Market, Earnings, & Allison Transmission (ALSN) - June 21, 2025

Market commentary, portfolio company earnings results, and a deeper look into Allison Transmission Holdings (ALSN)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market gave back some of the recent gains after pushing towards a new all time high. Volatility seems to have stabilized – daily movements are much smaller than during April.

The S&P 500 (SPY) has traded in a tight range, between 591 and 605, for the last two weeks. Market consolidation is often a sign of either accumulation in preparation for a move upwards or distribution at a top.

Notwithstanding the small pullback from this last week, the index still appears to have momentum with the index trading above its 200-day moving average and the 50-day moving average on a strong uptrend. If the index is able to hold, it might form a golden cross in the next few weeks.

Year-to-date performance across indices:

S&P 500 +1.47%

Nasdaq +2.92%

Dow Jones -0.79%

The S&P 500 is at the higher end of its historical valuation range. There are very few times the index has traded above a P/E of 23.8x, as shown by the black line.

If earnings grow as expected and if the multiple compresses to the normal P/E ratio of 19.8x over the next few years, the index could return ~6% per year. It is a narrow premium over risk-free rate (US 10-year yield) of 4.4%.

There has been a new cohort of popular retail-driven stocks, also known as “meme” stocks, that have generated incredible returns for the year: HIMS is +165%, AST +117%, PLTR +82%, and OSCR +58%. Such a strong risk-on appetite, where greed is favored over fear, could be a hint of froth in the market.

Money supply has been increasing, now up 1.44% year over year. While the Fed is holding firm on the big-headline topic of interest rates, an increase in the money supply seems to indicate they are stimulating the economy behind the scenes.

M2 money supply includes all liquid forms of money such as physical currency, checking accounts, savings accounts, and money market. Money supply can increase through a variety of mechanisms, primarily via the central bank, including open market operations, lowering the reserve requirements for banks, quantitative easing, or others.

