Market, Earnings, & Adobe (ADBE) - September 14, 2024

Market commentary, portfolio company earnings results, and a deeper look into Adobe (ADBE)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market experienced some turbulence starting September, momentarily dipping below the 50-day moving average. Over the last week, however, the S&P 500 was able to reclaim momentum and recoup the drawdown entirely.

The recent price action looks to have put in another higher low. The current level is likely to present some resistance. The market sold off the last two times the market approached the 565 level. How the market trades around that level will be key – can it break through or will it sell off again?

For now, the market is still in a strong uptrend.

Year-to-date performance across indices:

S&P 500 +18.0%

Nasdaq +16.0%

Dow Jones +9.8%

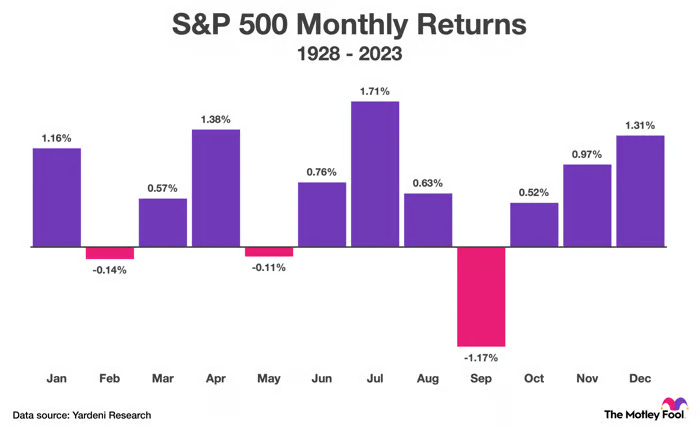

September is known to be a difficult time for the market. Looking back through 1928, calendar returns for September have averaged -1.1%. September is the worst month by a significant margin.

Election day is coming up on November 5th, adding additional uncertainty.

Markets however are future looking. These two pieces of information, and much more, are well-known and quickly priced in. September has started off with some volatility – it may have been front-loaded.

Shifting to the economy, inflation continues to subside. The CPI report for August showed inflation decelerating to 2.5% from the prior 2.9% reading.

Truflation, a real-time inflation index, is showing inflation is down to 1%.

Inflation appears to be under control and reasonably near the Fed’s 2% target.

