Market, Earnings, & Salesforce (CRM) - December 7, 2024

Market commentary, portfolio company earnings results, and a deeper look into Salesforce (CRM)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The stock market continues its smooth march upwards. The S&P 500 has closed higher in 12 of the last 14 sessions and is sitting at a new all time high.

In early November, SPY was met with resistance in its attempt to climb beyond $600. The picture has evolved. Now sitting at $607.80, it is possible $600 becomes a level of support.

December is historically a strong month. With such strong performance this year, many investors are likely incentivized to roll any gains over to the new year.

Year-to-date performance across indices:

S&P 500 +27.68%

Nasdaq +28.51%

Dow Jones +18.45%

There is a general sentiment of optimism across the country.

The stock market is up, on track for one of the strongest annual performances ever.

Earnings are solid and growing, exhibiting double digit growth year over year. The Magnificent 7 continue is estimated to grow earnings ~18% for 2025, while the rest the S&P 500 expects to grow ~15%

Consumers are spending. Black Friday sales were up over 10% y/y. Cyber Monday sales were up 7.3% y/y.

Interest rates are coming down, with the market expecting another cut in December, bringing the Feds Fund target rate down to 4.25-4.50%.

This optimism manifests in the market via higher multiples. The S&P 500 is trading at 22.2x next 12 months (NTM) earnings, vs its nearly 30 year average of 16.6x. The top 10 stocks are particularly expensive, trading at a multiple of 28.8x.

Monish Pabrai, a renown value investor akin to Warren Buffet, expressed his concerns about the index's high valuation. While he continues to invest selectively in companies that fit his style, he warns that investing in the index may be a “risky proposition.”

Looking into sector performance can help understand any ongoing or upcoming market rotation, potentially leading to some opportunities.

Since the election,

Consumer Discretionary has been the clear winner.

Communication, Finance, and Technology have fared very well.

Healthcare and Materials have been lagging behind.

