Market, Earnings, & McKesson (MCK) - August 17, 2024

Market commentary, portfolio company earnings results, and a deeper look into McKesson (MCK)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market has come back with a vengeance. The bulls showed up and bought the dip in full force.

The S&P 500 rose 7 days in a row. The index is now trading above both its long-term 200-day simple moving average (SMA) and near-term 50-day SMA.

From July 16th to August 5th, the market lost 8.5%. The S&P 500 has recovered most of the damage and now sits at less than 2% from an all time high.

Year-to-date performance across indices:

S&P 500 +16.5%

Nasdaq +16.0%

Dow Jones +7.9%

Panic struck the global markets on Monday, August 4th.

Nikkei, the Japanese stock market index, was down double digits after the Bank of Japan raised interest rates to 0.25%.

In the USA, the CPI index showed a month-over-month decline, sparking deflation talk. Unemployment came in higher than expected, triggering the Sahm rule. Warren Buffet had sold half of his Apple stake, building up the largest cash pile ever.

The Japanese market actions coupled with soft USA economic data created a perfect storm, fueling the unwinding of the “Yen Carry Trade.”

The Yen Carry Trade is a very widely applied strategy wherein investors borrow cheaply from the Yen and invest in higher yielding assets. Typically, heavy leverage is used.

For illustration, investors could

short Japanese Yen-based treasuries, effectively at 1% interest rates

buy USA dollar-based assets such as treasuries, effectively at 5% interest rates, or any other investment, such as S&P 500 or Nasdaq.

Therefore, earn a spread of 4%

The unwinding was triggered by the Bank of Japan raising rates as well as expectations of the Fed to lower rates to combat the softening market. The impact being two-fold:

The Yen strengthens vs. the US dollar – requiring more US dollars to pay back Yen-denominated loans. If an investor had borrowed $100-usd-worth of Yen, they would have to pay $105 USD if JPY/USD moved up 5%. Similarly, interest payments would now be more expensive.

The spread on the trade compressed. Initially it could have been invested at 5% with a cost of 1%, yielding 4%. After the moves, that could compress to 4% with a cost of 1.5%, resulting in a spread of 2.5%. This gives investors less cash flow to cover costs of interest, less profit to pay back borrowings, and a lowers their buffer for any future price fluctuations.

The size of the trade was estimated at $7 trillion. With such huge leverage, these positions are very sensitive to slight movements and could result in margin calls. At the risk of being wiped out, funds would have to forcibly sell assets, possibly all of their positions – not just currency positions.

This was seen as a global, systematic risk.

Fears of a recession brewed strong. The Bank of Japan issued a statement saying they would hold off on future moves in order to preserve global stability.

Volatility jolted higher, climbing nearly 500% up to a peak of 65.73.

Interestingly, the panic didn’t last very long. While the S&P 500 had dropped over 4% in a few hours, it ended the week down just 0.04%. And it has recovered strongly since then.

There is a lingering concern. The unwinding causes volatility and uncertainty. In the worst case scenario, it could create a credit crisis.

A credit crisis occurs when it becomes difficult for companies to borrow. In times of uncertainty and fear, the market tends to witness a “flight to safety” – as investors focus on the highest quality of companies. The cost of low quality debt (i.e. non-investment grade companies) spikes. This could result in companies being unable to refinance and or service their debt. As that happens, companies go bankrupt, jobs are lost, and consumer spending declines. The economy spirals into a recession.

In order to counteract that, the Fed would likely lower interest rates. This in theory lowers the cost of borrowing to stimulate the economy.

Given the interconnectedness of the global financial system, however, this could have the possibility of more chaos if the Yen Carry Trade is at the crux of the problem. Lower US interest rates would create more pressure on the Yen Carry Trade, potentially fueling more unwinding, more volatility, and more bankruptcies.

Fortunately, this week Aug 12-16 had better news.

Retail sales bounced back in July, rising 1% month over month, ahead of consensus estimates. Jobless claims fell to 227,000, lower than the 236,000 consensus and prior week’s 234,000. CPI rose 0.2% month over month in July, as expected. On their earnings release, Walmart topped estimates and raised their outlook, citing a strong consumer quelling concerns of a recession.

The market continues to price in 2-4 rate cuts for 2024, possibly bringing the fed funds rate target down to 4.25-4.50% by the end of the year, a full percentage point from the current 5.25-5.50%.

It is interesting to see how the entire market shifted from imminent recession to goldilocks in just one week.

This bull market has been very resilient, withstanding huge interest rate spikes, significant bank failures, troubled real estate market, and much more. The market has continually bounced back.

