Market, Earnings, & Intuit (INTU) - May 24, 2025

Market commentary, portfolio company earnings results, and a deeper look into Intuit (INTU)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market recovered quickly from the global-trade-induced correction. The S&P 500 posted a strong streak, with gains in 17 out of 20 trading days. The index briefly recovered all losses for the year, before giving back some of the gains.

The weakness in the last few trading days leaves the SPY index in a precarious position – just barely above $575, which happens to be both the local peak set on March 25th and the 200-day simple moving average.

As long as uncertainty and volatility linger, it may be prudent to remain cautious.

Year-to-date performance across indices:

S&P 500 -1.34%

Nasdaq -0.46%

Dow Jones -2.21%

The Trump administration stepped back from their hard stance on global trade. Scott Bessent stepped into the spotlight, helping ease the narrative. Negotiations began with many countries, showing possible green shoots. Trump pulled back on some tariffs. The market ran with the positive developments.

Then, over the last few days, Trump threatened to significantly increase tariffs on the European Union, reigniting uncertainty.

The volatility index (VIX), often known as the fear index, had declined significantly, before popping back.

Volatility crush events have historically been followed by above-average returns. May 2025 posted the largest 6-week volatility decline on the record.

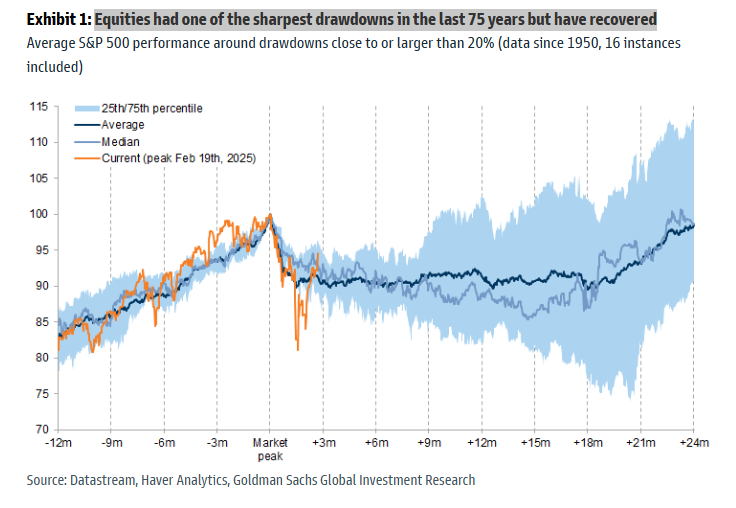

When looking at historical market performance before and after corrections, it is clear that the 2025 correction has been steep and the recovery swift. It also provides a cautious tale: it may take a while for the market to get back into bull mode.

Most of the buying over the last 4 weeks appears to have come from private clients and individual investors. Hedge funds and institutional investors have been taking money out.

Year-to-date, defensive sectors have been driving performance.

Utilities, Industrials, and Consumer Staples are leading the pack.

Consumer Discretionary, Health Care, Energy, and Technology have underperformed the SPY.

Yet over the last month, the story is different, signaling a potential rotation of capital.

Technology, Consumer Discretionary, Industrials, and Communications are leading significantly.

Health Care, Consumer Staples, Real Estate, and Energy are lagging behind.

The US Dollar is down 10% for the year, now at its lowest value over the last 3 years. A weaker dollar benefits companies with international sales, making their offerings relatively cheaper and more accessible.

A weaker dollar, however, makes imported goods more expensive which raises the price on everyday items. Combined with tariffs, which will also result in higher prices as some costs being passed through, there seems to be upward pressure on inflation.

Truflation, a real-time inflation index, shows inflation is moving swiftly upwards since April.

The bond market is also piecing the story together. While short-term rates may be driven by the Fed, longer term rates are set by the market.

The US 10 year-yield has been ticking higher since April and ended the week above 4.5%. Investors are demanding higher yields for longer duration.

As for the Fed, they are holding firm and staying patient. Expectations now call for only 2 rate cuts this year – down from 4 just a few months ago.

Earnings

Over the last two weeks, 1 portfolio company reported earnings.