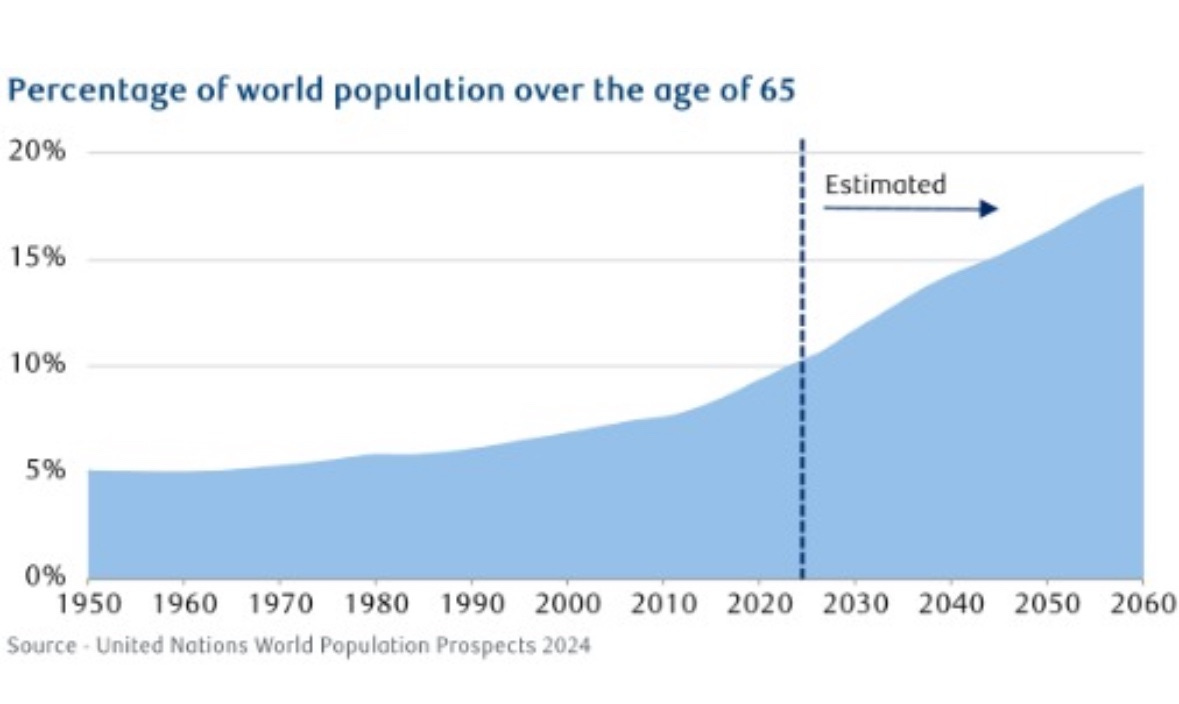

The Healthcare sector in particular may be worth a closer look. It is generally resilient, recession-proof, and has supportive secular tailwinds. For example, the percentage of the world’s population that is over the age of 65 is expected to increase from 10% to nearly 20% over the next few decades.

The index may be expensive today. It is by historical measures. At the same time, the market may very well stay expensive for many years to come.

To exit the market completely too early can effectively become the same as being wrong. Fortunately for the astute investor, the market always has plenty of investment options from which to choose.

Earnings

Over the last two weeks, 3 portfolio companies reported earnings.

Salesforce (CRM)

12/7/2024 CRM share price: $362

Market, Earnings, and CRM - December 9, 2023 share price: $248

Market & Earnings Review - March 4, 2023 share price: $186

Salesforce was founded in 1999 by Marc Benioff and grew to become the leader in customer relationship management (“CRM”), bringing companies and their customers together.

Today, they offer various offerings under their Customer platform:

Sales – allows sales teams to manage entire process from leads to opportunities to billing

Service – allows customer success teams to deliver personalized customer service and support across multiple channels (phone, chat, email,etc) as well as fieldwork; also includes an AI-powered chatbot

Platform – allows companies to build business apps with drag-and-drop tools

Slack – enterprise messaging system, “digital headquarters”

Marketing – allows companies to plan, personalize, and optimize customer marketing journeys

Commerce – unify the shopping experience across mobile, web, social, and store

Analytics – business intelligence applications on top of their business data, includes Tableau

Integration – easily connect data from any system to deliver a connected experience, primarily MuleSoft

Data Cloud – “Genie”, a hyper-scale real-time data platform

And the most recent offering: Agentforce is a complete AI system for enterprises, built on top of the Salesforce Platform. It allows companies to create, define, and leverage AI agents to accomplish work on their behalf – from a chatbot helping customers not just get information but also fulfilling complex workflows such as completing an exchange and making sure the new item has expedited delivery.

Agentforce is a strong example of Salesforce’s ongoing ability to innovate. It builds upon all of their prior products, particularly the treasure chest of customer-relevant data, as well as the recent Data Cloud offering. Agentforce stitches them all together to deliver autonomous workflow agents.

Salesforce has always been building an open platform, making their tools’ data and functionality available via APIs so that companies could build on top of them. This is a key part of their moat – their solutions are deeply engrained in their customers’ processes. Agentforce is another enhancement to that moat. No one will be able to replicate their Agentforce offerings or abilities because no one else has the data Salesforce has.

Alongside the ongoing innovation, Salesforce has been driving aggressive efficiency measures. Margin has expanded over the last few years as Marc Benioff, founder and CEO, aspires to be one of the most profitable companies in the world.

Diving into the financials:

Revenue increased 10% y/y, decelerating from the 20s a few years ago. Current RPO, an indicator of future revenue, grew 10%, which provides confidence in growth stabilizing at this level.

Gross margin came in at 77%, steadily trending higher over the years up from 73% a few years ago

EBITDA margin ticked up to 29%, a significant improvement from the 14% a few years ago

FCF margin ticked up to 32% – also trending upwards, and always great to see cash flow margins follow earnings closely

The balance sheet is strong, with 4.3b in net cash.

Shares outstanding were roughly flat at 957 million.

On efficiency, ROIC came in at 8.4%, FCF ROIC at 16.9%.

ROIC gives context on the performance of prior decisions.

Salesforce has historically been active in M&A. The focus on efficiency has tampered acquisitions and allowed the company to leverage past purchases.

