Market, Earnings, & Alphabet (GOOGL) - November 9, 2024

Market commentary, portfolio company earnings results, and a deeper look into Alphabet (GOOGL)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market had its strongest week of the year, gaining 4.75% with the post-election rally.

SPY briefly touched the 50-day simple moving average, before taking off decisively to a new all time high.

The technical picture remains strong. The last couple months of the year tend to be strong historically. With investors deferring any gains until the new year, the trend is likely to continue.

Year-to-date performance across indices:

S&P 500 +21.77%

Nasdaq +20.96%

Dow Jones +11.74%

Election day finally arrived on Tuesday, November 5, 2024. President Trump staged a remarkable comeback, to the dismay of many.

One trader, known as Theo, noticed a discrepancy in the early polling data and sought to take advantage of it. Theo placed a $30 million dollar bet. And it paid off, netting him $50 million in profit, a nearly 300% gain in less than a month.

The WSJ followed up with another article, “How the Trump Whale Correctly Called the Election”, explaining Theo’s rationale. One of the main drivers:

Polls failed to account for the “shy Trump voter effect,” Théo said. Either Trump backers were reluctant to tell pollsters that they supported the former president, or they didn’t want to participate in polls, Théo wrote.

To solve this problem, Théo argued that pollsters should use what are known as neighbor polls that ask respondents which candidates they expect their neighbors to support. The idea is that people might not want to reveal their own preferences, but will indirectly reveal them when asked to guess who their neighbors plan to vote for.

Théo cited a handful of publicly released polls conducted in September using the neighbor method alongside the traditional method. These polls showed Harris’s support was several percentage points lower when respondents were asked who their neighbors would vote for, compared with the result that came from directly asking which candidate they supported.

Trump’s comeback was very well received by the stock market, which gained 2.5% on the day to reach a new all-time high.

