Market, Earnings, and BKNG - August 5, 2023

Market commentary, portfolio company earnings results, and closer look into Booking Holdings (BKNG)

Every two weeks we share market and earnings reviews, as well as a deep dive into one portfolio company. Subscribe now to follow along.

Market

The S&P 500’s smooth ascent was finally met with resistance this last week. SPY came within 2 points of the 462 level we identified in our prior post, on July 22nd. It would not be surprising to see the market revert to the 430 level before turning and continuing higher.

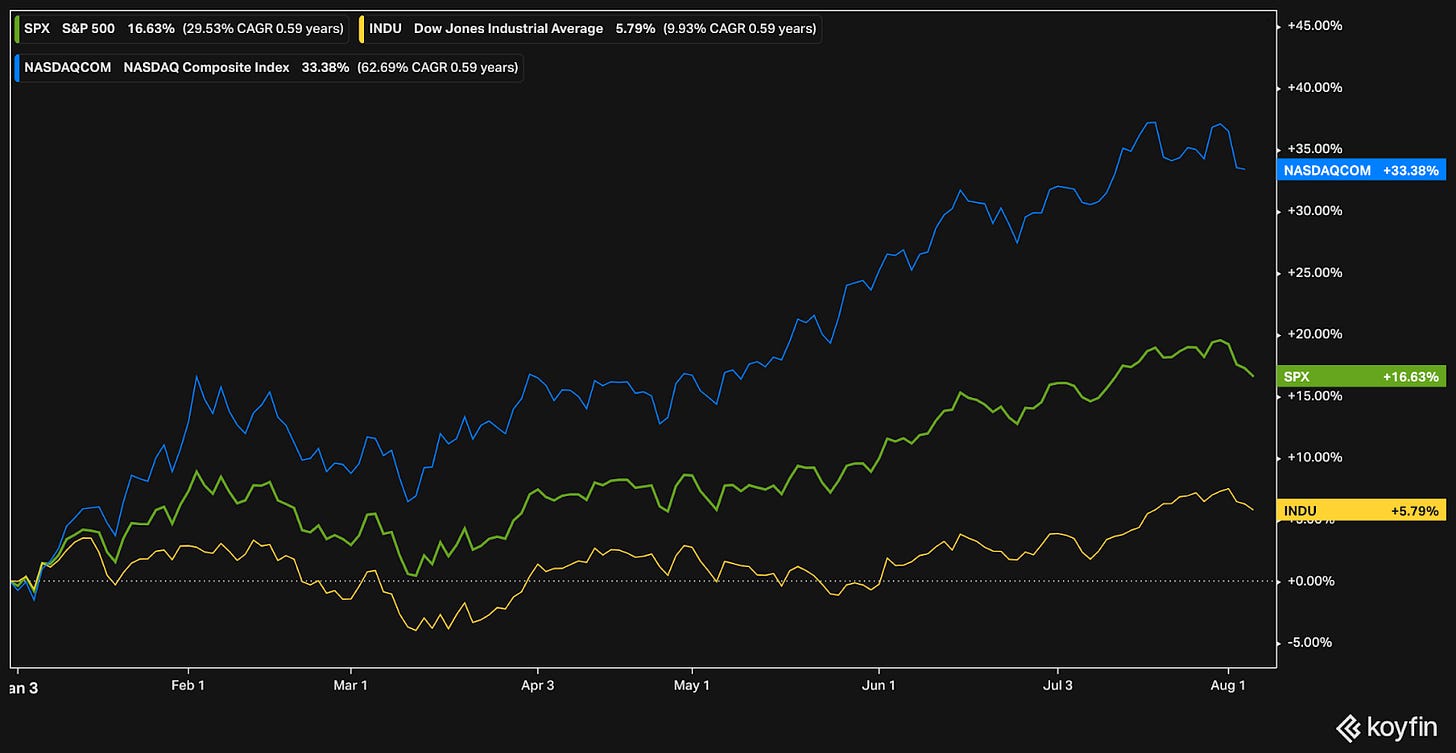

Year-to-date performance:

Nasdaq +33.4%

S&P 500 +16.6%

Dow Jones +5.7%

Index Valuation

Over the last 20 years, the S&P 500 has historically traded at a price-to-free-cash-flow (P/FCF) ratio of 19.56, or a FCF yield of 5.1%.

The market is currently trading for 24.5x P/FCF or 4.1% FCF yield, a premium to historical valuation.

With 10-year US treasuries trading for a 4% yield, the competition is stiff. The equity risk premium is a narrow 0.1% based on the FCF yield of 4.1%.

