Market, Earnings, & Abbott (ABT) - July 19, 2025

Market commentary, portfolio company earnings results, and a deeper look into Abbott Laboratories (ABT)

Every two weeks we share a review of the market, any earnings results, and a deep dive into one portfolio company. Subscribe now to follow along.

Market

The market has continued its steady climb over the past two weeks, pushing to new all-time highs as investor confidence grows. The S&P 500 (SPY) has decisively broken through previous resistance levels and continues trading comfortably above both its 50-day and 200-day moving averages, a bullish technical signal.

The primary driver of this momentum appears to be growing optimism around corporate earnings. The tangible productivity gains from artificial intelligence integrations are beginning to show up in financial results and, more importantly, in forward guidance.

Year-to-date performance across indices:

S&P 500 +7.08%

Nasdaq +9.78%

Dow Jones +4.23%

Uncertainty around global trade has resurfaced as a potential headwind for the market. The Trump administration has signaled a more aggressive tariff stance, with recent announcements including proposed tariffs of 50% on copper imports and Brazilian goods, 35% on select Canadian goods, and 30% on imports from the EU and Mexico, all with effective dates starting August 1st.

Despite the escalating rhetoric, equity markets appear to be pricing in a low probability of these threats materializing.

The S&P 500 has remained resilient, posting its 8th all-time high of the year last week.

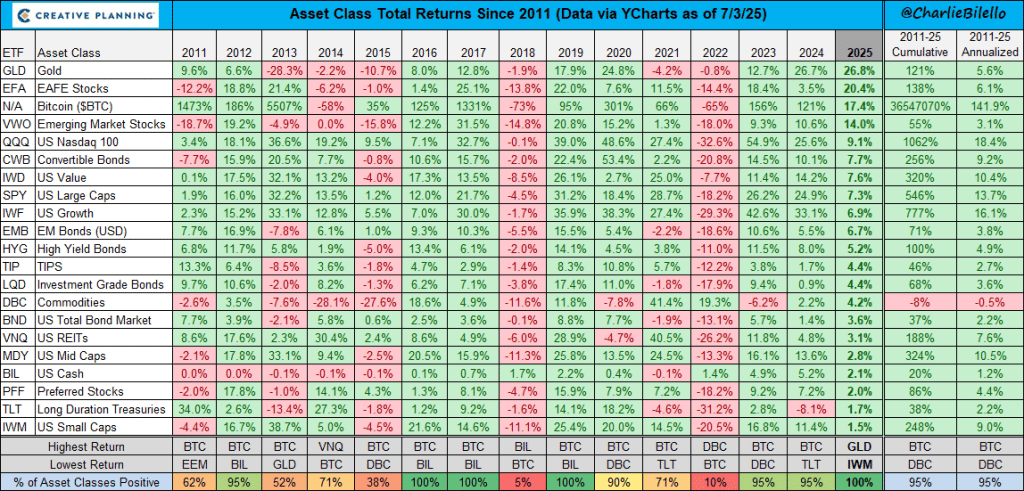

In fact, every major asset class is now green in 2025 – stocks, bonds, commodities, REITs, and more.

