Market, Earnings, & FactSet (FDS) - September 28, 2024

Market commentary, portfolio company earnings results, and a deeper look into FactSet (FDS)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The uptrend continues as the S&P 500 broke through the 565 double-top to another new all-time high. The stock market is now up more than 20% this year.

The beginning of September brought some weakness at the start, but the market was able to overcome seasonal headwinds.

On a technical level, the market is looking healthy, forming higher lows and trading above both the 50-day and 200-day moving averages. Strength begets strength.

Year-to-date performance across indices:

S&P 500 +20.24%

Nasdaq +18.93%

Dow Jones +12.16%

The much awaited first rate cut has arrived & the easing cycle has officially begun. On September 18th, 2024, the Fed issued a statement announcing a 50 bps rate cut, bringing the fed funds target rate down to 4.75%-5.00%.

Inflation is on the way down; the job market is loosening; and the current rates are restrictive.

The 50 bps cut surprised many people, who thought a 25 bps could be sufficient to start. While a lower interest rate is bullish for assets broadly, the worry is that the Fed is cutting more aggressively due to an expectation of a steeply worsening economy. For now, the economy has been steady.

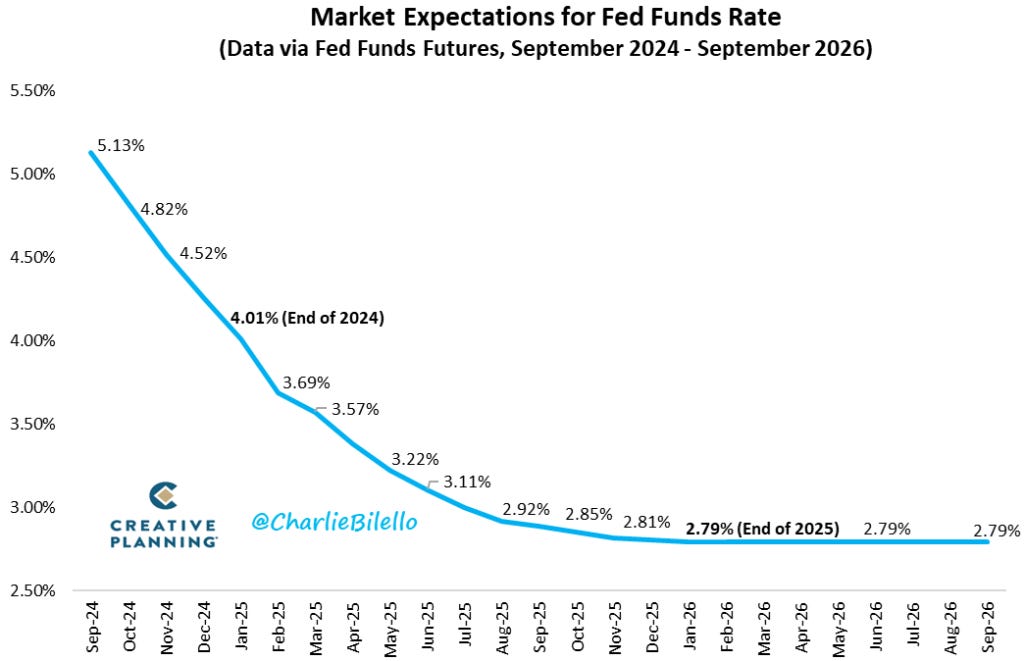

After the most recent policy change, the market now expects interest rates to end the year at ~4% and come down to ~2.8% by the end of 2025.