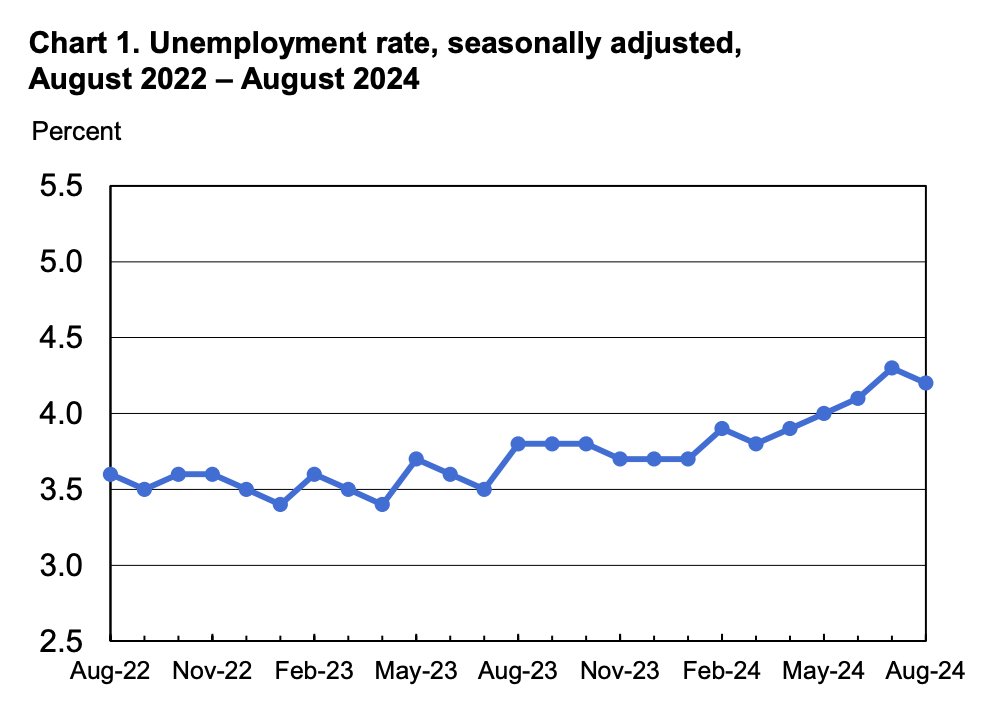

The job market continues to loosen. The unemployment rate for August came in at 4.2%, a meaningful change from the ~3.5% range a year ago.

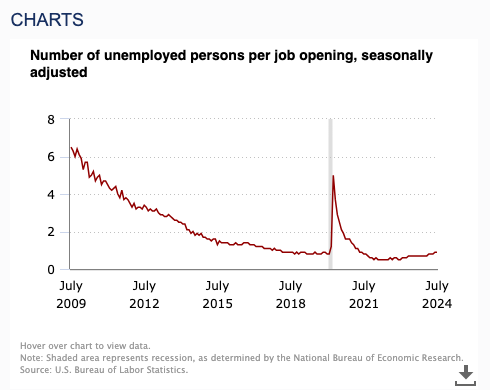

The ratio of unemployed persons per job openings continues to trend slightly upwards.

A few years ago, the “Great Resignation” was coined in reference to the amount of people quitting their job and moving to another. That dynamic is changing as the quit rate has hit a post-pandemic low.

Moderating inflation (“stable prices”) and ensuring a healthy job (“maximum employment”) market are two key mandates of the Federal Reserve.

The Fed has maintained a restrictive interest rate policy over the past year. One worry was inflation re-igniting such as it did in the 70s. The Fed Funds target is 5.25-5.50%, well above the inflation rate of 2.5%.

Coupled with the job market showing signs of weakness, it seems appropriate to lower the fed funds rate. Jerome Powell has publicly acknowledged it, citing the pace of the decrease as the key variable.

The market expects a 25 basis point cut in the next meeting on September 18th and another 75 bps by the end of the year.