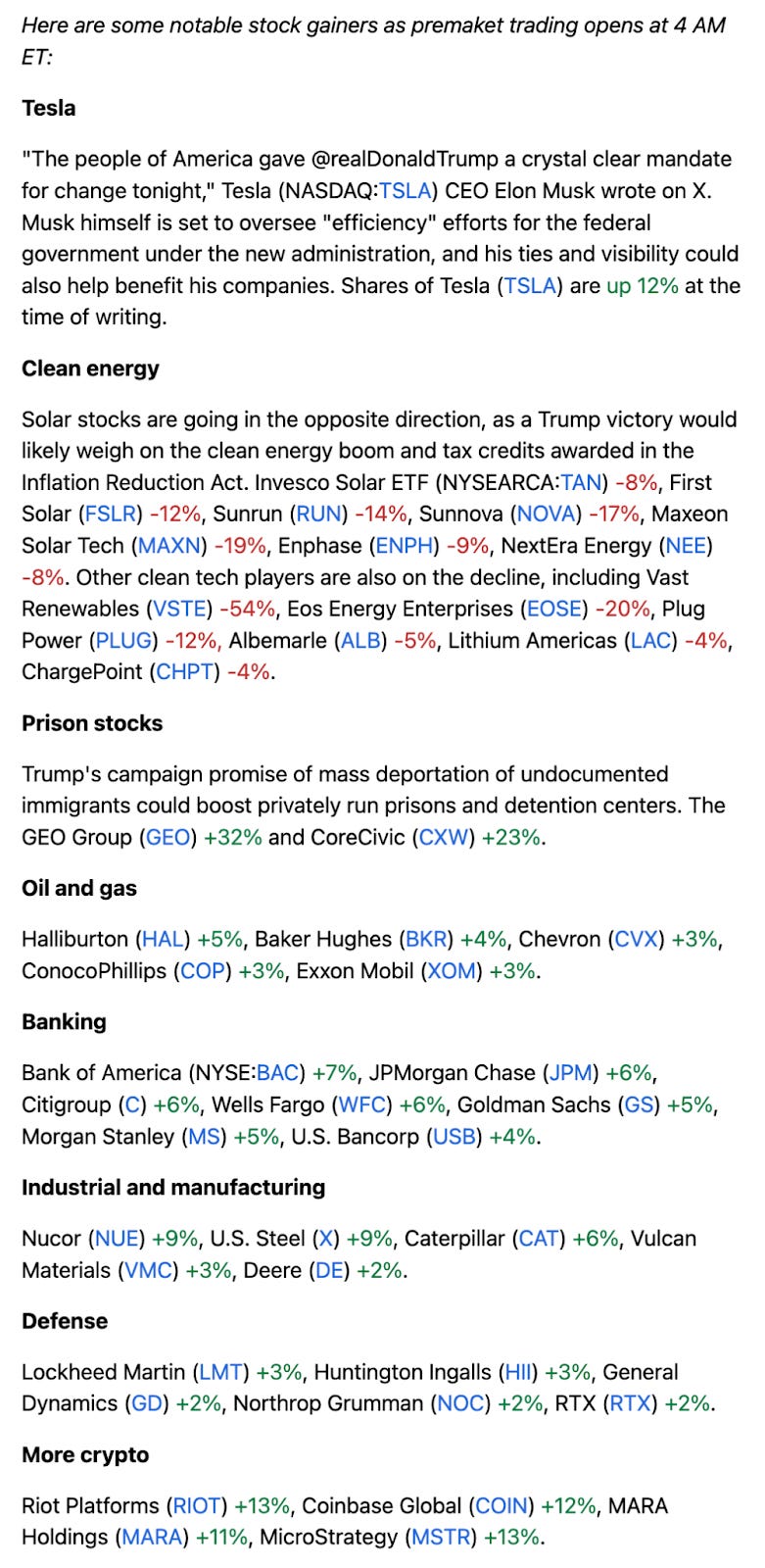

The market immediately adjusted to the new administration, creating winners and losers:

By the end of the week, all sectors were up, albeit some more than others. Consumer discretionary, energy, industrials, technology, and finance were the big winners. Defensive sectors including consumer staples, utilities, healthcare were weaker.

The Fed also met this week. They pushed their meeting by a day to accommodate the election. On Thursday, the Federal Reserve announced a 25 basis point cut, bringing rates down to 4.50-4.75%.

Market participants continue to see further cuts, although at a slower pace than before. The market is pricing in another 3 rate cuts through 2025, expecting rates to be 3.75-4.00% by the end of next year.

Yields have been moving up. The yield on 10Y had come down to ~3.6% in October. By November, it had jumped to 4.4%, an increase of over 20% in a single month.

The narrative for the higher yields has been that things are going well. The job market has been robust. Unemployment has held steady. Positive economic data suggests the economy continues to perform.

With Trump’s election, there’s more thinking that rates will stay higher for longer as tariffs and tax cuts would both be inflationary forces.

Earning season is wrapping up. Companies have generally reported strong earnings. Third quarter EPS grew 8% y/y vs. the expected 3%.

The market continues to see further growth, with earnings accelerating to double digit growth in 2025.

Investors are paying up for this performance, to the tune of nearly 26x P/E, the highest valuation since the 2000s.

FastGraphs provides another look, in comparison to earnings per share:

The consensus view is pricing in gains from technological advances like AI as well as business-friendly policy.

Earnings

Over the last two weeks, 12 portfolio companies reported earnings.

Alphabet (GOOGL)

Alphabet, the parent company behind Google, needs little introduction.

In 1995, Sergey Brin was considering Stanford for grad school and Larry Page was assigned to show Larry Page around the campus. A year later, they started working on a new search engine. Their core differentiating idea was to use links from other websites to determine the importance of individual pages.

In 1998, they raised $100,000 and officially created Google, Inc.

Some 26 years later, the company has grown to over over $350 billion in revenue and has a market cap of over $2 trillion.

Revenue for most recent quarter was $88.3 billion.

Google reports earnings across three main segments:

Google Services: $76.5 billion, ~87% of all revenue

Google Search makes up $49.4 billion

YouTube contributes $8.9 billion

Network advertising (where Google places ads on other websites) is $7.5 billion

Subscription platform and devices $10.7 billion

Google Cloud: $11.4 billion, ~13% of all revenue

This includes Google Workspace, the enterprise suite of tools including Gmail, Docs, etc, as well as the Google Cloud Platform – cloud infrastructure competitor to Amazon’s AWS and Microsoft’s Azure

Other Bets: $388 million, < 1% of revenue

Google has always been big on innovating and investing. Projects include Waymo autonomous driving cars, Wing drone delivery, the broadband business Google Fiber, and a life sciences company Verily, amongst many others. Some of these bets may very well pay off – Waymo already delivers more than 150,000 paid rides per week and is expanding into more cities.