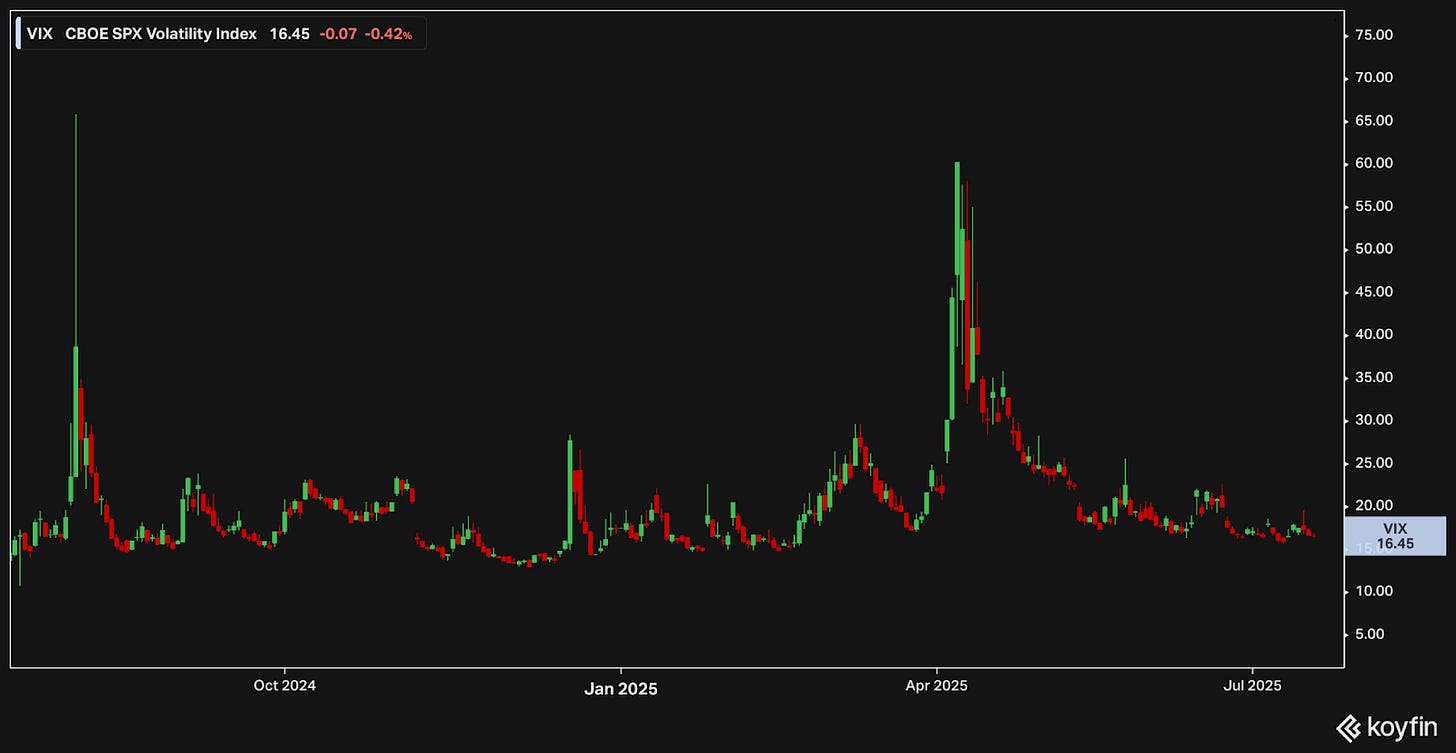

The CBOE Volatility Index (VIX) has fallen back to the low end of its recent range, indicating that demand for portfolio protection has waned and a "risk-on" sentiment prevails. While low volatility is often constructive for equities, it can also be a sign of complacency.

