Market, Earnings, & Agree Realty (ADC) - August 3, 2024

Market commentary, portfolio company earnings results, and a deeper look into Agree Realty (ADC)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

Market sentiment appears to have turned south, as volatility continues to increase. After an attempt to bounce off its 50-day simple moving average, the S&P 500 index accelerated lower breaking decisively below the trend line. The current drawdown of nearly -6% has surpassed the April sell off.

The decline has been more accentuated in the Nasdaq, which is now -10% off the recent peak. Given its relative resilience, the S&P 500 is now leading the indices in YTD performance.

Year-to-date performance across indices:

Nasdaq +9.6%

S&P 500 +12.1%

Dow Jones +5.3%

Volatility spiked higher, nearly reaching 30. Calm markets tend to drift higher, while highly active markets tend to correlate with declines. The VIX index, known as the fear index, captures the ratio of bearish put and bullish call option activity.

The recent volatility picked up steam throughout the week, with decisive selling on Friday. The 545 level was critical – now that it has been broken, it becomes a level of resistance. The next major level of support is ~520-525, another 2% decline from current prices. It is very possible for that level to hold.

Macro reports show inflation and yields continue to decline. Lower rates generally make cash-flowing assets more attractive.

Truflation shows inflation has come down to 1.53%, well below the Fed’s 2% target.

Yields continue to decline, with the 10Y breaking out of a channel down to 3.8% from the recent peak of 4.7% at the start of summer.

After the July FOMC meeting, the markets priced in multiple rate cuts for 2024. On Friday, the unemployment report came in higher than expected, rising to 4.3% vs the expected 4.1%, accelerating fears of a recession and adding to the likelihood for lower rates.

The market expects 3 rate cuts in 2024, which would take the Fed Funds Rate down to 4.50-4.75% by the end of the year. Given the deteriorating landscape, there is talk about 50 bp cuts. By early 2025, markets expect rates of 4.00-4.25%.

Up until last week, the macroeconomic backdrop seemed favorable for equities. The economy has been strong, posting 2.8% GDP growth. Inflation and rates are coming down. The yield curve may be starting to normalize. Earnings have been generally strong across the board. The rotation from Magnificent 7 to the rest of the universe of stocks can increase market breadth and support ongoing growth. The recession that everyone expected has yet to come.

This week sentiment shifted, making a strong statement on Friday, August 2nd. With the unemployment rate accelerating higher, the narrative changed towards a deteriorating economy. Volatility is increasing, breeding uncertainty. Discretionary spending and guidance came in softer than expected, via reports from Amazon and other large companies. As employment drops, there’s less disposable income and less spending. This leads to lower earnings, lower stock prices, less capital availability, less investment, less growth, etc.

The market is quick to react and extrapolate – and generally quite efficient. The current price action shouldn’t be terribly surprising. It is normal for markets to pull back after strong pushes forward. Timing the market is an impossible game if looking for consistent results. Investors are best served by staying the course.

It is in Wall Street’s interest to drive activity with emotions, fear, narratives, projections, and hope.

As an aside – there are now about 3 times as many financial products in the US as there are publicly traded equities.

Strong, resilient companies will be able to weather the storm (be it weeks, months or years) and come out stronger.

Earnings

Over the last two weeks, 18 portfolio companies reported earnings.

Earning season is well underway. Results have been strong across the market.

Big tech including Google, Microsoft, Meta, and Amazon had great earnings, yet shares have been generally selling off.

Amazon and Booking both indicated a more cautious consumer.

PayPal, which has been undergoing a turnaround, put up some good numbers this quarter. Two major concerns in the last few years have been margin compression and active users. Both of those are now improving, with transaction margins growing 8% y/y and active accounts increasing 0.4% q/q. There are multiple promising catalysts for further improvements including Fastlane by PayPal for optimizing guest checkout experience, as well as their new ad platform which can bring in high margin revenue.

Agree Realty (ADC)

Prior coverage:

Agree Realty is a well-run, triple-net lease REIT with a strong management team.