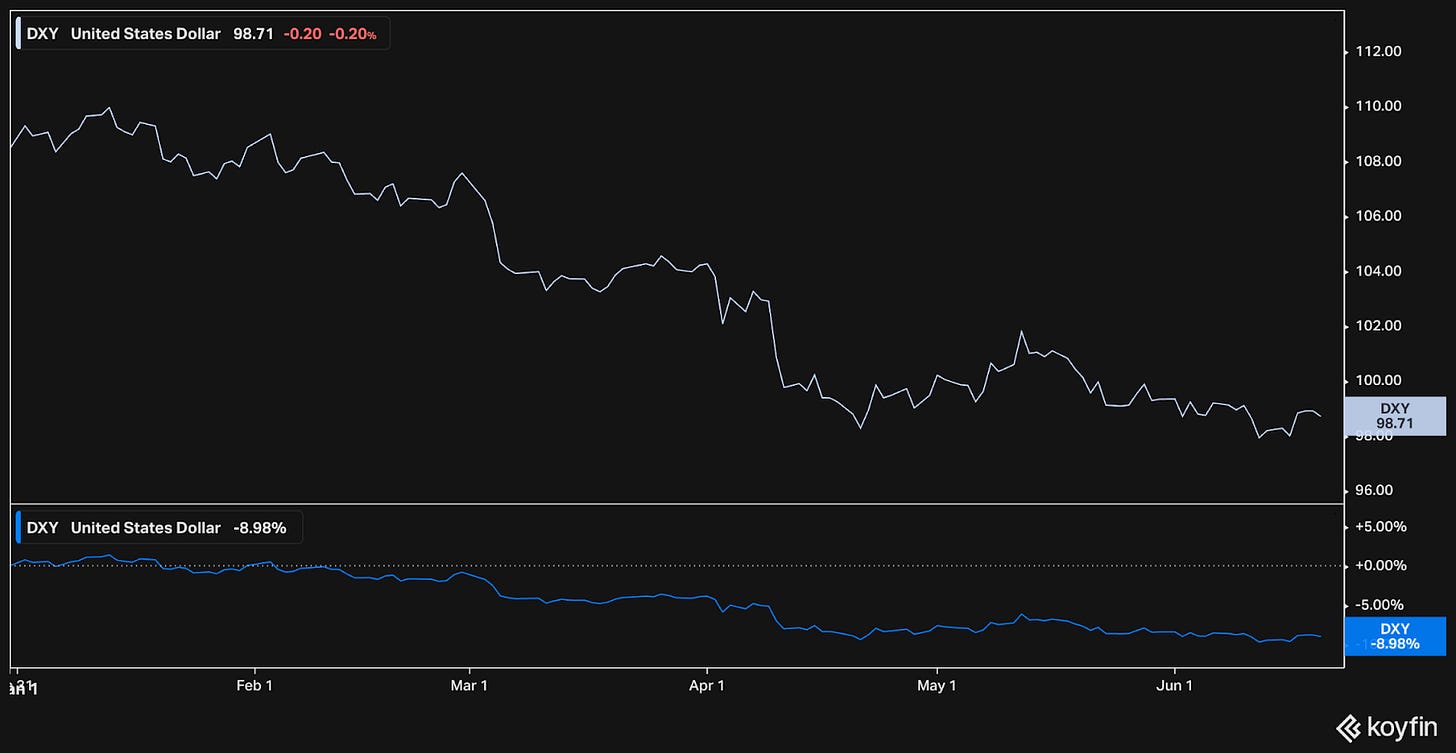

The USD Dollar is down nearly 9% for the year, yet seems to be stabilizing at the current level.

A weaker currency makes imports more expensive and contributes to inflationary pressures. At the same time, a weaker currency helps boost exports (making US goods cheaper for foreign buyers) and reduces the real debt burden because debt is set in nominal terms.

Taking a broader perspective, looking back 10 years, the dollar is still relatively strong. While strength from the post-COVID boom has faded, the dollar is right around the 10-year mean and at par with the peaks in 2017 and 2020.

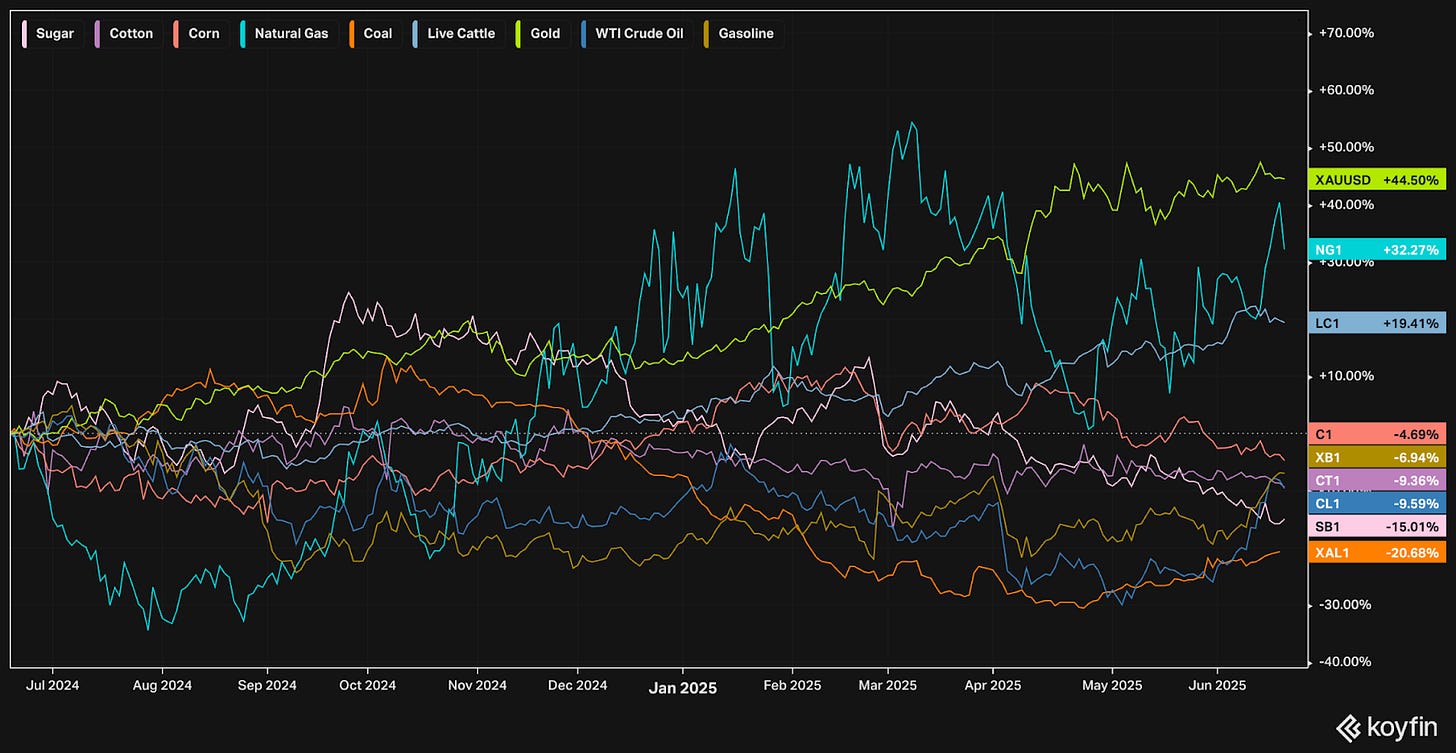

Commodities are a critical undercurrent for understanding inflation and the performance of certain sectors.

