Market, Earnings, & Intuit (INTU) - November 23, 2024

Market commentary, portfolio company earnings results, and a deeper look into Intuit (INTU)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market continues its uptrend, ending this last week with momentum after overcoming a small 2% pullback. The market bounced right off the $580 level, establishing it as an important area of support.

Strong selling would be unexpected throughout the rest of the year, as investors most likely hold off from booking taxable gains until next year 2025.

For a continued move up, the market would have to break through the resistance at $600 and turn that into support.

Year-to-date performance across indices:

S&P 500 +25.15%

Nasdaq +23.48%

Dow Jones +17.53%

The incoming Trump Vance administration has been busy. With Republican control of the House and Senate, they seem to be preparing some big changes. They have been making contentious cabinet nominations, including outsiders with strong entrepreneurial backgrounds.

Elon Musk and Vivek Ramaswamy will be leading the Department of Government Efficiency (DOGE).They seem very focused on eliminating costs and bloated bureaucracy.

Coincidentally sharing the same name, Dogecoin is a meme cryptocurrency that Elon Musk has touted in the past. Dogecoin is up significantly since the announcement.

Robert F. Kennedy Jr. was chosen to lead the department of Health & Human Services. RFK is an outspoken critic of the healthcare industry, particularly on the topics of vaccines and health.

Many healthcare companies, including Amgen, Pfizer, Merck, Danaher, Thermo Fisher, and many more, have sold off due to concerns and the uncertainty.

Coca Cola and Pepsi, two of the most renowned consumer staple companies, have similarly sold off due to the rhetoric around health & the Make America Healthy Again movement.

It is important to note that these drastic movements, worth 100s of billions of market cap, are all due to speculation of what policies the new administration will implement. There are no clearly defined policies at this time. It is the uncertainty that brings sellers to the table.

Trump’s policies, including tax cuts and tariffs, are expected to be inflationary.

Even after the recent rate cut, long term rates are staying higher, with 10 year treasuries yielding 4.4%.

This behavior is different from previous rate cut cycles, where 10-year yields either moved down or stayed flat.

For now, the market continues to expect another 25 basis point cut in December, which would bring the fed fund rate down to 4.25-4.50%.

By the end of 2025, the market expects a fed funds rate of 3.75-4.00%.

Earnings

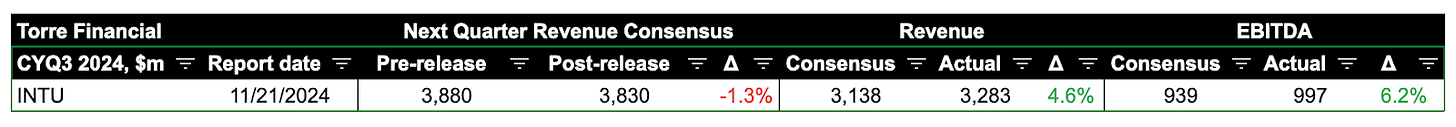

Over the last two weeks, 1 portfolio company reported earnings.

Intuit (INTU)

Intuit is the parent company behind many well known financial offerings including TurboTax, Credit Karma, QuickBooks, and Mailchimp, serving both consumers and small-and-medium businesses.

Their annual report introduces their business clearly and concisely:

“Intuit is a global financial technology platform with a mission to power prosperity around the world. Our platform helps consumers and small and mid-market businesses prosper by delivering financial management, compliance, and marketing products and services. We also provide specialized tax products to accounting professionals, who are key partners that help us serve small and mid-market business customers.

Across our platform, we use the power of data and artificial intelligence (AI) to deliver three core benefits to our customers:

helping put more money in their pockets

saving them time by eliminating work, and

ensuring that they have complete confidence in every financial decision they make

We help consumers do their taxes with ease and confidence, understand their financial picture, build credit, save more to make ends meet, get their largest tax refund, pay off debt, and receive personalized suggestions on how to grow their money. We help small and mid-market businesses grow and run their business all in one place, including bookkeeping, getting paid, accessing capital, paying employees, getting and retaining customers, and managing their customer relationships.

We do this through our global AI-driven expert platform and our offerings including TurboTax, Credit Karma, QuickBooks, and Mailchimp. We serve approximately 100 million customers and generated revenue of $16.3 billion in our fiscal year ended July 31, 2024.”

Intuit has a strong track record of growth and strong margins, with revenue compounding at 14% annually and net income margins averaging 20% over the last 10 years.

The company reports results under 4 segments:

Small Business & Self-Employed, which includes QuickBooks and MailChimp and is the largest at 59% of revenue and the fastest growing at 19% y/y

Consumer, primarily TurboTax, which makes up 27% of revenue

Credit Karma, contributing 10% of revenue

Pro Tax, which is about 4% of revenue and includes solutions for professionals including Lacerte, ProSeries, ProConnect, ProFile and ProTax

Intuit’s strategy is focused on five big bets:

Revolutionizing speed to benefit – leveraging AI to do things automatically in their products (i.e. categorizing expenses in QuickBooks)

Connecting people to experts – live connections to experts that are readily available, built into the product (i.e. TurboTax Live or QuickBooks Live)

Unlocking smart money decisions – helping people understand their financial picture (i.e. CreditKarma) which is undoubtedly very strategic data and insight.