It goes to show how difficult it is to time the market – impossible to do so consistently. Investors are best served by having a clear plan and staying their course.

Earnings

Over the last two weeks, 2 portfolio companies reported earnings.

McKesson (MCK)

“At McKesson, we are about Advancing Health Outcomes for All”

McKesson’s history goes back to 1833, when two young entrepreneurs, John McKesson and Charles Olcott, opened Olcott & McKesson as a drug import and wholesale business. They became the first nationwide wholesale pharmaceutical drug distribution network.

The company has stayed true to its roots. Headquartered in Irving, Texas, McKesson is the largest of three dominant pharmaceutical distributors across the United States.

The oligopoly, shared with Cardinal Health and Cencora (formerly AmerisourceBergen), together distributes over 90% of drugs in the US. It has been in place for years and is fortified by regulatory requirements and complications. The business is akin to a toll road connecting manufacturers and pharmacies, taking a royalty on every drug distributed.

McKesson operates in four business segments:

US Pharmaceutical – distributing medicine and supplies across the country; very thin margins; ~90% of revenue, yet ~60% of profit

Prescription Technology Solutions (“RxTS”) – solutions for medication access, affordability, insights, connecting all parties (patients, pharmacies, providers, pharmacy benefit managers, health plans, biopharma); < 2% of revenue, ~17% of profit

Medical-Surgical Solutions – distributing medical and surgical supplies (i.e. gloves, wipes, needles, other disposables/consumables, etc); ~3% of revenue, 15% of profit

International – distribution of medicine, supplies, and tech across Canada and Europe; ~5% of revenue, ~8% of profit

McKesson has grown to over $300 billion in revenue, primarily through distribution. The business exhibits low margins (gross margin of ~4%, free cash flow margin of ~1%). However, coupled with extremely low capital requirements and rapid inventory turnover, McKesson produces very attractive returns on capital. McKesson is also very efficient with working capital – they have a negative cash conversion cycle, meaning they typically get paid before paying out themselves.

Low margins act as a barrier to entry – it does not make an attractive market for new entrants. McKesson’s markup is less than 5%. For comparison, Costco’s markup is closer to 15%.

Buying, transporting, and selling pharmaceuticals can be complicated. Additionally, prescription costs (and healthcare more broadly) are always an important community and political topic.

The job is so complicated to do correctly and efficiently that even large players with significant scale – including Walmart, CVS, and Optum Health – rely on McKesson’s help

With over 51,000 employees, McKesson gets critical supplies and medicines distributed around the USA. Hospitals, pharmacies, and more rely on McKesson to help them get the correct assortments, at the right time.

Over 90% of distributions are direct-to-store. McKesson services most pharmacies on 24-hour notice and can deliver to many multiple times per day. 83% of customers receive more than five shipments per week. Route density drives efficiency and keeps the cost of incremental deliveries low.

McKesson has looked to diversify beyond distribution into technology and data. Prescription Technology Solutions (“RxTS”) represents a huge long-term opportunity, as McKesson is very well positioned and integrated across all parties. It is a high margin business, expected to grow 14-18%.

“RxTS has connections with most electronic health record systems, over 50,000 pharmacies, approximately 950,000 providers, most pharmacy benefit managers and health plans”

“... spans across the entire patient journey, including medication access and affordability, prescription decision support, prescription price transparency, benefit insight and dispensing support services, as well as third-party logistics and wholesale distribution support, to help increase speed to therapy, reduce prescription abandonment, and support improved health outcomes for the patient.”

“In the past year, RxTS helped patients save more than $8.8 billion on brand and specialty medications, helped to prevent an estimated 10.7 million prescriptions from being abandoned due to affordability challenges, and helped patients access their medicine more than 94 million times.”

McKesson’s strategy is focused on 4 pillars:

Focus on people and culture – aspiring to be the best place to work in healthcare

Drive sustainable core growth – support existing customers and improve operations

Expand oncology and biopharma platforms – building an oncology network and driving insights via Ontada and iKnowMed (electronic records for oncology)

Evolve and grow the portfolio – leverage data and technology including analytics, AI, automation; improved e-commerce experience on McKesson Connect & recently acquired Compile, a healthcare data platform aggregating and integrating data across US healthcare systems, to be the centralized data platform for commercializing data

McKessons’ focus on a centralized data platform is particularly attractive, especially given all the excitement and opportunities around AI. The other major players are focusing on other initiatives – Cardinal Health has been trying to fix their supplies business, while Cencora has been expanding into serving pets & animals.

