Market, Earnings, & Intercontinental Exchange (ICE) - February 15, 2025

Market commentary, portfolio company earnings results, and a deeper look into Intercontinental Exchange (ICE)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The S&P 500 climbed marginally higher, bouncing back from small declines and continuing its largely range-bound trading pattern since the election.

There have been some positive technical developments as the index broke out of the lower low, lower high pattern that emerged in January. The S&P 500 established a higher low on February 12th, rebounding from its 50-day moving average and moving up to a higher high.

The S&P 500 closed the week just below its all-time high.

While market uncertainty persists, the overall outlook remains positive. As the saying goes, stocks often climb a wall of worry.

Year-to-date performance across indices:

S&P 500 +3.96%

Nasdaq +5.25%

Dow Jones +4.71%

The January CPI report was released on February 12th. Inflation came in higher than expected at 3% year-over-year, up from 2.9% in December.

CPI rose 0.5% for the month, the biggest jump since August 2023 and a slight acceleration from December's 0.4% increase. Economists had forecast only a 0.3% rise.

The news surprised investors and shifted expectations. The market is now pricing in only 1 rate cut for 2025.

Key drivers of the recent CPI increase include:

Shelter (+4.4%): A major component of CPI (~35%), driven by rent (+4.2%) and owners' equivalent rent (+4.6%).

Transportation Services (+8.0%): The largest increase, with motor vehicle insurance (+11.8%) and airline fares (+7.1%) leading the surge.

Tobacco and Smoking Products (+6.8%).

Meats, Poultry, Fish, and Eggs (+6.1%).

Given that shelter (35% of CPI) and transportation (15% of CPI) saw substantial increases, they are very meaningful contributors to the overall rise in inflation.

Commodities have mostly decreased in price year-over-year: WTI crude is down 9%, Coal is down 13%, Gasoline is down 20%, Cotton is down 27%. Two major exceptions: Natural Gas +100% and Gold +45%. Commodities provide early insight into the direction of cost for transportation, energy, food, and more.

The U.S. Dollar had strengthened materially since September, with the DXY reaching a peak of 110 in mid-January before giving up some gains. A strong dollar hurts companies with significant international sales.

While the bond market has reacted to the new information, the 10-year and 2-year yields have remained generally steady and in a slight downtrend throughout 2025.

The 10-year yield is critically important as it often serves as the risk-free rate comparison, anchoring the cost of money for almost everything ranging from mortgages to credit card rates to business loans, etc.

The administration has been vocal about driving the 10 year yield lower. Treasury Secretary Bessent and President Trump have both publicly stated they want a lower 10 year yield.

While the Fed has significant control over short-term yields, longer-term yields are set by market and determined by the state and direction of the economy.

“If we deregulate the economy, if we get this tax bill done, if we get energy down, then rates will take care of themselves and the dollar will take care of itself.”

“Despite the growth estimates going up, the 10-year is coming down, because I believe the bond market is recognizing that…energy prices will be lower, and we can have noninflationary growth,” he said.

- Bessent

The current administration has been shaking up a lot. Some actions are deflationary such as reducing government spending and stimulating energy production, which benefit lower yields. Others are inflationary, such as tax cuts and tariffs.

While the administration is clearly pro-business, the balance of these two sides will only become evident over time.

Earnings

Over the last two weeks, 10 portfolio companies reported earnings.

Intercontinental Exchange (ICE)

The parent company behind the NYSE, Intercontinental Exchange (ICE) is a global provider of data services and technology solutions to many customers including financial institutions, corporations, and government entities.

Intercontinental Exchange (ICE) was founded in 2000 by Jeffrey Sprecher with the goal of creating a more transparent and efficient market for energy trading.

Sprecher, who had a background in the power industry, recognized the need for a centralized, electronic marketplace where energy producers and consumers could easily buy and sell contracts.

ICE started as an online platform for trading energy futures contracts. It quickly gained traction and expanded its offerings to include other commodities, such as agricultural products and metals.

In 2001, ICE acquired the International Petroleum Exchange (IPE), a London-based exchange that specialized in oil futures. This acquisition helped ICE establish a strong foothold in the European market and solidified its position as a leading global exchange.

In 2013, ICE acquired the New York Stock Exchange (NYSE), broadening its reach and diversifying its business.

Since 2018, ICE has been expanding into the mortgage business via acquisitions – Mortgage Electronic Registration Systems (2018), Simplifile (2019), Ellie Mae (2020), and most recently Black Knight (2023). Organizing the mortgage industry has been Sprecher’s idea since the Great Financial Crisis of 2008.

ICE’s core competencies essentially exchanges and indices. Today, ICE operates a wide range of exchanges and clearing houses around the world, across a variety of asset classes, including energy, commodities, equities, and fixed income.

