Market, Earnings, & Adobe (ADBE) - December 21, 2024

Market commentary, portfolio company earnings results, and a deeper look into Adobe (ADBE)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The stock market experienced a bout of volatility, with the S&P 500 index falling 3% in one single day.

The SPY dropped below its 50 day simple moving average, typically a bearish signal. On Friday, the market rallied back and closed just a hair below the 50 day SMA.

Although the sell off may feel jarring, the SPY is essentially back to where it was 1 month ago. Investors know that volatility is the price of admission in the stock market.

The end of the year is historically a strong period of gains, known as the “Santa Rally.” Only time will tell what this year has in store.

Year-to-date performance across indices:

S&P 500 +24.34%

Nasdaq +26.53%

Dow Jones +13.67%

The Federal Reserve met this week and cut interest rates by 0.25%, as expected by the market. This is the Fed’s third cut over the last three months. The current target rate is 4.25-4.50%.

The big news was the Fed’s forecast for 2025, which was reduced to 2 cuts for next year from prior expectations of 3.

After the press, the market is no longer expecting a January cut. The first cut is expected in March or May, with odds of another cut sometime later in the year.

Markets sold off quite aggressively. The Dow Jones lost 2.6% on Wednesday, marking its 10 losses in a row – its worst losing streak in 50 years. The S&P 500 and Nasdaq lost 3% and 3.6% respectively.

While the Fed did cut rates this week, the market seems to have been expecting more significant cuts in the future. Lower rates are beneficial for nearly every asset class. Given the new data, markets adjusted accordingly.

All sectors sold off. Over the last 5 days, the biggest laggards are Energy, Real Estate, and Materials. Technology, Utilities, Financials, and Healthcare have held up the best, losing less than the broader market.

Over the last month, growth has handily outperformed value.

The market has been fueled by an optimistic, risk-on sentiment. The job market is strong. Rates were coming down. Inflation is stubborn, yet tolerable. Trump’s administration promises efficiency, less regulation, and a pro-business agenda. The market started pricing in all the good potential outcomes.

The recent bout of volatility comes as a reminder that markets do not go straight up. There will be twists and turns along the way.

Whether this is a temporary downturn or a more durable shift in sentiment back towards reality, the market always presents opportunities for the astute investor. High quality businesses will continue to grow and strengthen regardless of the macroeconomic backdrop.

Earnings

Over the last two weeks, 2 portfolio companies reported earnings.

Adobe (ADBE)

Prior coverage:

Adobe is the parent company behind many well known products including Photoshop, Illustrator, Acrobat, and many more.

It is one of the largest software companies in the world and caters to creative professionals including photographers, video editors, graphic designers, marketers, and many more.

They operate three major businesses:

Creative cloud – software-as-a-service model for many of the well known creator applications including Photoshop for photo editing, Illustrator for vector graphics, InDesign for layout design, After Effects for motion graphics, and Premiere Pro for video editing, Express for quick edits, and many more

Experience cloud – customer journey tracking, analytics, marketing workflows, content, commerce, and insights to help enterprises understand their customers and optimize the experience

Document cloud – Acrobat for creating, editing, and modifying PDFs, as well as e-signature solutions

All three areas are growing double digits year-over-year and very promising.

Adobe has established themselves as a leader in AI, pushing forward with Adobe Firefly as the embedded solution for their creative suite of tools and Adobe Sensei for intelligence in documents and their experience platform.

Fiscal year 2024 Q4 results were very solid. Revenue and EBITDA came in ahead of expectations. Remaining performance obligations, a leading indicator of revenue (basically commitments that are not yet booked), grew 16% y/y, outpacing the company’s revenue growth for the quarter.

While the company beat on revenue and earnings, shares sold off due to lowered guidance.

They continue to focus and execute on their plan – specifically driving AI and customer acquisition.

Adobe has been investing heavily in AI. Given the lowered guidance, investors are concerned about the timing of those investments paying off. Adobe hasn’t been optimizing monetization. On the earnings call, CEO Shantanu Narayen, emphasized their current focus being adoption and high usage.

“The deep integration of Firefly across our flagship applications in Creative Cloud, Document Cloud, and Experience Cloud is driving record customer adoption and usage. Firefly-powered generations across our tools surpassed 16 billion, with every month this past quarter setting a new record”

Adobe is also investing heavily in new customer acquisition on the individual and SMB side of the market. This strategy may have arisen following the failed Figma acquisition. Adobe must stay relevant beyond the enterprise, to avoid a newcomer slowly entering their space.

“Creative Cloud growth drivers included: strong demand for new subscriptions for Creative Cloud All Apps across individuals, Teams, Enterprise and Education; strength in Creative Cloud single apps for Acrobat Pro, Lightroom and Photoshop; momentum with new subscriptions in emerging markets; demand for Adobe Express across education, SMB, and enterprises and adoption of Firefly Services in the enterprise.”

“We reimagined creativity and productivity for a broader set of customers with Adobe Express, the quick and easy create-anything app.”

While monetization is not the current focus, Adobe is performing very well and has a very strong financial profile. Adobe’s financials are solid. The company doesn’t require a lot of capital to operate, it is highly profitable, and very efficient.

They are executing on their stated plan. They’re focusing on embedding AI throughout their suite of solutions. These tools are critical for the professionals that use them every day.

Emerging competitors such as Figma and Canva can pose potential threats. They’ve gained rapid traction amongst consumers and amateurs. They have solid offerings and are no doubt interested in making their way up to larger businesses and enterprises, knowing that those are the bigger accounts.

To build a successful company, however, takes more than a solid product. Although Figma received $1 billion as a breakup fee, the acquisition process was a huge drain and time sink. The illusion of a significant payday was a distraction and has left many of the talented Figma team looking for new experiences. New York Times wrote up a detailed article: After Its $20 Billion Windfall Evaporated, a Start-Up Picks Up the Pieces.