Intuit (INTU)

Prior coverage:

"Intuit is a global financial technology platform with a mission to power prosperity around the world. Our platform helps consumers and small and mid-market businesses prosper by delivering financial management, compliance, and marketing products and services. We also provide specialized tax products to accounting professionals, who are key partners that help us serve small and mid-market business customers."

- Intuit 2024 Annual Report

Intuit is the parent company behind many well-known services including QuickBooks, Credit Karma, TurboTax, Mailchimp, and more.

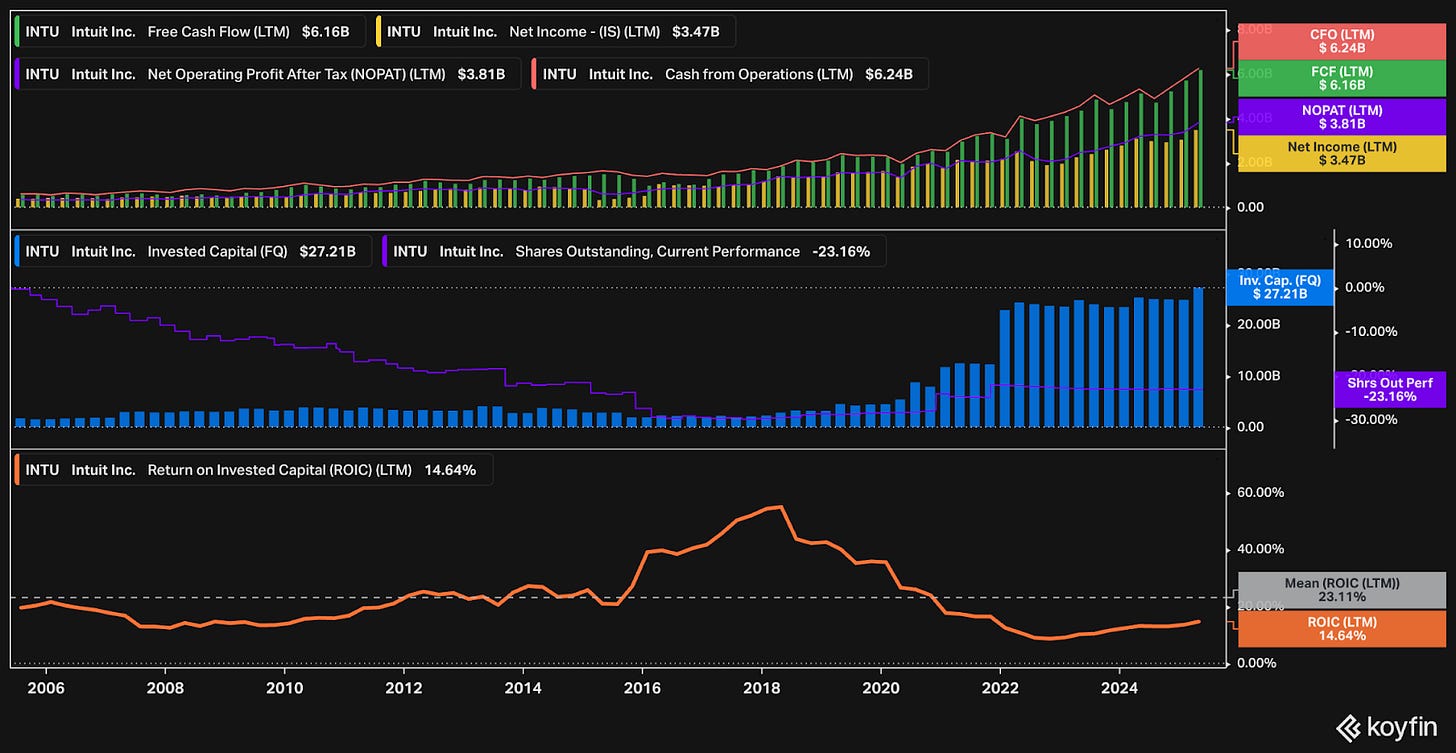

The business has grown significantly over time. Over the last 20 years, free cash flow has grown over 10x, from $560 million to over $6 billion.

