accounting. Whereas they previously expensed all R&D (lowering their tax bill) they must now capitalize and amortize some of it (increasing their tax bill). Higher tax bill means their free cash flow is reduced.

The balance sheet looks healthy, with over $8 billion in cash. Net debt has decreased recently, in part due to the termination fee as well as ongoing share buybacks.

Shares outstanding are down 1.5% y/y, continuing to decrease. Over the last 5 years, Adobe has reduced shares outstanding by 8.2%.

Efficiency metrics look strong, showing high 40s and 30s for EBITDA ROIC and FCF ROIC respectively.

Taking a look at the price action:

Adobe shares had a strong 2023 and started facing some resistance in Q1 2024. The “death cross” in April led to a further decline.

The most recent earnings result was strong and very well received. Shares jumped 15%, clearing the 50-day SMA. The inflection on the 50-day moving average is promising. We’ll want to see the price sustain and start to build momentum.

As for valuation:

Shares are trading at 10.4x NTM revenue and 21x NTM EBITDA. Given the maturity of the company, EBITDA is a more indicative multiple. 21x is very reasonable.

The FCF yield of 2.7% is reasonable given Adobe’s high quality – durable, predictable revenue; consistent growth; and opportunity ahead.

Analysts expect EBITDA to grow 10-11% per year through 2026.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share reduction of 1%.

Over the next 5 years, if EBITDA grows at 10% and the multiple compresses to 20x, investors could expect returns of ~10% per year.

For a more bullish case, consider 12% EBITDA CAGR and a 24x multiple. This would return ~16% annualized returns.

Fast Graphs provides another perspective.

If shares were to trade at the 20-year normal multiple of 27x in the near future, shares could be trading at $646. An investment at today’s price could return 8% per year.

Adobe’s 10-year normal P/FCF multiple is 32x, leaving the door open for additional upside.

Closing

At Torre Financial, we focus on finding the best investment opportunities at any time. We focus on companies that have high returns on capital, competitive advantages, and durable growth. We assess primarily on fundamentals, and continually reevaluate and rebalance according to what the market is offering.

Our approach is to stay invested in equities. Over time, equities will generate the best returns.

--

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.