Over the last year, gold (+44%), natural gas (+32%), and cattle (+19%) are up significantly.

Coal (-21%), gasoline (-7%), crude oil (-10%), and others are down year-over-year.

Inflation appears to have bottomed out in April, and has been climbing ever since. The Truflation index shows 2.14%, just in line with the Fed’s desired rate. The Fed will want to see inflation stabilize.

The market continues to expect the Fed Funds Rate to come down over the next few years, with 2 rate cuts in 2025.

Source: Standard Housing Report

Earnings

Over the last two weeks, 1 portfolio company reported earnings.

Allison Transmission (ALSN)

Allison Transmission’s origins trace back to 1915 when James Asbury Allison founded the Speedway Team Company, primarily in support of his Indianapolis 500 racing activities.

From its inception, Allison's business philosophy was profoundly rooted in "quality and workmanship". This foundational principle was famously encapsulated in a quote, prominently displayed on a sign in his shop: "Whatever leaves this shop over my name must be of the finest work possible". This historical emphasis on quality established a fundamental DNA for the company.

In 1917, during World War I, James promptly ceased all racing-related activities and redirected its engineering capabilities to support the US war effort, developing high-speed crawler-type tractors for artillery, manufacturing critical aircraft engines, and producing tank components, tank tracks, production superchargers, and reduction gearboxes.

In 1920, the Speedway Team Company was formally renamed the Allison Engineering Company. The company was recognized for its high quality offerings, particularly its Liberty aircraft engines.

General Motors acquired the company in 1929, focusing on aircraft engines. In 1941, Allison began designing transmissions for tracked military vehicles and created a dedicated subsidiary in 1946.

After World War II, Allison pivoted to focus on civilian transportation and entered the commercial transmission field, pioneering the first automatic transmissions for heavy-duty vehicles like delivery trucks and buses.

Today, Allison Transmission is a leading designer and manufacturer of transmission propulsion solutions for commercial and defense vehicles with over $3 billion in annual sales and a $7.5 billion market cap.

The business reports various segments:

On-highway worldwide contributes nearly 69% of revenue

Defense accounts for 7% of revenue

Parts & services is 21% of revenue

Off-highway is smaller segment, accounting for 3%

The company has a very strong financial profile.

Allison’s gross (48%) and net income margin (24%) has been top-tier amongst industrial peers.

The business and the management team have proven themselves over time. Analyzing the efficiency of the business:

Free cash flow conversion has always been very strong.

The company has grown with minimal investment and has been buying back shares aggressively. Shares outstanding are -53% over the last 10 years.

ROIC has trended upwards since 2021, and is at a very respectable 21%.

In addition to the buybacks, the company has delivered consistent dividend growth. The dividend is up 80% since 2019.

The company has a very clear strategic plan for continued growth, focusing on three key areas:

Defense sector. They recently were selected to help modernize the Indian Army's fleet with approximately 1,750 Future Infantry Combat Vehicles (FICVs), representing a potential multi-year revenue opportunity for Allison of "several hundred million dollars over the next two decades." They are also actively expanding their relationship with the Department of Defense.

Expanding current offerings. Allison is looking to expand automatic transmissions across the commercial spectrum such as Class 4-5 and Class 8 trucks. Off highway is another significant opportunity, as it represents a very small segment of the business today. Allison recently announced the acquisition of Dana’s Off Highway business, which helps expand end-markets significantly.

Allison is acquiring the Dana business for $2.7 billion, representing 6.8x adj. EBITDA. The acquisition will be immediately accretive.

Global service network expansion. Aftermarket revenue is typically more stable and profitable than new unit sales, and a strong service presence builds long-term customer loyalty, which is essential for recurring revenue.

All said, Allison is a company that has stood the test of time. Trucks and large machinery is unlikely to be disrupted anytime soon.

