Market, Earnings, & Danaher (DHR) - October 26, 2024

Market commentary, portfolio company earnings results, and a deeper look into Danaher (DHR)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

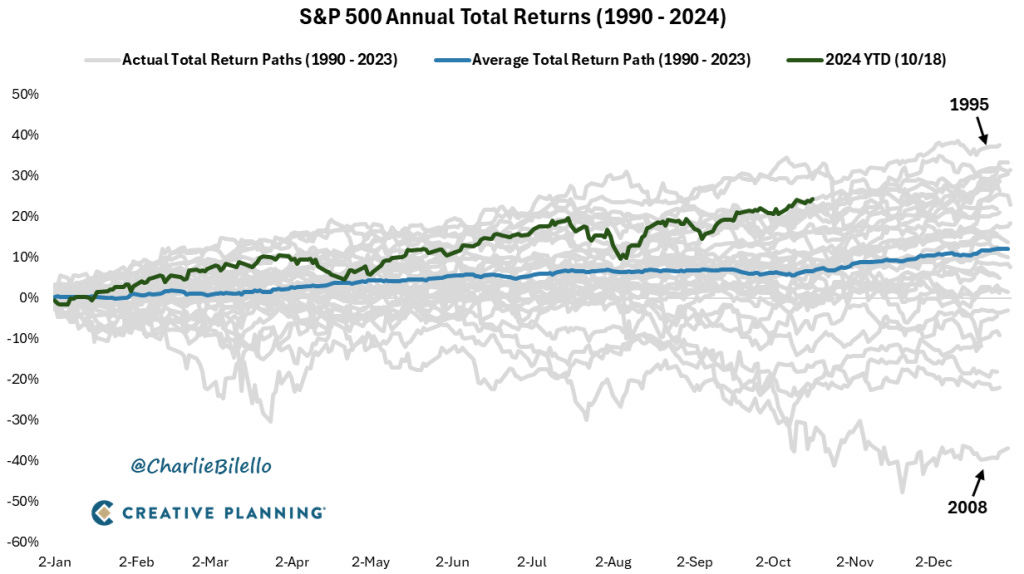

The broader market faced some resistance over the last week, with the S&P 500 losing ground four of the last five trading days.

The technical picture still looks strong, with SPY healthily above both the 50-day and 200-day moving averages. The trend continues to push the market higher, for now.

Year-to-date performance across indices:

S&P 500 +21.77%

Nasdaq +20.96%

Dow Jones +11.74%

The market is off to one of the strongest starts of the year.

History shows that after a good start, the market has continued to increase throughout the rest of the year.

As investors, it can be hard to grapple with that idea, especially as valuations appear to become stretched.

The S&P 500 is trading at elevated historical multiples:

3.6x EV/S (NTM) vs. a 10-year average of 2.6x; above the 2022 high of 3.5x

16x EV/EBITDA (NTM) vs. 10-year average of 12.8x; challenging the 2020 high of 16.3x

2.66% FCF yield (LTM) vs. 10-year average of 3.73%; the lowest levels over the last 10 years and significantly below the risk-free rate

With sufficient time, multiples tend to revert to normal. There are two ways that can happen:

Fundamentals increase (more sales, earnings, FCF)

Price decreases (market pulls back, SPY declines)

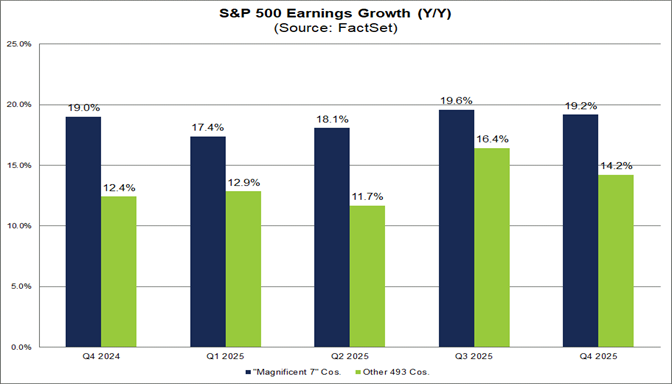

The current enthusiasm is driven by an optimistic outlook. The market expects double digit earnings growth each quarter throughout 2025.

The Magnificent 7, which make up over 30% of the index, are expected to grow earnings at 18-20% year-over-year.

The rest of the S&P 500 companies, the other 493, are expected to grow earnings 12-15%.

The current sentiment is quite the turnaround from just one month ago.

In September, the Fed cut rates by 50 basis points, starting the rate normalization processes while also worried about the job market.

Since then, employment has proven to be robust and inflation continues to cool.