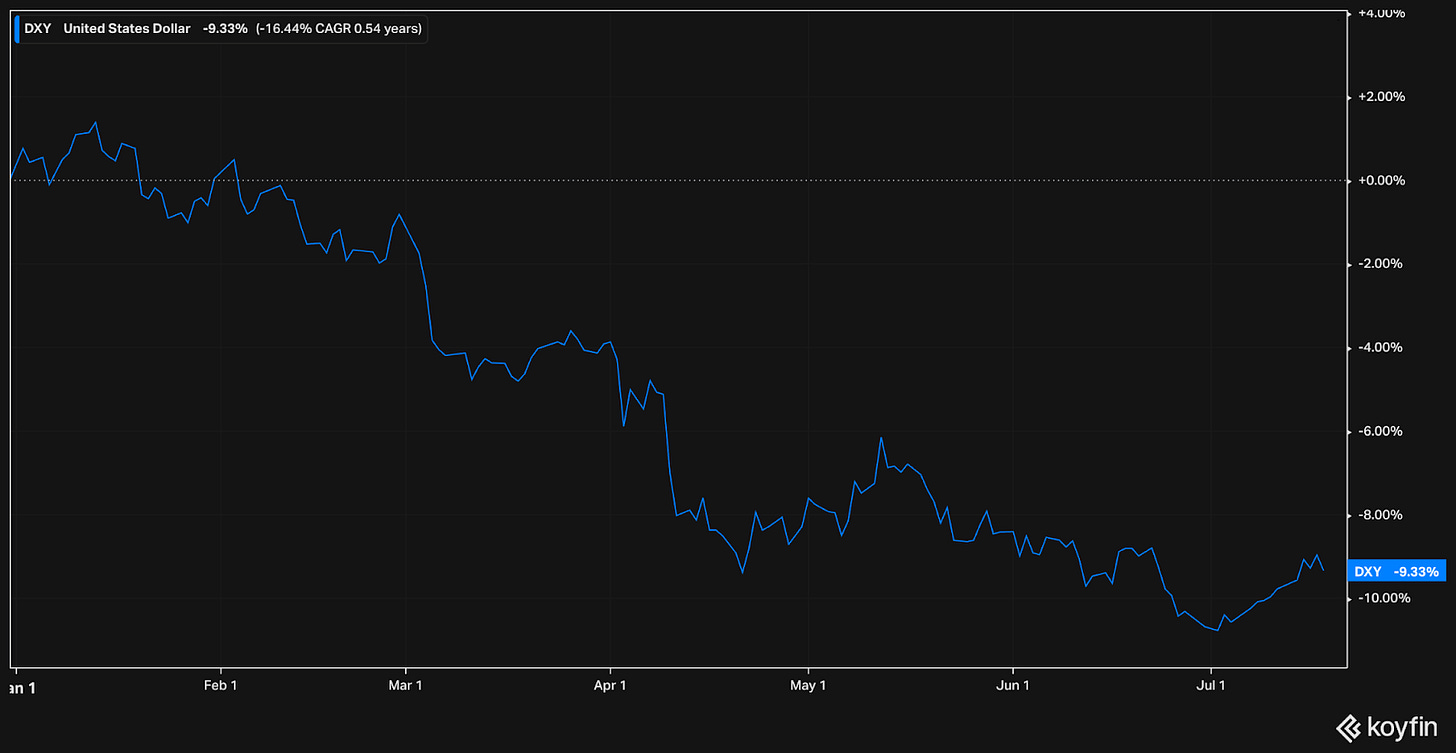

The US Dollar (DXY) is down nearly 10% for the year. Most of the weakening occurred earlier in the year. Over the last two weeks, the dollar has remained relatively stable. A stable dollar removes a potential headwind for multinational corporations, as currency fluctuations become less of a factor in earnings reports.

Inflation, as measured by Truflation's real-time index, has ticked up to 2.04%, likely driven by tariff-induced price increases.

The upward trend warrants monitoring and puts the Fed in a delicate position: they must balance the risk of reigniting inflation against the desire to normalize interest rates to support economic activity.

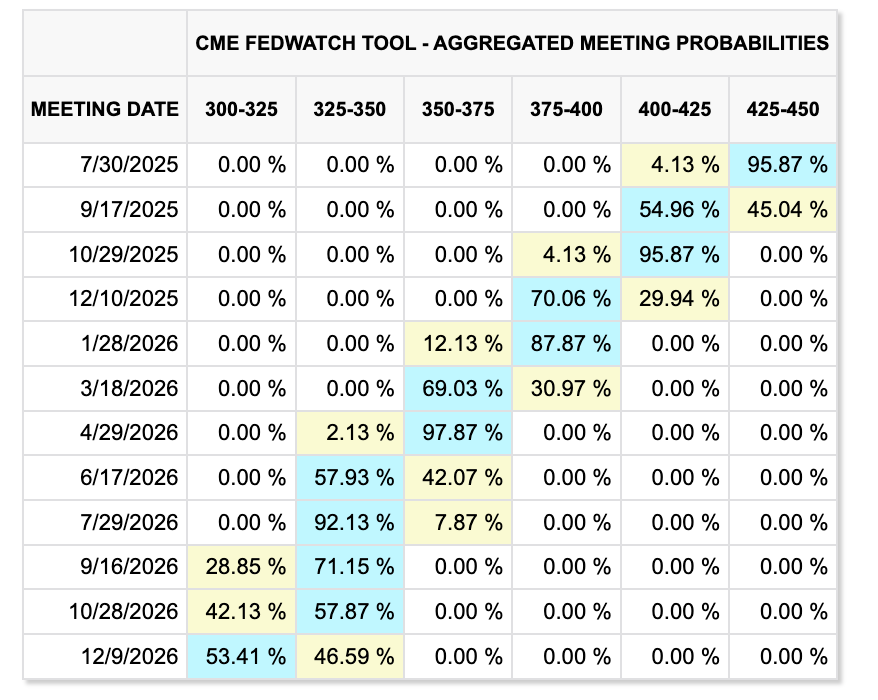

Rate cut expectations have been tempered. A July cut is now off the table. The market still expects 2 cuts in the fourth quarter.