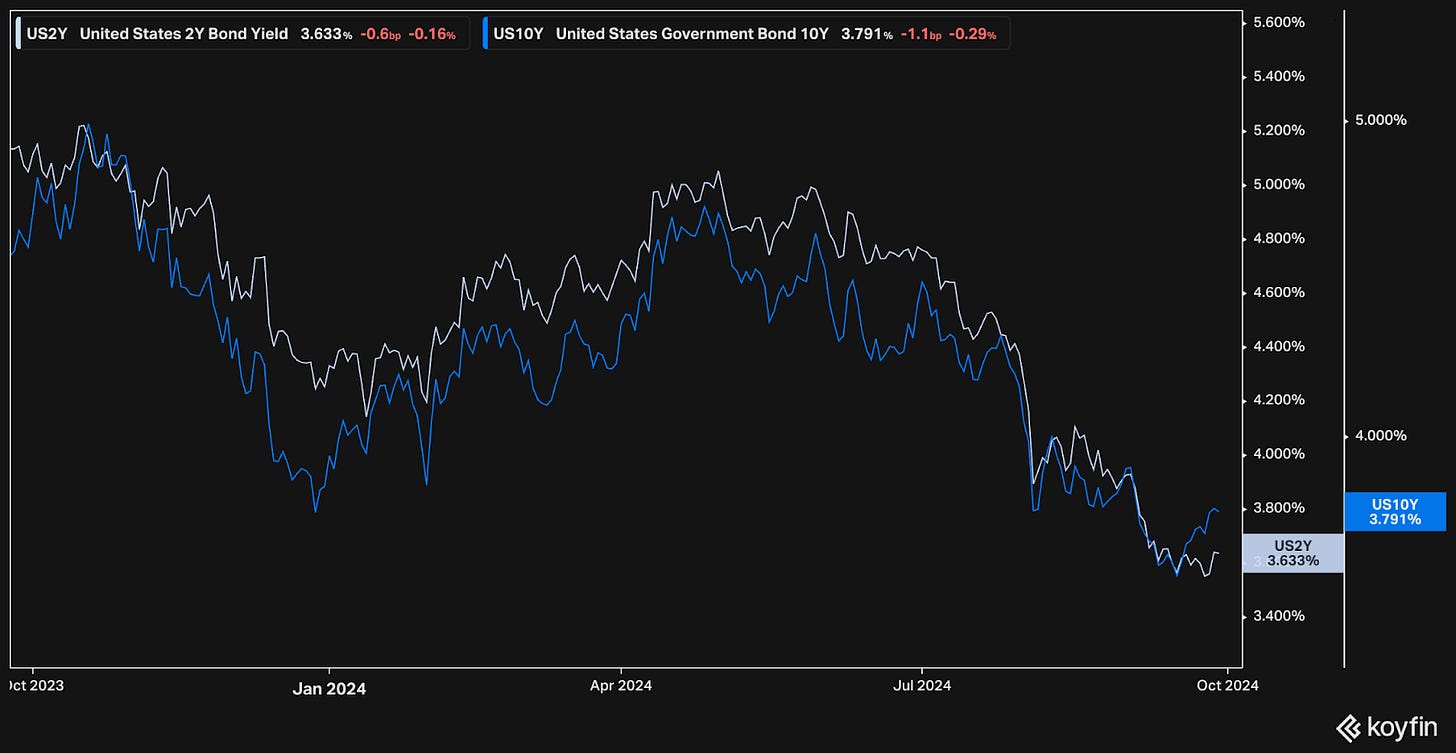

The Fed’s actions have an immediate effect on short term yields, as they compete directly. In fact, the US 2 year yield tends to lead the Fed’s actions.

The challenge is grappling with longer-term yields, on which the Fed has less of a direct impact. While the Fed funds rate is coming down and expected to come down over the next few years, the US 10 year yield has actually started increasing up to 3.8%.

Longer-term rates are driven by market participants. Yields rise as bond prices trade lower. Participants may be expecting longer term implications – a recession later, continued high government spending and deficits, etc.

The stock market has been resilient throughout the year. Although, it is looking a bit pricey.