ROIC ex goodwill came in at 27.8%.

ROIC ex goodwill gives an indication of ongoing capital requirements.

As for valuation:

Salesforce appears to be reasonably valued.

An EV/EBITDA multiple of 22.1x is not expensive given the quality of operations and opportunity for continued growth. The multiple is below the 10 year average of 27.1x.

The FCF yield of 3.5% is also quite attractive and significantly above (+1 standard deviation) the 10 year average of 2.6%.

Looking at the next few years, revenue is expected to grow ~9% and EBITDA is expected to grow ~10%.

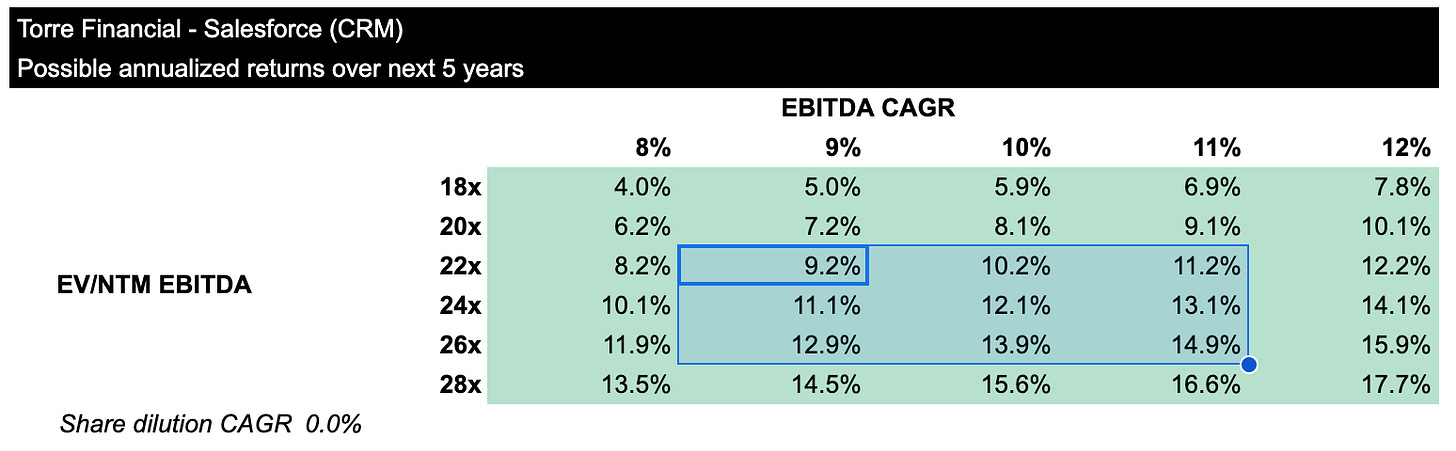

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes shares stay flat over time (i.e. buybacks continue to cancel out any dilution from SBC).

If EBITDA grows 10% and the multiple holds at 22x, shares could return 10.2% per year.

If the multiple were to expand slightly, an investment today could reasonably return 13%+ per year.

FastGraphs provides another look.

If shares were to maintain their current P/FCF multiple of 30x in a few years, shares could produce annualized returns of over 14%. This is significantly below the historical average multiple of 39x.

Taking a look at the price action:

Salesforce shares struggled through the first half of 2024, as the notion that AI was going to upend software offerings spread feverishly. Since then, Salesforce has proven they are a formidable player in AI and the share price has responded.

Shares have been in a clear uptrend starting the summer of 2024. A series of higher lows has helped build momentum. The golden cross came in early November, when the 50-day moving average crossed above the 200-day moving average. Shares shot up higher soon thereafter.

The most recent earnings call was met with a very positive response. Shares gapped up to a new all time high. Thin volumes make it difficult to call for stability at this time.

The volume profile shows there has been ample buying at the 360+ level. Shares face very little resistance, allowing them to keep moving upwards rather easily. This is the most likely path for the rest of December. If shares were to retreat, the likely levels of support would be first ~340 and next ~308.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.