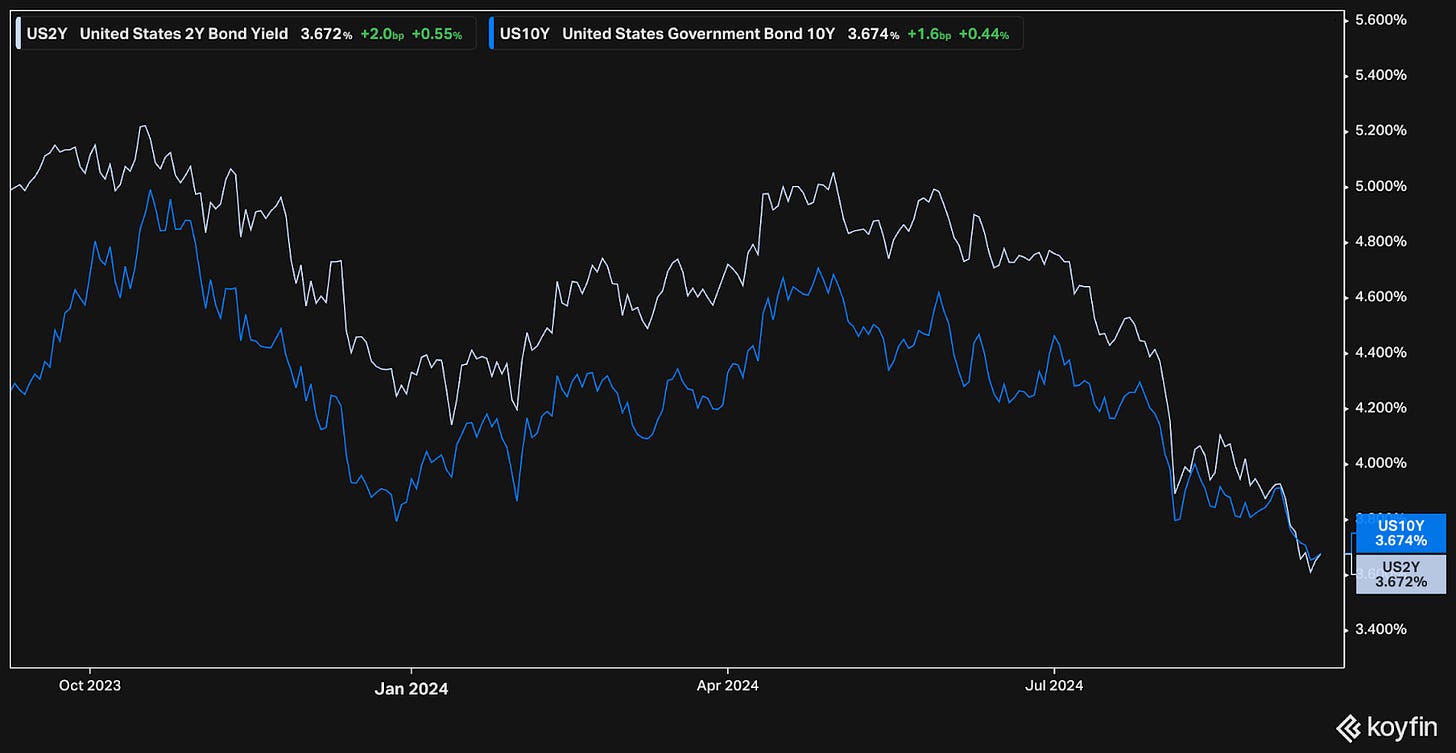

The bond market shows how these expectations get priced in quickly.

Yields on lower duration bonds (i.e. 2 years here), which are more closely tied to the fed funds rate, have come down meaningfully over the last months.

Yields on longer duration bonds (i.e. 10 years here) have been slightly less volatile as they are more closely tied to expectations of the longer term economy – job market, long term inflation, government policy, spending, etc.

Typically longer duration bonds have higher yields than shorter bonds – there’s more risk locking in money for a longer period of time. That dynamic has been flipped, or “inverted”, the last few years.

Recently the yield curve has been un-inverted. Long term yields are now above short term yields again.

The chart below shows the 10y-2y yield curve (the yield of 10y US treasuries minus 2y US treasuries) Historically, there has been a recession soon after the curve steepens (i.e. the 10 year yield increases relative to the 2 year yield).

This observation could be a reflection of other causal events. For example, when the economy weakens, the Fed tends to cut rates to stimulate the economy. That would cause a steepening – short term rates go much lower, while longer term rates stay relatively stable.

The key point in this case would be keeping an eye on the true driver, the economy. Jobs, inflation, consumer spending, and corporate earnings ultimately drive the market.

For now, the stock market continues in a bull trend. Year-to-date performance has been very strong. Historically, that strength tends to propagate throughout the year.

Earnings

Over the last two weeks, 1 portfolio company reported earnings.

Adobe (ADBE)

Prior coverage:

Adobe’s main business units consist of Creative Cloud, Document Cloud and Experience Cloud. They continue to show strength and innovate across all three.

Recent releases, focusing on both enabling everyone from enterprises to solopreneurs and freelancers, include:

A gen AI-powered content hub to help brands manage their assets

Adobe Experience Platform AI Assistant to help optimize user journeys including with personalized generated content and predictive analytics

Integrating with TikTok, to bring their commercial music library into Adobe Express

Video generative AI in Adobe Premiere Pro for professional video workflows

Over the last year or so, investors have questioned Adobe’s moat. The worries have centered around both open-source AI solutions as well as more traditional competitors disrupting their moat.

Open source AI tools like Dall-E and Midjourney are able to advance quickly. Early on, they were often touted as having the more realistic and higher-quality generated content. For a business however, this content is challenging to use. Companies must consider intellectual property & copyrights, brand personality & tone of voice, safety, consistency, and much more. It is unlikely that an enterprise could use open source software without investing significantly on top of the models to cover the aforementioned items as well as building it into their workflows.

The other threat is from up-and-comers, such as Figma and Canva. Both of these companies have gained significant traction and both focus on collaboration.