The effect: even though the short-term Fed Funds target rate is down, the bond market yields are up. Investors aren’t expecting such rapid cuts any more; they are expect rates to stay higher for longer.

The US 10 year yield was 3.6% when the Fed cut rates on September 18th. In roughly a month, it has climbed up to 4.25%.

Housing affordability has been a challenge. Rate cuts are, in theory, beneficial as they would help lower the cost of capital. Mortgages, however, are priced off 10-year treasuries.

Mortgage rates reached a 52-week low of 6.1% only to climb back up to nearly 7%.

Earnings

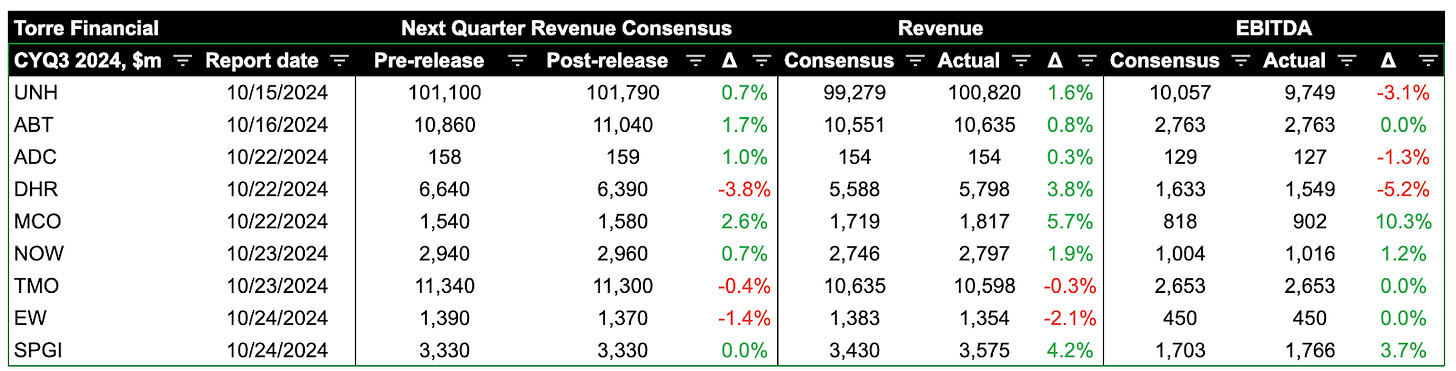

Over the last two weeks, 9 portfolio companies reported earnings.

Danaher (DHR)

“We’re Danaher - a leading global life sciences and diagnostics innovator, committed to accelerating the power of science and technology to improve human health.”

Danaher’s roots trace back to the late 1970s, when two brothers in their 20’s co-founded an investment partnership. They bought a bankrupt REIT in 1983 and founded Danaher, named after a Montana river where they would go fishing. They started acquiring manufacturing businesses, leveraging the REIT’s losses for tax benefits.

“This is a story about the swift, invisible rise of Steven and Mitchell Rales, two very young, very rich, very private brothers who are into plastics, tire changers, engine retarders, hand tools, industrial power chucks -- and debt and hostile takeovers…they oversee a sprawling conglomerate built on borrowed money and nurtured by a keen eye for mismanaged, unglamorous industrial companies.”

- “D.C.’s Rich, Unassuming Rales Brothers” , Washington Post, 1988

This brief origin story shows the straightforward thinking and broad approach that has underpinned Danaher’s success. For decades, Danaher has been looking for opportunities to create value much beyond a typical enterprise.

The company codified their culture and work values into a system, the “Danaher Business System” or DBS.

The whole system is underpinned by the idea of continuous improvement or “Kaizen”, stemming from the Toyota Production System. Kaizen is Japanese for "change for the better.” It is based on the idea that small, incremental changes over time can lead to significant improvement.

Danaher culture embodies this by tracking progress meticulously. Nearly everything has a metric. In 1991, the company simplified their approach, reducing their company-wide metrics from 50 to 8 metrics across finance, customers, and talent.

Organic revenue growth

Operating margin expansion

Cash flow/working capital turns

Return on invested capital

Quality (defects per million)

On-time delivery

Internal fill rate

Retention

The culture, and incentives, are set up to drive incremental, measurable improvements.