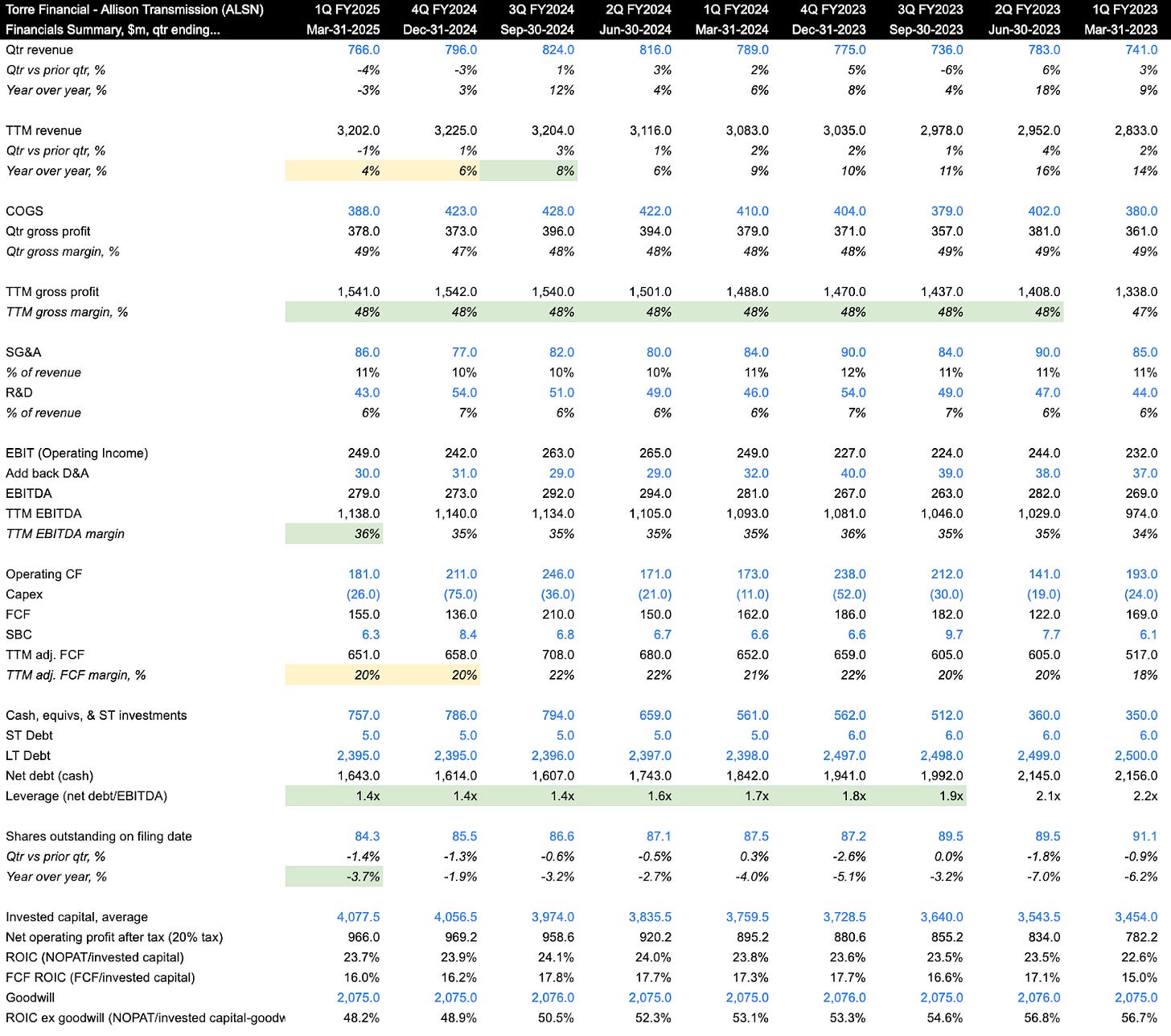

Diving into recent financials:

TTM revenue growth came in at 4% y/y, slowing down over prior years

TTM gross margin is 48%

TTM EBITDA margin improved to 36%

TTM FCF margin came in at 20%

The balance sheet is very strong, with $1.6 billion in net debt, or 1.4x EBITDA. This will increase when the Dana acquisition closes.

Shares outstanding decreased 3.7% y/y, demonstrating management’s commitment to continue returning capital

On efficiency, ROIC is 23.7% – a very strong level particularly for the industrial sector

As for valuation:

Shares currently trade for 7.8x EV/NTM EBITDA and a FCF yield of 7%. The transmission market may not be the fastest growing, but for a well managed company with a durable market this valuation can be very attractive.

Analysts expect the company to continue to grow slightly. Sales are expected to grow at ~2-3% CAGR, with EBITDA growing slightly faster at ~5-6% CAGR.

Looking out over the next 5 years, considering various EBITDA growth rates and exit multiples, we can analyze possible annualized returns across possible scenarios.

Assuming buybacks continue, enabling them to reduce shares outstanding by 4% annually, if EBITDA grows at just 3% CAGR and the multiple expands to 10x (which is very reasonable as the company grows), shares could return 15.4% per year.

Fastgraphs provides another look:

If the P/E multiple expands to 15x (which it has hit in the past), an investment today could generate annualized returns of 28%+ over the next few years.

If the P/E multiple doesn’t change at all, staying at 10.6x, an investment could produce nearly 13% annualized returns going forward.

Allison Transmission is quite a different company and investment than the rest of our portfolio. That being said, there are many things to like here including the durability of the market (i.e. the need for their products), the high quality of their brand and offerings, excellent shareholder-friendly management, all brought together with a very attractive valuation. The combination makes for a compelling investment case.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.