“A triple net lease (triple-net or NNN) is a lease agreement on a property where the tenant promises to pay all expenses, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.”

-Investopedia

Joey Agree, President & CEO, took over the helm from his father in 2009. Joey Agree has been focused on ensuring consistent results, building a high quality portfolio, and improving communication with shareholders.

Since 2009, shares have returned nearly 15% per year, for a total of 701%, outpacing the SPY’s 613%.

Agree’s growth strategy is based on 3 platforms:

Acquisitions, wherein they buy new properties

Development, wherein they build new properties

Development funding, wherein they give money to others to build new properties

To mitigate risk, they focus on four core principles: omni-channel and e-commerce resistant, recession resistant, avoiding private equity sponsorships, and strong real estate fundamentals.

They’ve built up an impressive, diversified portfolio of strong tenants, with over ⅔ being investment grade rated.

Agree actively manages their portfolio, acquiring and disposing of properties according to their standards. As an example, they started reducing exposure to Walgreens in 2017. Agree realized their model was not durable in the age of e-commerce – pharmacies brought customers in, yet convenience purchases made up their entire profit margin. As Walgreens doubled down on that strategy by purchasing 2,100+ Rite Aid locations, Agree was further convinced to dispose of those assets. Agree reduced Walgreens exposure from 30% in 2012 to less than 1% in 2024.

Agree Realty’s credit rating was recently upgraded to BBB+, recognizing their hard work. "The upgrade to a BBB+ credit rating is a testament to the disciplined and prudent manner in which we've grown the Company," said Peter Coughenour, CFO.

Being a REIT, the company is not capital light. REITs require capital to grow. In order to leverage REIT status and tax benefits, by law, they must distribute at least 90% of taxable income to shareholders. Their source of capital comes from the capital markets – issuing shares for equity and/or borrowing money through debt. The improved rating helps lower their cost of debt.