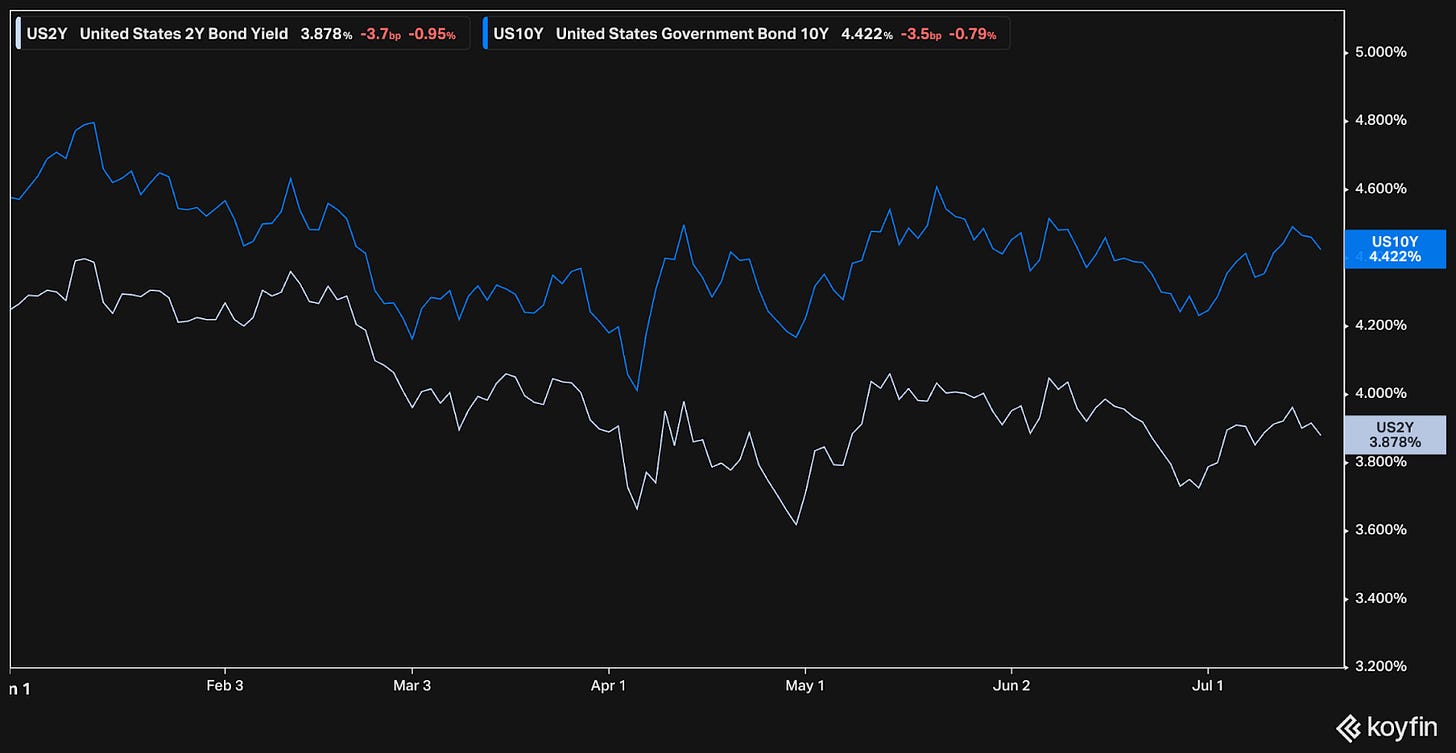

The bond market has been quick to pick up on inflation risks, widening the yield curve. While the 2-year yields have come down to 3.9%, the 10-year yields have remained stubbornly high at 4.4%.

There are many competing factors at play. On one hand, the tariffs bring uncertainty, inflation is climbing, national debt & spending keeps climbing, and yields are stubbornly high. On the other hand, rate cuts are on the horizon, inflation should settle, there’s ultimately optimism around trade policy, and we’re seeing significant productivity gains from all things AI.

"It's about time in the market, not timing the market."

Earnings

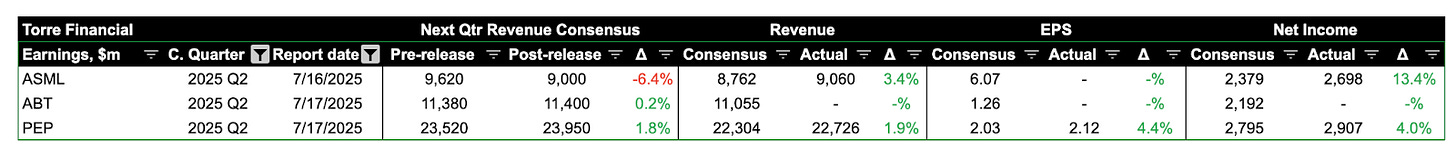

Over the last two weeks, 3 portfolio companies reported earnings.

Abbott Laboratories (ABT)

Prior coverage:

Abbott Laboratories is a diversified global healthcare company with a history of innovation stretching back to 1888. For over 135 years, Abbott has adapted and grown, evolving into a leader across a wide spectrum of healthcare.

After spinning out its pharmaceutical business, AbbVie (ABBV), in 2013, Abbott has focused on its diversified portfolio of branded generic pharmaceuticals, medical devices, diagnostics, and nutrition products.