Intuit has been highly efficient, with return on invested capital (ROIC) averaging 23% over the period. ROIC declined significantly in 2022, as the invested capital doubled with the acquisition of Mailchimp. It has been trending up since.

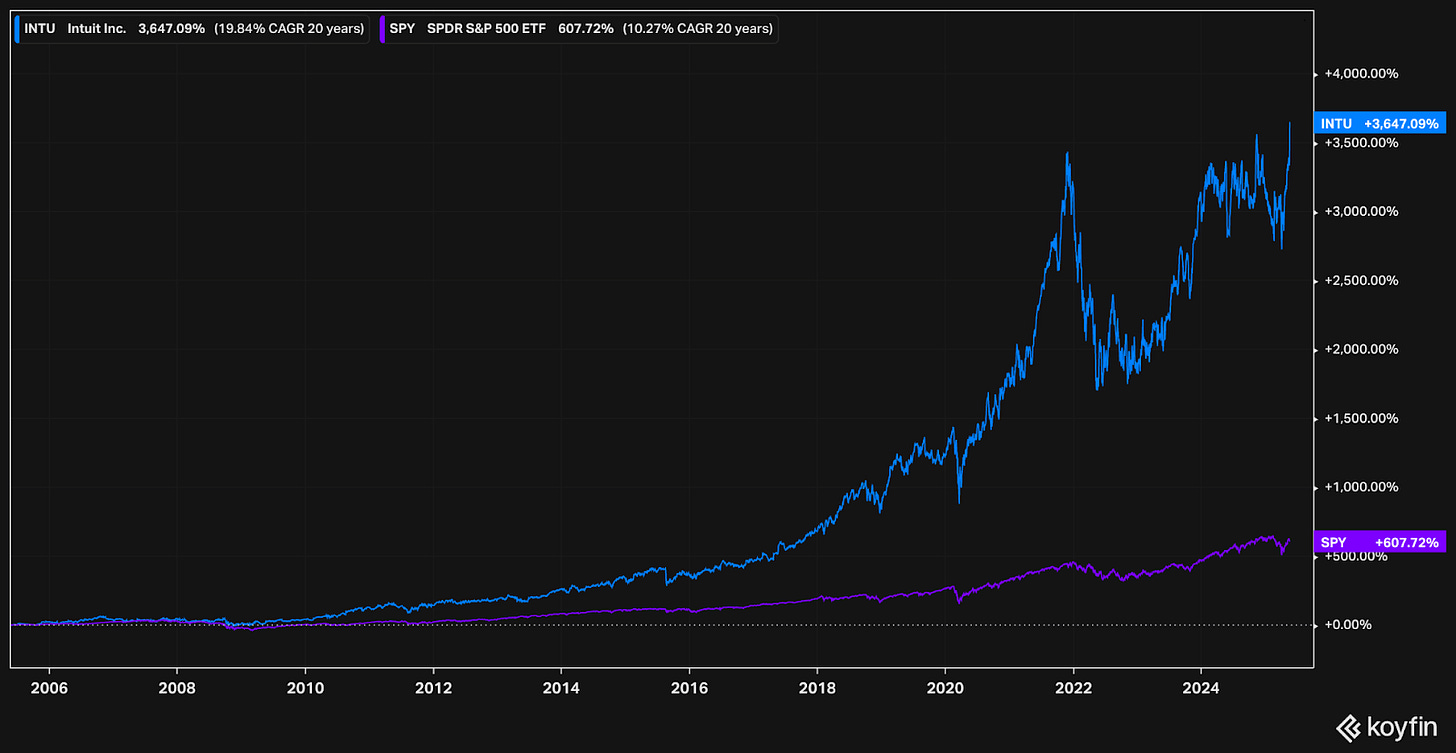

Over the last 20 years, an investment in Intuit would have generated annual returns of 19.8% CAGR while the S&P 500 (SPY) returned 10.3%.

Intuit continues to execute well to this day, serving consumers, entrepreneurs, small businesses, and tax professionals.

Intuit is well positioned in today's climate and benefits from many macro changes to the current landscape, including many actions of the current administration.