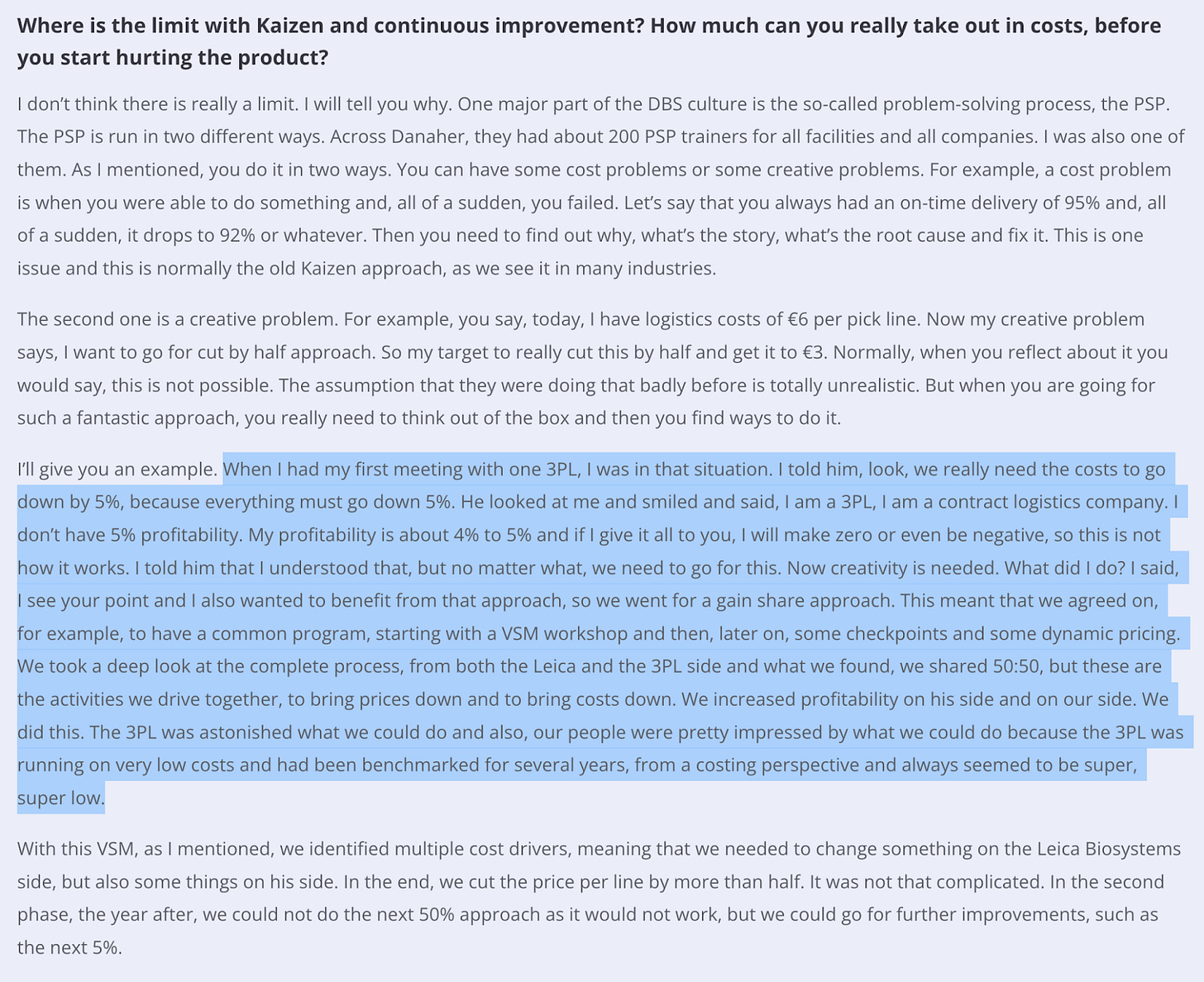

This anecdote from a former employee gives insight into how impactful it can be:

Mergers and acquisitions have always been a driving force behind Danaher’s sustained growth. Danaher has acquired hundreds of businesses. M&A is notoriously difficult to get right – few companies are able to. Thanks to their meticulous focus on the details, Danaher has been very successful in acquiring and selling companies as they see opportunities.

Another pivotal element of DBS is competing for shareholders. Danaher understands the importance of a strong investors base and strong stock price – it provides cheaper access to capital, fueling Danaher’s activity.

Shareholders have been rightly served. Over the last 20 years, DHR has compounded at a CAGR of 14.3% vs. 10.7% for the S&P 500.

DBS has been instrumental in getting Danaher to where it is today. Over the last decade, Danaher transformed from an industrial conglomerate to one of the leading healthcare companies in the world.

Danaher’s most recent spin off of Veralto in 2023, setting it up as a pure-play healthcare company with customers in Life Science, Biotechnology, and Diagnostics. Major acquisitions including Cytiva, Abcam, and Cepheid have been instrumental in the transformation.