Figma is collaborative design software primarily for software product designers and UI/UX (user interface/user experience) professionals, as they design web-based interfaces and work with software engineers for implementation.

Canva is collaborative design software primarily for beginners and amateurs looking to create graphic designs for various use cases, including presentations, social media, and more. It is more akin to Powerpoint or Google Slides.

Adobe is a suite of applications and end-to-end workflows primarily for creative professionals across graphic design, marketing, and video. The degrees of freedom and complexity are both greater.

Although the areas of focus are not an exact overlap, Adobe has taken notice of their success and has taken action.

Adobe attempted to acquire Figma for $20 billion, yet the deal was terminated in December 2023 due to regulatory concerns. Although unfortunate and costly, this process must have been a distraction for the Figma team. Adobe is not competing directly in this space. Adobe XD, the competing software product design software, is in maintenance mode.

Focusing on the beginners and amateurs, as Canva does, is an interesting play. As AI makes creativity more accessible to everyone, building the top of the funnel will become more and more competitive. Adobe is actively competing in this space with Adobe Express. The company continues to invest heavily, marketing it heavily, integrating AI functionality, and expanding it for enterprise usage.

While Adobe seeks to serve the full spectrum of customers, their strength lies in serving the enterprise. Their solutions are embedded in their customer’s workflows. They have built out the tablestake enterprise functionality – granular access, controls, user management, compliance, etc. It is difficult for a large company to replace an embedded solution, retool their workflows, and retrain their employees. Adobe has a large and expanding customer base that they are serving well and continue to deliver innovative solutions.

Adobe’s Q3 earnings were released on September 12th. Their performance for the quarter was very strong, exceeding the strong guidance they had set out.

Guidance for Q4, however, came in slightly lower than expected. While management mentioned this was due to deals getting pulled forward (This is usually a good thing! Investors dislike when deal time extends.), the worry is that the slower growth could be setting the tone for 2025.

Notwithstanding the guidance concerns, the business seems to be firing on all cylinders with all segments expanding and an optimistic outlook on the ability to integrate and sell AI-powered solutions.

Quotes from the earnings call with CEO Santanu Narayen:

Our vision revolves around Adobe's deep technology platforms across Creative Cloud, Document Cloud and Experience Cloud, which when integrated provide significant differentiation and value.

We're bringing together content creation and production, workflow and collaboration and campaign activation and insights across Creative Cloud, Express and Experience Cloud.

New offerings include Adobe GenStudio and Firefly Services empower companies to address personalized content creation at scale with agility and enable them to address their content supply chain challenges.

Our greatest differentiation comes at the interface layer with our ability to rapidly integrate AI across our industry-leading product portfolio.

With Creative Cloud, the demand for creative expression and design across media types and surfaces has never been greater. Consumers are sharing edited photos more than ever.

With Express, we're on a multiyear strategic journey to dramatically expand our reach across customer segments. Adobe Express is our AI-first content creation application, fulfilling our mission to enable creativity for all. The all-new release of Express across web and mobile earlier this year has been embraced by millions of users. They love how easy it is to create anything in Express.

Through the integration of Experience Cloud and Creative Cloud, Adobe is uniquely positioned to combine the right content, data and journeys in real-time for every customer experience.

Vanguard was able to increase quality engagement by 176% by focusing on one-to-one personalization and to realize millions in savings by improving content velocity and resource allocation with an end-to-end content creation workflow.

Diving into the financials:

TTM revenue growth came in at 11%. When looking at the decimals, it shows a slight acceleration.

Gross margin expanded to 89%. This is a top tier number.

EBITDA margin expanded to 39%.

Adjusted EBITDA margin, which adds back stock based compensation, came in at 48%.

FCF margin is holding steady at 31%. This will be hindered by the $1 billion breakup fee paid to Figma for another couple of quarters.

The balance sheet is strong and improving with net cash of 3.4 billion. The company has 7.5b in cash and equivalents, and just over 4.1b in debt.

Shares outstanding are declining at a pace of 2.3% y/y. In March 2024, the company announced a $25b share repurchase program. The company purchased 2.5 billion in Q3 and has $20.15 billion remaining, representing roughly 8.5% of the market value.