On a shorter time horizon, the equity risk premium is negative as the 2-year treasuries pay 4.8%.

Sectors

There is often opportunity in the market — investors just have to look for it.

As certain areas perform well, savvy investors rotate funds early into more compelling opportunities.

Year-to-date:

Communications (XLC), Technology (XLK), and Consumer Discretionary (XLY) are the clear leaders.

Utilities (XLU), Health Care (XLV), and Energy (XLE) have been underperforming.

Looking at a closer timeframe, within the last month:

Energy (XLE) has taken the lead alongside Financials (XLF) and Communications (XLC)

Utilities (XLU), Real Estate (XLRE), and Technology (XLK) have been the weakest

The Utilities sector, with many high-dividend-yield, low-growth companies, is likely feeling pressure from higher rates. Real Estate is likely in the same boat. Those are likely in a holding pattern until rates start to come down.

Health Care looks to be an attractive sector, deserving of further diligence.

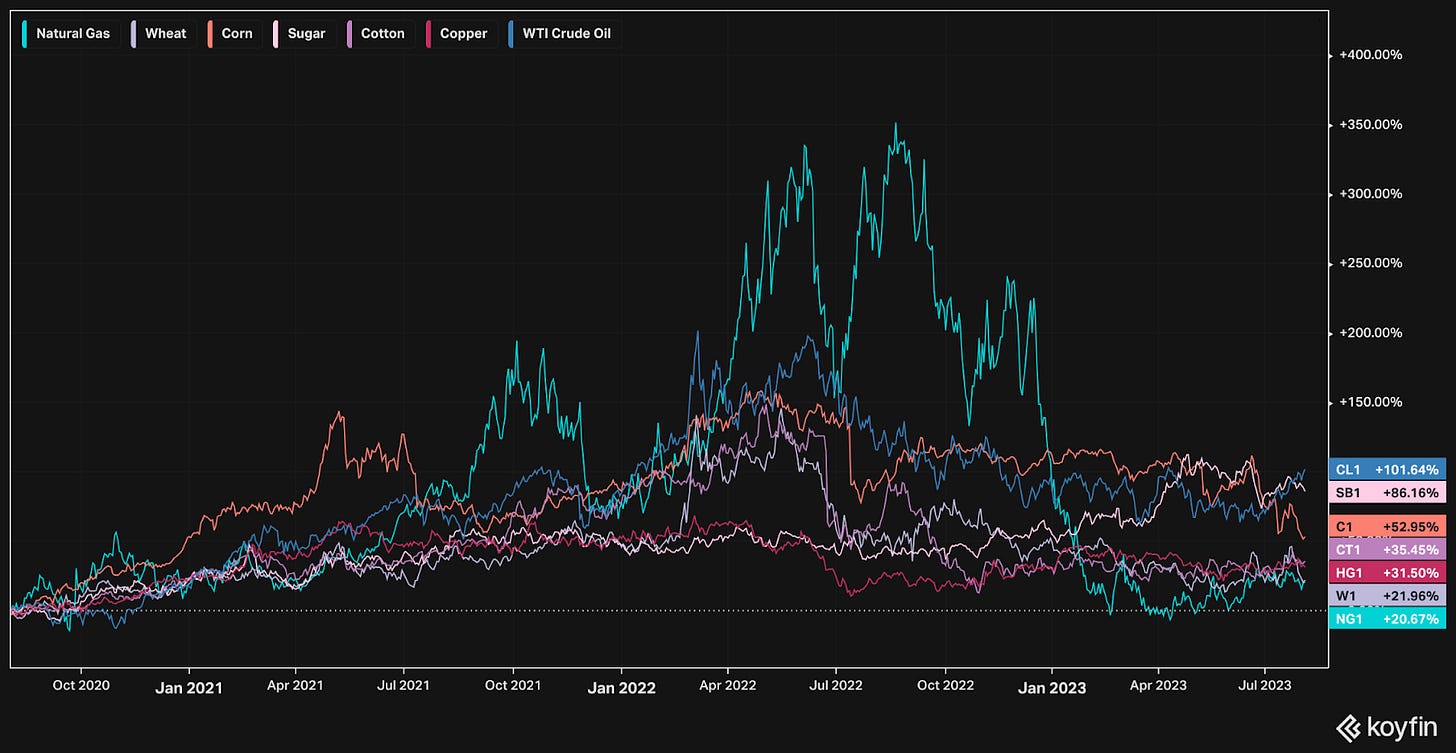

Commodities

After a roller coaster 2022, commodities prices seem to be stabilizing this year.

Fed & Rates

Stable and lower commodity prices and lower inflation have given the Fed more room to breathe.