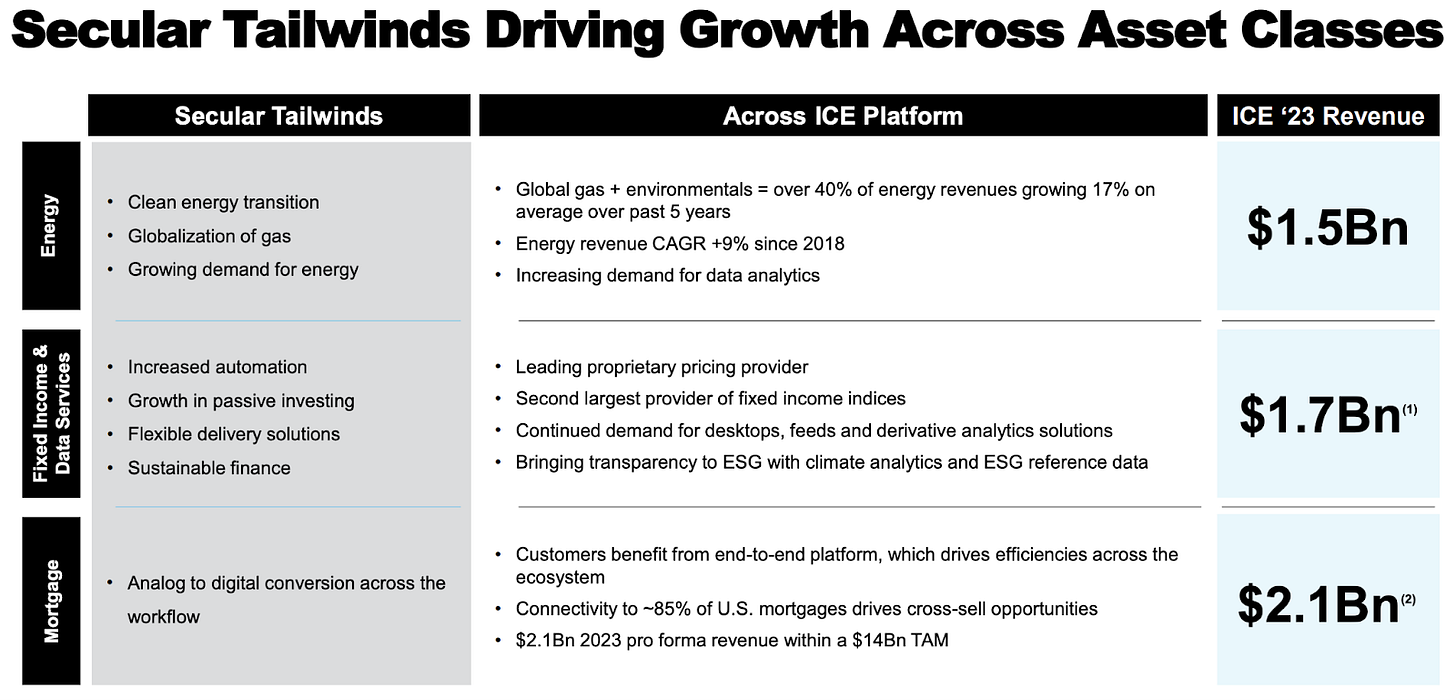

The business is very well positioned across their asset classes.

Their focus on data, establishing benchmark indices as industry standards, is a very compelling business with strong margins and network effects. The exchange business has similar compelling attributes, and also fuels the data business.

Additionally, these services, amongst others they offer, are essentially a risk management offering. When times get difficult, these indices and their exchanges become even more necessary as participants purchase hedges or sell positions to reduce risk. This anti-fragility is an awesome trait to have as a business.

ICE offers solutions for equities, bonds, commodities, and mortgages – the largest asset classes that exist. They have a lot of room, nearly unlimited for practical purposes, to expand and grow. They are very well positioned as a leader and authority.

The company has consistently grown revenue, earnings, and free cash flow over time.

Diving into the quarterly financials:

TTM revenue was up 16% y/y, a deceleration from the prior +21% yet still quite healthy

Gross margins get reported as 100% due to a reporting quirk. The GAAP reported revenue is after transaction-based expenses, due to the principal versus agent rule. The reality is that revenue should be higher than what is reported. See the quarterly income statement provided by ICE below:

TTM EBITDA margin came in at 60% – a more meaningful metric and very high margin.

TTM FCF margin is 45%, similarly a very strong margin, emphasizing the moat they have around their businesses

As for the balance sheet, they have 844m in cash and equivalents, with nearly 20b in debt. ICE has much higher leverage than most other portfolio companies. Yet put in context of the 5.6b in EBITDA, the leverage ratio is 3.4x which isn’t unreasonable.

Shares outstanding increased 0.3%, less than the 2.5% gains from prior quarters.

ROIC and FCF ROIC came in at 8.6%, showing the companies performance inclusive of capital expenditures on M&A

ROIC ex goodwill is 23%, showing the low ongoing capital requirements of the company. While they have invested heavily in acquiring other companies, the business is capital-light. As long as they pause the acquisitions, ROIC should rise steadily over time.

As for valuation:

ICE shares trade at a 17.9x NTM EBITDA multiple, or 5.6% yield. This doesn’t seem expensive for such a high quality, established company. The current multiple is higher than the 10-year historical mean of 15.5x.