Tariffs and global instability have created plenty of uncertainty for companies with international business, whether that is higher costs due to tariffs on foreign production or customers holding off purchasing or growing with USA counterparts due to the government’s actions. Intuit's business is relatively sheltered from all of it, as it primarily offers software and services within the USA, albeit with limited exposure to Canada.

DOGE and fiscal oversight has led to the decommissioning of many governmental programs and operations. As these are being pushed over to the private sector, they drive increasing importance of Intuit's offerings such as QuickBooks and TurboTax.

The Trump administration has called for deregulation, making things easier for businesses. Lower barriers will result in higher profit which in turn will encourage competition – creating more new businesses that will likely use Intuit’s services.

Changes to the tax code also seem to be on the near horizon. Tax returns will have to adapt to new rules, reinforcing TurboTax’s value proposition. Tax cuts would also strengthen and incentivize more small businesses, supporting QuickBooks.

Although it seems to be continually delayed, interest rates are expected to decline over the coming years, which would drive increased demand for lending products. Intuit’s Credit Karma would benefit significantly, as its affiliate model matches consumers with the right financial products.

Intuit has long been a leader in AI for financial services. They've continued to innovate and embed solutions into their offerings, streamlining workflows and saving their customers time. Intuit has a unique treasure chest of financial data that puts them in a uniquely strong position.

The most recent May 2025 earnings call substantiates the businesses’ strengths, as revenue grew 15% and they raised guidance across all company metrics including revenue, operating income, operating margin, and earnings per share.

The market reacted positively. Shares jumped 8% the next day, even as indices were nearly -1%.

Diving into recent financials:

TTM revenue growth ticked up to +15%, consistently accelerating over the last few years

TTM gross margin was steady at 80%, a very strong level

TTM EBITDA margin jumped up to 33%

TTM FCF margin increased to 34%. It is important to see strong cashflow conversion from earnings to FCF.

TTM adjusted FCF margin (FCF minus stock based compensation) came in at 23%. SBC is quite significant, yet the company is able to operate very profitably in spite of it.

The balance sheet is strong with 6.2b of cash and 6.4b of total debt. The net debt of 232 million is marginal.

Shares outstanding ticked down further to -0.2%. Share count has been generally steady over the last few years, which is good to see given the high SBC. Intuit did repurchase $754 million of stock in the last quarter, and has another $2.8 billion remaining in their repurchase authorization.

The company is operating efficiently, with ROIC increasing to 16.3% and FCF ROIC of 23.7%.

Including goodwill in invested capital gives context on management's historical decisions - answering questions such as "how well have prior acquisitions played out?"

When removing goodwill from the invested capital, the efficiency (ROIC ex-goodwill) jumps up to 34.8%.

Removing goodwill from invested capital gives context about the company's ongoing capital requirements - answering questions such as "how much capital will they need to plow back into the business as they continue to grow?"

As for valuation:

Shares currently trade for 23.2x EV/NTM EBITDA and a FCF yield of 3.1%. This seems to be close to fair valuation for a high quality, proven company.

The current valuation is slightly above the 10-year historical means of 22.5x EV/NTM EBITDA and 3.3% FCF yield.

Analysts expect the company to continue to grow. Sales are expected to grow at ~13% CAGR, with EBITDA growing slightly faster at ~14% CAGR.

Looking 5 years out, if we compare potential EBITDA growth rates across various possible exit multiples, we can analyze expected annualized returns for various scenarios.

If EBITDA grows at 12% CAGR and the multiple compresses to 22x, shares could return 11% per year over the next 5 years.

If EBITDA grows at 14% CAGR and the multiple ends at 24x, shares could return 15% per year over the next 5 years.

Fastgraphs provides another look:

If the current P/E multiple (36.9x) were to compress to the historical average (33.9x) over the next few years, shares could produce returns of over 10% per year.

Given the strong historical execution, coupled with the current landscape providing positive tailwinds, Intuit seems to be an attractive investment opportunity even after the recent pop in stock price.

We added recently at around $570 and are content to hold. Buying below $650 seems to offer a suitable margin of safety for double digit forward returns.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.