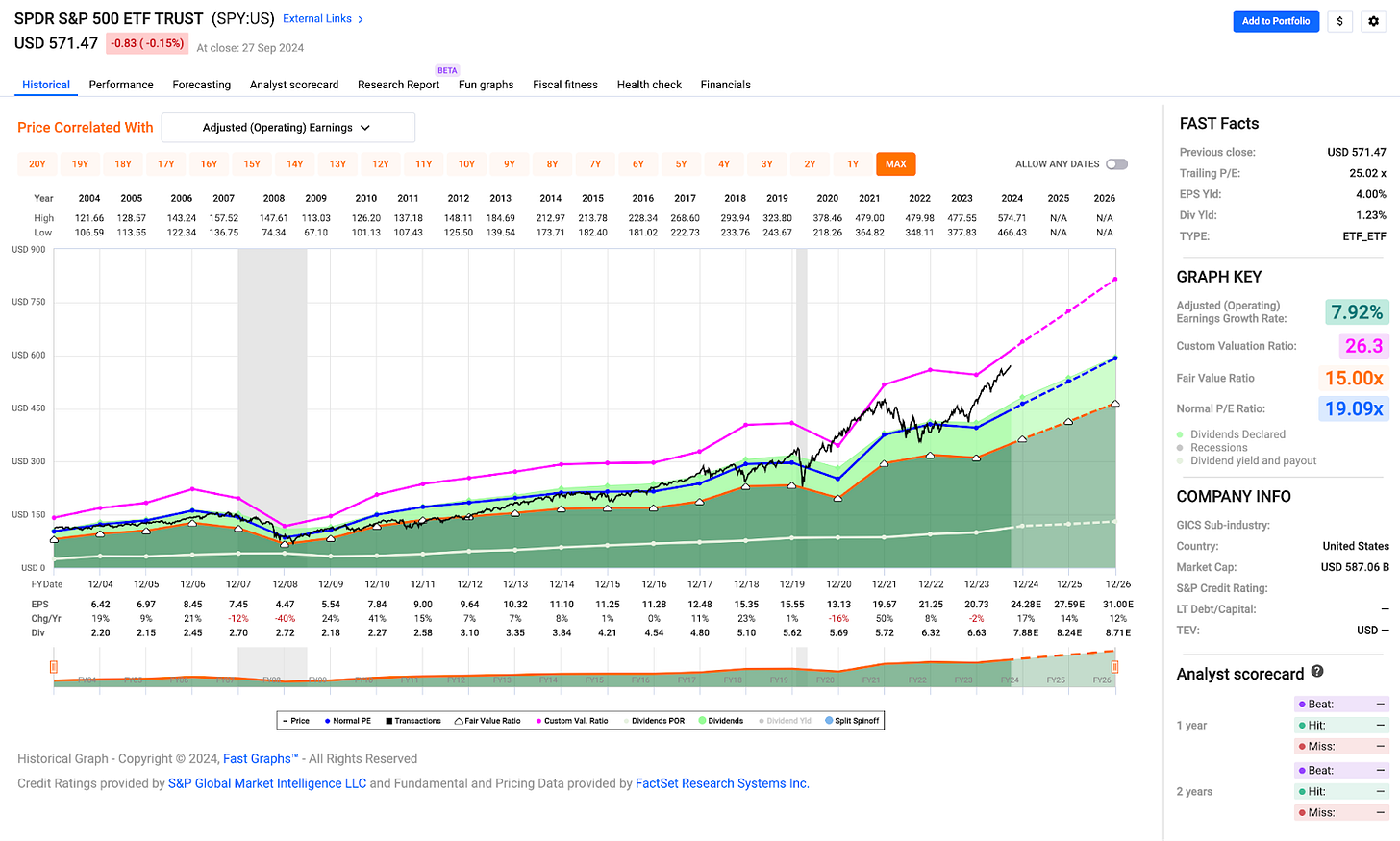

The SPY is trading for 25x price/earnings or more than 30% above its historical multiple of 19x, according to Fastgraphs. The current earnings yield is 4%, only a slight premium over the US 10 year yield of 3.8%.

Undercurrents have helped, as sector leaders have shifted. Rotations are healthy for bull markets.

Year-to-date leaders include Utilities, Communications, and Finance.

Over the last 3 months, leaders include Real Estate, Utilities, and Consumer Discretionary.

Over the last month, Consumer Discretionary, Utilities, Materials, and Industrials have fared well. Technology seems to be staging a bit of a comeback after some late-summer weakness.

The third quarter comes to a close next week on Monday, September 30th, 2024.

Earnings

Over the last two weeks, 1 portfolio company reported earnings.

FactSet (FDS)

FactSet was founded in 1978 when Howard Willie and Chuck Snyder envisioned a better way for distributing financial data to Wall Street.

At that time, companies had to purchase raw data directly from a vendor, and then hire programmers to make the data user-friendly.