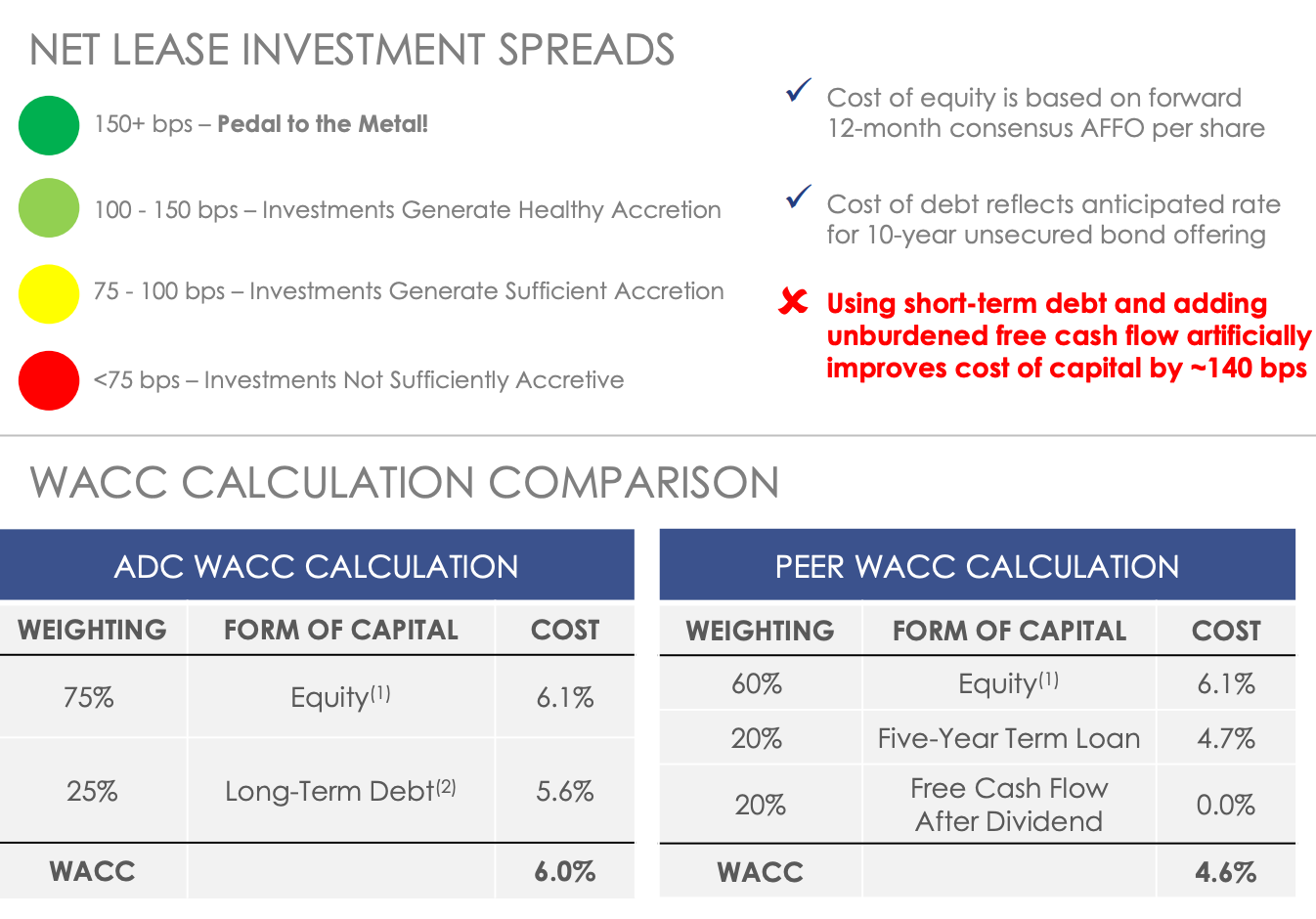

Their capital allocation ideology is simple – invest in opportunities that make money. They calculate their weighted-average cost of capital (WACC) conservatively. They look to deploy capital in opportunities that return around 100 bps over that cost. In other words – if their cost is 6%, they look for opportunities that yield over 7%.

Over the years, they’ve encoded their standards into internal technology they call Arc – it helps track opportunities pipeline as well as assess return on existing properties.

REITs are sensitive to interest rates. As rates go up, their cost of capital increases. The hurdle rate for new opportunities is higher. The underlying properties are affected similarly – the rent amount is the same, but the building is worth less due to a higher cap/hurdle rate required by investors.

This effect is also present in the reverse – as rates go down, REITs benefit significantly. When rates are going down, investors look for more durable income distributions. As rates go down, REIT yields are more attractive vs. government notes. REITs cost of capital decreases, allowing for more accretive growth. Instead of lowering their distribution, REITs tend to grow their distribution over time.

The last few years have been challenging with rising rates. Shares declined in 2023 as rates were rising.

Insiders saw this as an opportunity, and jumped in to buy shares. Insider purchases are generally a strong vote of confidence, as they are putting more money into a company that they already have extremely high exposure to, considering their salary, benefits, and likely everything that gives them their livelihood.

Over the last few years, insiders purchased more than $18.5m dollars of shares, as they dipped below $70. In 2023, alone it was $12m. In 2024 year-to-date, they’ve purchased $5.5m worth. These executives and directors are using their own money to buy more shares of ADC.

Shares have moved up significantly as of late, climbing 20% in the last 3 months.

Diving into the financials:

