Market, Earnings, & MercadoLibre (MELI) - March 1, 2025

Market commentary, portfolio company earnings results, and a deeper look into MercadoLibre (MELI)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

Volatility increased the last two weeks, as the S&P 500 sold off and broke below the 50-day moving average.

The market has been on a generally steady climb over the past year. The few times the index lost momentum and dipped below the 50-day moving average, it was able to bounce back and recover quickly.

This time around, the S&P 500 seems to have consolidated and traded sideways since late January. After a double top, prices are now moving down. The index is currently down 3% from the peak. For comparison, the drawdown in August 2024 was a decline of just over 8%.

Difficult to say how deep any pull back may go. Historically, pull backs of 10% happen about once a year.

Year-to-date performance across indices:

S&P 500 +1.24%

Nasdaq -0.61%

Dow Jones +3.05%

The current administration continues to stir uncertainty, both within the federal government and on international policies.

DOGE is diving into many departments, analyzing projects, making cuts, and driving layoffs.

Many federal programs are in turmoil, not only USAID, but also headline programs like the FBI.

Internationally, the commentary on huge changes like 10-25% tariffs seems to come and go regularly. As of the end of February, plans are back on for significant increases.

The Fear & Greed index has come in at “Extreme Fear”, a big shift from the “Neutral” rating just 1 month ago. Investors seem to be increasingly nervous about the market.

While many big tech companies reported earnings a few weeks ago, these last two weeks brought reports from more mega cap heavy-weights including Nvidia, Salesforce, Home Depot, Lowe’s, Intuit, Workday, and many more. While results for the quarter may have been solid, performance has been sagging lately.

Taking a broader look, there seems to be a divergence in performance across sectors.

Consumer Staples, Real Estate, and Health Care – all of which are typically more defensive, safe-havens – have held up well, even showing slight growth.

Communication, Consumer Discretionary, and Technology have sold off much more significantly.

The strength in defensive sectors signals a shift in risk appetite, with investors becoming more risk averse, inline with the Extreme Fear rating.

It may be an early sign of a rotation, as investors harvest gains from the winning sectors and move in to harvest opportunities in other sectors that haven’t seen such significant appreciation.

Earnings

Over the last two weeks, 5 portfolio companies reported earnings.

Mercado Libre (MELI)

Founder Marcos Galperín was wrapping up his MBA at Stanford GSB and set out to replicate the success of eBay for Latin America. In 1999, he founded MercadoLibre in Buenos Aires, Argentina.

By 2006, MercadoLibre was the largest online e-commerce platform in Latin America

In 2007, MercadoLibre became the first Latin American technology company to be listed on the NASDAQ

The company has adapted well to the unique challenges of the Latin American market, building trust, and creating reliable payment and shipping systems.

“Over the past 20 years, Mercado Libre had developed a diversified business model, one aimed at boosting electronic commerce. With the Mercado Libre Marketplace as the hub and engine, the company developed additional business units to provide payment solutions, logistics, financing, advertising and software services. The Mercado Libre ecosystem was designed to provide users with a complete portfolio of services to facilitate commercial transactions and to provide buyers and sellers with an environment that fostered the development of a large e-commerce community in Latin Am.”

Mercado Libre has expanded its services significantly. Today’s ecosystem consists:

Mercado Libre Marketplace – connecting buyers and sellers for a wide range of products, facilitating transactions, benefitting from the growing e-commerce penetration in Latin America; 90% is 3rd party sellers, 10% is first-party basis (sold by MercadoLibre)

Mercado Libre Classifieds – a listing service with only a placing fee, in comparison to the final value fee from the marketplace

Mercado Ads – advertising solutions for businesses across the MercadoLibre platform

Mercado Pago – a fintech platform providing payment solutions for online and offline transactions, including digital wallets, payment processing, and credit solutions; supports the marketplace, also has ample runway given the large unbanked and underbanked population

Mercado Envios – logistics solutions such as shipping and delivery services for sellers, includes warehousing, fulfillment, and tracking services; supports and improves the marketplace with faster delivery times and higher reliability

Meli+ – a loyalty program in Brazil and Mexico offering free shipping, cashback, and more benefits

These services are intertwined and all help drive e-commerce and digitalization in Latin America.

In comparison to USA services, Mercado Libre effectively built out and operates LatAm versions of eBay or Amazon, PayPal to facilitate payments on their platform and then expanded beyond, Braintree/Stripe/Ayden payment processing, Amazon’s FBA fulfillment services, Amazon Ads, Amazon Prime, as well as Upstart AI credit lending services.