Adobe has a significant advantage with its time-tested ecosystem, that saves professionals significant time via the tight integration across tools. This seamless integration and propagation of changes across applications allows professionals to move between tasks without breaking their workflow.

Diving into the financials:

TTM revenue grew 11%, holding relatively steady over the last few years

Guidance calls for revenue growth to slow slightly to 10%, yet companies are known for providing conservative outlooks & RPO growth shows the possibility of even acceleration

TTM gross margin held steady at 89%. This is very impressive and shows how efficient the company is at the unit level.

TTM EBITDA margin came in at 40%, showing a steady uptrend

TTM FCF margin jumped up to 37%, as the company works past the $1b breakup fee they paid Figma. Historical margins were 40%+, so more room to improve there.

Balance sheet is strong, with a net cash position of $2.2 billion

Shares outstanding declined 2.4% y/y. Their share buybacks are more than offsetting stock based compensation.

The company is very efficient, with ROIC of 36% FCF ROIC at 38.6%. ROIC gives context on the performance of prior decisions.

ROIC ex goodwill is significantly higher at 97%. ROIC ex goodwill gives an indication of ongoing capital requirements. Most of Adobe’s capital outlay has been due to acquisitions. The company’s operations do not require much capital at all.

As for valuation:

Adobe trades for an EV/NTM EBITDA multiple of 16.9x. This is not very expensive at all for such a profitable and capital efficient company with ongoing growth.

For context, Adobe’s 10 year average multiple is 23.5x with a standard deviation of 5.1x. The current multiple is more than 1 standard deviation cheaper than the historical average.

The FCF yield of 4.1% is very attractive as well, in absolute terms as well as in historical terms compared to the 10 year average of 3.06%.

(Note in the LTM FCF in the chart below has not yet been updated with the latest earnings report.)

Looking at the next few years, revenue is expected to grow ~9-10% and EBITDA is expected to grow ~9%.

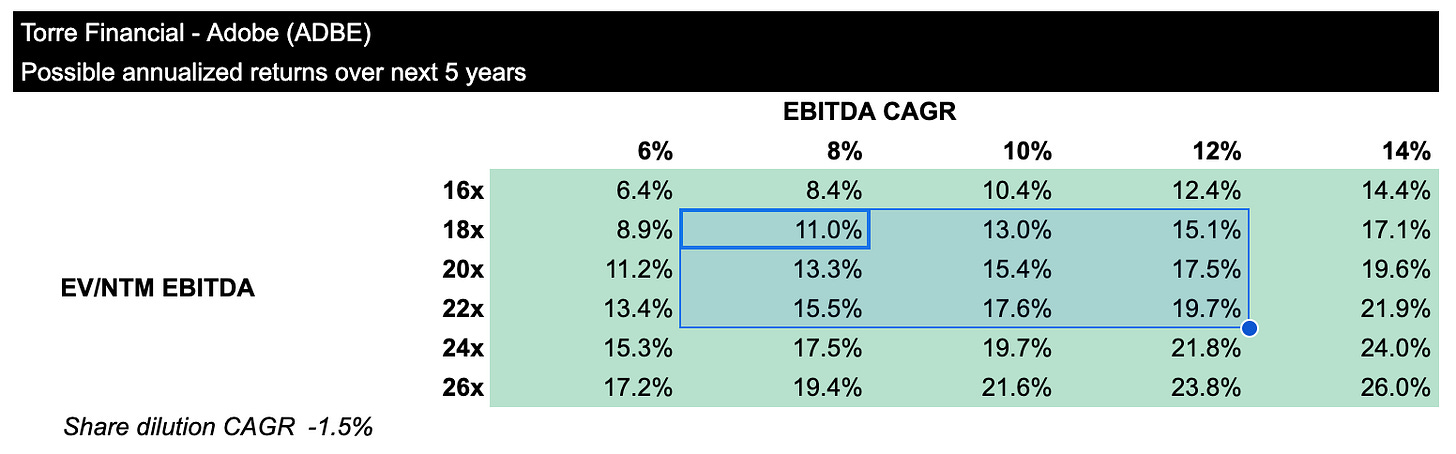

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes share count declines by 1.5% each year due to continued buybacks.

An investment in ADBE can very reasonably yield double digit returns.

If EBITDA grows at 8% CAGR and multiple trades at 18x, shares could return 11% per year

If EBITDA grows at 10% CAGR and multiple trades at 20x, shares could return 15% per year

If EBITDA grows at 10% CAGR and multiple trades at 22x, shares could return 18% per year

FastGraphs provides another look.

Looking a few years out, if shares were to trade at a P/E of 25x, shares could return 13% per year.

If shares were to trade at their historical normal P/E of 38.6x, shares could return 30%+ per year.

Taking a look at the price action:

After the interest-rate induced sell off in 2022, Adobe shares recovered significantly throughout all of 2023.

The beginning of 2024 brought some volatility, with shares drawing down nearly 30%.

The most recent sell off dropped below the June 2024 low, forming a series of lower highs and lower lows & indicating bearish momentum.

The 50-day simple moving average (SMA) is below the 200-day SMA, which is a bearish signal. The price is also trading below both moving averages, further supporting the downtrend.

The relative strength indicator (RSI), currently below 30, indicates that the stock may be oversold. This could suggest a potential reversal in the near term.

The volume profile shows low activity around the current price levels. If the stock were to bounce back, there would likely be some resistance at ~$470. On the downside risk, the next level of strong support would be ~$380.

All said, the current technical picture doesn’t look too great. Over time, the company’s strong fundamentals are likely to become reflected in the stock price. It may, however, be a choppy ride in the short term.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.