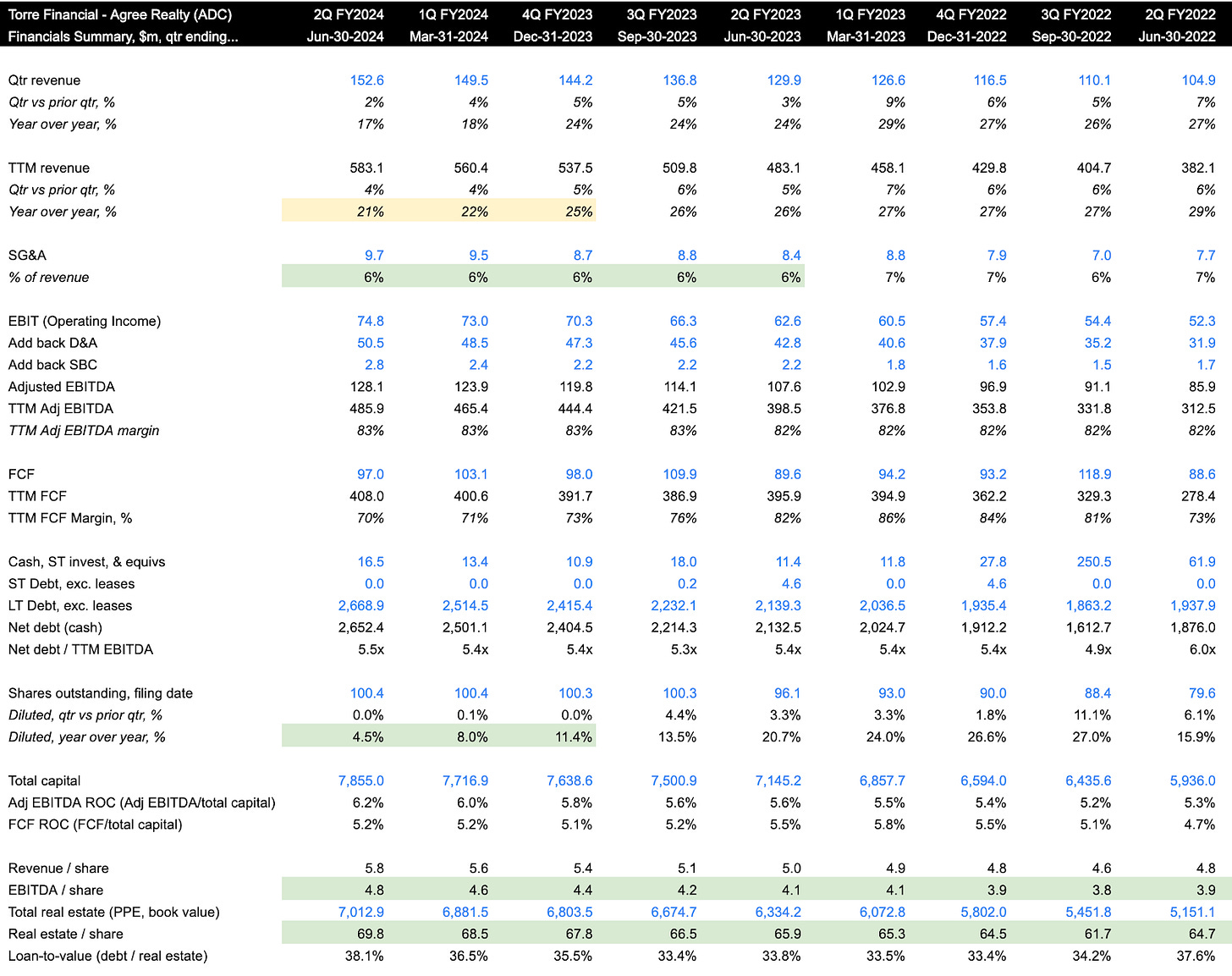

TTM revenue slowed slightly to 21% y/y. Recall, as a REIT growth comes from new capital outlays. Growth is very dependent on access to capital and satisfactory opportunities.

SG&A costs have stayed flat at 6%, showing their focus on operational excellence. This has historically been as high as 10%.

EBITDA margins of 83% seem to be in a positive, gradual trend, up from 81% in the past.

FCF margin of 70% is a significant decline from 80%+ prior. FCF tends to have more volatility and has varied from 55-75% in the past.

Balance sheet is strong, with leverage coming in at 5.5x EBITDA. While capital light companies may have much lower leverage, for REITs this is very adequate considering the underlying hard assets supporting the business. 5x is considered quality for REITs; highly leveraged REITs might have up to 10 or 15x.