Google has 7 different platforms with more than 2 billion monthly active users.

Google Chrome

Google Workspace

Android

Google Play Store

YouTube

Gmail

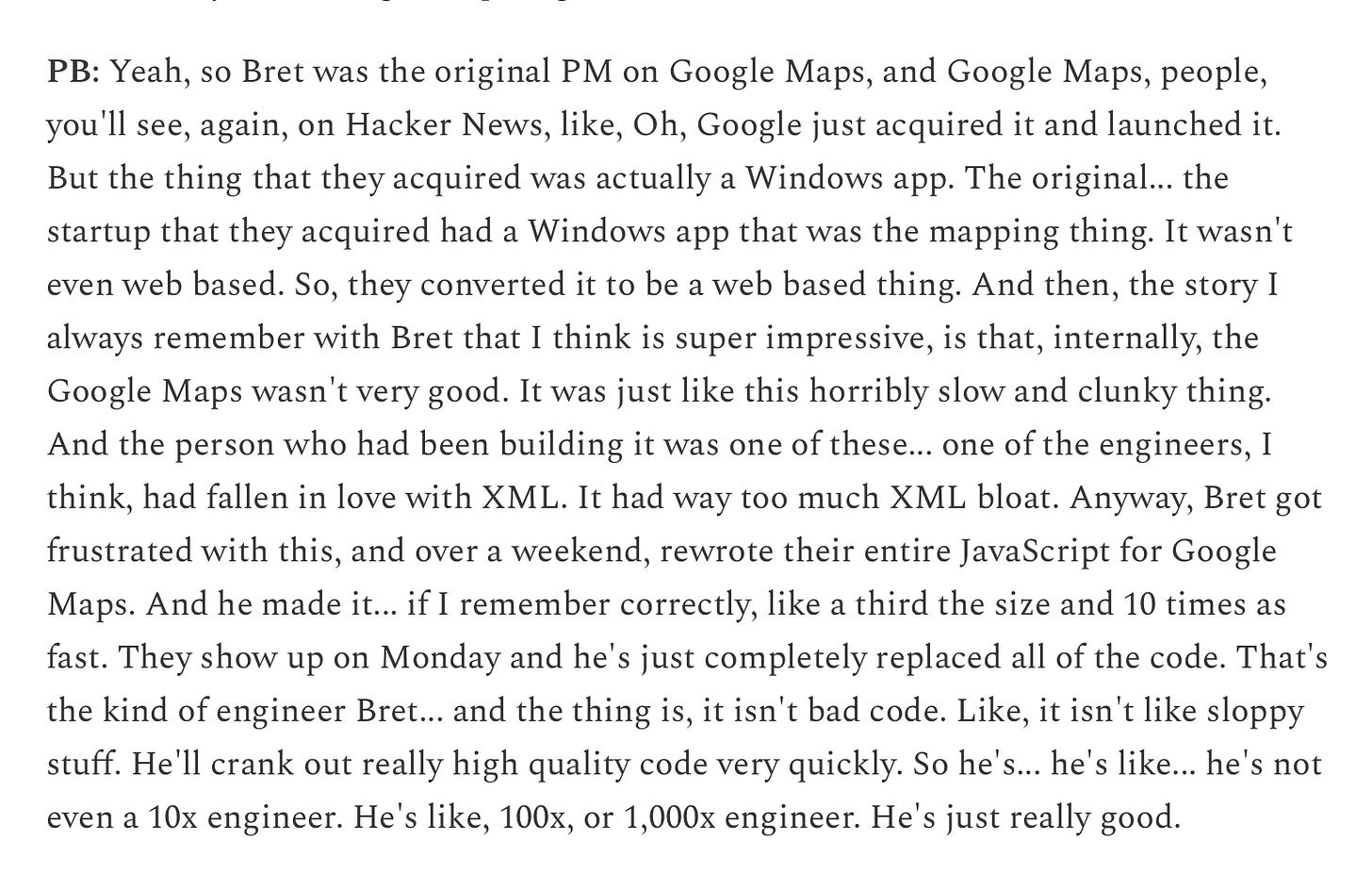

Google Maps

Each of these is interesting to dive in on their own! Google Maps was a very small acquisition that was fully revamped internally.