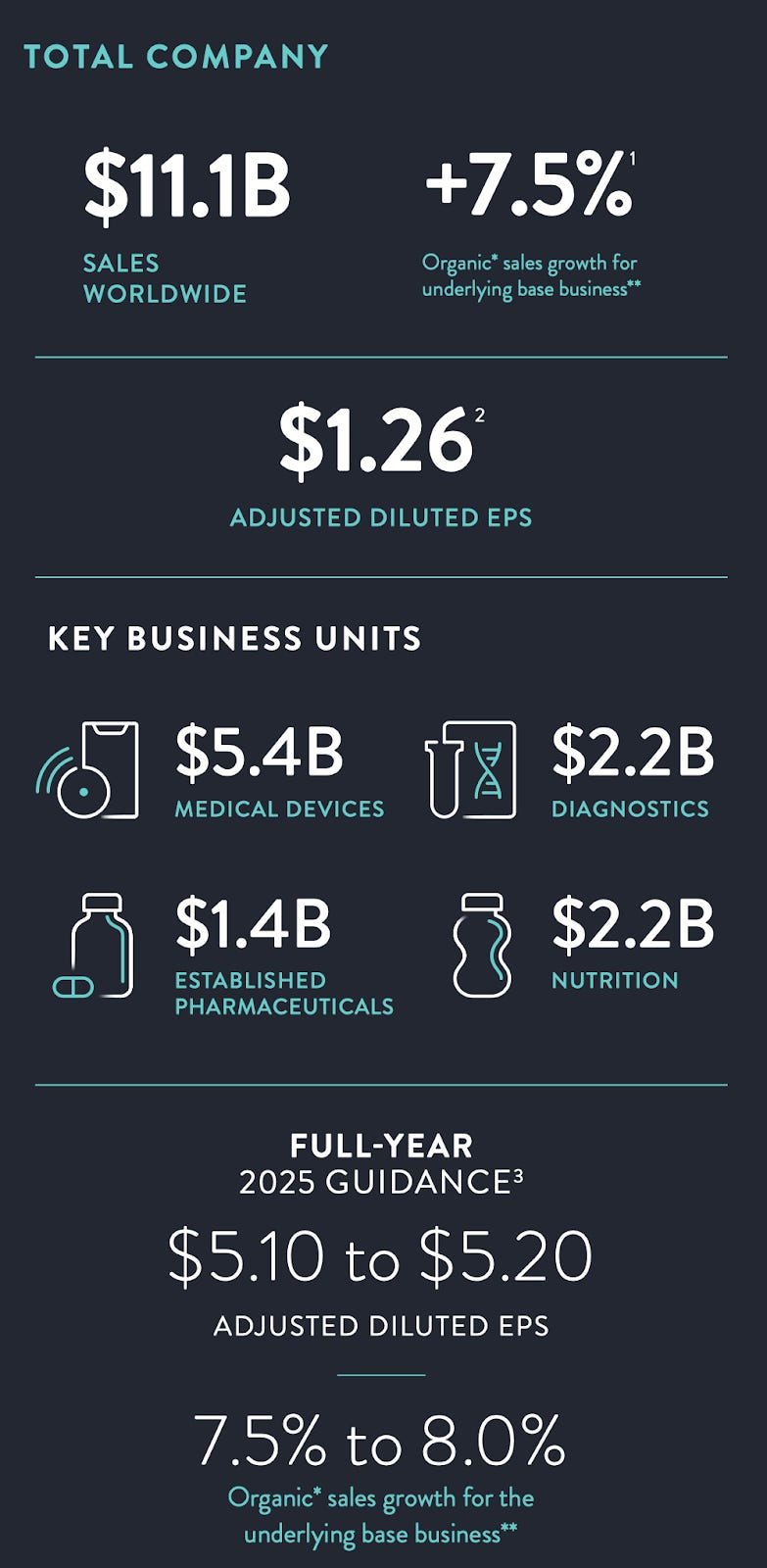

Today, Abbott's business is organized into four major segments:

Medical Devices (~49% of sales): A broad range of products including rhythm management, electrophysiology, heart failure, structural heart, and vascular technologies. Key products include the FreeStyle Libre continuous glucose monitoring system, MitraClip for heart valve repair, and various pacemakers and defibrillators.

Diagnostics (~20% of sales): Core laboratory, molecular, and point-of-care diagnostic systems and tests that are used in hospitals, laboratories, and clinics worldwide.

Nutrition (~13% of sales): A portfolio of science-based pediatric and adult nutritional products, including well-known brands like Similac, PediaSure, Ensure, and Glucerna.

Established Pharmaceuticals (~20% of sales): A portfolio of branded generic pharmaceuticals, sold exclusively in emerging markets.

The business has a resilient financial profile, benefiting from its diversification, essential product offerings, and a strong presence in both developed and high-growth emerging markets.