Shares outstanding increased 4.5% y/y, down from higher dilution in past quarters. As mentioned earlier, this is how REITs raise capital. As long as it is being put to work productively, it should be accretive on a per share basis.

EBITDA ROC and FCF ROC are 6.2% and 5.2% respectively. This can be compared to the interest rates, which are currently ~4% for 5Y or 10Y treasuries.

Revenue/share, EBITDA/share and real estate/share have been steadily increasing over the years. ADC has nearly $70 worth of real estate in book value!

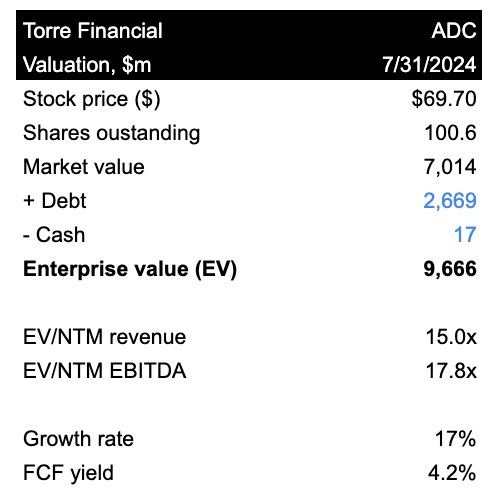

As for valuation:

ADC trades at 17.8x NTM EBITDA, or a 5.6% EBITDA yield. Considering longer term rates are now below 3.8% and most likely will continue to decline, ADC is still relatively attractive at the current valuation.

The dividend yields 4.3% and is paid out monthly. As for alternatives, investors can get money market yields of 5%. That opportunity, however, is short lived as rates are expected to come down in September. ADC, conversely, is expected to increase their dividend distribution every year.

Analysts expect revenue to grow ~13% CAGR over the next few years.

EBITDA is expected to grow similarly ~13-14%.

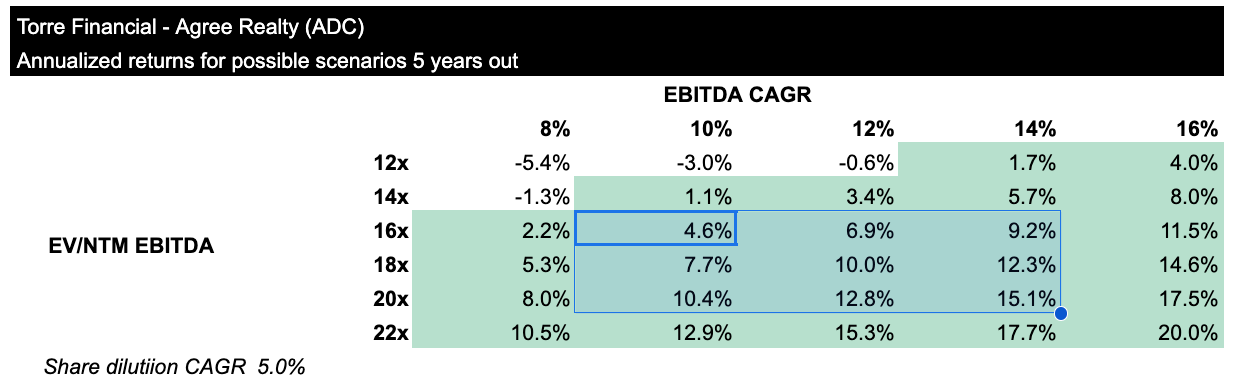

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share dilution of 5%, supporting the growth rate.

Over the next 5 years, investors could expect between 5-15% annualized returns.

Fast Graphs provides another perspective.

Over the last 15 years, shares have traded at a normal P/AFFO multiple of 17.15x. Today, they trade at 17.2x.

If shares maintain the 17.15x multiple, shares could move up to $76 in the next few years, delivering 8% annualized returns from current prices, inclusive of dividends.

The current momentum could lead to a higher multiple, allowing for some additional upside opportunity. Shares tend to overshoot on both the downside and the upside.