This broad array of services – and all of them successful – is a significant accomplishment.

While Amazon entered Latin America in 2012, MercadoLibre has been able to sustain their success and momentum. The varied cultures, behaviors, and expectations are quite different and MercadoLibre has been able to adapt their services well to those needs.

MercadoLibre’s largest countries are Argentina, Brazil, and Mexico, although they serve many more.

The company’s long-term financial profile validates their success. They have been profitable since their IPO and have grown very rapidly.

Over the last 10 years:

Revenue grew from less than $600 million to nearly $21 billion – nearly 35x!

Free cash flow grew from $172 million to over $7 billion – nearly 41x!

In 2024 Q4, MercadoLibre served over 67 million unique active buyers with each purchasing on average 7.8 items.

On the fintech side, they have over 61 million monthly active users with over 10 billion in assets under management (i.e. savings, investments) and a growing credit portfolio of over 6.5 billion.

While Mercado Libre has been investing regularly, they have been able to grow the business very efficiently, demonstrated by their return on invested capital of nearly 20% that is steadily increasing.

They have a long runway ahead, with Latam tailwinds including growing internet and smartphone penetration, relatively low e-commerce penetration, underdeveloped financial infrastructure, and the significant head start they have to establish themselves as a leader across many critical verticals.

Diving into the quarterly financials:

TTM revenue was up 38%, on top of 40%+ growth the prior years

TTM gross profit margin ticked down to 53%, a very respectable margin for an e-commerce operator

TTM EBITDA ticked up to 16%, and seems to oscillate between 15-20%

TTM FCF margin came in at 34%, significantly higher than EBITDA, demonstrating their ability to collect cash in advance – a good signal on pricing power

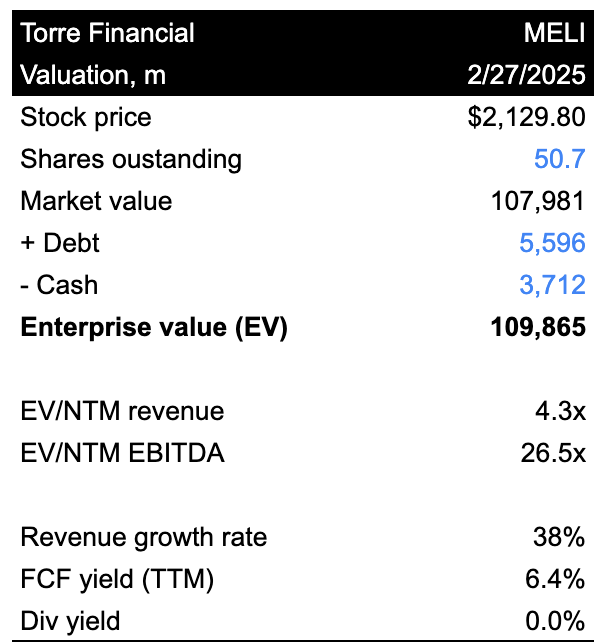

Balance sheet is strong with $3.7 billion in cash and $5.5 billion in debt, a small and easily manageable amount of net debt

Shares outstanding were flat y/y. Historically they have stayed relatively stable, showing good equity management

ROIC and FCF ROIC came in at 23% and 65% respectively, very strong numbers.

ROIC ex-goodwill similarly came in at 24%. MercadoLibre has very little goodwill as they have mostly developed their offerings internally and grown organically – another very positive sign for durability and innovation

As for valuation:

MELI shares trade at a 26.5x NTM EBITDA multiple. This does not seem expensive at all, rather it seems quite cheap for 38% growth, and such a strong track record. The current multiple is right around the 10-year historical mean of 26.9x.

Foreign companies typically trade at a discount compared to American companies, due to increased risk. Also, it is more difficult for investors in the USA to be familiar with their offerings as they may not see them in their day-to-day life.

From a FCF perspective, MELI shares yield 6.4%. Also very cheap, and significantly cheaper than the 10-year historical mean of 2.3%.

Looking at the next few years, revenue is expected to grow ~20% and EBITDA is expected to grow ~25%.

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes share count declines by 0.5% per year. Returns include dividends.

Over the next 5 years…

If EBITDA grows at 22% CAGR and the multiple contracts to 20x, shares could return 14.9% per year

If EBITDA grows at 24% CAGR and the multiple is mostly maintained at 25x, shares could return 22.2% per year

Fastgraphs provides another look:

If shares were to trade at a P/E of 30x, significantly below their historical normal P/E, shares could generate annualized returns of 16% going forward.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.