The Feds target fund rate of 5.25-5.50% is healthily above the treasury yields ranging from 4.0-4.8%. This puts the Fed’s policy in a restrictive stance, further helping to ease inflation.

Consensus estimates on the probability of a soft landing keep increasing as time passes.

The market expects the Fed to hold steady at the current rate and then cut rates as soon as March 2024.

Q2 2023 Earnings

“Overall, 84% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 79% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 73%.”

- Factset

Many companies with international exposure are benefiting from the weak US Dollar, as currency headwinds have become tailwinds.

Over the last two weeks, 17 portfolio companies reported earnings.

Our companies reported strong results, with the majority seeing upwards revisions in revenue estimates for the next quarter.

Danaher (DHR) is the one outlier. Even though estimates came down, Danaher’s commentary on the earnings call gave confidence that the worst may be behind them. Danaher’s management team, who has a very strong track record and is seen as highly trustworthy, had been hesitant to hint at any inflection points previously. Danaher shares gained after the report.

Many of our companies surprised to the upside and were cheered by the market. Six companies – GOOGL, MSCI, META, AMZN, NET, BKNG – saw shares gain in the order of 8-10% after reporting earnings.

We had two companies with post-earnings sell offs: Paycom (PAYC) and PayPal (PYPL). Both companies appear to be operating business as usual – there were no surprises.

Paycom shares had run up significantly prior to earnings, stretching the valuation. PayPal continues on their strategy to focus on quality and expand into unbranded processing. Fundamentals are in the right direction, inline with the strategy. Investors are concerned about flat/declining active users on the branded side. Transactions per user, revenue, total processing volume, and other key fundamental metrics continue to increase.

Booking Holdings (BKNG)

“We truly believe travel to be a great force for good. It is this deeply held belief that drives our mission day in and day out to make it easier for everyone to experience the world. … Travel will always remain fundamental to people’s lives.”

- Glenn Fogel, President & CEO, Booking Holdings

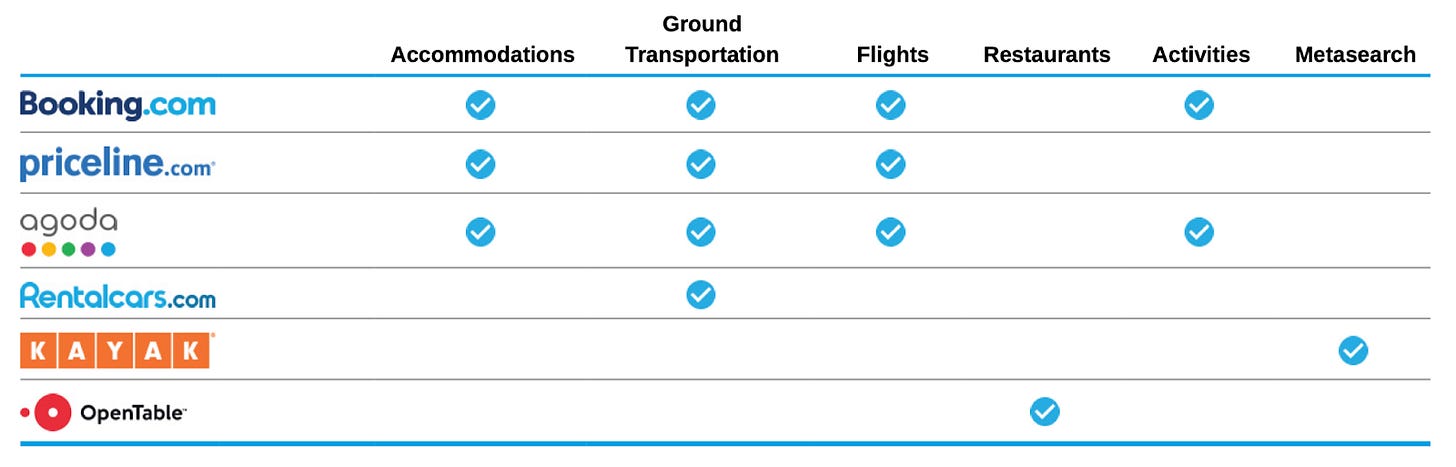

Booking Holdings owns and operates popular brands in travel marketplaces including Booking.com, Priceline, agoda, rentalcars.com, Kayak, and OpenTable.

Booking is a global company, with over 21,000 employees across the world: ~15% in USA, 50% in Europe, 35% in Asia Pacific.

The company has an interesting founding story. Jay S. Walker launched Priceline.com in 1997. The company went public just 2 years later in 1999. In 2005, Priceline acquired Booking.com – the leading hotel booking website in Europe. In 2018, the company changed its name from The Priceline Group to Booking Holdings.