From a FCF perspective, ICE shares yield 3.7%. Also not extremely expensive, yet a bit more expensive than its 10-year historical mean of 4%.

Looking at the next few years, revenue is expected to grow ~5-6% and EBITDA is expected to grow ~6-8%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes share count declines by 0.5% per year. Returns include dividends.

Over the next 5 years…

If EBITDA grows at 6% CAGR and the multiple contracts to 17x, shares could return 6.3% per year

If EBITDA grows at 8% CAGR and the multiple is mostly maintained at 18x, shares could return 10% per year

Fastgraphs provides another look:

If shares were to trade at the historical average or normal P/E of 22.3x, shares could generate annualized returns of 6% going forward.

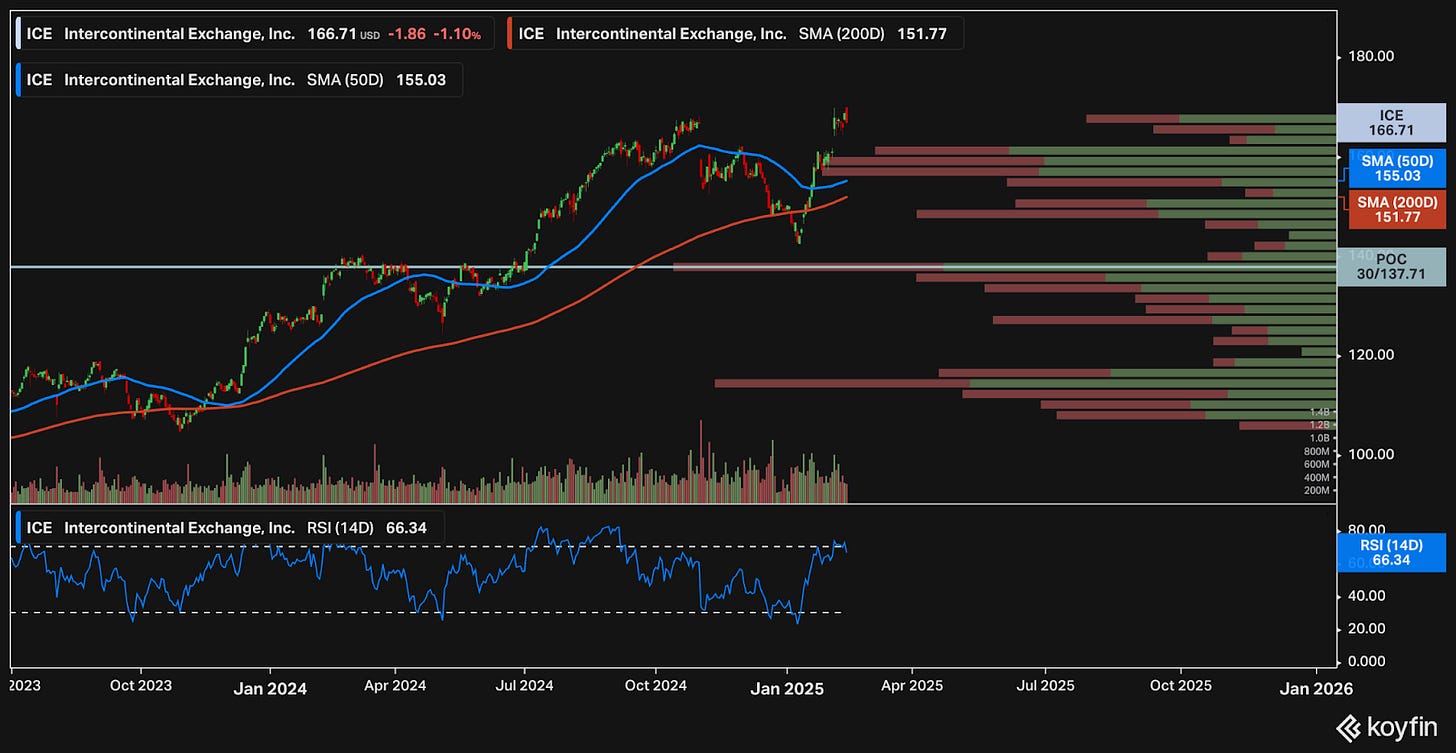

Taking a look at the price action:

Over the last year, the stock has been in a general uptrend with some bumps along the way.

From October 2024 through the end of the year, shares dipped down to the low 140s. As of January 2025, shares have bounced back with strength and recently broke out to a new all time high of $168.

ICE is currently above both its 50-day and 200-day simple moving average, indicating a strong uptrend.

The volume profile indicates a robust level of support at ~$162. From the volume shelves, it would seem pretty dramatic for shares to trade all the way down to ~150. As for looking up, resistance is limited as shares sit near all time highs.

The relative strength indicator (RSI) shows the strong momentum but is also hovering right around the overbought levels (RSI of 70).

While a short-term consolidation or pullback is possible, overall, ICE remains in a bullish structure.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.