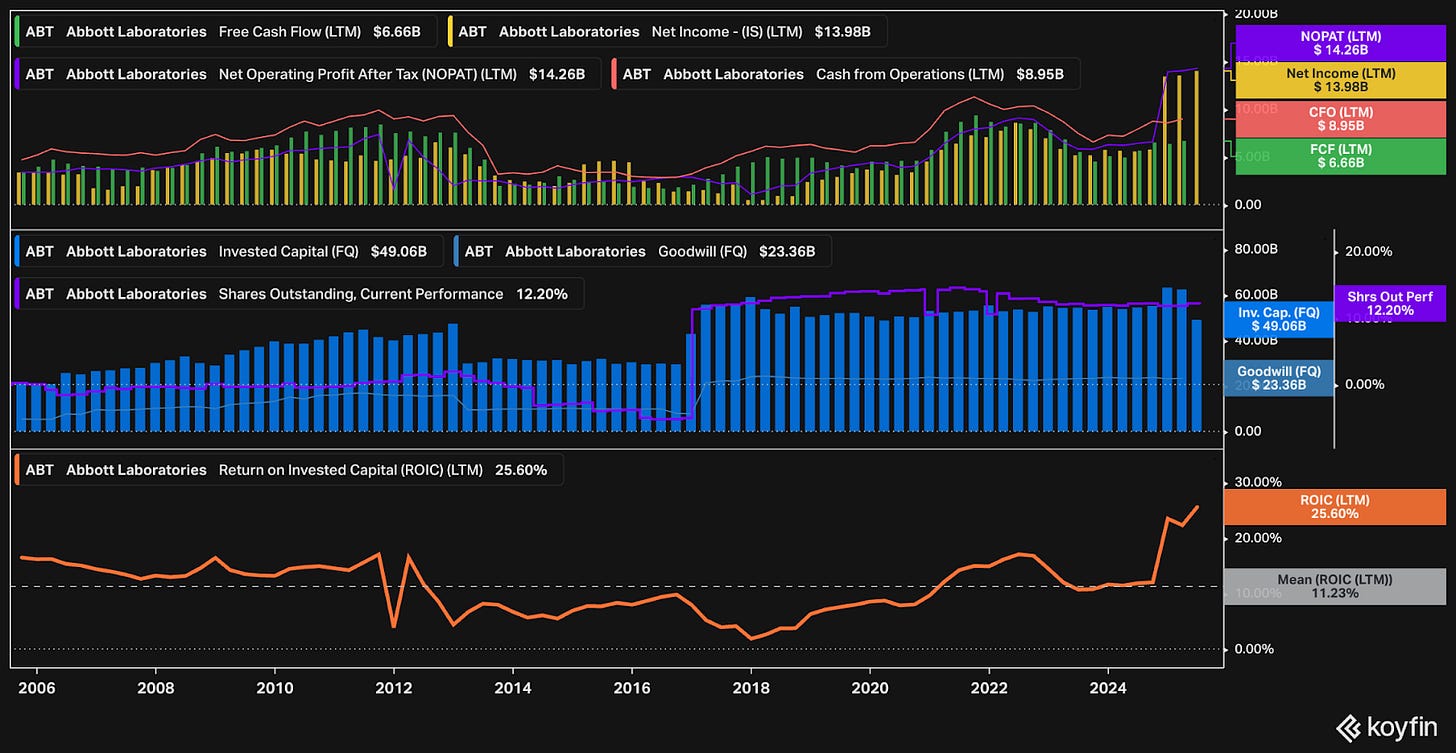

Analyzing the efficiency of the business, Abbott has maintained a solid return on invested capital (ROIC), which has been steadily improving since the AbbVie spinoff. This demonstrates a durable competitive advantage and management's ability to allocate capital effectively.

The company is also a "Dividend Aristocrat," having increased its dividend for over 50 consecutive years, underscoring its commitment to shareholder returns.

Abbott is a leader in the large, growing, and non-discretionary healthcare markets. The company is well-positioned to benefit from secular tailwinds such as an aging global population, the rising prevalence of chronic diseases like diabetes and heart disease, and increasing healthcare access in emerging economies.