Willie and Snyder sought to make usable data directly available to clients. They started Company FactSet with the idea of producing a four-page company analysis report using Value Line data. They delivered this paper report to clients via bike messengers.

Fast forward to today, FactSet is one of the leading financial information offerings out there alongside S&P Capital IQ, Refinitiv (now LSEG), and Bloomberg Terminal (best primarily for bonds).

FactSet provides access to verified financial information via website, desktop, mobile, and APIs.

A lot of the data is publicly available, as public companies have to file quarterly reports with the SEC. However, it requires a lot of work to process that data, to get it right, to derive insights, etc. FactSet works to ensure that it is normalized and standardized, allowing money managers to move through it quickly and compare. Additionally, FactSet adds other data sources, enables customer workflows, and makes the data available in whichever form clients need it.

FactSet has historically reported in three segments:

Research & Advisory – the largest in terms of revenue, at roughly 43%. This is the most mature offering, which includes workstations, advisor dashboards, research management solutions, client relationship management. Clients include investment bankers, wealth advisors, buy and sell-side analysts, portfolio managers, amongst others.

Analytics and Trading – roughly 32% of revenue, this segment includes portfolio construction, order management, and trade execution. Clients include institutional asset managers and asset owners.

CTS – roughly 25% of revenue. This is the fastest growing segment, focused on providing core content and technology however the customer needs it. This includes via data feeds, cloud infrastructure, APIs, and much more.

As of 2024, FactSet revised the reporting segments to focus on their customers, as follows:

Institutional Buy-side – essentially renaming of Analytics & Trading; focused on asset managers, asset owners, and hedge funds

Dealmakers – a split of Research & Advisory; focused on banking, sell-side, corporate, private equity, and venture capital

Wealth – a split of Research & Advisory; focused on wealth management workflows

Partnerships and CGS – solutions for content providers, financial exchanges, and rating agencies

FactSet’s offering is resilient. They sell market data and insights – core inputs into making important decisions. Especially in times of turbulence, clients need this visibility to be informed, maneuver turbulence, and make better & well-formed decisions. Essentially, FactSet sells risk management.

FactSet has an impressive history, with 44 years of consecutive revenue growth, 28 years of consecutive EPS growth, and 25 years of consecutive dividend growth.

They have over $2.2 billion in annual revenue, with an operating margin of 38%.

Revenue is recurring, as clients pay annually for the service. FactSet tracks this as “Annual Subscription Value” (ASV), akin to SaaS companies’ annual recurring revenue (ARR). Retention is consistently greater than 90%.

FactSet serves over 8,200 clients and has over 216,000 users on the platform.

There’s a huge runway for continued growth, as the opportunity of total users worldwide is greater than 3 million.

As of 2024, there are over 15,000 registered investment advisors. Considering an average staff of 75, that is a potential 1.1 million users.

As of 2023, there were over 390,000 people employed in the Investment Banking & Securities Intermediation industry in the United States.

Additionally, consider insurance companies (100,000s), consulting (millions), PE/VC (100,000s), technology platforms, and many more.

FactSet has been innovating since the early days. They were the first to create workflows that brought financial data into spreadsheets like Excel.

They pride themselves on having an open platform. They intentionally want to keep it open, allowing customers to plug into the data as they need and embed it into their workflows.

Although FactSet is very well positioned today, they are not completely immune to the changing world. Recent headwinds include slowdown in financial hiring, slowdown in deal activity, reduction in active management, and consolidation of a large customer (Credit Suisse). FactSet has been able to navigate those effectively.

The biggest risk the company faces is that data aggregation, collection, and clean up becomes commoditized. Generative AI elevates this risk. Although a significant risk, we find this to be a low probability event. Getting the data correct (at scale) is a difficult challenge. Customers are paying for timeliness and correctness. AI is known to hallucinate and be off. Customers cannot risk making decisions with wrong information. The more likely outcome is that other companies build solutions on top of FactSet’s data.

FactSet is always looking to improve, and their strategic investments are focused on 3 areas:

Expanding their data

Embedding FactSet into client workflows

Executing on AI

FactSet has demonstrated durable growth, high efficiency, and competitive advantages over time. Their strategic initiatives set out to further expand their moat.