The change was driven by a pursuit of continuous improvement. Leadership identified opportunities to expand gross margin and operating margins, to have more recurring revenue, and to set the company up for continued organic growth.

Today, Danaher has three reporting segments:

Biotechnology

“Our Biotechnology businesses deliver researchers and biopharmaceutical companies the expertise, tools, and services they need to develop and commercialize life-changing therapeutics. We support our customers from discovery to delivery as they undertake life-saving activities ranging from fundamental biological research to developing and manufacturing innovative vaccines, biologic drugs, novel cell and gene therapies, and new technologies such as mRNA.”

Life Sciences

“Our Life Sciences businesses are dedicated to accelerating the discovery, development, and delivery of solutions that safeguard and improve human health. We bridge the gap between research and practical application, enabling the development of revolutionary innovations such as biopharmaceuticals and enhanced synthetic biologics—helping people live longer, healthier lives.”

Diagnostics

“We're generating proprietary insights into disease areas and innovation trends to develop inventive solutions of high clinical impact. Operating in both established and emerging markets, we provide our expertise to healthcare practitioners, researchers, and other leaders in the field, enabling them to save and improve lives. Our businesses come together for unparalleled breadth and depth of offerings, resulting in high-quality and accurate diagnostic confidence for a wide range of critical health conditions.”

Danaher’s businesses are in very attractive markets, particularly with biotechnology.

“The global biotechnology market size accounted for USD 1.55 trillion in 2024 and is expected to reach around USD 4.61 trillion by 2034, expanding at a CAGR of 11.5% from 2024 to 2034. The North America biotechnology market size reached USD 521.02 billion in 2023.”

- Precedence Research

Another source, Grand View Research, sees it similarly:

“The global biotechnology market was valued at USD 1.55 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.96% from 2024 to 2030.”

If Danaher is able to grow market share, they would be growing at a faster rate than the industry.

Danaher’s new business has experienced the boom and bust of the COVID pandemic.

After a rapid expansion in 2020-2021, the business has been normalizing. 2023 seems to be the year of stabilization, setting the stage for continued organic growth.

China, which accounts for more than 10% of total revenue, has been slower to normalize. The recently announced national stimulus programs could be beneficial.

Given the depressed stock, Danaher started buyback stock in 2024.

“While M&A remains our bias for capital deployment, we believe these repurchases will provide an attractive return given the strength of our long-term organic growth, earnings, and cash flow outlook.’

- Danaher, 2Q24 Earnings Call

The company repurchased shares at a price of $259, a price higher than today’s $248.

Danaher’s new business has faced some cyclicality with the pandemic. Barring black swan events, their healthcare businesses will be more resilient to fluctuations in the economy. The company has a unique culture that is always looking for improvements. They are set up with a long runway of organic growth.

Diving into the financials:

TTM revenue is down 8% year-over-year. The trend is improving, with quarterly revenue up 3% y/y. Danaher spun out Veralto in 2024, their environmental and applied solutions segment with over $4 billion in revenue. This makes the revenue decline look worse than it is. Note that core revenue has still been declining recently, even after the divestiture.

TTM gross margin of 59% is slightly improved and has steady over time

TTM EBITDA margin came in at 31%. It seems to be stabilizing there, after declining from 35%.

TTM FCF margin of 24% has similarly been under pressure.

The balance sheet is healthy and manageable, with 14.9 billion of net debt, or 2.6x TTM FCF.

Shares outstanding have declined by 2.2% year over year, as Danaher started buying back shares

On efficiency, ROIC ex goodwill is the most meaningful metric by which to look at the cash needs of Danaher’s businesses. They’ve made meaningful investments in the businesses they acquired. Those are in the past. As for ongoing working capital needs, the company is very efficient with a ROIC ex-goodwill of 18%. As the acquired companies continue to grow, the ROIC will follow.

Overall, a bit of a complicated picture with current fundamentals. They will need to turn around soon – as is expected by the market.

As for valuation:

At face value, the valuation is reasonable for a high-quality company. With the context of the current financials, it does feel like a stretch. Danaher’s silver lining is opportunity going forward: the growing and resilient industry, their recurring revenue business model, and unique culture.

When compared to historical levels, Danaher is trading at an elevated valuation. Over the last 10 years, shares traded at a mean multiple of 19.2x and mean FCF yield of 3.70%.

Given Danaher’s recent changes, the historical record may not be as helpful a comparison. The company has gone through a radical transition from a conglomerate of industrials to a lifesciences company with more steady demand and recurring revenue.

Looking forward, revenue is expected to grow 6-7% per year over the next few years.