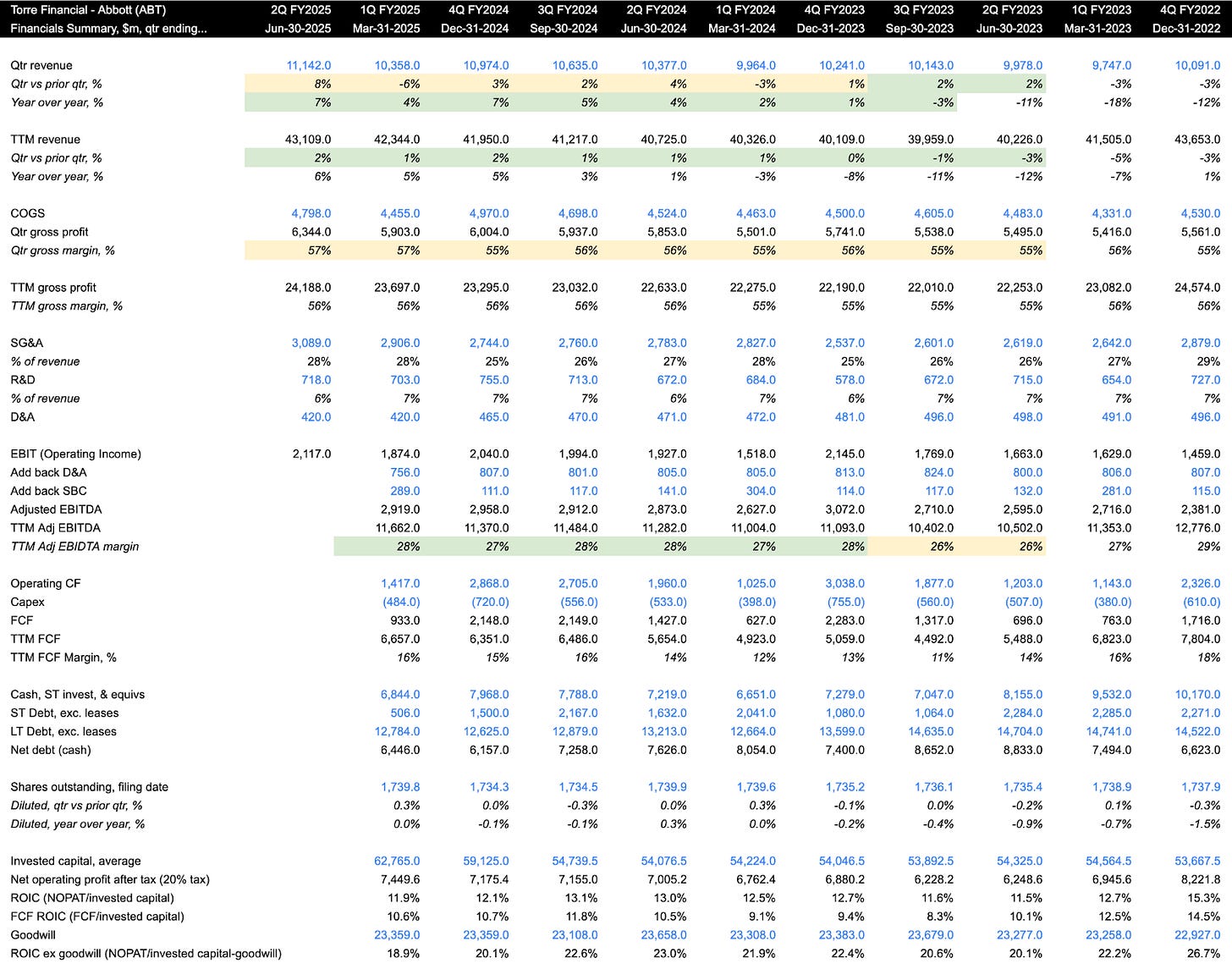

Diving into recent financials:

TTM revenue growth came in at 6% y/y, a slight deceleration, though the most recent quarter showed strong 7% y/y growth.

TTM gross margin is exceptionally stable at 56%, demonstrating significant pricing power and brand strength.

TTM EBITDA margin improved to 28%, a sign of strong operational control and leverage.

TTM FCF margin came in at 16%, towards the higher end of the historical range

The balance sheet is very strong, with $6.8b in cash and $13.2b in debt. The net debt of $6.5b shows a very low leverage ratio of 0.6x TTM EBITDA.

Efficiency remains solid. ROIC and FCFROIC are 11.9% and 10.6% respectively.

Adjusting for Goodwill/past acquisitions, we can get a sense of the ongoing capital requirements and future efficiency. ROIC ex-goodwill is 18.9%, showing a positive outlook.

These are welcome numbers for the healthcare sector, which tends to have high costs due to regulation and compliance.

Shares outstanding are flat y/y and have been quite stable over the last few years.