Be the center of small business growth – help them get and retain customers, get paid faster, manage and get access to capital, pay employees, etc. Intuit has expanded much beyond just doing accounting, into operations, financing, and marketing.

Disrupt the small business mid-market – extending their core offerings stated above to mid-market companies, those with 10-100 employees

The company has been executing on their plan. Some examples include:

QuickBooks establishing a network, so users can find other companies in a shared directory (competing with Bill.com’s bill pay network)

QuickBooks enhancing invoicing functionality and adding payment options – so now customers can pay your QuickBook invoice directly

QuickBooks has an integrated Capital offering, allowing customers to request access to financing

Payroll is integrated directly into QuickBooks, allowing the system to orchestrate payroll payments

CreditKarma helps people monitor their credit score, get the lowest rate on loans, choose the best credit card, and suggests strategies like consolidating debt.

TurboTax Live connects people to experts directly in the product as they are doing their tax return, so they can get clarification on any doubts, a 2nd opinion, or an expert review. They also offer full tax prep services via experts.

QuickBook Live similarly includes expert advice and also offers full outsourced bookkeeping services.

MailChimp provides marketing, automation, and notification functionality to help businesses attract and retain customers, turning emails and SMS into revenue. Intuit acquired MailChimp in 2021 for a hefty price of $12 billion.

Intuit has effectively consolidated the small-and-medium business (SMB) market, boasting an estimated 70-85% share of small business accounting market. This stands as one of Intuit’s strongest competitive advantages – it is difficult to gain such mass adoption in such a fragmented industry. Their products and services are effectively the standard for anyone starting a new business.

Competing offerings certainly exist – Xero has made a big push to compete with QuickBooks’ accounting offering; Bill.com is focused on accounts payable and accounts receivable; H&R Block competes with TurboTax; the Government/IRS has made efforts to offer free filing services. Yet even with competition, Intuit’s offerings stand out by quality, brand, and popularity.

The areas in which Intuit operates are critical operations for any business, giving them a significant market opportunity of which they have only scratched the surface with 5% penetration.

The rise of the gig economy, i.e. freelancers and other small businesses, is a material tailwind for Intuit. Some stats highlighting the growth:

The share of the U.S. workforce in the gig economy rose from 10.1 percent in 2005 to 15.8 percent in 2015. source

In 2023, 64 million people worked as freelancers in the U.S., and by 2027, that number is expected to increase to 86.5 million. This would make freelancers more than half of the total U.S. workforce. source

Intuit has built an ecosystem of financial applications that give it a unique data advantage, a critical competitive advantage in the new age of AI. They are best positioned to successfully bring AI to the tax and accounting world. No other party has the breadth or scale of the data.

Intuit has demonstrated their ability to evolve and execute.

Diving into the financials:

Revenue increased 12% y/y, slightly down from 13% last quarter. Looking forward, Intuit guided for 12-13% revenue growth for full year 2025.

Gross margin came in at 79%, holding steadily around 79-80%.

EBITDA margins held steady at 31%, sticking to a tight historical range of 30-31%

FCF margin ticked up to 31%

The balance sheet is strong, with 2.8b in net debt. That is roughly half of annual FCF; easily coverable

Shares outstanding have stayed flat around 280 million. They did repurchase $570 million, and have $4.3 billion remaining. This is partially offset by the stock-based compensation.

The company is quite efficient, with strong returns on invested capital. ROIC came in at 14%. ROIC gives context on the performance of prior decisions. To get a better indicator on the ongoing capital requirements, we can back out goodwill. ROIC ex-goodwill comes in at 31.3% Given this dynamic, we’d expect the 14% ROIC to increase over time as the business grows, closing the gap of a higher return on the incrementally invested capital.

For context, goodwill effectively doubled in 2021 with the $12 billion acquisition of Mailchimp

As for valuation:

Intuit’s valuation is neither excessively cheap nor expensive.

An EV/EBITDA multiple of 24x is reasonable for their growth and quality. The current multiple is slightly below the 5 year average of 26x.

The FCF yield of 2.6% is inline with the market and inline with Intuit’s 5 year average.

Looking at the next few years, revenue is expected to grow ~12% and EBITDA is expected to grow ~14%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes shares stay flat over time (i.e. buybacks continue to cancel out any dilution from SBC).

In the scenario of 12% EBITDA CAGR and multiple compression to 22x EV/EBITDA, shares could return 10.7% per year.

If the multiple were to hold at 24x or above, an investment today could reasonably return 15%+ per year.

Fastgraphs provides another look.

If shares were to hold their 10-year-average year P/E of 38x in the future, shares could produce annualized returns of over 17%.

The downside case, with shares trading at the lowest P/E seen in the last 10 years of 28.5x (during the Covid panic and in 2022), would result in annualized returns of 5.5%.

Taking a look at the price action:

Intuit shares have been in a steady uptrend from January 2023 through January 2024. Shares stalled throughout 2024, trading rangebound between $560-660.

Current price action is sitting on a strong volume shelf, providing significant support at the $600 level.

If the shares are able to reclaim the $670 level, that could set up a path to new all time highs.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.