Share performance has significantly outperformed the index over the 5 years. The divergence began in early 2022, when the majority of the market including many technology and software names sold off significantly. McKesson shares took off. They have delivered 31% CAGR.

McKesson’s valuation was significantly suppressed up until 2020-2021 primarily due to uncertainty around the opioid lawsuits. McKesson, alongside Carindal Health and Cencora, settled in early 2022 for a total of $19.5 billion over 18 years.

Cencora: $6.1 billion

Cardinal Health: $6.0 billion

McKesson: $7.4 billion

McKesson has had a lot of momentum recently, renewing accounts with CVS and winning over big customers such as Optum from competitors.

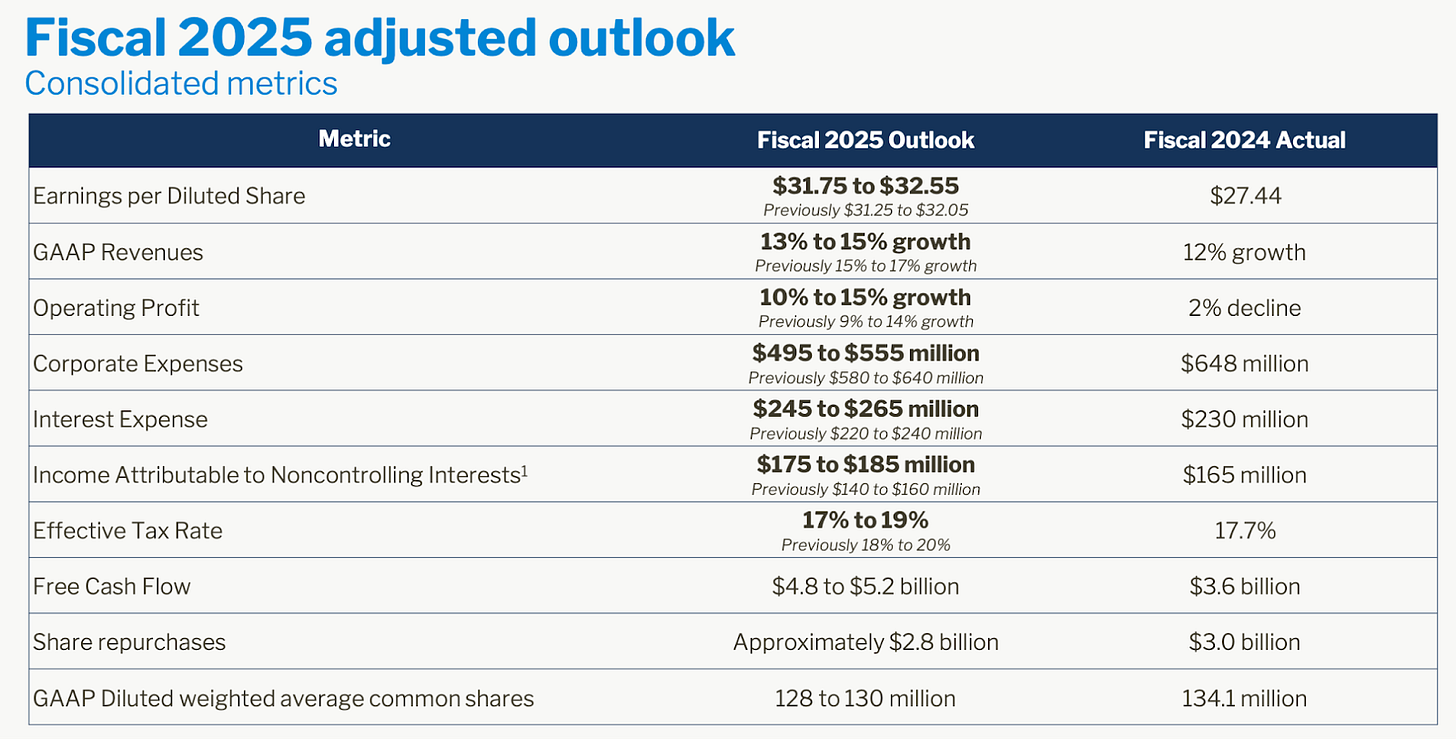

In the most recent earnings call, revenue came in below expectations and guidance was lowered. Earnings guidance was increased.

While softening revenue can be concerning, it had minimal impact on McKesson's earnings. One of the main detractors is the patent-cliff on Humira. Large customers have switched from brand-name Humira ($$$$) to generic options ($).