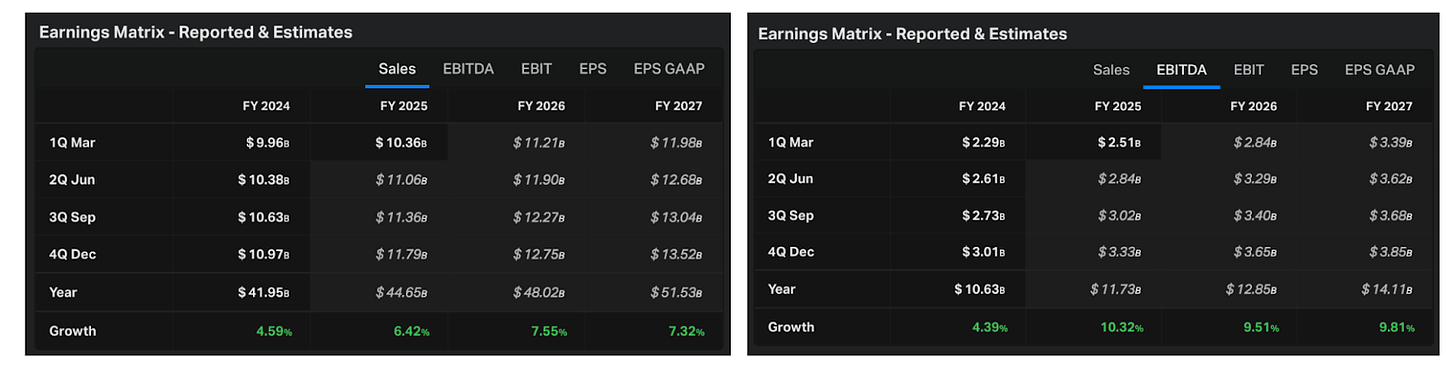

As for valuation:

Shares currently trade for 18.4x EV/NTM EBITDA and a FCF yield of 3%. For a market leader with Abbott's durable growth profile and quality, this valuation appears reasonable, sitting right around its 10-year historical average.

Analysts expect the company to continue to grow slightly. Sales are expected to grow at ~6-8% CAGR, with EBITDA growing slightly faster at ~10% CAGR.

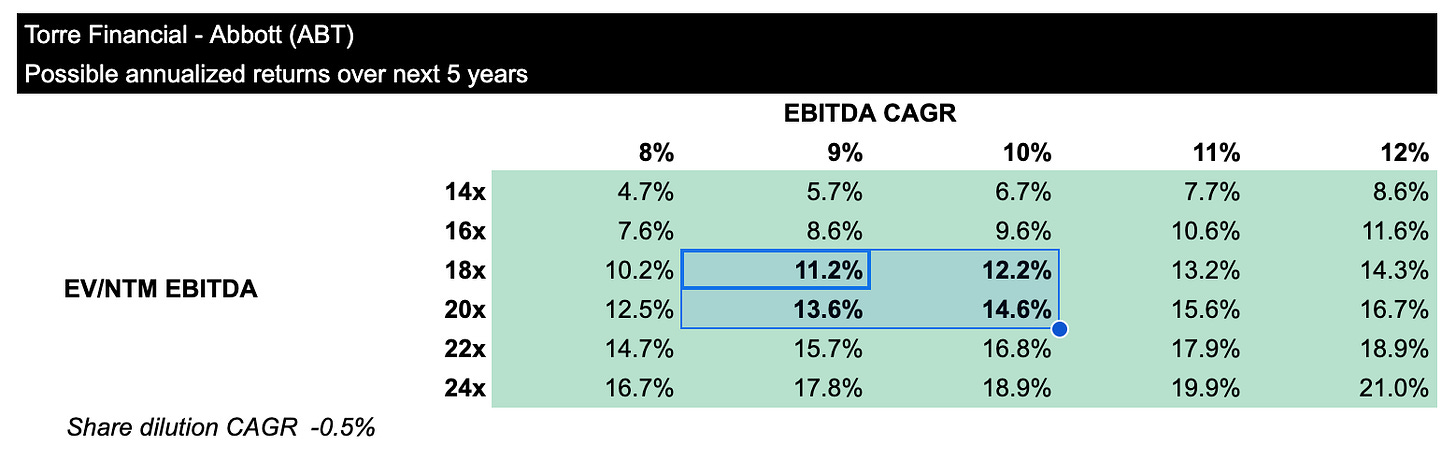

Looking out over the next 5 years, considering various EBITDA growth rates and exit multiples, we can analyze possible annualized returns.

Assuming management continues to execute…

If EBITDA grows at 9% CAGR and the multiple is maintained at 18x, shares could return over 11% per year.

If EBITDA grows at 10% CAGR and the multiple expands to 20x, shares could return 14.6% per year.

FAST Graphs provides another look:

If the P/E multiple contracts to its historical normal 22.6x, an investment today could generate annualized returns of 7.8%+ over the next few years.

If the P/E multiple were to stay steady at 25x, that would bump up the annual return to 12.2%.

Abbott Laboratories is a diversified leader in essential healthcare markets with strong secular tailwinds, a shareholder-friendly management team, and a resilient financial profile, all available at a reasonable valuation.

–

Torre Financial is an independent investment advisory firm focused on companies with high return on capital, competitive advantages, and durable growth. Our approach is to stay invested in equities: over time, equities generate the best returns.

Federico Torre

Torre Financial

federico@torrefinancial.com

Disclaimer: This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.