Throughout their whole history they’ve stayed true to their mission:

“Our mission is to make it easier for everyone to experience the world. Our services empower people to cut through travel barriers like money, time, language, and overwhelming options, to easily and confidently get where they want to go, stay where they want to stay, dine where they want to dine, pay how they want to pay, and experience what they want to experience. We connect consumers making travel reservations with travel service providers around the world through our online platforms.”

Booking earns revenue primarily from enabling consumers to make travel service reservations, with a take rate of roughly 15% of gross booking value. Other revenue streams include advertising services, restaurant reservations and restaurant management services, as well as other upsells such as travel-related insurance revenues.

They have been a clear leader in the space – not just from sales, but also innovation and trends. Booking was the first to acknowledge the critical role that Google played in booking travel. Search engine marketing (SEM) and search engine optimization (SEO) are two key ways to drive traffic. Uncomfortable with the over reliance on Google, Booking focused on driving traffic via their mobile app. With additional brand marketing and an improved customer experience, Booking has successfully reduced their reliance on Google.

They continue to drive innovation. They are building out their vision of the connected trip, including everything from hotels, taxis, cars, flights, attractions, etc. Their Genius loyalty program adds to customer stickiness. Recently, they have built out their payment platform and are seeing increasing adoption across bookings, with 15% using it in 2019 up to 27% in 2021. Booking’s payment processing solution is a win-win. Booking is able to hold the float between the booking and the reservation date; hotels are more confident of the booking happening & payment is streamlined.

Booking’s business model is resilient. Travel is a discretionary spend and is likely to be one of the first things consumers can dial down if conditions tighten. During the pandemic, booking and travel ground to a halt. In 2020, gross bookings dropped 63% and revenues dropped 55%. As a marketplace, Booking managed to remain profitable throughout.

Other concerns to the business model include direct bookings (i.e.travelers preferring to book on the operator’s site or app directly) as well as possibly reduced travel due to remote work and virtual reality solutions.

Diving into the financials:

Revenue growth has been strong coming out of the pandemic, with TTM revenue growth of 32%. Revenues of $19.3 billion have now significantly surpassed the pre-pandemic high of $15 billion. Growth is expected to continue moderating going forward, with analysts expecting roughly 10% for the next 2 years.

Gross margins are very strong at 86%, having progressed steadily with the post-pandemic expansion. Gross margins have now surpassed the 85% of the pre-pandemic high.

EBITDA and FCF margins are very healthy in the 35-40% range.

Balance sheet is strong, with net cash of $656 million.

Shares outstanding continue to decline at a very impressive rate – shares outstanding are down 10% year-over-year! The management team has been aggressively taking advantage of the opportunity to buy shares.

Efficiency metrics are looking very strong, with EBITDA return on capital and FCF return on capital in the 46-50% range. FCF ROC of 46% means that for every dollar invested, the company generates $0.46 in free cash flow per year!