Taking a look at the price action:

Shares rose quickly in June and July. A breather, or small pullback, wouldn’t be surprising. Shares could dip back to ~$66, where there’s a volume shelf providing support.

The next key level would be $74. There’s a volume shelf there that will likely provide some resistance. Once overcome, however, shares could drift higher into the $80s with little friction.

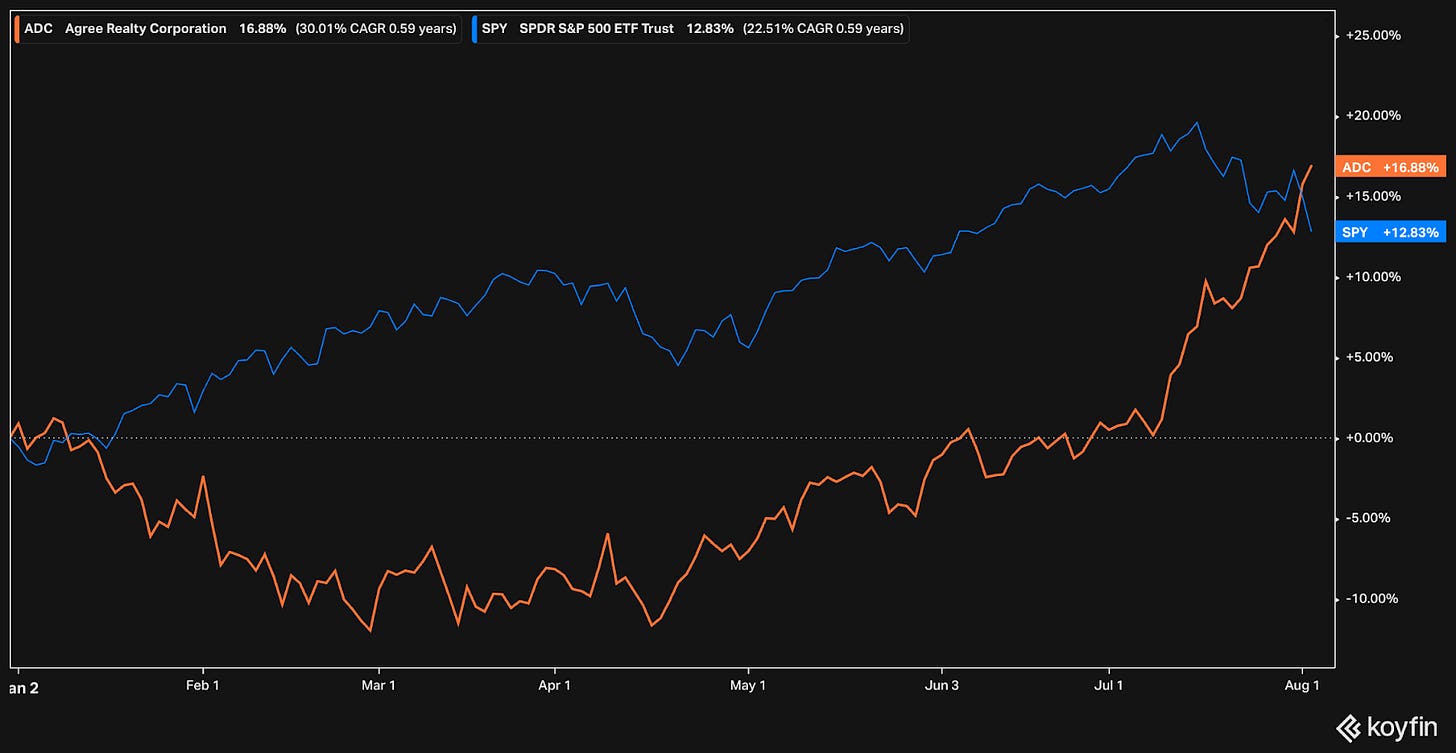

Agree’s share price has a very low correlation with the index, as can be seen in the YTD performance.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.