On efficiency, Adobe’s ROIC comes in at 34.5% and 31.5% for net earnings and FCF respectively. When excluding goodwill, which gives a look at future capital requirements of the business, those numbers are even stronger up in the 90%+. Adobe is a cash generating machine.

Additionally, not shown in the table above, Adobe reports on their order book via the remaining performance obligation. This is a leading indicator for revenue – basically agreements with customers for which revenue has yet to be recognized. They have about 90% of last 12 month’s revenue in their RPO and it is growing at 15% – faster than revenue! This is a very positive sign for future revenue growth.

As for valuation:

Valuation seems very reasonable at 20.3x EV/NTM EBITDA and 2.8% FCF yield.

Over the last 10 years, Adobe traded at a mean multiple of 21.3x and the mean FCF yield 3.3%. Recall the current FCF is temporarily suppressed due to the 1b termination fee to Figma.

Looking forward, sales are expected to grow 10-11% per year over the next few years.

EBITDA is expected to grow similarly at ~10%.

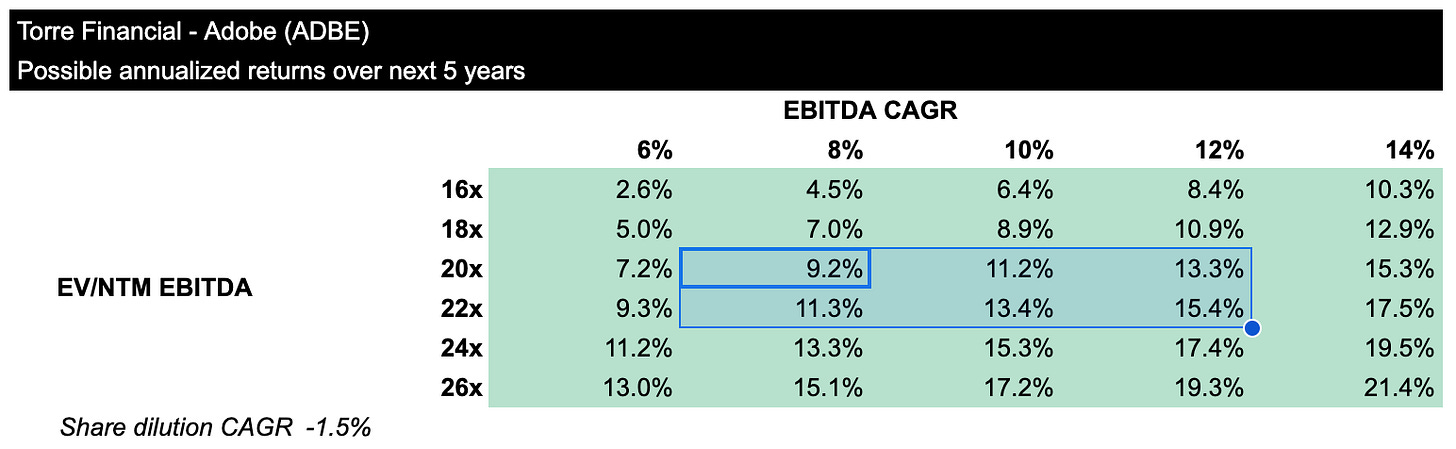

The following table shows possible annualized returns over the next 5 years across various scenarios. The model assumes annual share reduction of 1.5%.

If the company trades at multiples of 20-22x, shares could return between 9-15% per year.