Google purchased YouTube for $1.65 billion in 2006. Today, YouTube has reached a $50 billion revenue run rate. For context, Netflix is at some $38 billion.

Recently, there have been two dominant narratives around Google: AI and Cloud.

OpenAi’s ChatGPT kicked off the AI boom in a big way. The world quickly came to see the value and impact of generative AI.

Concerns spread into Google’s search dominance. If people started using ChatGPT as their default place to get information, Google would lose traffic and hence their largest segment would be at significant risk.

Because ChatGPT came out so strong, Google was said to be asleep at the wheel. Google, however, has been researching this space for many years. They develop a lot of things internally and test rigorously before deciding what products or services to “externalize.”

While generative AI search engines have gained in popularity, the world has also come to acknowledge their limitations. For example, results can include hallucinations or inaccurate facts. Google, as an incumbent, faces much more reputation risk than a new upstart. Inaccuracies are much more costly for Google.

Since then, Google has come out stronger than ever with both their Gemini AI offerings, which is embedded into the workspace tools that billions of people use every day, as well as their cloud infrastructure.

The cloud infrastructure powering Google Cloud Platform (GCP) is one of Google’s strongest opportunities. It is a huge market wherein Google has the expertise and is well positioned for ongoing growth.

Over the last 4 and a half years, Google Cloud has quadrupled its revenue while expanding operating margins from -61% to 18%.

These charts show the growth rates across the three major competitors in the space: AWS, Azure, and Google Cloud.

Google Cloud, although smaller, is accelerating and taking share. Google’s GCP is known to be better for processing large amounts of data efficiently and has been a leader in enabling AI solutions.

As the chip-buying-frenzy has shown, infrastructure is critical for the age of AI and Google, with their experience, technology, and expertise is well positioned to build a strong moat.

Diving into the financials:

TTM revenue grew 14% y/y, continuing the recent acceleration

TTM gross margin ticked up to 58%, as Google continues to drive down costs for serving AI-driven search results

TTM EBITDA increased to 35%, showing those improvements coming down to the bottom line. This is a really strong operating margin.

TTM FCF margin decreased to 16%. This is driven mainly by capex, investments in their AI infrastructure, which came in at $13 billion for the quarter.

Balance sheet is strong, with over $80 billion in net cash

Shares outstanding are down 2.2% y/y, and have been decreasing over the last few years, as the company has been buying back shares

ROIC of 25.5% is very strong, and has been trending up. ROIC ex-goodwill is even stronger, at 28.1%. Google is very efficient and doesn’t require a lot of working capital to scale (naturally as primarily a software company)

As for valuation:

Google is by no means expensive by operating metrics.

5.5x revenue or 12.8x EBITDA is very attractive, and significantly cheaper than the broader market.

The FCF yield of 2.7% is a little lower, again, due to those capital expenditures. If investors believe those are good, worthwhile investments, that shouldn’t be a concern. Even at 2.7%, the FCF yield is better than the broader market’s 2.65%.

Looking at the next few years, revenue is expected to grow 11-14% and EBITDA is expected to grow 14-27%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share reduction of -2%.

With conservative assumptions of 12-16x multiples and 10-12% EBITDA CAGR, GOOGL shares could return annualized results of 11-20% going forward.

FastGraphs provides another look.

If shares were to trade at a P/E of 25 (well below the historical PE of 29.75x), shares could return 18-19% annualized returns.

Taking a look at the price action:

GOOGL has been in a consistent uptrend since January 2023.

The recent dip to $148 in September 2024 broke below the long-term 200-day moving average trendline. That could have been cause for concern for investors. Shares came back up over the 200-day and 50-day moving average.

Right as the 50-day line approached the 200-day line (when that crosses in a downward trend that is known as the death cross), shares broke out to the upside.

The current price of $178 is sitting right on top of a strong volume shelf at ~$177. If that price holds, that shelf can become support. If so, there doesn’t look to be much resistance moving from the current price to reaching a new all time high in the 190s.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Great work as always. Any quick thoughts on MELI? No position but wonder if this is an opportunity (overall market exuberance might keep me away from anything though...)