Diving into the financials:

TTM revenue growth came in at 10%, slower than prior quarter yet inline-to-high compared to prior years

Gross margin came in at 4.1%, flat q/q and trending down from prior years where it was closer to 5%

SG&A costs of 2.5% have improved q/q, and are down materially from prior years’ 3.5-4%. This is likely the outcome of driving operational efficiencies.

TTM EBITDA margin of 1.6% was slightly down q/q but mostly inline with prior years

TTM FCF margin came in at 1.1%, a decrease from prior quarters. On the earnings call, they mentioned increased inventory ramp up in preparation for Optum, which is a rational explanation.

Balance sheet is strong with $2.3 billion in cash and $5.3b of debt. They are able to cover their net debt with FCF from just 1 year – that’s very healthy.

Shares outstanding are down 3.9% y/y. The company has been aggressively repurchasing shares, and has a remaining $10 billion authorized (~13% of the market cap). This trend is likely to continue.

EBITDA return on capital and FCF return on capital are very high at 85% and 58% respectively. This is a testament to the low capital requirements of the company. If the company returns another $10 billion in buybacks, the total capital invested in the company could go negative!

As for valuation:

Shares are not expensive. 12.5x EV/NTM EBITDA is not very demanding, particularly for such a proven and recession-proof company. The low valuation could be due to concerns with the low margins.

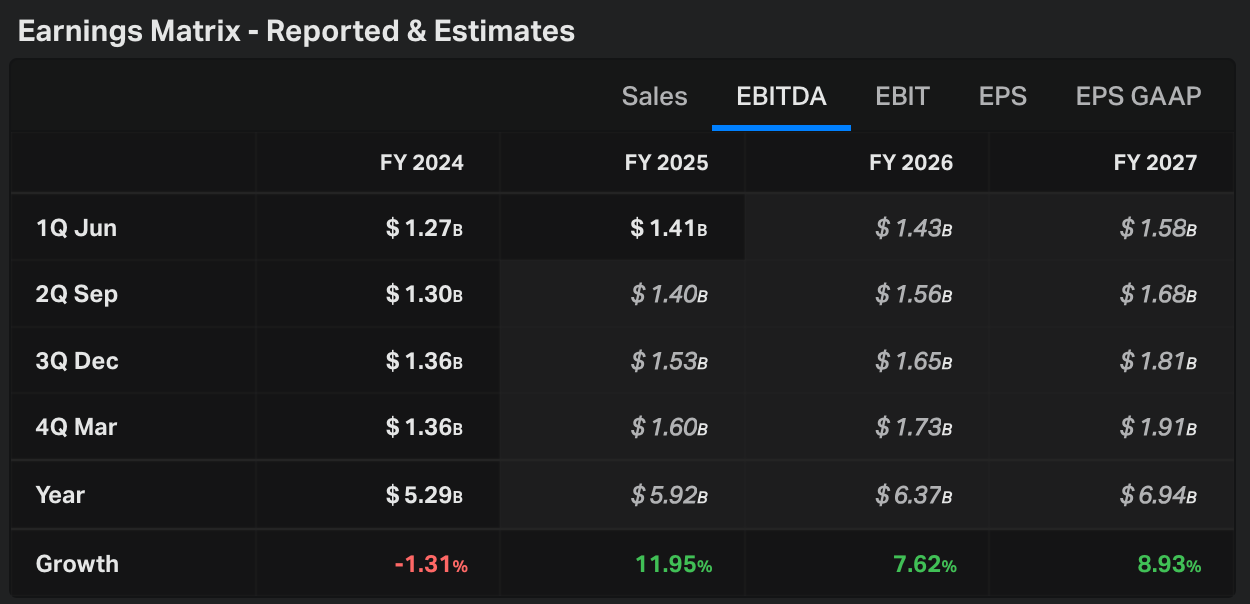

Sales are expected to grow ~9-10% CAGR over the next few years.

EBITDA is expected to grow similarly ~9-10% CAGR.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share reduction of 3%.

If multiples compress from 12.5x to 10x, shares could produce 7-9% annualized returns.

If the multiple expands slightly to 14x, shares could return 15-17% annualized returns.

Taking a look at the price action:

Shares have been on a steady march higher for most of the last 12 months, staying firmly above the 200-day moving average. The price has occasionally dipped below the 50-day SMA.

Shares sold off recently after the latest earnings call which had lower revenue results and guidance. Shares found support at a volume shelf, right above $530. The RSI hit 35 which is typically an indication of being oversold.

Although revenue was soft, earning guidance was raised. Given the strength of the chart with positive trendline and significant volume support, shares could very likely recover and continue higher.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.