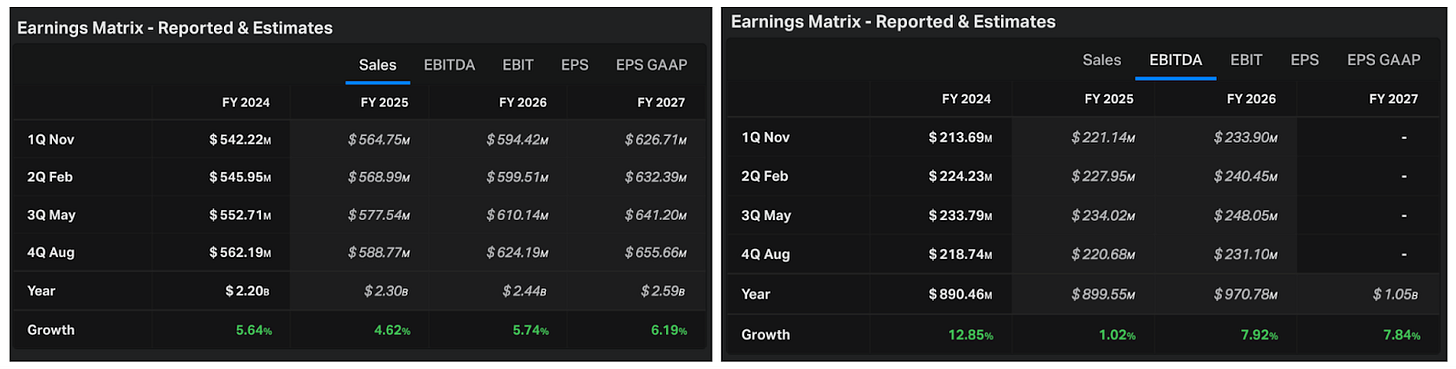

Diving into the financials:

TTM revenue grew 6% year-over-year; this is down from prior years’ growth of up to 20%. This has been weighing on the company and is primarily due to the loss of a large customer (UBS acquired Credit Suisse).

TTM gross profit expanded to 54% and has been steady over the last few years

EBITDA margins of 39% are trending up

Adjusted EBITDA margins of 42% show that SBC is not creating a huge gap

FCF margins of 28% are steady

The balance sheet is strong with very little net debt of $873 million, or 1.4x TTM FCF. Net debt has been trending down.

Shares outstanding have been steady, after a period of decline.

Efficiency looks very strong with ROIC of 19%, FCF ROIC of 17.5% and ROIC ex-goodwill of 26.7%. This is a capital light business that is able to grow without needing capital.

As for valuation:

Valuation seems very reasonable. The EV/NTM EBITDA multiple of 20.4x and FCF yield of 3.4% doesn’t seem neither cheap nor expensive.

It is currently trading inline with/slightly cheaper than its historical measures. Over the last 10 years, FactSet traded at a mean multiple of 20.5x and the mean FCF yield 3.3%.

Looking forward, revenue is expected to grow 5-6% per year over the next few years. EBITDA is expected to grow slightly faster at ~8%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share reduction of 0.3%.

If in 5 years FactSet trades at multiples of 20-22x, shares could return between 7-13% per year.

Fastgraphs provides another look.

It is worth calling out the steady increase in earnings per share – EPS has increased every single year since 2004!

If shares were to maintain the current blended P/E multiple of 26.5, FactSet could trade up to $540 in a few years, delivering annualized returns of roughly 7%.

Taking a look at the price action:

FactSet shares (FDS) faced significant pressure beginning 2024, much likely due to the headwinds mentioned above.

Late summer, shares took a turn and popped up. Their Q4 earning report on September 19th, 2024, served as a catalyst, putting some of the headwinds behind them and painting a more optimistic outlook.

Although the 50-day trendline is below the 200-day trendline, shares are now trading above both. Both the 50-day and 200-day have also inflected and are moving upwards. The golden cross (when the 50-day crosses above the 200-day) could be another upside catalyst.

The relative strength indicator (RSI) looks a bit over extended, as shares moved up nearly 16% in just over a month.

Shares popped up above multiplied volume shelves. There’s a strong volume shelf at the 458-460 area. As long as the share price holds above that, that shelf can turn into solid support.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.