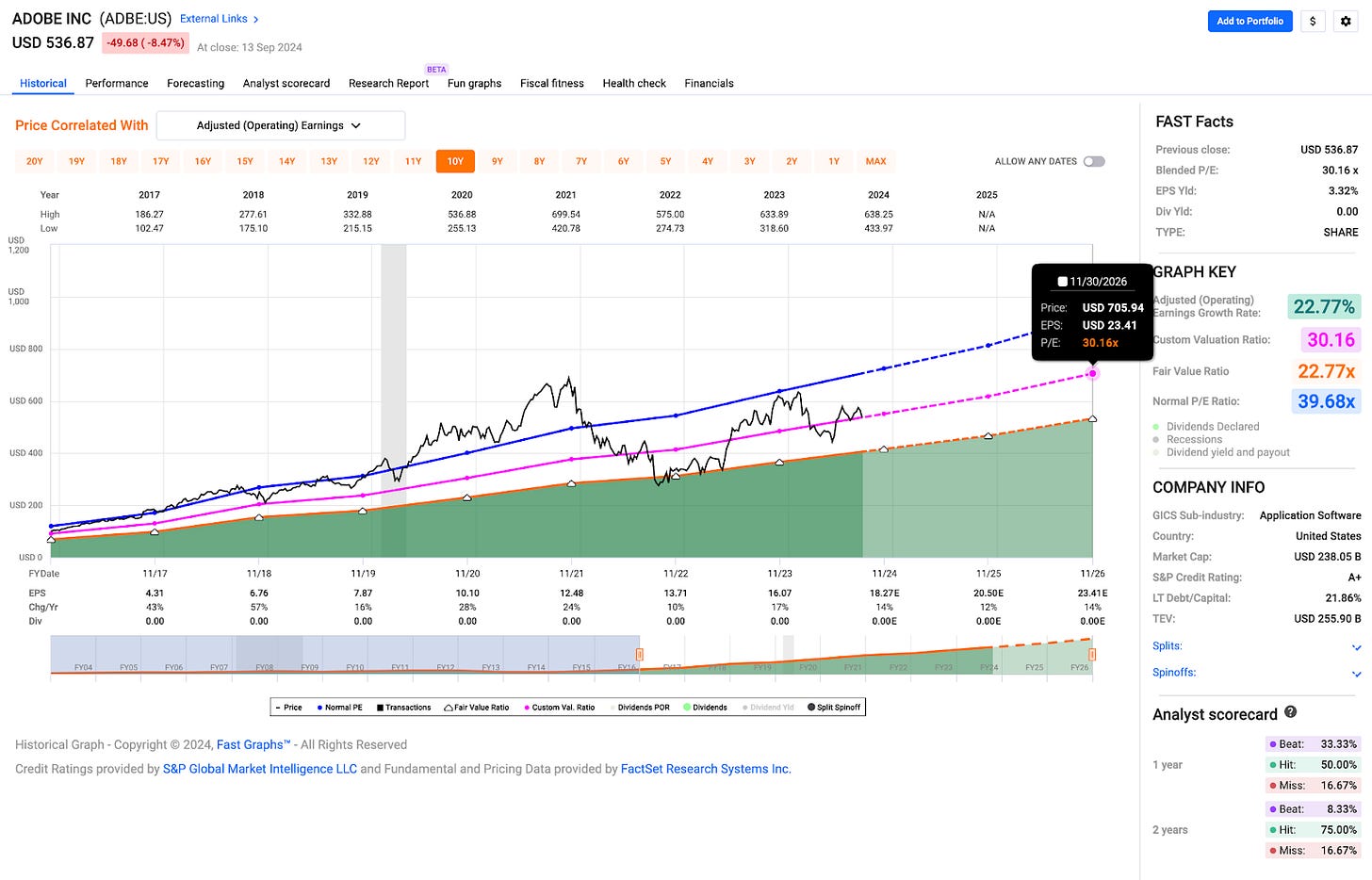

Fastgraphs provides another look.

If shares were to maintain the current blended P/E multiple of 30.16x, Adobe could trade up to $705 in a few years, delivering annualized returns of over 13%.

Taking a look at the price action:

Shares sold off nearly 9% after the most recent earnings announcement. Shares are now trading below both the 50-day and 200-day moving averages.

There are, however, some constructive signs.

The 50-day average is still above the 200-day average, showing some momentum was building.

The current price is sitting right on top of a strong volume shelf that can provide support.

The RSI is showing shares are getting close to being oversold.

If shares are able to hold the current level, they could form a strong base. The current level would form another higher low.

It will be critical to see shares maintain or bounce from the current level in the coming weeks. The share price will need to cross above the 200-day moving average to continue the momentum.

Risk-reward wise, the setup today seems like a good entry point for a long term investor.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.