EBITDA is expected to grow slightly faster at 9-10%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share reduction of 0.3%.

If in 5 years Danaher trades at multiples of 22-24x, shares could return between 7-13% per year.

Fastgraphs provides another look. Again, the picture is complicated by the fact that the company has changed radically over the last few years.

If shares were to trade at 30x FCF (slight compression from today’s 33.4x) in a few years, shares could return 7% annualized returns.

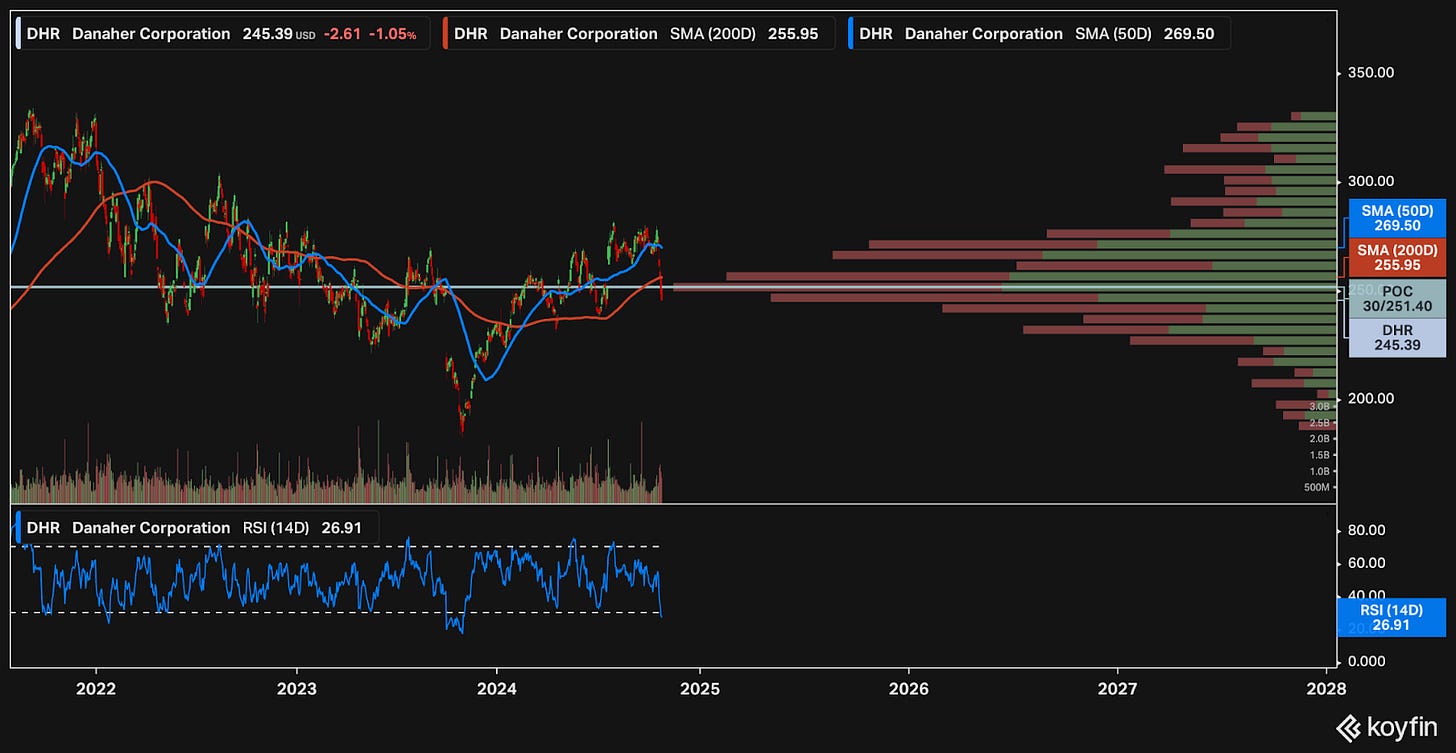

Taking a look at the price action:

Danaher shares have been under pressure throughout 2022 and 2023. This year, 2024, brought some optimism, with investors seeing green shoots of a turning environment.

After the most recent earnings call, Danaher shares sold off, likely due to management’s typical cautious outlook.

Shares look to be oversold, with the 14-day RSI indicator below 27.

Shares are sitting right on a significant volume shelf around 240-250. If the price drops below $240, there might be more room to fall. If shares can hold the current level, they could stabilize.

Recall Danaher was buying back shares at $259 – they deemed that price as an attractive use of capital.

Danaher is likely in a holding pattern as the industry normalizes. Once that happens, Danaher will be well on its way for continued growth.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.