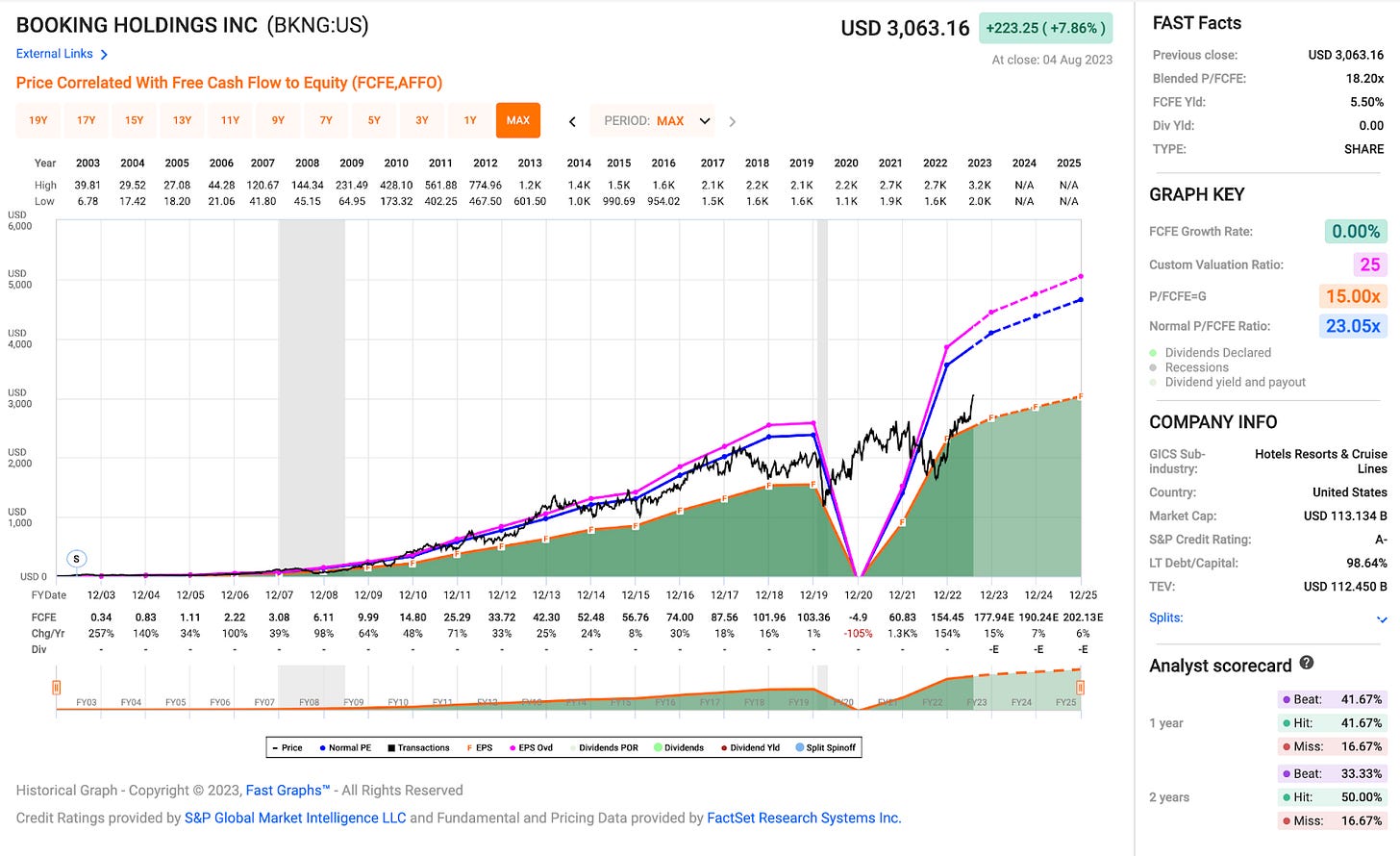

Until recently, BKNG shares had been somewhat stagnant. As of February 2023, shares had gained a meager 20% over the prior 5 year period. Covid clearly impacted the company, and the recovery hadn’t quite been accepted by investors. 2023 appears to be a breakout year. In June and July, shares pushed through the 2690 level which had previously been met with strong resistance. Coupled with a strong Q2 earnings report, shares are now up 52% YTD.

As for the valuation:

Even after a significant climb, shares are attractively valued at 4.9x EV/NTM revenue and 14.8x EV/NTM EBITDA.

The FCF yield of 5.9% is attractive – significantly higher than the market’s 4.1%. Booking’s expected double digit growth is also higher than the market.

The following table shows potential annualized returns over the next 5 years given a spectrum of EBITDA multiples and EBITDA growth rates. This model incorporates a 4% annual share count reduction.

Assuming no meaningful change to the multiple of 14-16x EV/NTM EBITDA and achievable growth of 10%, investors could reasonably expect annualized returns of 13-16% over the next five years. Any additional improvement or enhancement could yield a higher return.

Fastgraphs provides another valuable perspective.

Looking at P/FCF, shares continue to trade for a substantial discount (18.2x) compared to the historical multiple (23x). Even at current prices, there is a realistic opportunity for double digit returns going forward.

Closing thoughts

The stock market is often said to climb a wall of worry – the market can continue to rise even in the face of negative news.

Higher rates punished stocks last year. Rate increases have continued throughout 2023, yet stocks have gained tremendously.

The equity risk premium is now significantly squeezed. Treasuries and bonds offer compelling yields in comparison to stocks. Some investors may find that attractive.

At Torre Financial, we focus on investing in companies. We look at company fundamental performance first. We strive to stay invested through good times and bad, always looking for the best fundamental companies to drive the best returns. We continually evaluate our positions and rebalance according to what the market is offering.

Earlier this year, we identified Booking (BKNG) as a compelling opportunity – weighing the risks and ongoing concerns of a recession. We make investment decisions looking out 18 months ahead.

https://twitter.com/ftorre104/status/1629518404666396673

Next week we will hear earnings from DDOG, UPST, and TTD.

Stay tuned.

--

Torre Financial is an independent investment advisory firm focused on emerging and established compounders.

Federico Torre

Torre Financial

federico@torrefinancial.com

https://torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.